Multiple Devices and Screens

advertisement

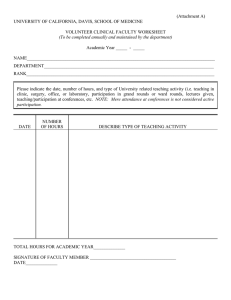

© 2015 Phocuswright Inc. All Rights Reserved. 1 1,000 startups Founded since 2005 Focused on digital travel Tagged vertically (segment) and horizontally (medium/technology) © 2015 Phocuswright Inc. All Rights Reserved. 2 US$12 billion+ Publicly disclosed angel, seed, venture funding & industry acquisitions Base: 986 companies Notes: Publicly disclosed funding information up to December 2014. Includes pre-IPO funding rounds for HomeAway and Qunar. Excludes funding rounds and acquisitions of companies established prior to 2005. Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 3 3 52% Raised in 2014 alone (think Uber) Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 4 What’s the State of Online Travel Companies? Crowded © 2015 Phocuswright Inc. All Rights Reserved. 6 6 Majority of Online Travel Startups Concentrate on Just Three Regions 40% 26% 27% Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 7 Funding Follows Entrepreneurial Drive, Regional Online Travel Growth 49% 15% 32% Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 8 U.S., Chinese Online and Mobile Travel Intermediaries Have Raised the Most Capital Since 2005 Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 9 9 U.S., Chinese Online and Mobile Travel Intermediaries Have Raised the Most Capital Since 2005 Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 10 10 Few Win in the Race for Capital Share of Total Funding Raised by Online Travel Companies Worldwide, 2005-2014 Uber 22% Others 51% Didi Dache 7% Airbnb 7% Trivago 6% HomeAway Qunar 4% 3% Base: 986 companies Notes: Publicly disclosed funding information up to December 2014. Includes pre-IPO funding rounds for HomeAway and Qunar. Excludes funding rounds and acquisitions of companies established prior to 2005. Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 11 Many Imitate Few Innovate © 2015 Phocuswright Inc. All Rights Reserved. 12 12 Raised ~$6B $40B Valuation Market Cap $3B Raised $795M $13B Valuation Raised $332.5M $2B Valuation Raised $81M+ Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 13 But There’s A Whole Lot More to Ground Transportation Than Point-to-Point Taxis … Founded in 2007, acquired by India’s Ibibo Group (Naspers) for $94M in June 2013 Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 14 One in Five Travel Startups Are Mobile-Oriented Inspire Curate Locate Save Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 15 Mobile Is the Fastest Growing Horizontal Segment 1,832% Funding Growth in Mobile Travel Startups Between 2011-2014 Base: 986 companies Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 16 Here Comes the Money © 2015 Phocuswright Inc. All Rights Reserved. 17 25 Total Funding (US$M) 2.700 130 309 91 161 0 0 Ground Transport Number of Companies Private Accommodation Publicly Disclosed Funding Lodging Average Funding Per Company (US$M) Capital Raised by Travel Startups by Vertical Focus, 2005-2014 Air Average Funding Per Company Base: 986 companies Notes: Publicly disclosed funding through December 2014. Excludes funding rounds and acquisitions of companies established prior to 2005. Also excludes select funding rounds that would otherwise skew the results (e.g., Baidu's $306 million acquisition of Qunar in 2011, Uber's $2.4 billion and Didi Dache's $800 million funding rounds in 2014). Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 18 Total Funding (US$M) 2.700 25 410 195 163 168 0 0 Booking Number of Companies Mobile Publicly Disclosed Funding Search Average Funding Per Company (US$M) Capital Raised by Travel Startups by Horizontal Focus, 2005-2014 Content Play Average Funding Per Company Base: 986 companies Notes: Publicly disclosed funding through December 2014. Excludes funding rounds and acquisitions of companies established prior to 2005. Also excludes select funding rounds that would otherwise skew the results (e.g., Baidu's $306 million acquisition of Qunar in 2011, Uber's $2.4 billion and Didi Dache's $800 million funding rounds in 2014). Source: Phocuswright Inc. © 2015 Phocuswright Inc. All Rights Reserved. 19 © 2015 Phocuswright Inc. All Rights Reserved. 20 Thank You! Chetan Kapoor Research Analyst, Asia Pacific Phocuswright @KapoorChetan #phocuswright