Year 2012-13 - United Bank of India

advertisement

·

F

F

⁄

F

F

kË

F

=

+

F

òF

W=

+

“

º

F

Œ

F

=

+

fi

∂

F

WC

J

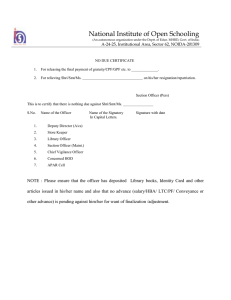

Handing over Dividend Cheque

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

F

g◊

+

G

kP

∞

‹

F

F

=

W+

⁄

F

[∂

F

—

F

[Ê

F

aE

Õ

‹

F

áF

J

Ê

F

k“

Ÿ

F

kÕ

F

P

Œ

F

º

WË

F

=

+

,

Í

F

U

⁄

F

F

ı

=

+

fi

ı

F

WŒ

F

,

P

Ê

F

∏

F

U

‹

F

Ê

F

F

a 2011-12 =

+

F

·

F

F

⁄

F

F

kË

F

òF

W=

+

,

‹

F

]Ÿ

F

U

E

F

G

a=

W+

=

+

F

‹

F

a—

F

F

·

F

=

+

P

Œ

F

º

WË

F

=

+

Í

F

U

ı

F

k°

F

‹

F

E

F

‹

F

a,

‹

F

]Ÿ

F

U

E

F

G

a=

W+

P

Œ

F

º

WË

F

=

+

Í

F

U

ı

F

kº

U

—

F

=

]+

¤

F

F

fi

∂

F

ª

F

F

‹

F

]Ÿ

F

U

E

F

G

a=

W+

H

∏

F

fi

⁄

F

F

fi

∂

F

áF

W∑

F

=

W+

H

.

¤

F

.

“

.

J

Ê

F

k¤

F

].

áF

W.

“

Í

F

U

Ê

F

U

;

F

kº

F

W∑

F

F

=

+

U

H

—

F

P

ı

ª

F

P

∂

F

¤

F

Wk,

⁄

F

F

fi

∂

F

ı

F

fi

=

+

F

fi

=

W+

¤

F

F

Œ

F

Œ

F

U

‹

F

P

Ê

F

∏

F

fi

F

°

‹

F

¤

F

k∑

F

U

Í

F

U

Œ

F

¤

F

F

WŒ

F

F

fi

F

‹

F

µ

F

¤

F

U

Œ

F

F

=

+

F

W“

º

F

Œ

F

=

+

fi

∂

F

WC

J

Shri Bhaskar Sen, the then CMD-UBI, handing over the dividend cheque for the FY 2011-12 to

Shri Namo Narayan Meena, Hon'ble Minister of State for Finance, Govt. of India, in the

presence of Shri Sanjay Arya, ED-UBI; Shri Sandeep Kumar, Director-UBI &

Shri V. Gandotra, DGM & CRM, UBI North India Region

Annual Report

P

Ê

F

F

‹

F

ı

F

[ò F

U

CONTENTS

P

Œ

F

º

WË

F

=

+

¤

F

k∞

·

F

l

Board of Directors

¤

F

F̆

“

Ÿ

F

kÕ

F

=

+

;

F

µ

F

l

General Managers

Ÿ

F

Yk=

+

=

+

F

ı

F

kP

áF

—

∂

F

G

P

∂

F

F̆

ı

F

E

F

Yfi

ı

F

k=

+

·

—

F

l

Brief History & Vision Statement of the Bank

P

Œ

F

—

F

F

º

Œ

F

=

+

U

J

=

+

§

F

·

F

=

+

l

Performance at a glance

Ë

F

W‹

F

fi

Õ

F

F

fi

=

+

F

Wk =

+

F

Wı

F

kº

WË

F

l

Message to the Shareholders

ı

F

[ò F

Œ

F

F

l

Notice

Ÿ

F

kÕ

F

Œ

F

P

Ê

F

òF

F

fi

P

Ê

F

¤

F

Ë

F

aE

Z

fi

P

Ê

F

Ë

·

F

W

F

µ

F

P

Œ

F

º

WË

F

=

+

F

Wk =

+

U

P

fi

—

F

F

W©

aJ

Ê

F

k“

l

Directors' Report &

Management Discussion and Analysis

=

k+

—

F

Œ

F

U

E

P

⁄

F

Ë

F

F

ı

F

Œ

F

=

+

U

P

fi

—

F

F

W©

a

l

Corporate Governance Report

f

F

X

F

µ

F

F

l

Declaration

49V =

ı

F

[ò F

U

=

+

fi

µ

F

=

+

fi

F

fi

=

W+

&

F

µ

∞

W+

E

Œ

F

]ı

F

F

fi

“

¤

F

F

µ

F

—

F

∑

F

l

Certificate Pursuant to Clause 49V

of the Listing Agreement

=

k+

—

F

Œ

F

U

E

P

⁄

F

Ë

F

F

ı

F

Œ

F

—

F

fi

·

F

W&

F

F

—

F

fi

U

áF

=

+

F

Wk =

+

F

“

¤

F

F

µ

F

—

F

∑

F

l

Auditors' Certificate on Corporate Governance

·

F

W&

F

F

—

F

fi

U

áF

=

+

F

Wk =

+

U

P

fi

—

F

F

W©

a

l

Auditors' Report

31 ¤

2013 =

F

F

òF

a,

+

F

∂

F

]·

F

Œ

F

—

F

∑

F

l

Balance Sheet as on 31st March 2013

1-E

12

E

Œ

F

]ı

F

[ò F

U

Œ

F

]ı

F

[ò F

U

l

Schedule 1 - Schedule 12

31 ¤

F

F

òF

a 2013 =

+

F

Wı

F

¤

F

F

—

∂

F

Ê

F

F

a=

+

F

·

F

F

⁄

F

-̆

F

P

Œ

F

·

F

W&

F

F

l

Profit & Loss Account for the year

ended 31st March 2013

13 18

E

Œ

F

]ı

F

[ò F

U

E

Œ

F

]ı

F

[ò F

U

l

Schedule 13 - Schedule 18

31 ¤

F

F

òF

a,

2013 =

+

F

Wı

F

¤

F

F

—

∂

F

Ê

F

F

a=

+

F

Œ

F

=

+

º

U

“

Ê

F

F

˘

P

Ê

F

Ê

F

fi

µ

F

l

Cash Flow Statement for the year

ended 31st March 2013

—

F

U

·

F

fi

W+

E

k∂

F

;

F

a∂

F

Œ

F

‹

F

U

—

F

[c°

F

U

—

F

‹

F

F

a—

∂

F

∂

F

F

≥

F

cò F

F

“

=

+

©

U

=

+

fi

µ

F

3=

l

New Capital Adequacy Framework

Disclosures Under Pillar-3

2-3

4-5

7

8-9

10-13

14-25

26-63

64-94

95

96

97

98-100

102-103

104-115

116-117

118-154

155-156

157-174

2012-13

2012-13

P

Œ

F

º

WË

F

=

+

¤

F

k∞

·

F

BOARD OF DIRECTORS

Í

F

U

¤

F

∂

F

U

E

òF

aŒ

F

F

⁄

F

F

;

F

aÊ

F

Í

F

U

º

U

—

F

=

+

Œ

F

F

fi

k;

