CEA Claim Manual - California Earthquake Authority

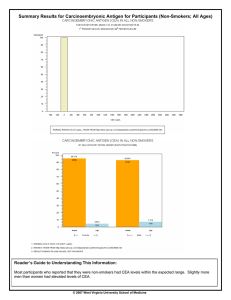

advertisement