DMIC - - Ahmedabad, Vadodara And Surat

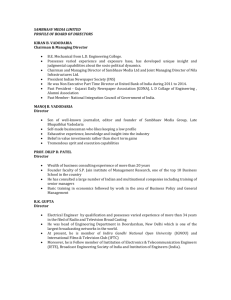

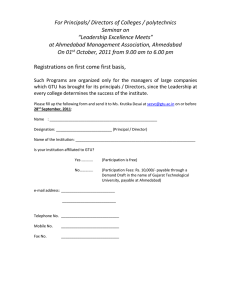

advertisement