Consultation Paper - Department of Lands

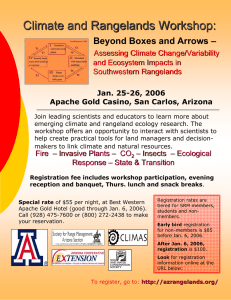

advertisement