2016 Hired Hauler Packet

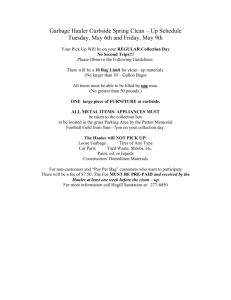

advertisement