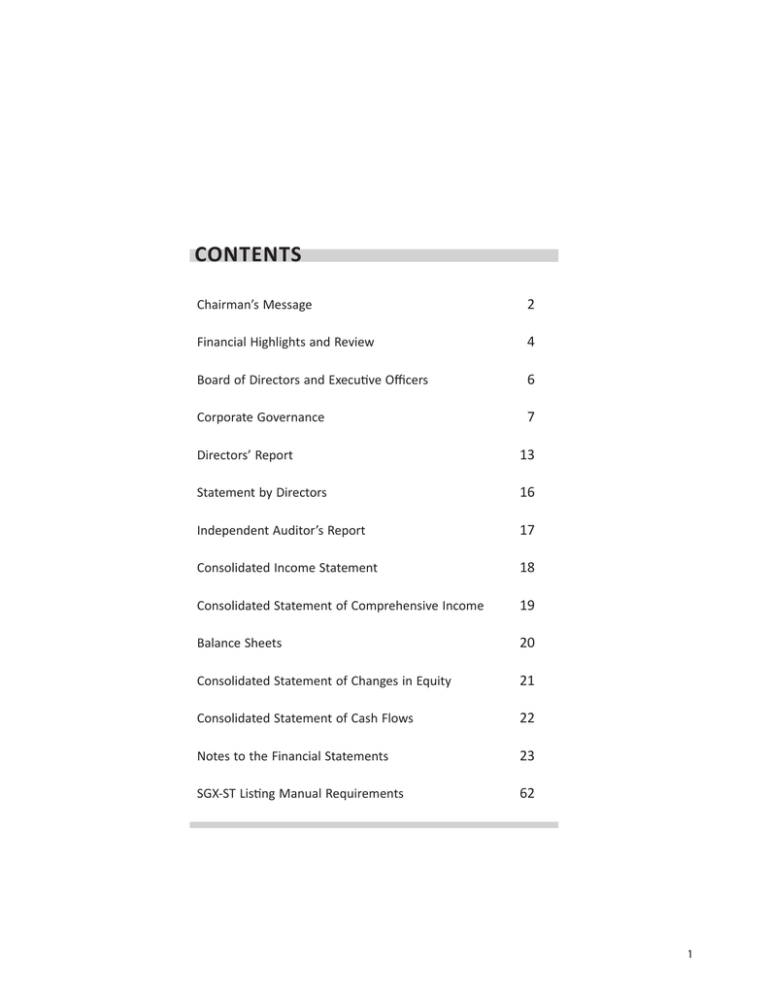

contents - Creative

advertisement