CMS Issues Final Hospice Payment Rule for FY2015 Below is a

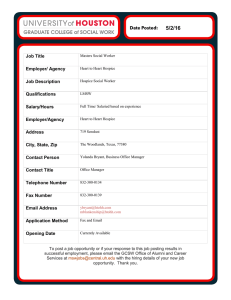

advertisement

CMS Issues Final Hospice Payment Rule for FY2015 Below is a summary of the key policy changes of the FY2015 hospice final. The rule included final payment rate information and policy changes that become effective on Oct. 1, 2014. Providers will note that CMS did not take any action on the definitions of “related condition” and “terminal illness”. CMS indicated it will consider the comments received and definitions for possible future rulemaking. FY2015 Rates (Final) 1. Payment increase changes: In the FY2015 Hospice Wage Index final rule, the hospital market basket increase is slightly higher than in the proposed rule – 2.1% in the final rule compared to 2.0% in the proposed rule. Please note the rates below in calculations for FY2015. 2. Wage index changes: CMS released updated tables with all wage index values, representing a change from the tables released for the proposed FY2015 wage index. Please note those changes when calculating rates for FY2015. The CMS link to the wage index tables is here. For hospices submitting required hospice quality data Code 651 652 655 656 Description Routine Home Care Continuous Home Care Full Rate applies to 24 hours of care Hourly rate = $38.75 Inpatient Respite Care General Inpatient Care Increase by the FY2015 FY2014 Payment Final hospice FY 2015 Final Rates payment Payment Rate update of 2.1% $156.06 X 1.021 $159.34 $910.78 X 1.021 $929.91 $161.42 $694.19 X 1.021 X 1.021 $164.81 $708.77 If a hospice does not submit the required hospice quality data, the regulations require that the hospice payment update (market basket) percentage be reduced by 2.0%. For FY2015, as an example, the rates would increase by 0.1% if the hospice did not submit the required hospice quality data. See the chart below. For hospices who DO NOT submit the required hospice quality data Code Description 651 Routine Home Care Continuous Home Care 652 Full Rate applies to 24 hours of care 655 656 Increase by the FY2015 hospice FY2015 FY2014 Payment payment update Hospice Rates percentage Payment Rate of 2.1% minus 2% = 0.1% increase $156.06 X 1.001 $156.22 Hourly rate = $38.75 Inpatient Respite Care General Inpatient Care $910.78 X 1.001 $911.69 $161.42 $694.19 X 1.001 X 1.001 $161.58 $694.8 NOE (Notice of Election) FILING Requirement: Effective October 1, 2014 hospices must file the NOE within five calendar days after the effective date of the election. Timely filing is considered having the NOE submitted and accepted by the Medicare Administrative Contractor (MAC). The date of election will count as day zero so if a patient were admitted on a Thursday, the hospice must have the NOE filed (submitted and accepted) no later than Tuesday. Consequence: Hospices that do not submit the NOE timely cannot bill for any days of care until the NOE is accepted by the MAC. The hospice cannot charge the beneficiary for hospice care during this time and must continue to provide hospice care to the beneficiary. CMS refers to these as ‘provider liable’ days Tips and Notes: The NOE must be filed by DDE, mail or messenger. CMS did state they would look into the possibility of submitting the NOEs electronically but until then hospices must submit them via DDE, mail or messenger. Hospices should ensure that they are able to get the NOE submitted via DDE and develop a back-up plan for mailing or delivering the NOE by messenger to the MAC should the ability to submit it via DDE be interrupted and the situation does not meet one of the four exceptions. This may require a change in scheduling and staffing of personnel submitting the NOE. For instance, if the person(s) submitting the NOEs does not come into the office at least weekly, is on vacation, or unexpectedly not able to submit the NOE; another staff member will need to be trained to submit the NOE and verify that it has been accepted within the 5 day timeframe. There are four exceptions to the timely filing requirement. The hospice must document the situation meeting the exception and request the exception. Only if the MAC grants the exception are the consequences waived for the hospice. MACs will provide hospices with information about exceptions processes/policies in the future. The four situations CMS listed for exceptions are: 1. Fires, floods, earthquakes, or other unusual events that inflict extensive damage to the hospice’s ability to operate; 2. An event that produces a data filing problem due to a CMS or MAC systems issue beyond the control of the hospice; 3. A newly Medicare-certified hospice that is notified of that certification after the Medicare certification date, or which is awaiting its user ID from its MAC; or 4. Other circumstances determined by CMS to be beyond the control of the hospice. CMS stated in its comments that it will not allow exceptions for hospice personnel issues; internal IT systems issues that the hospice may experience; the hospice not knowing the requirements; and failure of the hospice to have back-up staff to file the NOE. OCHCH is suggesting that hospices: add a compliance audit to their program that audits for the submission of the NOE within the required timeframe modify processes and staffing as needed to ensure compliance develop a back-up submission plan modify policies and procedures to reflect this new requirement, its exceptions, and the hospice’s modified processes make every effort to submit and have the NOE accepted as soon as possible after election as CMS indicated it may consider shortening the five day requirement in the future NOTR (Notice of Termination/Revocation) FILING Requirement: Effective October 1, 2014 hospices must file the NOTR within five calendar days after the effective date of discharge or revocation, unless the hospice has submitted a final claim. Timely filing is considered having the NOTR submitted and accepted by the Medicare Administrative Contractor (MAC). The date of revocation or discharge will count as day zero so if a patient revoked on a Thursday, the hospice must have the NOTR filed (submitted and accepted) or a final claim submitted no later than Tuesday. Consequence: CMS will not impose any consequences for late filing of the NOTR (or not