2010 Annual Report

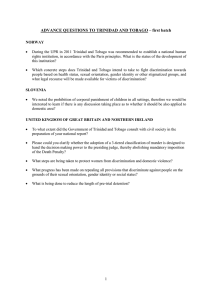

advertisement