european gas daily

advertisement

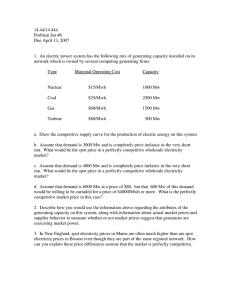

EUROPEAN GAS DAILY Volume 20 / Issue 215 / November 5, 2015 News & Analysis Market Commentary OMV to launch 2016/17 stock auction on Store-x Dutch flow drop supports NBP spot ■■1.7 TWh working gas volume offered ■■Traders wait for additional info to consider bids Spot gas prices on the UK’s NBP trading hub found support Wednesday in what is overall a bearish market as gas flows from the Netherlands (continued on page 2) Engie hit by weaker commodity prices, LNG Gas Natural Q3 sales down 3% on year Gas Natural expects its first US LNG in 2016 Lithuania LNG plant brings bargaining power ‘Efficiency gains may boost Norway output’ 2 2 2 3 9 (Eur/MWh) Day ahead 22 Forex, oil buffet TTF markets ZEE prices largely steady, tracking UK German curve supported by weaker euro French spot plunges after early gains PSV curve edges higher Winter-15 Summer-16 Q1-16 UK NBP 21 Day ahead December 20 Dutch TTF 19 Day ahead December 18 p/thEur/MWh $/MMBtu % change D-1 36.725 17.759 5.650 39.00018.859 6.000 -0.27 ▼ 36.148 17.475 5.562 37.07917.925 5.705 -0.14 ▼ 0.00 — +0.42 ▲ Belgian Zeebrugge Beach 17 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Source: Platts Nov-15Oct-15 (Trade date) 3.5 Day ahead December (Eur/MWh) 36.100 17.457 5.556 37.35018.061 5.749 -0.14 ▼ 36.148 17.475 5.562 37.49318.125 5.769 -1.96 ▼ 36.717 17.750 5.650 38.21718.475 5.880 -3.27 ▼ 36.872 17.825 5.673 37.28618.025 5.737 -0.56 ▼ +0.13 ▲ +0.14 ▲ French TRS* Day ahead Quarter ahead 3.0 Day ahead December French PEG Nord PSVNCG LOCATION SPREADS Day ahead December 2.5 2.0 +0.54 ▲ German GASPOOL 1.5 Day ahead December 1.0 0.5 +0.42 ▲ NetConnect Germany 0.0 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Source: Platts Oct-15 Nov-15 (Trade date) UK CLEAN SPARK VS CLEAN DARK SPREADS – MONTH AHEAD 10 4 5 5 6 7 Platts European gas midpoints, November 4, 2015 NCG TIME SPREADS 23 (continued on page 4) (Eur/MWh) Dark 8 Spark 50% HHV Spark 45% HHV Day ahead December 36.614 17.700 5.634 37.59618.175 5.785 -0.98 ▼ Day ahead 38.269 +0.14 ▲ December 38.32018.525 5.896 +0.41 ▲ +0.51 ▲ +0.41 ▲ Austrian VTP 18.500 5.888 Italian PSV 6 Day ahead 41.165 4 December 41.37220.000 6.366 +0.38 ▲ 2 Spanish AOC 0 December 40.64819.650 6.254 -0.76 ▼ -2 02-Jul 17-Jul 03-Aug 18-Aug 03-Sep 18-Sep 05-Oct 20-Oct 04-Nov (Trade date) 19.900 6.334 All prices assessed at 16:30 London time. At month roll, the day-on-day percentage change for month-ahead contracts will reflect delivery-month comparison where applicable. Spreads include CPS – Carbon Price Support. Efficiency at Higher Heating Value. Source: Platts www.platts.com www.twitter.com/PlattsGas NATURAL GAS European Gas Daily November 5, 2015 NEWS & ANALYSIS OMV to launch 2016/17 stock auction on Store-x ...from page 1 STORAGE The Austrian natural gas storage operator OMV Gas Storage will hold a capacity storage auction of about 1.7 TWh (160 million cu m) working gas volume November 26 for the year April 2016 to April 2017, European trading platform Store-x, which markets primary and secondary gas storage capacity products, said this week. The operator OMV will offer 100 standard bundle products, each one consisting of: n Injection rate: 8 MWh/h (18,000 cu m/d) n Withdrawal rate: 12 MWh/h (27,200 cu m/d) n Working gas volume: 17,000 MWh (1.6 million cu m) Some traders said they would need to get further information on the reserve price as well as on the injection and withdrawal specific period in order to evaluate whether they want to bid. All relevant documents for the auction will be published November 12 2015, Store-x said in a press release. As part of the so-called keyed auction procedure, the bidder has to submit a binding offer in the form of a bid, while the operator has to determine a call period, which should not be more than three months. Store-x will forward all offers submitted by bidders to the operator once the invitation to tender ends. Store-x will then inform the bidders when they have forwarded the bid to the operator, which will decide whether to accept or not the offers forwarded by Store-x. OMV has over 2 Bcm of storage capacity in Austria and Germany. — Lucie Roux Engie hit by weaker commodity prices, LNG ■■Revenues slip in first nine months of 2015 ■■LNG business hit by Yemen, Egypt issues ■■Oil, gas output rises on new field contributions UTILITIES French energy group Engie said Wednesday its nine-month operating performance was hit by falling commodity prices, which, among other things, led to lower realized prices and reduced arbitrage opportunities for its LNG activities. As a result of the more challenging operating environment, Engie said it expected its net income for 2015 to come in at the lower end of a previously adjusted range of Eur2.75 billion-3 billion ($3 billion-$3.25 billion). Total group revenues in the first nine months amounted to $53.5 billion, down 1.5% from the same period last year, Engie — formerly known as GDF Suez — said in an earnings statement. “This decrease is notably due to the drop in commodity prices and the unavailability of Doel 3 and Tihange 2 nuclear plants, despite a more favorable temperature compared to 2014,” Engie said. The group was hit particularly badly in its global gas and LNG division, where revenues in the