Statements - Phoenix Beverages

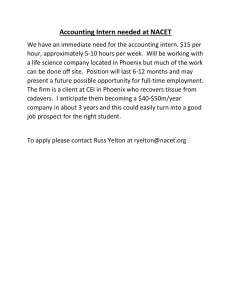

advertisement