Provincial Sales Tax (PST) Notice Notice to Off

advertisement

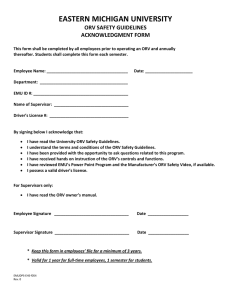

Provincial Sales Tax (PST) Notice Notice 2013-011 Issued: August 2013 Revised: December 2014 Notice to Off-Road Vehicle Owners Provincial Sales Tax Act Latest Revision: The revision bar ( ) identifies changes to the previous version of this notice dated November 2014. For a summary of the changes, see Latest Revision at the end of Page 2. This notice explains how the PST applies to off-road vehicles (ORVs), including snowmobiles, ATVs and dirt bikes purchased or received as a gift in BC or acquired outside BC and brought into BC. You must pay PST on ORVs you purchase, lease or receive as a gift in BC, and ORVs you purchase, lease or receive as a gift outside BC and bring into the province, unless a specific exemption applies. The PST applies regardless of whether or not the ORV is required to be registered. If you acquire an ORV from a seller or lessor who is registered to collect PST, the seller or lessor will collect any PST payable on the ORV. If you acquire an ORV from another person in BC, or you acquire an ORV outside of BC and then bring, send or receive delivery of the ORV in BC, you must self-assess or pay any PST payable to the Insurance Corporation of British Columbia (ICBC) at the time of registration. If you have already purchased, received as a gift or brought an ORV into BC and have not yet paid PST, you must self-assess or pay any PST payable to ICBC at the time of registration. For more information about PST payable on vehicles, including ORVS, and claiming exemptions on vehicles, see Bulletin PST 308, PST on Vehicles. Tax Rates and Payment Information If you purchase an ORV at a private sale, you must pay PST at the rate of 12% of the purchase price. This includes purchases you make outside BC and bring into the province, and purchases you made previously without paying PST. In the case of ORVs from outside BC, PST is payable on the depreciated purchase price at the time the ORV enters BC. For information on depreciated purchase price, see PST Bulletin 308, PST on Vehicles. If you receive an ORV as a gift from a person other than a GST registrant providing a taxable supply, either in BC or outside BC but within Canada, you must pay PST at the rate of 12% of the fair market value of the ORV. If the ORV was acquired as a taxable supply from a GST registrant (e.g. ORV dealer) in BC or outside BC but within Canada, or you bring the ORV into BC from outside Canada (regardless of whom it was acquired from), you must pay PST at the rate of 7% of the purchase price. In Ministry of Finance, PO Box 9442 Stn Prov Govt, Victoria BC V8W 9V4 the case of ORVs from outside BC, PST is payable on the depreciated purchase price at the time the ORV enters BC. If you must register the ORV, ICBC will collect the PST at the time of registration if PST has not yet been paid. Otherwise, you must self-assess the PST payable using the Casual Remittance Return (FIN 405) and include a copy of the bill of sale with your payment. If you acquire an ORV from a seller or lessor who is registered to collect PST, you must pay any PST payable to the seller or lessor. ORVs Acquired Before April 1, 2013 PST of 12% applies to ORVs acquired at a private sale: in BC on or after July 1, 2010 and before April 1, 2013, and outside BC but within Canada and brought into BC on or after July 1, 2010 and before April 1, 2013. If you must register the ORV, ICBC will collect PST at the time of registration if PST has not yet been paid. Otherwise, you must self-assess the PST payable using the Casual Remittance Return (FIN 405) and include a copy of the bill of sale with your payment. You may be required to pay the provincial portion of the HST on that ORV if the applicable tax has not been paid for ORVs acquired: at a sale that is a taxable supply from a GST registrant (e.g. ORV dealer) outside BC but within Canada and brought into BC on or after July 1, 2010 and before April 1, 2013, or brought into BC from outside Canada on or after July 1, 2010 and before April 1, 2013. For more information, please contact us (see Further Information below). For ORVs acquired or brought into BC before July 1, 2010, the 7% provincial sales tax (under the Social Service Tax Act) applies. If you did not pay PST at the time of purchase or bringing it into BC, you must self-assess the tax payable using the Casual Remittance Return (FIN 405) and include a copy of the bill of sale with your payment. You will not be required to pay the PST at the time of registration. Further Information If you have any questions, please call us toll free at 1 877 388-4440 or email your questions to CTBTaxQuestions@gov.bc.ca You can also find information on our website at gov.bc.ca/pst The information in this notice is for your convenience and guidance and is not a replacement for the legislation. You can access the legislation and regulations on our website under Publications. Latest Revision December 2014 Provided a reference for more information about the depreciated purchase price Notice to Off-Road Vehicle Owners Page 2 of 5 Frequently Asked Questions Documentation Required to Prove Payment of Tax on ORVs If you purchased the ORV in BC, brought it into BC, or received an ORV as a gift, on or after July 1, 2010 and did not pay