having a final claim submitted) at this time but will consider doing so in the future. Tips and Notes: CMS may use type of bill 81B as the NOTR. However, it does not appear that CMS systems/MAC systems are ready to handle this. CMS indicates it will communicate instructions to MACs in the future. NAHC and HAA are suggesting that hospices: add a compliance audit to their program that audits for the submission of the NOTR or the final claim within the required timeframe modify processes and staffing as needed to ensure compliance develop a back-up submission plan modify policies and procedures to reflect this new requirements and the hospice’s modified processes make every effort to submit and have the NOTR accepted as soon as possible after termination/revocation as CMS indicated it may consider shortening the five day requirement in the future ADDITION OF ATTENDING PHYSICIAN TO HOSPICE ELECTION FORM AND CHANGE OF DESIGNATED ATTENDING PHYSICIAN Requirement: Effective October 1, 2014 the hospice election statement must include the patient’s choice of attending physician Information identifying the attending physician should be recorded on the election statement in enough detail so that it is clear which physician or NP was designated as the attending physician. Hospices have the flexibility to include this information on their election statement in whatever format works best for them, provided the content requirements in §418.24(b) are met. Language on the election form should include an acknowledgement by the patient (or representative) that the designated attending physician was the patient’s (or representative’s) choice. Effective October 1, 2014 if a patient (or representative) wants to change his or her designated attending physician, the patient (or representative) must file a signed statement, with the hospice, that identifies the new attending physician in enough detail so that it is clear which physician or NP was designated as the new attending physician The statement needs to include o the date the change is to be effective, o the date that the statement is signed, and o the patient’s (or representative’s) signature, along with an acknowledgement that this change in the attending physician is the patient’s (or representative’s) choice. The effective date of the change in attending physician cannot be earlier than the date the statement is signed. The hospice should include information such as the physician’s full name, office address, or NPI number on the election form when needed to correctly identify the attending physician chosen by the beneficiary (such as when there is more than one physician with the same last name). Consequence: If the election statement is not completed as required the hospice cannot bill Medicare and, upon review, if CMS finds the election statement to be incomplete or not completed correctly it could require the hospice to pay back any monies received that are tied to the election. If the hospice does not document a change in attending physician correctly CMS could deny payment for effected days. Hospices may also be at risk of survey deficiencies. Tips and Notes: CMS defines the hospice attending physician as “…either 1) a doctor of medicine or osteopathy legally authorized to practice medicine and surgery by the State in which he or she performs that function or action; or 2) a nurse practitioner who meets the training, education, and experience requirements described elsewhere in our regulations.” The definition also sets out the requirement that the patient identify the attending physician at the time he or she elects to receive hospice care, as having the most significant role in the determination and delivery of the individual's medical care. There are two additional conditions of participation to note: §418.52(c)(4) the patient has the right to choose his or her attending physician. §418.64(a)(3) requires that if the attending physician is unavailable, the hospice medical director, hospice contracted physician, and/or hospice physician employee is responsible for meeting the medical needs of the patient. CMS has heard about some hospice practices which are of concern. They are a hospice: changing a patient’s attending physician when the patient moves to an inpatient setting, often changing the attending to an NP assigning an attending physician based on whoever is available CMS clarifies in its comments that the attending physician status need not change when a patient enters GIP. If the attending physician is not available or declines to fulfill the duties of the attending physician when the patient is in an inpatient setting, the hospice physician fills in as required at 418.64(a)(3). This also applies when the attending physician does not have privileges at the inpatient facility. Hospice should document in the medical record situations where the attending is no longer willing or available to follow patient. Hospice should inform the patient/representative that a new attending may be chosen. Hospices are reminded that the attending physician at a facility does not necessarily meet the definition of the hospice attending physician. For instance, a nursing home patient’s record may indicate that the medical director of the nursing facility is the patient’s attending; however, the hospice still needs to discuss this with the patient/representative and provide the patient the option of choosing an attending physician for hospice care. CMS also clarified that a patient can choose a hospitalist to be the patient’s attending physician for hospice care; however, the hospice should notify the patient that hospitalists only follow patients who are hospitalized. Hospices are also reminded that when a physician refers a patient to hospice care this does not mean the referring physician is the attending physician. Again, the patient chooses the attending physician. CMS will issue educational materials to alert hospices and treating physicians about inappropriate use of the attending physician modifier on claims and will update beneficiary materials. OCHCH suggests hospices: Educate all staff regarding the definition of attending physician for hospice care, the patient’s right to choose the attending physician, and what process to follow and documentation