Everest Group PEAK Matrix for RPO - Focus on IBM-Kenexa

advertisement

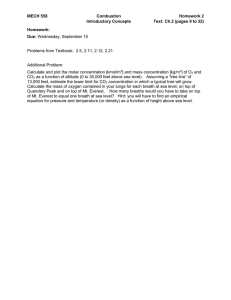

Everest Group PEAK Matrix™ for RPO Service Providers Focus on IBM-Kenexa September 2014 Copyright © 2014 Everest Global, Inc. This document has been licensed for exclusive use and distribution by IBM-Kenexa EGR-2014-3-E-1232 Introduction and scope Everest Group recently released its Recruitment Process Outsourcing – Service Provider Landscape with PEAK Matrix™ Assessment 2014 report. This report analyzes the changing dynamics of the RPO landscape and assesses service providers across several key dimensions. As a part of this report, Everest Group updated its classification of 22 service providers on the Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix for RPO into Leaders, Major Contenders, and Emerging Players. The PEAK Matrix is a framework that provides an objective, data-driven, and comparative assessment of RPO service providers, based on their absolute market success and delivery capability. Everest Group also identified seven service providers as the “2014 RPO Star Performers”, based on the strongest forward movement demonstrated on the PEAK Matrix Year-on-Year (YoY). Based on the analysis, IBM-Kenexa emerged as a “Leader”. This document focuses on IBM-Kenexa’s RPO experience and capabilities, and includes: IBM-Kenexa’s positioning on the RPO PEAK Matrix Everest Group assessment of IBM-Kenexa Detailed RPO profile of IBM-Kenexa Buyers can use the PEAK Matrix to identify and evaluate different service providers. It helps them understand service providers’ relative strengths and gaps. However, it is also important to note that while the PEAK Matrix is a useful starting point, results from the assessment may not be directly prescriptive for each buyer. Individual buyers will have to consider their unique situation and requirements, and match them against service provider capability for an ideal fit. Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 2 We define RPO as transfer of ownership of all or part of recruitment processes or activities on an ongoing basis Strategy Judgment-intensive Transaction-intensive HR strategy Employee relations Regulatory and compliance Global mobility Performance management Learning Recruitment Compensation Benefits Payroll Employee data management HR information systems and reporting Employee contact center Recruitment Employer branding Sourcing Screening Applicant tracking Interview scheduling and co-ordination Assessment Offer letter management Background verification Onboarding Vendor management For this study, we include RPO deals in which: A minimum of four or more recruitment processes are included The outsourcing deal is active and is at least one year in deal length The deal scope should not be limited to only temporary hires The buyer employee size is 3,000 or more This study does not include “out-tasking” arrangements (typically handled by recruitment agencies, staffing companies, or executive search firms) that are managed on a project-by-project basis rather than through an ongoing long-term arrangement Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 3 IBM-Kenexa consolidated its position as a Leader on the Everest Group PEAK Matrix for RPO Leader Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix for RPO Randstad Sourceright PeopleScout Pontoon Star Performer IBM-Kenexa Allegis Global Solutions AMS Hays Futurestep KellyOCG AON Hewitt Accenture 25th percentile Market success Major Contenders Cielo Emerging Player 75th percentile High Low WilsonHCG Hudson RPO Peoplestrong Neeyamo Resource Solutions Seven Step RPO Advantage xPO Yoh Emerging Players Low 1 2 Source: Major Contender 75th percentile Leaders The RightThing ManpowerGroup 25th percentile RPO delivery capability1 (Scale, scope, technology, delivery footprint, and buyer satisfaction) High Refer to page 13 for more details on RPO Star Performer methodology Service providers scored using Everest Group’s proprietary scoring methodology given on page 11 Everest Group (2014) Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 4 IBM-Kenexa (page 1 of 4) RPO service capability and strategy Company profile: IBM-Kenexa has been a business solutions provider in the field of human resource management for 25 years. IBM-Kenexa delivers software solutions, business processes, and expert consulting that helps organizations impact business outcomes through HR. It offers a comprehensive suite of unified products and services that support the entire employee life cycle from pre-hire to exit. The Smarter Workforce solution measures employee engagement, talent management, and leadership development Headquarter: Wayne, Pennsylvania, United States Leadership: Phil Stewart, President Website: http://ibm.co/1qRuYtC Offshore1 Nearshore1 Onshore Not Available (N/A) N/A N/A Total RPO delivery FTEs = N/A Functional capabilities within key RPO areas across regions Coverage – self Through partners Not offered North America EMEA Regions Employer branding Current RPO market segment focus Buyer segment: Targets both the mid-market (3,000 to 15,000 employees), as well as the large market segment (>15,000 employees) Geography: North America, Central and South America, EMEA, and Asia Pacific Partnership RPO service provider: None HRO service provider: None Sourcing Screening Applicant tracking Interview scheduling and co-ordination Assessment Offer letter management Background checking Recent RPO-related developments/announcements January 2014: Announced the Software-as-Service (SaaS)-based IBM Kenexa Talent Suite Onboarding Vendor management South America Other capabilities Offered Description Other capabilities Offered Description Analytics Yes Assessment Yes Employer branding Yes Mobile-based solutions Yes Smarter Workforce measures employee engagement, talent management, and leadership development IBM Kenexa Employment Branding that includes both Organizational Cultural Insight Survey and Recruitment Marketing N/A Asia Pacific