F

E

Õ

‹

F

áF

J

Ê

F

k“

Ÿ

F

kÕ

F

P

Œ

F

º

WË

F

=

+

=

+

F

‹

F

a—

F

F

·

F

=

+

P

Œ

F

º

WË

F

=

+

Í

F

U

ı

F

k°

F

‹

F

E

F

‹

F

a

=

+

F

‹

F

a—

F

F

·

F

=

+

P

Œ

F

º

WË

F

=

+

Smt Archana Bhargava

Shri Deepak Narang

Shri Sanjay Arya

Chairperson & Managing Director

Executive Director

Executive Director

Í

F

U

ı

F

kº

U

—

F

=

]+

¤

F

F

fi

⁄

F

F

fi

∂

F

ı

F

fi

=

+

F

fi

¬

F

fi

F

Œ

F

F

P

¤

F

∂

F

P

Œ

F

º

WË

F

=

+

Í

F

U

¤

F

∂

F

U

ı

F

]fi

W&

F

F

¤

F

fi

F

k∞

U

Í

F

U

ı

F

]Œ

F

U

·

F

;

F

X

‹

F

·

F

E

kË

F

=

+

F

P

·

F

=

+

;

F

Yfi

=

+

F

‹

F

F

a·

F

‹

F

U

Œ

F

P

Œ

F

º

WË

F

=

+

⁄

F

F

fi

∂

F

U

‹

F

P

fi

°

rF

Ê

F

aŸ

F

=

kY +

=

+

U

Œ

F

F

P

¤

F

∂

F

P

Œ

F

º

Ë

WF

=

+

Shri Sandeep Kumar

Smt. Surekha Marandi

Govt. of India Nominee Director

Reserve Bank of India

Nominee Director

2

Shri. Sunil Goyal

Part-time Non-official Director under CA

Category

Annual Report

P

Œ

F

º

WË

F

=

+

¤

F

k∞

·

F

Í

F

U

P

˘

fi

µ

‹

F

Ÿ

F

X

fi

F

2012-13

BOARD OF DIRECTORS

Í

F

U

Í

F

WP

µ

F

=

+

ı

F

W*

Í

F

U

P

=

+

fi

µ

F

Ÿ

F

U

.

Ê

F

F

º

X

º

P

fi

‹

F

F

E

kË

F

=

+

F

P

·

F

=

+

;

F

Yfi

=

+

F

‹

F

F

a·

F

‹

F

U

Œ

F

P

Œ

F

º

WË

F

=

+

E

kË

F

=

+

F

P

·

F

=

+

;

F

Yfi

=

+

F

‹

F

F

a·

F

‹

F

U

Œ

F

P

Œ

F

º

WË

F

=

+

E

kË

F

=

+

F

P

·

F

=

+

;

F

Yfi

=

+

F

‹

F

F

a·

F

‹

F

U

Œ

F

P

Œ

F

º

WË

F

=

+

Shri Hiranya Bora

Shri Srenik Sett

Part-time Non-Official Director

Part-time Non-Official Director

Í

F

U

—

F

U

‹

F

[

F

=

+

F

kP

∂

F

f

F

X

F

E

P

Õ

F

=

+

F

fi

U

=

+

¤

F

aò F

F

fi

U

P

Œ

F

º

WË

F

=

+

Shri. Pijush Kanti Ghosh

Officer Employee Director

Í

F

U

ı

F

k°

F

U

Ÿ

F

—

F

P

∂

F

=

+

F

¤

F

;

F

F

fi

=

+

¤

F

aò F

F

fi

U

P

Œ

F

º

WË

F

=

+

Shri Kiran B Vadodaria

Part-time Non-official Director

Í

F

U

ı

F

Z

¤

F

WŒ

F

¤

F

°

F

]¤

F

º

F

fi

Ë

F

W‹

F

fi

Õ

F

F

fi

=

+

P

Œ

F

º

WË

F

=

+

Shri Sanjib Pati

Shri Saumen Majumder

Workmen Employee Director

Shareholder Director

3

2012-13

¤

F

F̆

“

Ÿ

F

kÕ

F

=

+

;

F

µ

F

Í

F

U

E

kŸ

F

fi

U

F

Œ

F

kº

Shri Ambarisha Nanda

Í

F

U

ı

F

k°

F

‹

F

=

]+

¤

F

F

fi

Shri Sanjay Kumar

GENERAL MANAGERS

º

WŸ

F

F

Ë

F

U

F

¤

F

]&

F

°

F

U

a

Shri Debashish Mukherjee

Í

F

U

Œ

F

fi

WË

F

=

]+

¤

F

F

fi

=

+

—

F

[fi

Shri Naresh Kumar Kapoor

4

Í

F

U

º

WŸ

F

;

F

] F̆

Shri Deb Guha

Í

F

U

Ÿ

F

U

.

=

W+

.

—

F

©

Œ

F

F

‹

F

=

+

Shri B. K. Patnaik

Annual Report

¤

F

F̆

“

Ÿ

F

kÕ

F

=

+

;

F

µ

F

Í

F

U

fi

P

ª

F

Œ

F

º

W

Shri Rathin De

Í

F

U

Ë

F

P

Ë

F

Ë

F

W&

F

fi

P

¤

F

Í

F

F

Shri Sasi Sekhar Mishra

2012-13

GENERAL MANAGERS

Í

F

U

¤

F

F

Œ

F

ı

F

Õ

F

fi

Shri Manash Dhar

¤

F

F

W.

E

Ÿ

º

]·

F

Ê

F

F

P

º̆

Md. Abdul Wahid

5

Í

F

U

P

Ê

F

=

+

F

ı

F

ı

F

U

∂

F

F

fi

F

¤

F

&

F

]©

Ê

F

F

∞

Shri Vikas Sitaram Khutwad

Í

F

U

ı

F

∂

‹

F

Œ

F

F

fi

F

‹

F

µ

F

ı

F

F

C

Shri Satya Narayan Sahu

2012-13

Company Secretary, Compliance Office &

Secretary to the Board of Directors

=

k+

—

F

Œ

F

U

ı

F

P

òF

Ê

F

J

Ê

F

kE

Œ

F

]—

F

F

·

F

Œ

F

E

P

Õ

F

=

+

F

fi

U

:

Í

F

U

P

Ÿ

F

=

e+

¤

F

P

°

F

∂

F

ı

F

X

¤

F

Bikramjit Shom

fi

P

°

F

ı

©

dF

fi

J

Ê

F

kË

F

W‹

F

fi

©

dF

kı

F

◊

+

fi

J

°

F

Wk©

:

Registrar & Share Transfer Agent:

P

·

F

k=

+

G

Œ

F

©

F

G

¤

F

“

F

.

P

·

F

.

ı

F

U

13 —

F

Œ

Œ

F

F

·

F

F

·

F

P

ı

F

·

=

+

P

¤

F

·

ı

F

=

k+

—

F

F

H

k∞

hı

F

J

·

F

Ÿ

F

U

J

ı

F

fi

X

∞

,

⁄

F

k∞

]—

F

(

—

F

)

¤

F

]kŸ

F

G

a400 078

Link Intime India Pvt. Ltd.

