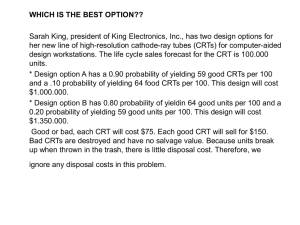

An Analysis Of The Demand For CRT Glass

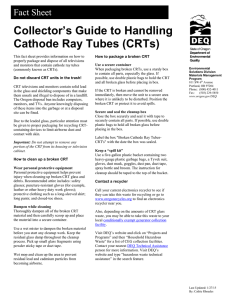

advertisement