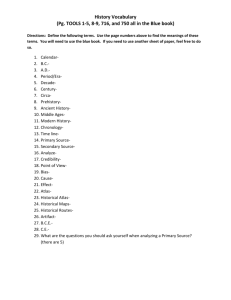

Ancient Land Law: Mesopotamia, Egypt, Israel

advertisement