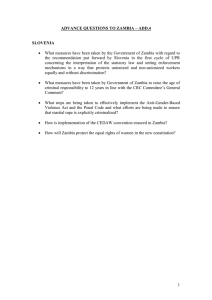

Enterprise Development Programmes in Tanzania and Zambia

advertisement