tax, you will be required to pay the applicable sales tax at the time of registration, unless a specific exemption applies. Similar to other vehicles, ICBC will collect any tax owing at the time of registration. What am I required to provide to the ICBC agent as evidence I paid tax on my ORV? The following outlines what documentation to provide to the ICBC agent at the time of registration as proof tax was paid on the ORV. The Ministry recommends owners of ORVs keep their documents for five years for audit purposes. Purchased at a private sale Purchased in BC or brought into BC July 1, 2010 - March 31, 2013 • Documents from the Ministry of Finance confirming tax paid. • If you did not keep these documents, then you or your broker can follow up with the ministry to confirm you self-assessed tax. Purchased from an HST/GST registrant (i.e. motor vehicle dealer) On or after April 1, 2013 • Documents from the Ministry of Finance confirming BC PST paid. If you did not keep these documents, then you or your broker can follow up with the ministry to confirm you self-assessed tax. • Bill of sale from a BC PST registered seller (that is not a GST registrant) showing BC PST paid. Purchased in BC or brought into BC July 1, 2010 - March 31, 2013 On or after April 1, 2013 • Bill of sale from seller showing • Bill of sale from seller showing BC PST paid, or HST paid, or • If you are unable to get a copy of • If you are unable to get a copy the bill of sale from the dealership of the bill of sale from the (i.e. the dealership is out of dealership (i.e. the dealership is business), you will be required to out of business), you will be provide a notarized statement required to provide a notarized about the purchase, including statement about the purchase, whom you purchased the ORV including whom you purchased from and the payment of tax. the ORV from and the payment of tax. Please note: For ORVs purchased on or after November 17, 2014, a notarized statement will not be accepted. Brought into BC from outside Canada July 1, 2010 - March 31, 2013 On or after April 1, 2013 • Record of payment of HST to • Record of payment of PST to Canada Border Services CBSA or a copy of the import Agency (CBSA) or a copy of the document indicating payment of import document indicating tax. payment of tax. Notice to Off-Road Vehicle Owners Page 3 of 5 Example 1 You purchased an ORV in October 2013 from a dealership in BC and paid PST at the time of purchase. When you register your ORV, you will not be required to pay PST provided you present your bill of sale to the ICBC broker. Example 2 You purchased an ORV in Washington State and brought it into BC in December 2013. You paid the PST to CBSA. When you register your ORV, you will not be required to pay PST if you provide documentation indicating you paid PST at the time of importation. What if I do not have proof of payment of tax? ICBC has the authority to refuse to register your ORV if taxes under the Excise Tax Act (Canada), Consumption Tax Rebate and Transition Act or the Provincial Sales Tax Act have not been paid. To register your ORV, you will need to provide proof of payment of tax or pay sales tax to ICBC. If you purchased your ORV, were gifted the ORV or brought it into BC on or after July 1, 2010, this will apply to you. If you do not provide any documentation related to the ORV, you will be required to pay PST at the rate of 12% when you register it. Example 1 You purchased an ORV from a dealership in Alberta, paying the GST at the time of purchase. In September 2014, you bring it into BC, without self-assessing the PST. At the time of registration, you will be required to pay PST at a rate of 7%. Example 2 You purchased an ORV at a private sale in BC in May 2012 and did not self-assess tax to the Ministry of Finance on the purchase. As you did not self-assess tax, you will be required to pay PST at the rate of 12% at the time of registration. What if I received my ORV as a gift? If you received an ORV as a gift in BC, or you receive an ORV as a gift from outside BC and bring or send the ORV into the province, you must pay PST on the fair market value of the ORV, unless a specific exemption applies. For information on vehicle exemptions, including ORVs, see Bulletin PST 308, PST on Vehicles. How would tax be calculated on my ORV at the time of registration? Tax is calculated based on the purchase price of the ORV, or in the case of an ORV received as a gift, the fair market value of the ORV. When you register your ORV, you will be required to declare the purchase price you paid for the ORV, or the fair market value of the ORV if received as a gift, on the vehicle transfer form. If the ORV was purchased and brought into BC from another jurisdiction within Canada, the tax is calculated based on the depreciated purchase price at the time the ORV entered BC. Notice to Off-Road Vehicle Owners Page 4 of 5 Does the Ministry of Finance review transactions? As with all vehicle transactions on which PST is owing, the ministry routinely reviews transfers of ORVs to ensure tax is paid as required. In doing so, the ministry may require information to support the purchase price you declare. If you are unable to support the purchase price or fair market value claimed, you may be assessed additional PST on the ORV. Notice to Off-Road Vehicle Owners Page 5 of 5