Measuring Supply Chain Performance: Guide to

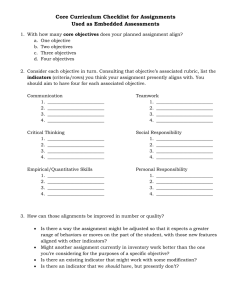

advertisement