Pentair, Inc. - Investor Relations Solutions

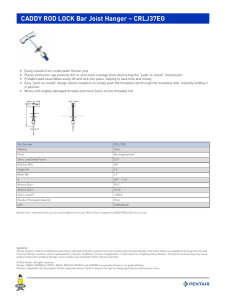

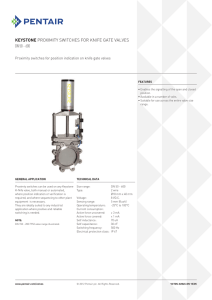

advertisement