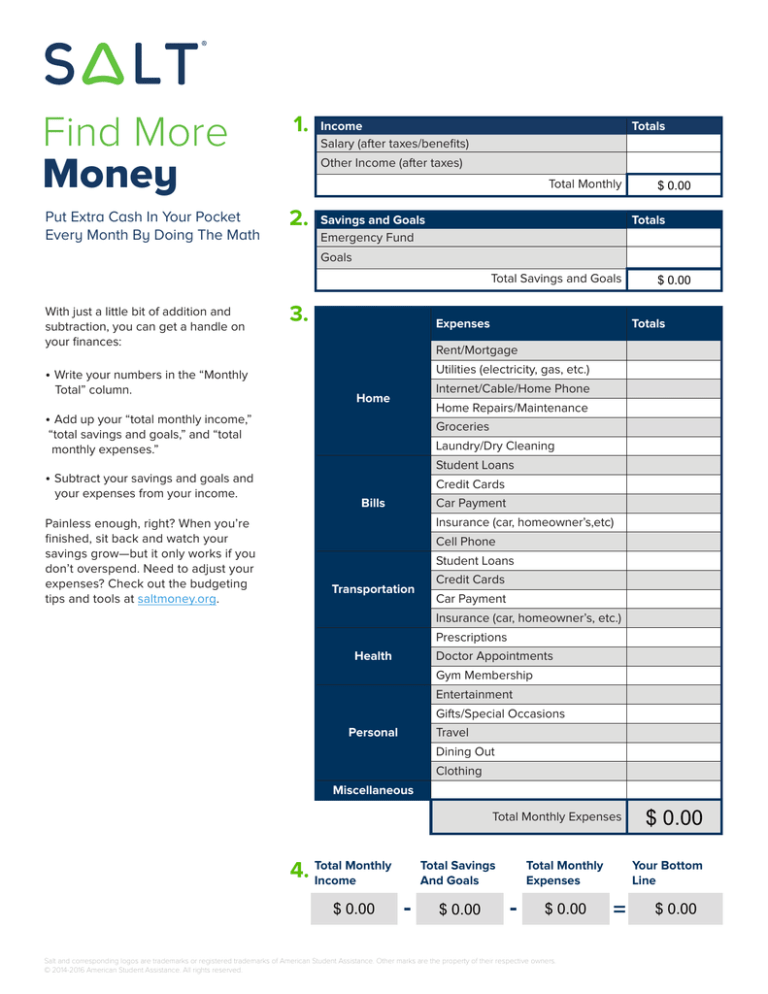

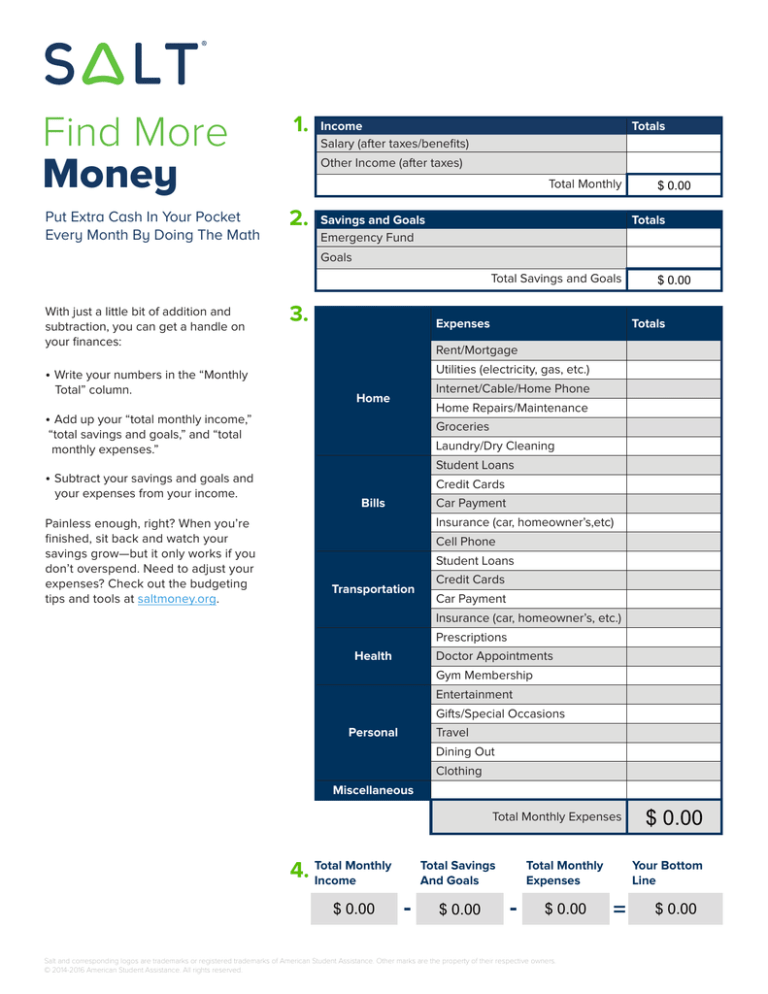

Find More

Money

1.

Put Extra Cash In Your Pocket

Every Month By Doing The Math

2.

Income

Salary (after taxes/benefits)

Totals

Other Income (after taxes)

Total Monthly

Savings and Goals

Emergency Fund

$ 0.00

Totals

Goals

Total Savings and Goals

With just a little bit of addition and

subtraction, you can get a handle on

your finances:

3.

Expenses

Utilities (electricity, gas, etc.)

Internet/Cable/Home Phone

Home

Home Repairs/Maintenance

• Add up your “total monthly income,”

Groceries

“total savings and goals,” and “total

monthly expenses.”

Laundry/Dry Cleaning

Student Loans

• Subtract your savings and goals and

your expenses from your income.

Painless enough, right? When you’re

finished, sit back and watch your

savings grow—but it only works if you

don’t overspend. Need to adjust your

expenses? Check out the budgeting

tips and tools at saltmoney.org.

Totals

Rent/Mortgage

• Write your numbers in the “Monthly

Total” column.

$ 0.00

Credit Cards

Bills

Car Payment

Insurance (car, homeowner’s,etc)

Cell Phone

Student Loans

Transportation

Credit Cards

Car Payment

Insurance (car, homeowner’s, etc.)

Prescriptions

Health

Doctor Appointments

Gym Membership

Entertainment

Gifts/Special Occasions

Personal

Travel

Dining Out

Clothing

Miscellaneous

Total Monthly Expenses

Monthly

4. Total

Income

$ 0.00

Total Savings

And Goals

-

$ 0.00

Total Monthly

Expenses

-

$ 0.00

Salt and corresponding logos are trademarks or registered trademarks of American Student Assistance. Other marks are the property of their respective owners.

© 2014-2016 American Student Assistance. All rights reserved.

$ 0.00

Your Bottom

Line

=

$ 0.00