C-13 Pannalal Silk Mills Compound

L B S Road, Bhandup (W)

Mumbai – 400078

ı

F

F

kP

Ê

F

P

Õ

F

=

+

=

Wk+

Ω

U

‹

F

·

F

W&

F

F

—

F

fi

U

áF

=

+

:

Statutory Central Auditors:

¤

F

Wı

F

ı

F

a°

F

F

g°

F

a fi

U

∞

J

Wk∞

=

k+

—

F

Œ

F

U

¤

F

Wı

F

ı

F

a∞

U

.

=

W+

.

ö F

°

F

fi

J

Wk∞

=

k+

—

F

Œ

F

U

¤

F

Wı

F

ı

F

aJ

¤

F

.

òF

Z

Õ

F

]fi

U

J

Wk∞

=

k+

—

F

Œ

F

U

¤

F

Wı

F

ı

F

aJ

¤

F

.

ı

F

U

.

⁄

F

k∞

F

fi

U

J

Wk∞

=

k+

—

F

Œ

F

U

¤

F

Wı

F

ı

F

a fi

¤

F

WË

F

ı

F

U

.

E

;

F

eÊ

F

F

·

F

J

Wk∞

=

k+

—

F

Œ

F

U

¤

F

Wı

F

ı

F

aP

º

Œ

F

WË

F

¤

F

W˘

∂

F

F

J

Wk∞

=

k+

—

F

Œ

F

U

M/s. George Read & Co.

M/s. D. K. Chhajer & Co.

M/s. M. Choudhury & Co.

M/s. M. C. Bhandari & Co.

M/s. Ramesh C Agrawal & Co.

M/s. Dinesh Mehta & Co.

—

F

k°

F

U

=

_+

∂

F

=

+

F

‹

F

F

a·

F

‹

F

=

+

F

—

F

∂

F

F

:

Registered Office Address:

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

sF

gr◊

+

G

kP

∞

‹

F

F

‹

F

]Œ

F

F

G

©

W∞

©

F

Ê

F

fi

11 ˘

W¤

F

k∂

F

Ÿ

F

ı

F

]ı

F

fi

µ

F

U

=

+

X

·

F

=

+

F

∂

F

F

700 001

United Bank of India

United Tower

11 Hemanta Basu Sarani

Kolkata – 700001

Website

www.unitedbankofindia.com

E-mail

investors@unitedbank.co.in

6

Annual Report

2012-13

Ÿ

F

Yk=

+

=

+

F

ı

F

kP

áF

—

∂

F

G

P

∂

F

F̆

ı

F

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

=

+

F

G

P

∂

F

F̆

ı

F

1914 ı

F

WË

F

]fl

X̆

∂

F

F

˘

Yó =

]+

P

¤

F

·

·

F

F

Ÿ

F

YkP

=

k+

;

F

=

+

F

fi

—

F

X

fi

WË

F

Œ

F

P

·

F

P

¤

F

©

W∞

(

1914 ¤

F

Wk &

F

]·

F

F

ª

F

F

)

,

=

]+

P

¤

F

·

·

F

F

‹

F

]P

Œ

F

‹

F

Œ

F

Ÿ

F

Yk=

+

P

·

F

P

¤

F

©

W∞

(

1922 ¤

F

Wk &

F

]·

F

F

ª

F

F

)

E

Z

fi

C

;

F

·

F

U

Ÿ

F

Yk=

+

(

1932 ¤

F

Wk &

F

]·

F

F

ª

F

F

)

12 E

É©

[Ÿ

F

fi

,

1950 =

+

X

Ÿ

F

k;

F

F

·

F

ı

F

WŒ

©

d·

F

Ÿ

F

Yk=

+

P

·

F

P

¤

F

©

W∞

¤

F

Wk ı

F

¤

F

F

¤

F

WP

·

F

∂

F

C

E

F

ó ‹

F

˘

Ÿ

F

Yk=

+

1918 ¤

F

Wk Ÿ

F

k;

F

F

·

F

ı

F

Wk©

d·

F

·

F

X

Œ

F

=

+

¤

—

F

Œ

F

U

P

·

F

P

¤

F

©

W∞

=

W+

fl

—

F

¤

F

Wk &

F

]·

F

F

ª

F

F

ó G

Œ

F

=

W+

ı

F

¤

F

F

¤

F

W·

F

Œ

F

ı

F

W 18

P

º

ı

F

¤

Ÿ

F

fi

,

1950 =

+

X

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

F

gr◊

+

+

G

kP

∞

‹

F

F

P

·

F

P

¤

F

©

W∞

Ÿ

F

Œ

F

F

ó 19 °

F

]·

F

F

G

a,

1969 =

+

X

13 E

Œ

‹

F

Ÿ

F

Yk=

+

X

k=

W+

ı

F

F

ª

F

ı

F

F

ª

F

G

ı

F

Ÿ

F

Yk=

+

=

+

F

⁄

F

U

fi

F

Ò

dU

‹

F

=

+

fi

µ

F

C

E

F

E

Z

fi

∂

F

º

Œ

F

]‡

—

F

J

=

+

Œ

F

J

Ÿ

F

Yk=

+

=

W+

fl

—

F

¤

F

Wk G

ı

F

=

+

F

H

º

h⁄

F

Ê

F

C

E

F

ó Ÿ

F

F

º

¤

F

Wk =

+

©

=

+

Ÿ

F

Yk=

+

P

·

F

P

¤

F

©

W∞

,

∂

F

W°

F

—

F

]fi

G

k∞

P

ı

©

d‹

F

·

F

Ÿ

F

Yk=

+

P

·

F

P

¤

F

©

W∞

,

P

Œ̆

º

]ı

∂

F

F

Œ

F

¤

F

=

+

F

b©

F

G

·

F

Ÿ

F

Yk=

+

P

·

F

P

¤

F

©

W∞

E

Z

fi

Œ

F

F

fi

k;

F

Ÿ

F

Yk=

+

E

F

gr◊

+

G

kP

∞

‹

F

F

P

·

F

P

¤

F

©

W∞

=

+

F

⁄

F

U

G

ı

F

Ÿ

F

Yk=

+

¤

F

Wk P

Ê

F

·

F

‹

F

Œ

F

C

E

F

ó

Ÿ

F

Yk=

+

=

+

F

“

Õ

F

F

Œ

F

=

+

F

‹

F

F

a·

F

‹

F

4,

É·

F

F

G

Ê

F

f

F

F

©

ı

©

dU

©

(

ı

F

k“

P

∂

F

G

ı

F

WJ

Œ

F

.

ı

F

U

.

º

∏

F

ı

F

F

fi

µ

F

U

=

W+

Œ

F

F

¤

F

ı

F

W°

F

F

Œ

F

F

°

F

F

∂

F

F

˘

Y)

¤

F

Wk ª

F

F

P

°

F

ı

F

W 1971 ¤

F

Wk

¤

F

Z

°

F

[º

F

“

Õ

F

F

Œ

F

=

+

F

‹

F

F

a·

F

‹

F

,

‹

F

]Œ

F

F

G

©

W∞

©

F

Ê

F

fi

¤

F

Wk P

Ë

F

ÿ

©

P

=

+

‹

F

F

;

F

‹

F

F

ó

BRIEF HISTORY OF THE BANK

History of United Bank of India dates back to 1914. Comilla Banking Corporation Ltd. (established in

1914), Comilla Union Bank Ltd. (established in 1922) and Hooghly Bank Ltd. (established in 1932)

amalgamated with Bengal Central Bank Ltd., formed on October 12, 1950, originally established in 1918 as

Bengal Central Loan Company Ltd. to form United Bank of India Ltd. on December 18, 1950. On July 19,

1969, the Bank was nationalized along with 13 other Banks as a Corresponding New Bank. Subsequently,

Cuttack Bank Ltd., Tezpur Industrial Bank Ltd., Hindustan Mercantile Bank Ltd., and Narang Bank of India

Ltd. were merged with the Bank. The Head Office of the Bank was situated at 4, Clive Ghat Street (presently

known as N. C. Dutta Sarani), Kolkata - 700001 from where it was shifted to United Tower, it’s present Head

Office in 1971.

