Increasing Global Competition and Labor Productivity: Lessons from

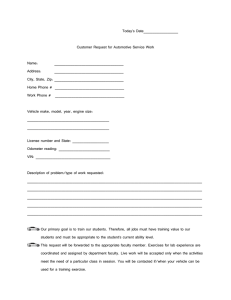

advertisement