Third Party Intermediaries – exploration of market issues and options

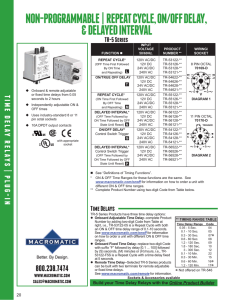

advertisement