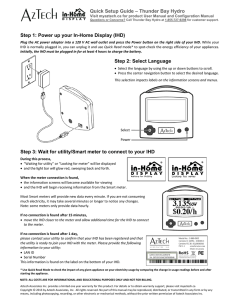

Pacific Gas and Electric Company`s Home Area Network (HAN) Pilot

advertisement