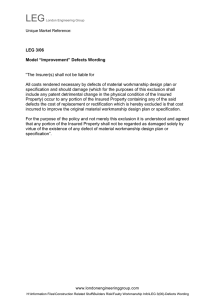

(CGL) Policy

advertisement