Stanford W-9 - Stanford University

advertisement

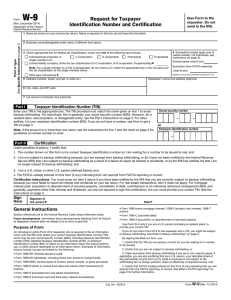

cmW9 Give Form to the Request for Taxpayer identification Number and Certification requester. Do net send to the IRS. (Rev. December 2014) DepenmenlofmeTraasxy Internal Revenue Service I Naiie (a ettn on yaw frtome tax reran). Name fl r*ed on It Unit do not leave tNs be ba’Jt Th. Board of TnmteesoIthe Island StanfordJunior University 2 &sinese nr.Wdoregwded ufly name. P dI*ent Ironi above a 4 Exaiiptbis (codes apply only to 3 Chock appropriale box (or federal tax c4sahlcMtn: dack only on. of the fouowing seven boxes: catein entitles. not iridMajals; see S Q wdvnmv,oie poalator or Q Tnmtfstate Q C Corporation D S Corporation Q patnerfl gçte-membw LW D tiNted flaumy caTflny. Efler Ha tax desaliketla, (Cat corporation, 9.3 corporatIon, P.pathw.JiIp) b I 1 any) pipe code Exetbi ban FATCA repathg A rode any) Nets. For a slegie-oninber at that Is dleregwdect do itt drek at: check Ha apwowWa box hi the be above r the lax thsa’Cathn of the srgImrthv 0,-a Trust with Corporate Powers - IRC Section 501(c)(3) .qr ee ucuoisj a’ I Requester’s name i’d aees (optional 5 M&ns (mimber, sHeet, end apt. or stAte ma) 0 II 3145 Porter Drive City, slate, end ZIP code Palo Alto, CA 94304 7 LIst account nwrbfl) lam (oplbone)) U Taxpayer Identification Number (TIN) W Enter your TIN in the appropriate box. The TiN provided must rnaldi the name given on lIne 1 to avoid 1 Soclalta backup withholding. For lndMduab, this Ia generally your social security ntmiber (SSN). However, for a resident alen, sole proprietor, or disregarded entity, see the Part I Instwctlons on page 3. For other entities, It is your employer IdentificatIon number (BIN). If you do not have a number, see How to get a UNon page 3. Nets If the account is In more than one name, see the instwctbens for line 1 end the chest on page 4 for guidelines on whose number to enter. mill fly number — — or Empleyer Idenlilkeden number j j 9 4 1 j j j j j6j I 5 5 3 5 Codification Under penalties of perjury, I certify that 1. The ntsnbeakiown on tinS form Is my correct taxpayer ldentificakn number (or lam walling for a number to be Issued to ma); and 2. I am not subject to backup withholding because: (a) lam exempt horn backup witNwlding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I em subject to backup withholdings, a result of a false to report all Interest or dividends, or (c) the IRS has notified me that I am no longer subject 3. I to backup witflidding; and an aU.S citizen or other U.S. person (defined below); and 4. The FATCA code(s) entered on this form (if any) kid Catkig Owl I am exempt from FATCA report Wig S coned. Certification Wistucifon. You must cross out item 2 above If you have been notIfied by the IRS that you are currently subject to backup v.ithholdMg became you have (ailed to report all Internet and dividends on your tax return. For real estate transactions, Kern 2 does not apply. For mortgage interest paid, acquisitIon or abandorvnent of secured property, cancellation ci debt, contributions to an IndIvIdual retIrement armngement (IRA) and generally, payments other than Interest and dividends, you are not required to sign the certification, but you msmt provide your correct TiN. See the instructions on pageS. Sign Here us.pemona L_Q04n.a..’ Detfl i’-’f 1 Form 1096 gicmemortgageknterest), 1098-B (student loan interest), 1096-1 General Instructions (tuition) Section references ore to the Internal Revenue Code unless otherwise noted. Future developments. Inlonnation abatE developments affectbrç Form W’9 (auth as legleletion enacted alter we release H) S at ewwh.gcv/Mt Purpose of Form An frdvlthjal ormitky (Form W-9 requester) Mc S reqdred to me en intonation retian wIt, the IRS must obtain you correct taxpayer t’l whidi nay be your sodal tacitly nirber SN), IndMdtml taxpayer identification mn.be(lfltq. .dop&n taxpayer IdetiIttbT rOnbr(A1V4. or employer iderWicaston rarter (III, to report an l inI&nwtioi reran the nfl paid to you,, or other rant reportable on an infornalon retain. Exanwbes of Wdormnatlor, ratnn kO4e, bit eta rat tInted to, the telbowrg: • Form 1o99.tNr oras aimed Cr pakf • Form 1099-DIV *tdetxls. ktkIdWiQ times (toni stocks or imiftal faith) • Fern, 10994150 (vesfors types of Income, pita. awards, or gross proceeds) a Form 1099-B (stock or nziuel bud sales en crein otiw trnadh’a by brtlras) a Form logos (proceeds from ree) at ftrflr’) a Form 1099-K (machag d and Had pfl network traisactiors) rag,, 1099-c (canceled debt) Foon 1099-AØcquhltion or abandoranant of secured property) U Form w-e only if you are a US. person (including a resident auen), to provide yotir correct uN. if you do nd sham Foam w-9 tO lhe requester with. 7 you might be&ib/ect to harMs wiHro1ng. See What Is backtp uWthho,g? on page 2. By sIgnIng Ha lHIed.ord loon, you: • • 1. evilly that the TiN you n gIving (a coned (or yori are wallIng fore runb& be baacfl, a Certify that you as rat subject to b&ktc wtflioldlng, or a calm exiiptlon bent backup witthol&ç if yorj as a U.S. exempt payee. If you. acable IIwe of •pptable. you as also catifykig that as any p tneelfp Income bane U.S. trade or biatass S itt alibied to the weilioldkig tax en foreign pairam’ share of eifedtvefr cotited income, and 4. Certify that FATCAcodeW ordered en 04 form (if a rdatq Vat you are exenipt ban the FATCA sporting, is coat See What ft MICA r%odklg? on plie 2 Ia tailS Wander,. Cat. Na. 10231X Form W-9 (Pew, t2-20t4)