‹

F

]Œ

F

F

G

©

W∞

ı

F

k=

+

·

—

F

United Vision

¤̆

F

F

fi

F

ı

F

k=

+

·

—

F

Ê

‹

F

F

Ê

F

ı

F

F

P

‹

F

=

+

∂

F

F

,

P

Ê

F

Ë

Ê

F

F

ı

F

J

Ê

F

k—

F

F

fi

º

P

Ë

F

a∂

F

F

=

W+

Ê

F

F

∂

F

F

Ê

F

fi

µ

F

¤

F

Wk,

ı

F

¤

F

P

Ò

E

P

⁄

F

Ë

F

F

ı

F

Œ

F

E

Z

fi

ı

F

F

¤

F

F

P

°

F

=

+

H

∏

F

fi

º

F

P

‹

F

∂

‹

F

X

k=

W+

H

òòF

∂

F

¤

F

¤

F

F

Œ

F

=

+

X

k=

+

X

E

—

F

Œ

F

F

=

+

fi

,

ı

F

¤

F

ı

∂

F

ı

Ê

F

∂

Ê

F

F

Õ

F

F

P

fi

‹

F

X

k=

+

U

E

—

F

Wá F

F

E

X

kE

Z

fi

E

—

F

Œ

F

W=

+

¤

F

aò F

F

P

fi

‹

F

X

k=

+

U

¤

F

˘

∂

Ê

F

F

=

+

F

ká F

F

E

X

k=

+

U

—

F

[fi

F

=

+

fi

Œ

F

W

E

Z

fi

°

F

X

P

&

F

¤

F

“

Ÿ

F

kÕ

F

Œ

F

—

F

fi

ı

F

¤

F

]P

òF

∂

F

Ÿ

F

·

F

º

W∂

F

WC

J

,¤̆

F

F

fi

Wº

WË

F

=

W+

J

=

+

,

Ê

‹

F

Ê

F

ı

F

F

‹

F

Ê

F

_P

J

Ê

F

k·

F

F

⁄

F

“

º

∂

F

F

—

F

fi

=

Wk+

Ω

U

⁄

F

[∂

F

,

;

F

P

∂

F

Ë

F

U

·

F

,

“

Z

√

X

P

;

F

=

+

U

H

Œ

Œ

F

∂

F

,

;

F

eF

˘

=

+

P

˘

∂

F

W

F

U

,

“

;

F

F

¤

F

U

,

E

F

P

ª

F

a=

+

‡

—

F

¤

F

Wk ı

F

]º

_≥

s,

E

P

&

F

·

F

⁄

F

F

fi

∂

F

U

‹

F

Ÿ

F

Yk=

+

=

W+

‡

—

F

=

W+

‡

—

F

¤

F

Wk H

⁄

F

fi

Œ

F

F

˘

Ykó

ı

F

F

fi

∂

F

:

,

ı

F

Ê

F

X

a=

_+

Ò

∂

F

F

=

+

U

“

F

P

—

∂

FŬ

,

¤̆

F

F

fi

WŸ

F

Yk=

+

=

+

F

E

F

k∂

F

P

fi

=

+

º

Ë

F

aŒ

F

E

Z

fi

“

Wfi

µ

F

F

F̂

U

∂

FX̆

;

F

F

ó

To emerge as a dynamic, techno savvy, customer- centric, progressive and financially sound premier bank of

our country with pan India presence, sharply focused on business growth and profitability, with due

emphasis on risk management in an environment of professionalism, trust and transparency, observing

highest standards of corporate governance and corporate social responsibilities, meeting the expectations of

all its stakeholders as well as the aspirations of its employees.

Essentially, Pursuit of Excellence is going to be core philosophy and driving force for the bank.

7

2012-13

Performance Highlights of

Financial Year 2012-13

P

Ê

F

∏

F

U

‹

F

Ê

F

F

a 2012-13 =

W+

P

Œ

F

—

F

F

º

Œ

F

=

+

U

¤

F

]&

‹

F

Ÿ

F

F

∂

F

Wk

=

]+

·

F

Ê

‹

F

Ê

F

ı

F

F

‹

F

¤

F

Wk 11.35% =

+

U

Ê

F

_P

Total Business grow by 11.35%

—

F

P

fi

òF

F

·

F

Œ

F

;

F

∂

F

·

F

F

⁄

F

¤

F

Wk 12.1% =

+

U

Ê

F

_P

Operating Profit up by 12.1%

Ÿ

‹

F

F

°

F

E

F

‹

F

¤

F

Wk 16.21% =

+

U

Ê

F

_P

Interest Income up by 16.21%

;

F

Yfi

Ê

‹

F

F

°

F

E

F

‹

F

¤

F

Wk 45.53% =

+

U

Ê

F

_P

Non-Interest Income up by 45.53%

E

P

;

F

e¤

F

X

k¤

F

Wk 9% =

+

U

Ê

F

_P

Advances up by 9%

°

F

¤

F

F

¤

F

Wk 12.9% =

+

U

Ê

F

_P

Deposits up by 12.9%

—

F

[k°

F

U

—

F

‹

F

aF

—

∂

F

∂

F

F

11.66%; —

F

fi

,

©

U

‹

F

fi

1- 8.40 % —

F

fi

Capital Adequacy at 11.66%; Tier 1 at 8.40 %

“

F

ª

F

P

¤

F

=

+

∂

F

F

“

F

—

∂

F

áF

∑

WF

¤

F

kW P

º

J

°

F

F

Œ

F

WÊ

F

F

·

F

WE

P

;

F

¤

eF

X

k¤

F

kW 15% =

+

U

Ê

F

P

_ Advances to Priority Sector grew by 15%

J

¤

F

J

ı

F

G

aE

P

;

F

e¤

F

X

k¤

F

Wk 20.91% =

+

U

Ê

F

_P

MSE Advances grew by 20.91%

8

Annual Report

2012-13

=

+

F

‹

F

aP

Œ

F

—

F

F

º

Œ

F

=

+

U

J

=

+

§

F

·

F

=

+

fi

F

P

Ë

F

=

+

fi

X

∞

s`¤

F

Wk

Amount in ` Crore

PERFORMANCE AT A GLANCE

¤

F

F

Œ

F

º

k∞

/ Parameters

Ë

F

F

&

F

F

E

X

k=

+

U

ı

F

k&

‹

F

F

/ No. of Branches

—

F

[k°

F

U

/ Capital

G

aP

ÉÊ

F

©

U

/ Equity

—

F

U

J

Œ

F

ı

F

U

—

F

U

J

ı

F

/ PNCPS

“

F

fi

P

áF

∂

F

J

Ê

F

kE

P

Õ

F

Ë

F

W

F

/ Reserve & Surplus

—

F

[k°

F

U

—

F

‹

F

F

a—

∂

F

∂

F

F

/ Capital Adequacy

Ÿ

F

Yı

F

W·

F

I / Basel I

Ÿ

F

Yı

F

W·

F

I / Basel II

ı

F

◊

+

·

F

·

F

F

⁄

F

/ Gross Profit

Ë

F

] ·

F

F

⁄

F

/ Net Profit

=

]+

·

F

°

F

¤

F

F

/ Total Deposit

E

Z

ı

F

∂

F

°

F

¤

F

F

/ Average Deposit

“

P

∂

F

Ë

F

∂

F

Ê

F

_P

/ Per Cent Increase

ı

F

◊

+

·

F

E

P

;