Proprietary assessments on capacity, capability, and cultural fit Technology solutions – BrassRing and various recruitment portals Talent N/A Proprietary addYes Onboarding, organizational culture, performance Community on tools management, engagement survey, and leadership 1 FTEs in offshore (e.g. India) or nearshore (e.g. Eastern Europe and Latin America) locations, and delivering services to North America or Western Europe Source: Everest Group (2014) Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 5 IBM-Kenexa (page 2 of 4) RPO client portfolio RPO experience Total number of current RPO clients: 54 Total number of annual hires managed: 65,000 Frequency of inclusion of geographies in RPO deals 100% = 54 clients Major RPO clients North America 80% EMEA 40% N/A Asia Pacific Central and South America RPO split of hires by type 100% = 65,000 hires RPO split of hires by job family 100% = 65,000 hires Finance & legal professionals3 Technology Senior professionals2 management 5% 11% 25% Blue collar1 14% 15% 100% Permanent 1 2 3 Source: 15% Sales & marketing 15% Call-center professionals Healthcare professionals RPO split of clients by industry 20% 28% RPO buyer-size mix 100% = 54 clients Government / public sector Others Manufacturing 15% 20% 100% = 54 clients 3,000-15,000 employees 5% BFSI 5% Energy and utilities 35% 20% 15% 20% 65% Healthcare /Pharma >15,000 employees Hi-tech and telecom Blue collar includes jobs in operations, production, mining, construction, maintenance, technical installation, facilities, janitorial, security, etc. Technology professionals category includes engineers, IT professionals, researchers, and scientists Finance & legal professionals include accounting, finance, and legal professionals Everest Group (2014) Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 6 IBM-Kenexa (page 3 of 4) Key RPO delivery locations Toronto Wayne Lincoln Boston Frisco Raleigh Amsterdam London Krakow Paris Budapest Munich Dalian Tokyo Suzhou Dubai Vizag Hong Kong Manila San Jose Cyberjaya Singapore Hortlandia Buenos Aires Auckland Melbourne Source: Everest Group (2014) Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 7 IBM-Kenexa (page 4 of 4) Detailed assessment of RPO capabilities Delivery capability assessment IBM-Kenexa is a Leader on Everest Group PEAK Matrix for RPO 75th High percentile Assessment dimension IBM-Kenexa 25th percentile Market success Major Contenders 75th percentile Leaders Low Emerging Players Low 25th percentile High RPO delivery capability (Scale, scope, technology, delivery footprint, and buyer satisfaction) 1 Source: 5% 5% 2012 2013 Low Rating Remarks Scale High number of RPO FTEs employed; part of IBM, a Fortune 50 company Scope High industry and job family coverage; strong multi-country RPO capabilities; however, lacks blended model experience Technology capability Strong analytics capabilities; launched IBM Kenexa Talent Suite recently Delivery footprint Widespread delivery footprint with good usage of offshoring Buyer satisfaction High buyer satisfaction rating based on strong score in relationship management and implementation capabilities Overall Overall remarks IBM-Kenexa is a Leader on RPO PEAK Matrix with significant scale, high technology capability, and wide delivery footprint With the integration of IBM-Kenexa under way, clients are cautiously optimistic of potential future gains It is one of the very few providers that can offer technology-integrated and truly end-to-end recruitment services including the value-added components (such as analytics, branding, and assessment) along with broader talent management services. It has also added these capabilities into a broad talent management suite It is also one of the few providers with large multi-country RPO capabilities and delivery experience in a single provider model Buyers cite its sourcing capabilities, collaboration, and global delivery capabilities as its key strengths. However, the lack of proactive-ness in servicing new initiatives is a gap cited by buyers Market success assessment RPO market share1 Percentage share by number of contracts High Percentage share by annual number of hires 6% 2012 5% 2013 Based on contractual and operational information as of October 2013 Everest Group (2014) Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 8 Appendix Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 9 Everest Group classifies the RPO service provider landscape based on its PEAK Matrix Performance | Experience | Ability | Knowledge (PEAK) Matrix Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix for RPO High Leaders Top quartile performance across market success and capability 2nd or 3rd quartile performance across market success and capability 25th percentile Market success2 Major Contenders Low Emerging Players 4th quartile performance across market success and capability Low 1 2 Source: 75th percentile 75th percentile 25th percentile RPO delivery capability1 (Scale, scope, technology, buyer satisfaction, and delivery footprint) High Service providers scored using Everest Group’s proprietary scoring methodology given on page 11 Based on a combination of total number of RPO clients, revenue from RPO, and total number of hires managed per year Everest Group (2014) Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 10 Service providers are positioned on Everest Group PEAK Matrix, based on evaluation of two key dimensions Measures success achieved in the market. Captured through a combination of total number of RPO clients, revenue from RPO, and total number of hires managed/ year Market success Leaders Major Contenders Emerging Players Delivery capability Scale Measures the scale of operations through: Overall company revenue FTEs employed 1 2 Scope Measures ability to deliver services successfully. Captured through five sub-dimensions: Technology capability Measures the scope of Measures the capability services provided through: and investment in Process coverage recruitment technology Geographic coverage Industry