first nine months were down 38% year on year to Eur3.2 billion. “This significant decrease is explained by the drop in oil and gas prices on the European and Asian markets, largely reducing arbitrage opportunities for the LNG activity, and by the disruption in supply from Egypt since January 2015 as well as from Yemen since April,” Engie said. The Yemen LNG plant, with which Engie has a long-term LNG purchase agreement, has been offline since mid-April amid increasing security concerns around the facility. Copyright © 2015 McGraw Hill Financial 2 No cargoes have been exported from the facility since mid-April. Egypt has diverted its gas production for domestic use given increasing shortages. Oil, gas output Engie said its total oil and gas production through the end of September was 43.5 million barrels of oil equivalent (160,000 boe/d). That is an increase of 15,000 boe/d compared with the yearago period. Engie said the rise was “thanks to contributions coming from fields commissioned in 2014, Juliet in the UK, Amstel in the Netherlands and Gudrun in Norway.” The group also reiterated its pledge not to invest in new coal-fired power generation. “In October, Engie announced that all its new investments in power production will be in projects that emit no or little CO2, in renewable energies and in natural gas,” it said. “This economic and ecological decision to build no further coalfired power plants, leads to stop all projects which had not yet been firmly committed.” — Stuart Elliott Gas Natural Q3 sales down 3% on year ■■Spanish sales fall 5% year on year ■■European distribution rises 7% at 37.6 TWh ■■Power generation falls 1% on year in the period DEMAND Spanish power and gas utility Gas Natural Fenosa reported Wednesday that its wholesale gas sales in the third quarter fell 3% year on year to 66.8 TWh following lower demand in the domestic market. Sales fell 5% year on year to 39.2 TWh in Q3 while sales outside Spain decreased 1% year on year to 27.5 TWh, according to a regulatory filing. Meanwhile the company said that the volume of gas distributed to European retail customers was up 7% year on year to 37.3 TWh. The volume of electricity distributed in Europe was down 3% in annual comparison at 8.3 TWh. The company ended the year with 5.7 million points of gas sale within the region, up 0.4% year on year, and 4.5 million points of electricity sale, also up 0.4% year on year. In the power segment, the company reported a 1% fall in Spanish power generation to 9 TWh in the wake of a 26% drop in hydropower generation to 317 GWh. In contrast, nuclear generation increased 12% year on year to 1.2 TWh and coal-based production 6% over the period to 2.8 TWh. — Gianluca Baratti Gas Natural expects its first US LNG in 2016 ■■CEO sees early FOB quantities ■■Company paying $6.33/MMBtu FOB in 2016 LNG Spain’s Gas Natural Fenosa expects to obtain some early quantities of LNG from the US Sabine Pass LNG terminal during 2016, according to company CEO Rafael Villaseca. The company, which has a 4.8 Bcm/year contract starting in 2017, said Wednesday it expects to place some volume ahead of that date, without saying how much. Villaseca said the company has already made agreements to sell 3 Bcm of the annual 4.8 Bcm it has agreed to buy from the plant’s operator Cheniere Energy. Villaseca said Gas Natural would buy US gas at an average of $6.33/MMBtu on a FOB basis for 2016. The company said it expects to sell 120 TWh of LNG globally in 2016, with 80% of that volume already covered. — Gianluca Baratti European Gas Daily November 5, 2015 Lithuania LNG plant brings bargaining power ■■LNG facility boosts supply security: Misiunas ■■Eyes role as key regional gas supplier ■■Terminal currently has 3.5 Bcm of spare capacity LNG Before Lithuania began importing LNG at the end of 2014, the move had already proven to be beneficial for the small Baltic country — it enabled Vilnius to win a much better price from Gazprom for its Russian gas supplies. And with its new LNG import facility holding plenty of spare capacity, Lithuania hopes to be able to become a bigger regional supplier of gas, reaching its Baltic neighbors and Poland in the coming years, the head of Lithuania’s state-controlled energy holding company told Platts Tuesday. In a wide-reaching interview, Lietuvos Energija CEO Dalius Misiunas said the decision to build an LNG import facility had fundamentally changed market dynamics in Lithuania and the wider Baltic region. Up until the start of LNG imports, Lithuania and its neighbors had been effectively 100% dependent on Russian gas supplies — and that lack of optionality meant Russia could push the price up as high as it liked. “LNG gives us additional security of supply and also gives us independence of supply — it basically reduced the dependence on a single source, which in turn impacted prices,” Misiunas told Platts. “The same year we started LNG supplies we had a reduction in the Gazprom price, which brought us back to the European market level.” Since 2003, the price Lithuania paid for Russian gas went up from $85/1,000 cu m to some $500/1,000 cu m just a few years ago. “That was a real threat to our economy,” Misiunas said. “The price now — we basically pay a similar price to what the Germans are paying, the European level.” Platts assessed the