F

e¤

F

/ Gross Advances

E

Z

ı

F

∂

F

ı

F

◊

+

·

F

E

P

;

F

e¤

F

/ Average Gross Advances

“

P

∂

F

Ë

F

∂

F

Ê

F

_P

/ Per Cent Increase

=

]+

·

F

Ê

‹

F

Ê

F

ı

F

F

‹

F

/ Total Business

“

P

∂

F

Ë

F

∂

F

Ê

F

_P

/ Per Cent Increase

P

Œ

F

Ê

F

WË

F

/ Investments

“

F

ª

F

P

¤

F

=

+

∂

F

F

“

F

—

∂

F

áF

W∑

F

E

P

;

F

e¤

F

/ Advances to Priority Sector

Ë

F

] °

F

¤

F

F

=

+

F

“

P

∂

F

ı

F

∂

F

/J

J

Œ

F

Ÿ

F

U

ı

F

U

/ Per Cent of Net Credit / ANBC

=

]+

·

F

=

+

¤

F

aò F

F

fi

U

/ Total Staff

“

P

∂

F

=

+

¤

F

aò F

F

fi

U

Ê

‹

F

Ê

F

ı

F

F

‹

F

/ Business Per Employee

9

2010-11

2011-12

2012-13

1597

1680

1729

344.42

361.00

374.71

800

800

800

3877.26

4418.69

4709.01

11.16%

10.48%

9.77%

13.05%

12.69%

11.66%

1507

1829

2050

523.97

632.53

391.9

77845

89116

100651

67855

76242

87791

9%

12%

15.15%

53934

63873

69708

46196

53433

60962

19%

16%

14.09%

131779

152989

170359

18.80%

16.10%

11.35%

26259

29059

33463

17751

22258

25604

41.52%

41.30%

40.09%

15062

15500

15479

8.60

9.70

10.83

2012-13

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

F

gr◊

+

G

kP

∞

‹

F

F

“

Õ

F

F

Œ

F

=

+

F

‹

F

F

a·

F

‹

F

:

‹

F

]Œ

F

F

G

©

W∞

©

F

Ê

F

fi

11,

˘

W¤

F

k∂

F

Ÿ

F

ı

F

]ı

F

fi

µ

F

U

=

+

X

·

F

=

+

F

∂

F

F

700 001

ı

F

[ò F

Œ

F

F

UNITED BANK OF INDIA

HEAD OFFICE: UNITED TOWER

11 HEMANTA BASU SARANI

KOLKATA – 700001

NOTICE

ı

F

[ò F

Œ

F

F

º

U

°

F

F

∂

F

U

˘

YP

=

+

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

F

g◊

+

G

kP

∞

‹

F

F

(

Ë

F

W‹

F

fi

J

Ê

F

kŸ

F

Y*

=

Wk+

)

P

Ê

F

P

Œ

F

‹

F

¤

F NOTICE IS HEREBY GIVEN that pursuant to Regulation 48 of

2010 =

W+

P

Ê

F

P

Œ

F

‹

F

¤

F

48 =

W+

E

Œ

F

]ı

F

F

fi

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

F

gr◊

+

G

kP

∞

‹

F

F

=

W+

Ë

F

W‹

F

fi

Õ

F

F

fi

=

+

X

k=

+

U the United Bank of India (Shares & Meetings) Regulations 2010,

òF

F

Yª

F

WÊ

F

F

P

F

a=

+

E

F

¤

F

ı

F

⁄

F

F

Ë

F

]=

e+

Ê

F

F

fi

P

º

Œ

F

F

k=

+

21 °

F

[Œ

F

2013 =

+

X

—

F

[Ê

F

F

a˚

9.30 Ÿ

F

°

F

W the fourth Annual General Meeting of the shareholders ofst

UNITED BANK OF INDIA will be held on Friday, June 21

⁄

F

F

F

F

⁄

F

Ê

F

Œ

F

ı

F

⁄

F

F

;

F

F

fi

,

fi

F

Ò

dU

‹

F

—

F

]ı

∂

F

=

+

F

·

F

‹

F

,

Ÿ

F

]·

F

Ÿ

F

WP

∞

‹

F

fi

fi

X

∞

,

E

·

F

U

—

F

]fi

,

=

+

X

·

F

=

+

F

∂

F

F 2013, at 9.30 A.M. at Bhasha Bhavan Auditorium, National

700 001 ¤

F

Wk X̆

;

F

U

P

°

F

ı

F

¤

F

Wk P

Œ

F

¤

Œ

F

F

kP

=

+

∂

F

P

Ê

F

F

‹

F

Ë

F

F

P

¤

F

·

FX̆

k;

F

Wó

Library, Belvedre Road, Alipore, Kolkata-700027 to transact the

following business:1. 31 ¤

F

F

òF

a,

2013 =

+

X

ı

F

¤

F

F

—

∂

F

Ê

F

F

a=

W+

Ÿ

F

Yk=

+

=

W+

∂

F

]·

F

Œ

F

—

F

∑

F

,

·

F

F

⁄

F

F̆

P

Œ

F

&

F

F

∂

F

F

=

W+ 1.

To discuss, approve and adopt the Balance Sheet, Profit &

st

°

F

P

fi

J

“

º

P

Ë

F

a∂

F

Ÿ

F

Yk=

+

=

W+

P

=

e+

‹

F

F

=

+

·

F

F

—

F

F

Wk —

F

fi

P

Œ

F

º

WË

F

=

+

¤

F

k∞

·

F

=

+

U

P

fi

—

F

X

©

aE

Z

fi Loss Account of the Bank as at and for the year ended 31

∂

F

]·

F

Œ

F

—

F

∑

F

E

Z

fi

·

F

W&

F

F

—

F

fi

U

áF

=

+

=

+

U

P

fi

—

F

X

©

a—

F

fi

òF

òF

F

a,

H

ı

F

=

+

F

E

Œ

F

]¤

F

X

º

Œ

F

E

Z

fi March, 2013, the Report of the Board of Directors on the

workings and activities of the Bank for the period covered by

E

k;

F

U

=

+

F

fi

=

+

fi

Œ

F

F

ó

the Accounts and the Auditor's Report on the Balance Sheet

and Accounts.

2.

G

aP

ÉÊ

F

©

U

Ë

F

W‹

F

fi

—

F

fi

P

Ê

F

∏

F

U

‹

F

Ê

F

F

a 2012-13 =

W+

P

·

F

J

·

F

F

⁄

F

F

kË

F

f

F

X

F

µ

F

F

=

+

fi

Œ

F

F

ó

3.