and job-family coverage Blended RPO experience Multi-country RPO capability Delivery footprint Buyer satisfaction Measures the satisfaction Measures the delivery levels2 of buyers across: footprint and the global Goal realization sourcing mix through: Delivery footprint across Process delivery Implementation ten regions1 Relationship Offshoring capability management Ten regions are North America, Latin America, United Kingdom, Western Europe, Eastern Europe, Middle-East and Africa, Australia and New Zealand, India, China, and rest of Asia-Pacific Measured through responses from three referenced buyers for each service provider Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 11 Additionally, Everest Group confers the “Star Performers” title to providers that demonstrate the strongest forward movement over time on the PEAK Matrix Market success Methodology Everest Group selects Market Star Performers based on the relative year-on-year movement of each service provider, on the PEAK Matrix Year 1 Service provider Year 0 In order to assess advancements on market success, we evaluate the performance of each of the service providers on PEAK Matrix across a number of parameters including: Increase in number of RPO clients Growth in revenue from RPO Increase in number of hires managed Capability In order to assess advancements on capability, we evaluate the performance of each service provider on PEAK Matrix across a number of parameters including: Annual growth in scale Increase in scope of services Expansion of delivery footprint Technology enhancements/investments RPO STAR Performers The top-quartile performers on each of the identified parameters are identified and the “Star Performer” rating is awarded to the service providers with: The maximum number of top-quartile performances across all of the above parameters and At least one area of top-quartile performance in both market success and capability advancement The “Star Performers” designation relates to year-on-year performance for a given service provider and does not reflect the overall market leadership positions. Those identified as the Star Performers may include “Leaders”, “Major Contenders”, or “Emerging Players” Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 12 FAQs (page 1 of 2) Does the PEAK Matrix assessment incorporate any subjective criteria? Everest Group’s PEAK Matrix assessment adopts an objective and fact-based approach (leveraging service provider RFIs and Everest Group’s proprietary databases containing providers’ deals and operational capability information). In addition, these results are validated / fine-tuned based on our market experience, buyer interaction, and provider briefings Is being a “Major Contender” or “Emerging Player” on the PEAK Matrix, an unfavorable outcome? No. PEAK Matrix highlights and positions only the best-in-class service providers in a particular functional/vertical services area. There are a number of providers from the broader universe that are assessed and do not make it to the PEAK Matrix at all. Therefore, being represented on the PEAK Matrix is itself a favorable recognition What other aspects of PEAK Matrix assessment are relevant to buyers and providers besides the “PEAK Matrix position”? PEAK Matrix position is only one aspect of Everest Group’s overall assessment. In addition to assigning a “Leader”, “Major Contender” or “Emerging Player” title, Everest Group highlights the distinctive capabilities and unique attributes of all the PEAK Matrix providers assessed in its report. The detailed metric level assessment and associated commentary is helpful for buyers in selecting particular providers for their specific requirements. It also helps providers showcase their strengths in specific areas What are the incentives for buyers and providers to participate/provide input to PEAK Matrix research? Participation incentives for buyers include a summary of key findings from the PEAK Matrix assessment Participation incentives for providers include adequate representation and recognition of their capabilities/success in the market place, and a copy of their own “profile” that is published by Everest Group as part of the “compendium of PEAK Matrix providers” profiles Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 13 FAQs (page 2 of 2) What is the process for a service provider to leverage their PEAK Matrix positioning status ? Providers can use their PEAK positioning rating in multiple ways including: – Issue a press release declaring their positioning/rating – Customized PEAK profile for circulation (with clients, prospects, etc.) – Quotes from Everest Group analysts could be disseminated to the media – Leverage PEAK branding across communications (e-mail signatures, marketing brochures, credential packs, client presentations, etc.) The provider must obtain the requisite licensing and distribution rights for the above activities through an agreement with the designated POC at Everest Group Copyright © 2014, Everest Global, Inc. EGR-2014-3-E-1232 14 At a glance With a fact-based approach driving outcomes, Everest Group counsels organizations with complex challenges related to the use and delivery of the next generation of global services Through its practical consulting, original research, and industry resource services, Everest Group helps clients maximize value from delivery strategies, talent and sourcing models, technologies, and management approaches Established in 1991, Everest Group serves users of global services, providers of services, country organizations, and private equity firms in six continents across all industry categories Dallas (Headquarters) info@everestgrp.com +1-214-451-3000 New York info@everestgrp.com +1-646-805-4000 Toronto canada@everestgrp.com +1-647-557-3475 London unitedkingdom@everestgrp.com +44-207-129-1318 Stay connected Websites www.everestgrp.com research.everestgrp.com Twitter @EverestGroup @Everest_Cloud Blogs Delhi india@everestgrp.com +91-124-284-1000 www.sherpasinblueshirts.com