Thriving in a Global Market: Technology Strategies for UK Civil

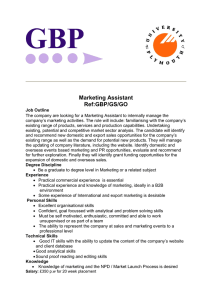

advertisement