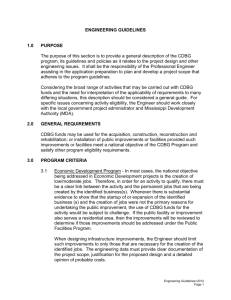

categories of eligible activities

advertisement