P

Œ

F

¤

Œ

F

P

·

F

P

&

F

∂

F

ı

F

k=

+

·

—

F

=

+

F

WJ

=

+

P

Ê

F

Ë

F

W

F

ı

F

k=

+

·

—

F

=

W+

‡

—

F

ı

F

kË

F

F

WÕ

F

Œ

F

ı

F

P

˘

∂

F

‹

F

F

Ÿ

F

;

F

Yfi3. To consider and if thought fit, pass with or without

modification, the following resolution as a Special

ı

F

¤

F

§

F

F

°

F

F

Œ

F

F

‹

F

F

P

Ê

F

òF

F

fi

=

+

fi

∂

F

WC

J

—

F

F

P

fi

∂

F

P

=

+

‹

F

F

°

F

F

Œ

F

F

:

2.

To Declare Dividend on Equity Shares for the Financial Year

2012-13.

Resolution:

“ı

F

k=

+

·

—

F

—

F

F

P

fi

∂

F

P

=

+

‹

F

F

;

F

‹

F

F

P

=

+

Ÿ

F

YkP

=

k+

;

F

=

k+

—

F

Œ

F

U

(

H

—

F

=

e+

¤

F

F

Wk =

+

F

E

P

⁄

F

;

F

e µ̆

F

E

F

Yfi

E

k∂

F

fi

µ

F

)

E

P

Õ

F

P

Œ

F

‹

F

¤

F

,

1970 (

E

P

Õ

F

P

Œ

F

‹

F

¤

F

)

fi

F

Ò

dU

‹

F

=

_+

∂

F

Ÿ

F

Yk=

+

(

“

Ÿ

F

kÕ

F

Œ

F

E

F

Yfi

P

Ê

F

P

Ê

F

Õ

F

“

F

Ê

F

Õ

F

F

Œ

F

)

‹

F

F

W°

F

Œ

F

F

,

1970 (

‹

F

F

W°

F

Œ

F

F

)

‹

F

]Œ

F

F

G

©

W∞

Ÿ

F

Yk=

+

E

F

gr◊

+

G

kP

∞

‹

F

F

(

Ë

F

W‹

F

fi

E

F

Yfi

Ÿ

F

Y*

=

+

)

P

Ê

F

P

Œ

F

‹

F

¤

F

,

2010 =

W+

E

Œ

F

]ı

F

fi

µ

F

¤

F

Wk E

F

Yfi

⁄

F

F

fi

∂

F

U

‹

F

P

fi

°

F

Ê

F

a

Ÿ

F

Yk=

+

(

“E

F

fi

Ÿ

F

U

E

F

G

a”)

,

⁄

F

F

fi

∂

F

ı

F

fi

=

+

F

fi

(

“°

F

U

E

F

WE

F

G

a”)

,

⁄

F

F

fi

∂

F

U

‹

F

“

P

∂

F

⁄

F

[P

∂

F

J

Ê

F

kP

Ê

F

P

Œ

F

¤

F

‹

F

Ÿ

F

F

W∞

a(

“ı

F

WŸ

F

U

”)

=

W+

E

Œ

F

]¤

F

F

Wº

Œ

F

,

ı

F

¤̆

F

P

∂

F

,

¤

F

k°

F

[fi

U

,

‹

F

P

º

˘

YE

F

Yfi

/

E

ª

F

Ê

F

F

G

ı

F

ı

F

kŸ

F

kÕ

F

¤

F

Wk E

—

F

WP

áF

∂

F

P

=

+

ı

F

U

E

Œ

‹

F

“

F

P

Õ

F

=

+

F

fi

U

E

F

Yfi

G

ı

F

ı

F

kŸ

F

kÕ

F

¤

F

Wk Ë

F

∂

F

Wb

∂

F

ª

F

F

ı

F

kË

F

F

WÕ

F

Œ

F

°

F

Yı

F

F

P

=

+

E

Œ

F

]¤

F

F

Wº

Œ

F

º

W∂

F

Wı

F

¤

F

‹

F

H

Œ

F

=

W+

¬

F

fi

F

P

Ê

F

P

˘

∂

F

˘

YE

F

Yfi

P

°

F

ı

F

¤

F

Wk

P

Œ

F

º

WË

F

=

+

¤

F

k∞

·

F

=

+

U

ı

F

¤̆

F

P

∂

FF̆

WE

F

Yfi

Ë

F

∂

F

Wb =

W+

E

Õ

F

U

Œ

F

E

ª

F

F

a∂

F

h,

ı

F

WÊ

F

U

(

—

F

[c°

F

U

°

F

F

fi

U

E

F

Yfi

E

—

F

WP

áF

∂

F

“

=

+

©

U

=

+

fi

µ

F

)

E

P

Õ

F

P

Œ

F

‹

F

¤

F

,

2009 (E

G

aı

F

U

∞

U

E

F

fi

P

Ê

F

P

Œ

F

‹

F

¤

F

Œ

F

)

/

¤

F

F

;

F

aº

Ë

F

U

a,

‹

F

P

º

⁄

F

F

fi

∂

F

U

‹

F

P

fi

°

F

Ê

F

aŸ

F

Yk=

+

,

ı

F

WÊ

F

U

,

=

W+

¬

F

fi

F

E

P

Õ

F

ı

F

[ò F

Œ

F

F/ —

F

P

fi

—

F

∑

F

E

F

P

º

Ÿ

F

YkP

=

k+

;

F

E

P

Õ

F

P

Œ

F

‹

F

¤

F

,

1949, “

P

∂

F

⁄

F

[∂

F

U

P

Ê

F

P

Œ

F

‹

F

¤

F

Ÿ

F

F

W∞

aE

P

Õ

F

P

Œ

F

‹

F

¤

F

,

1992

E

F

Yfi

E

Œ

‹

F

“

‹

F

F

W°

‹

F

=

+

F

Œ

F

[Œ

F

E

ª

F

F

Ê

F

F

ı

F

¤

F

‹

F

ı

F

¤

F

‹

F

—

F

fi

E

Œ

‹

F

ı

F

k;

F

∂

F

“

F

P

Õ

F

=

+

F

P

fi

‹

F

F

Wk

¬

F

fi

F

°

F

F

fi

U

P

=

+

J

;

F

J

E

F

Yfi

ı

©

F

g=

+

J

Éı

F

òF

Wk°

F

=

W+

ı

F

F

ª

F

=

+

U

;

F

G

aP

·

F

P

ı

©

k;

F

=

+

fi

F

fi

=

W+

Ë

F

∂

F

F

aÕ

F

U

Œ

F

,

°

F

F̆

cŸ

F

Yk=

+

=

W+

G

P

ÉÊ

F

©

U

Ë

F

W‹

F

fi

ı

F

[ò F

U

Ê

F

˘

Yk,

J

∂

F

º

h¬

F

fi

F

Ë

F

W‹

F

fi

Õ

F

F

fi

=

+

F

Wk =

+

U

ı

F

¤̆

F

P

∂

F

Ÿ

F

Yk=

+

=

W+

P

Œ

F

º

WË

F

=

+

¤

F

k∞

·

F

(

G

ı

F

=

W+

—

F

Ë

òF

F

∂

F

G

ı

F

WŸ

F

F

W∞

aE

P

⁄

F

P

˘

∂

F

P

=

+

‹

F

F

°

F

F

J

;