necessary in instances where the attending physician is unable or unwilling to fulfill the role Modify the election statement to include o Patient’s choice of attending physician o Acknowledgement by the patient (or representative) that the designated attending physician was the patient’s (or representative’s) choice. Develop and implement a change in designated attending physician form to include o Identification of the new attending physician in enough detail so that it is clear which physician or NP was designated as the new attending physician o the date the change is to be effective, o the date that the statement is signed, and o the patient’s (or representative’s) signature, along with an acknowledgement that this change in the attending physician is the patient’s (or representative’s) choice. Note: The effective date of the change in attending physician cannot be earlier than the date the statement is signed. Add compliance audits for attending physician choice, proper election statement requirements, and change in designated attending physician requirements Hospice Self-Reporting of CAP Requirement: Hospices will self-report the aggregate cap only (as opposed to the aggregate and inpatient cap) 5 months after the end of the cap year, or March 31 of each year. Overpayments are required to be paid when the report is submitted, although options for an extended repayment plan are available. Consequence: If the provider does not file its cap report as required, CMS will suspend payments to the hospice in whole or in part until the aggregate cap is filed with the MAC. Tips and Notes: MACs will continue to calculate the inpatient caps for providers. MACs will also reconcile all payments at the final cap determination but will not initiate the aggregate cap report. CMS requires hospices to wait at least 3 months after the end of the cap year, or January 31 or later, to calculate the self-determined aggregate cap, including a reasonable number of claims. This means hospices must calculate their aggregate cap between February 1 and March 31 each year beginning in 2015. Hospices will need to remit any overpayments at that time as well unless utilizing an extended repayment plan. Providers will follow the same extended repayment schedule and processes that were in effect prior to this requirement. Hospices will need to use the Provider Statistical and Reimbursement (PS&R) system in order to complete the aggregate cap determination. CMS has made efforts in the last two years to update the Provider Statistical and Reimbursement (PS&R) system. The updated PS&R enables hospices to calculate estimated caps and to monitor their cap status at different points during the cap year. OCHCH suggests hospices: Ensure they are able to access the PS&R. The passwords expire approximately every six months. Verify that the data in the PS&R is accurate Modify processes as necessary to ensure the cap determination is completed during the required timeframe. Periodically check the hospice’s data throughout the year to determine if a cap overpayment is likely and make necessary modifications to cash reserves to accommodate for this. HOSPICE QUALITY REPORTING PROGRAM (HQRP) Requirement: Hospices must continue to comply with the HIS requirements and begin compliance with the Hospice CAHPS survey requirements in January 2015. Consequence: Hospices not participating in the HQRP will have their payment update for the corresponding payment year reduced by 2 percentage points which could result in a negative payment, unless the hospice has requested and CMS has granted an extension/exception due to extraordinary circumstances beyond the provider’s control. Tips and Notes: OCHCH suggests hospices: Continue to comply with the HIS requirements and prepare to comply with the Hospice CAHPS survey requirements. Additional information on these requirements can be found on the HIS webpage and the Hospice CAHPS webpage. Maintain documentation of any extraordinary circumstances impacting the ability to participate in the HQRP program and follow the process CMS outlines (at a future date on the CMS hospice quality webpage) for requesting an extension/exception. DIAGNOSIS CODING FOR HOSPICES Requirement: Hospices must comply with the ICD-9/ICD-10 CM coding guidelines and must include the principle diagnosis and all related diagnoses on the hospice claim. Consequence: Effective October 1, 2014 (for those claims submitted on or after October 1, 2014) hospice claims containing inappropriate principal or secondary diagnosis codes, per ICD-9-CM coding conventions and guidelines, will be returned to the provider and will have to be corrected and resubmitted to be processed and paid. (for all claims submitted Effective October 1, 2014 CMS will implement edits related to etiology/manifestation code pairs from the Medicare code editor (MCE). Effective October 1, 2014, CMS will RTP hospice claims using “debility” or “adult failure to thrive” as the principal diagnosis. Additionally, CMS will RTP claims using an inappropriate dementia code as a principal diagnosis -- including those that require that the underlying causal condition be coded first. Tips and Notes: OCHCH suggesst hospices: Include ALL appropriate diagnoses that describe a patient’s terminal condition and related conditions on claims Prepare for utilization of proper ICD-9 CM coding guidelines and ensure these guidelines are followed for all claims submitted on or after October 1, 2014. This means a hospice will most likely need to properly apply the coding guidelines in September as most September claims will be submitted in October. Train applicable staff on the coding guidelines and maintain continuing education for applicable staff Add a compliance audit(s) for the ICD-9/ICD-10 CM coding guidelines PART D OCHCH suggests hospices continue to work within the prior authorization guidelines outlined by CMS in its July 18, 2014 memo. REMOVAL OF DEFINITION OF SOCIAL WORKER OCHCH suggests the hospice verify that its policies, job descriptions, etc. include the proper definition of social worker found at 418.114(b)(3) which was effective on December 2, 2008. Hospices can find the definition in the code of federal regulations or Appendix M of the State Operations Manual.