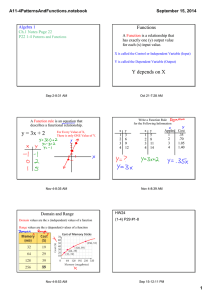

Title: Field of study

advertisement