F

F

,

°

F

F

WP

=

+

Ÿ

F

F

W∞

a¬

F

fi

F

;

F

P

*

∂

F

P

=

+

ı

F

U

ı

F

P

¤

F

P

∂

F

E

ª

F

Ê

F

F

G

ı

F

ı

F

k=

+

·

—

F

¬

F

fi

F

“

F

—

∂

F

E

P

Õ

F

=

+

F

fi

ı

F

¤

F

W∂

F

H

ı

F

=

W+

Ë

F

P

É∂

F

“

‹

F

F

W;

F

=

+

fi

Œ

F

W=

W+

P

·

F

J

;

F

P

*

∂

F

ı

F

P

¤

F

P

∂

F

)

°

F

F

W

E

F

Ê

F

k©

Œ

F

,

“

ı

∂

F

F

Ê

F

E

F

P

º

°

F

F

fi

U

=

+

fi

Œ

F

W(

◊

+

¤

F

aE

F

Ê

F

k©

Œ

F

=

W+

¤

F

]«

W—

F

fi

E

F

fi

áF

µ

F

=

W+

P

·

F

J

“

F

Ê

F

Õ

F

F

Œ

F

ı

F

¤

F

W∂

F

E

F

Yfi

/E

ª

F

Ê

F

F

J

Wı

F

W⁄

F

F

;

F

=

W+

“

P

∂

F

‹

F

F

W;

F

U

=

W+

E

F

Õ

F

F

fi

—

F

fi

E

F

Yfi

P

◊

+

fi

·

F

F

;

F

[=

+

F

Œ

F

[Œ

F

¬

F

fi

F

Ê

‹

F

F

P

É∂

F

‹

F

F

Wk =

+

U

J

Wı

F

U

Í

F

WP

µ

F

‹

F

F

Wk =

W+

P

·

F

J

E

Œ

F

]¤

F

P

∂

F

º

U

°

F

F

ı

F

=

+

∂

F

U

˘

Y)

J

=

+

“

ı

∂

F

F

Ê

F

E

P

⁄

F

·

F

W&

F

/“

ı

F

—

F

YÉ ©

E

ª

F

Ê

F

F

J

Wı

F

WE

Œ

‹

F

º

ı

∂

F

F

Ê

F

W°

F

,

⁄

F

F

fi

∂

F

E

ª

F

Ê

F

F

P

Ê

F

º

WË

F

¤

F

Wk “

∂

‹

F

W=

+

10 fl

—

F

‹

F

W=

W+

E

kP

=

+

∂

F

¤

F

[·

‹

F

=

W+

G

aP

ÉÊ

F

©

U

Ë

F

W‹

F

fi

E

F

Yfi

“

U

P

¤

F

‹

F

¤

F

ı

F

¤

F

W∂

F

fl

.

1000 =

+

fi

F

W∞

s(

J

=

+°̆

F

F

fi

=

+

fi

F

W∞

s fl

—

F

‹

F

W)

ı

F

WE

P

Õ

F

=

+

Œ

F

14

“RESOLVED THAT, pursuant to the provisions of the

Banking Companies (Acquisition and Transfer of

Undertakings) Act, 1970 (Act), The Nationalised Banks

(Management and Miscellaneous Provisions) Scheme, 1970

(Scheme) and the United Bank of India (Shares and

Meetings) Regulations, 2010 and subject to the approvals,

consents, sanctions, if any, of the Reserve Bank of India

(“RBI”), the Government of India (“GOI”), the Securities

and Exchange Board of India (“SEBI”), and / or any other

authority as may be required in this regard and subject to

such terms, conditions and modifications thereto as may be

prescribed by them in granting such approvals and which

may be agreed to by the Board of Directors of the Bank and

subject to the regulations viz., SEBI(Issue of Capital and

Disclosure Requirements) Regulations, 2009 (ICDR

Regulations) / guidelines, if any, prescribed by the RBI,

SEBI, notifications/circulars and clarifications under the

Banking Regulation Act, 1949, Securities and Exchange

Board of India Act, 1992 and all other applicable laws and

all other relevant authorities from time to time and subject to

the Listing Agreements entered into with the Stock

Exchanges where the equity shares of the Bank are listed,

consent of the shareholders of the Bank be and is hereby

accorded to the Board of Directors of the Bank (hereinafter

called “the Board” which shall be deemed to include any

Committee which the Board may have constituted or

hereafter constitute to exercise its powers including the

powers conferred by this Resolution) to offer, issue and allot

(including with provision for reservation on firm allotment

Annual Report

F̆

W,

Ÿ

F

YkP

=

k+

;

F

=

k+

—

F

Œ

F

U

(

H

—

F

=

e+

¤

F

F

Wk =

+

F

E

P

⁄

F

;

F

e µ̆

F

E

F

Yfi

E

k∂

F

fi

µ

F

)

E

P

Õ

F

P

Œ

F

‹

F

¤

F

,

1970

=

W+

⁄

F

F

;

F

3(2J

)

=

W+

E

Œ

F

]ı

F

F

fi

Ÿ

F

Yk=

+

=

+

U

E

Õ

F

U

=

_+

∂

F

—

F

[c°

F

U

=

+

U

H

òòF

∂

F

¤

F

ı

F

U

¤

F

F

fl

—

F

‹

F

W

3000 =

+

fi

F

W∞

s=

W+

Ÿ

F

Yk=

+

=

+

U

=

]+

·

F

“

F

P

Õ

F

=

_+

∂

F

P

Œ

F

P

Õ

F

¤

F

Wk ı

F

W fl

—

F

J

374.71 =

+

fi

F

W∞

s=

+

U

¤

F

F

Y°

F

[º

F

“

º

∏

F

G

aP

ÉÊ

F

©

U

Ë

F

W‹

F

fi

—

F

[k°

F

U

=

W+

ı

F

F

ª

F

E

ª

F

Ê

F

F

ı

F

kË

F

F

WÕ

F

Œ

F

=

W+

E

Œ

F

]ı

F

F

fi

E

Õ

F

U

=

_+

∂

F

Ê

F

P

Õ

F

a∂

F

—

F

[c°

F

U

(

‹

F

P

º

˘

Y)

,

P

°

F

ı

F

W⁄

F

P

Ê

F

‹

F

¤

F

Wk E

P

Õ

F

P

Œ

F

‹

F

¤

F

¤

F

Wk G

ı

F

“

=

+

F

fi

Ë

F

F

P

¤

F

·

F

P

=

+

‹

F

F

°

F

F

ı

F

=

+

∂

F

F

˘

YP

=

+

=

Wk+

Ω

ı

F

fi

=

+

F

fi

˘

fi

ı

F

¤

F

‹

F

Ÿ

F

Yk=

+

=

+

U

“

º

∏

F

G

aP

ÉÊ

F

©

U

—

F

[c°

F

U

=

+

F

51% =

W+

Œ

F

U

òF

WÕ

F

F

fi

µ

F

Œ

F

Ŭ

k=

+

fi

Wk;

F

W,

òF

F

˘

WŸ

F

™

F

=

_+

∂

F

E

ª

F

Ê

F

F

Ÿ

F

F

°

F

F

fi

º

fi

=

W+

“

U

P

¤

F

‹

F

¤

F

,

J

=

+

E

ª

F

Ê

F

F

E

P

Õ

F

=

+

Í

F

_k&

F

·

F

F

¤

F

Wk ı

F

º

ı

‹

F

F

Wk ¤

F

Wk ı

F

WJ

=

+

‹

F

F

E

P

Õ

F

=

+

ı

F

º

ı

‹

F

Ê

FŸ

F

Yk=

+=

W+=

+

¤

F

aò F

F

P

fi

‹

F

F

Wk,⁄

F

F

fi

∂

F

U

‹

FŒ

F

F

;

F

P

fi

=

+

F

Wk,E

P

Œ

F

Ê

F

F

ı

F

U⁄

F

F

fi

∂

F

U

‹

F

(

J

Œ

F

E

F

fi

E

F

G

a)

,

=

k+

—

F

P

Œ

F

‹

F

F

Wk,

Ê

‹

F

P

É∂

F

;

F

∂

FÊ

Fı

F

F

Ê

F

a°

F

P

Œ

F

=

+

,

P

Œ

F

Ê

F

WË

Fı

F

kı

ª

F

F

Œ

F

,

ı

F

P

¤

F

P

∂

F

‹

F

F

c,Œ

‹

F

F

ı

F

,&

F

F

W°

Fı

F

kı

ª

F

F

Œ

F

,‹

F

F

W;

‹

F

∂

F

F

“

F

—

∂

Fı

F

kı

ª

F

F

;

F

∂

F&

F

fi

U

º

º

F

fi

(

É‹

F

[E

F

G

aŸ

F

U

)

°

F

Yı

F

WP

Ê

F

º

WË

F

U

ı

F

kı

ª

F

F

;

F

∂

F

P

Œ

F

Ê

F

WË

F

=

+

(

“J

◊

+

E

F

G

aE

F

G

a”)

,

Ÿ

F

Yk=

+

,

P

Ê

F

∂

∂

F

U

‹

F

ı

F

kı

ª

F

F

J

c,

⁄

F

F

fi

∂

F

U

‹

F

—

F

F

fi

ı

—

F

P

fi

=

+

P

Œ

F

P

Õ

F

,

Ê

F

Wkò F

fi

—

F

[c°

F

U

P

Œ

F

P

Õ

F

,

P

Ê

F

º

WË

F

U

Ê

F

Wkò F

fi

—

F

[c°

F

U

P

Œ

F

Ê

F

WË

F

=

+

F

Wk,

fi

F

°

‹

F

E

F

Y√

F

WP

;

F

=

+

P

Ê

F

=

+

F

ı

F

P

Œ

F

;

F

¤

F

,

Ÿ

F

U

¤

F

F

=

k+

—

F

P

Œ

F

‹

F

F

Wk,

“

F

WP

Ê

F

∞

Wk©

◊

k+

∞

,

—

F

WkË

F

Œ

F

◊

k+

∞

,

P

Ê

F

=

+

F

ı

F

P

Ê

F

∏

F

U

‹

F

ı

F

kı

ª

F

F

Œ

F

F

Wk ‹

F

F

E

Œ

‹

F

ı

F

kı

ª

F

F

E

F

Wk,

“

F

P

Õ

F

=

+

F

fi

U

E

ª

F

Ê

F

F

P

=

+

ı

F

U

E

Œ

‹

F

Ê

F

;

F

a=

W+

P

Œ

F

Ê

F

WË

F

=

+

¤

F

F

Y°

F

[º

F

P

Ê

F

P

Œ

F

‹

F

¤

F

/¤

F

F

;

F

º

Ë

F

U

a=

W+

E

Œ

F

]ı

F

F

fi

E

ª

F

Ê

F

F

H

—

F

‹

F

]aÉ ∂

F

¤

F

Wkı

F

W=

+

F

WG

a⁄

F

U

ı

F

¤

F

[˘

°

F

F

WG

aP

ÉÊ

F

©

U

/E

P

Õ

F

¤

F

F

Œ

‹

F

Ë

F

W‹

F

fi

/Ÿ

F

Yk=

+

=

W+

“

P

∂

F

⁄

F

[P

∂

F

‹

F

F

Wk ¤

F

Wk,

Ÿ

F

Yk=

+

°

F

Yı

F

F

P

=

+

H

P

òF

∂

F

ı

F

¤

F

§

F

W,

P

Œ

F

Ê

F

WË

F

=

+

fi

Œ

F

W=

W+

P

·

F

J

“

F

P

Õ

F

=

_+

∂

F

˘

Yó ”

“—

F

]Œ

F

:

ı

F

k=

+

·

—

F

—

F

F

P

fi

∂

F

P

=

+

‹

F

F

;

F

‹

F

F

P

=

+

G

ı

F

G

Ë

‹

F

[,

“

ı

∂

F

F

Ê

F

‹

F

F

E

F

E

F

Ê

F

k©

Œ

F

=

+

F

W

2012-13

and/or competitive basis of such part of issue and for such

categories of persons as may be permitted by the law then

applicable) by way of an offer document/prospectus or such

other document, in India or abroad, such number of equity

shares of the face value of Rs.10 each and in any case not

exceeding Rs. 1000 Crore (Rupees One Thousand Crore)

including premium which, together with the existing Paidup Equity share capital of Rs. 374.71 crore shall be within

the total authorized capital of the Bank of Rs.3000 crore,

being the ceiling as per Section 3(2A) of the Banking

Companies (Acquisition and Transfer of Undertakings) Act,

1970 or to the extent of enhanced Authorised Capital as per

the Amendment (if any ), that may be made to the Act in

future, in such a way that the Central Govt. shall at all times

hold not less than 51% of the paid-up Equity capital of the

Bank , whether at a discount or premium to the market price,

in one or more tranches, to one or more of the members,

employees of the Bank, Indian nationals, Non-Resident

Indians (“NRIs”), Companies - private or public,

Investment Institutions, Societies, Trusts, Research

Organizations, Qualified Institutional Buyers (“QIBs”) like

Foreign Institutional Investors (“FIIs”), Banks, Financial

Institutions, Indian Mutual Funds, Venture Capital Funds,

Foreign Venture Capital Investors, State Industrial

Development Corporations, Insurance Companies,

Provident Funds, Pension Funds, Development Financial

Institutions or other entities, authorities or any other

category of investors which are authorized to invest in equity

/ preference shares / securities of the Bank as per extant

regulations/guidelines or any combination of the above as

may be deemed appropriate by the Bank."

“RESOLVED FURTHER THAT, such issue, offer or

allotment shall be by way of public issue, rights issue, or

such other issue which may be provided by applicable laws,

with or without over-allotment option and that such offer,

issue, placement and allotment be made as per the provisions

of the Banking Companies (Acquisition and Transfer of

Undertakings) Act, 1970, the SEBI (Issue of Capital and

Disclosure Requirements) Regulations, 2009 (“ICDR

Regulations”) and all other guidelines issued by the RBI,

SEBI and any other authority as applicable, and at such time

or times in such manner and on such terms and conditions as

the Board may, in its absolute discretion, think fit."

—

F

P

Ÿ

·

F

=

+

G

Ë

‹

F

[,

fi

F

G

©

hı

F

G

Ë

‹

F

[,

‹

F

F

J

Wı

F

F

=

+

F

WG

aE

Œ

‹

F

G

Ë

‹

F

[¬

F

fi

F

P

=

+

‹

F

F

°

F

F

J

;

F

F

P

°

F

ı

F

=

+

F

E

P