German Gaspool day-ahead gas price Tuesday at $5.754/MMBtu — or the equivalent of $207.80/1,000 cu m. Russian gas auctions? By introducing competition to Russian gas, Lithuania won some muchneeded bargaining power. The discount it won for its Russian gas imports was “substantial,” Misiunas said, at around 22%-23%. And it was retroactively applied, bringing the overall price down further. But what of the future? Misiunas said it was possible Gazprom could switch its sales mechanism to the Baltic region and hold auctions to sell its gas. “We are observing the situation around what Gazprom’s strategy will be for next year. They have done some pilot auctions and they have just announced recently that they could use an auction system for Baltic supplies as well. It depends on how that will develop and what mechanism they will choose for their supplies to the region,” he said. Gazprom has to face up to the fact that countries are no longer as dependent on Russian gas as they were in the past and that it increasingly faces competition from LNG in Europe. “My belief is that we will have more competition on the market,” Misiunas said. “The cost of Russian gas is much lower than the current sales price — the breakeven price. They have sufficient flexibility to compete. That is a decision [for them] on how they see their future markets and how far they want to go with the competition,” he said. In 2015, LNG will represent 25% of Lithuania’s total gas consumption which is expected to be 2-2.1 Bcm. So Russia still supplies 75% of Lithuania’s gas. Economic rationale Indeed, there have been some question marks about the economic viability of the LNG import terminal in Lithuania given that it is currently vastly underused and Russian gas is still cheaper. But Misiunas said it was not just about economics. “This project is a security of supply project. Then if you evaluate all the factors — including the reduction in the Russian gas price — then you can see the economic reason behind it,” he said. “What we have today is security of supply at a higher level, we have two different sources of gas and the infrastructure to cover all our demand from each of those sources. And we have negotiating power on both sides. “When you compare it with where we were two years ago, it’s a completely different story.” The facility has a current maximum import capacity of 4 Bcm/year, but a total of only 0.5 Bcm is expected to be delivered this year. The spare capacity means Lithuania could import more LNG for onward supply to its neighbors. “This is part of our plans — we want this market to develop. Since the beginning of the year we have supplied some gas from Lithuania to Estonia. We are now talking to the Latvians about supplying gas to them. Our goal is to activate the market as much as possible. Our LNG facility can support the whole region.” In addition, Misiunas said Lithuanian-imported LNG could also go to Poland via a planned gas interconnector. “If the price is good, if it works economically, the structure will support supplies to Poland once the interconnector is finished,” he said, adding that the current plan was to complete the line in 2020. LNG sources, demand concerns At present, Lithuania imports LNG from a single supplier — Norway’s Statoil — which was selected in a tender process in August 2014. But Lietuvos Energija also has a number of master trade agreements (MTAs) with different LNG suppliers to enable it to buy spot cargoes. One MTA is with the US. “We are definitely looking into the US market at the moment, we have been in talks with most of the export terminal developers, and we are evaluating US export potential,” Misiunas said. But, he said, Lithuania would not eye LNG imports from the US’ first phase of export projects. “Later projects — those coming online in 2019-2022 — this could have potential.” But while Lietuvos Energija has plans for a diverse LNG import portfolio, there is one lingering doubt about the region’s future prospects — falling demand. “Unfortunately consumption is going down in Lithuania, and has been going down rapidly in the past few years,” Misiunas said. “And next year, consumption will be a further 10%-15% lower. It’s not good news for the gas industry.” The main drivers of demand decline for gas is the increased use of biomass in heat generation and the removal of subsidies for gas-fired power generation. The startup at the end of this year of an electricity interconnector from Sweden has reduced the need for domestic power production. So, while Lithuania is enjoying its newly enhanced gas supply security, there is little point in having a diversified import portfolio if you don’t have the demand. But with other LNG import plans in the region, including Gasum’s planned Finngulf facility, being abandoned or slowed, Lietuvos Energija will be pinning its hopes on supplying the wider Baltic region. — Stuart Elliott (continued on page 9) Copyright © 2015 McGraw Hill Financial 3 European Gas Daily November 5, 2015 Platts UK NBP assessments, November 4, 2015 Market Commentary Dutch flow drop supports NBP spot ...from page 1 to the UK, which began unexpectedly at the start of the week, ended as abruptly during the morning, leaving the system short. At the 1630 UK market close, the within-day contract was valued at 37.15 pence/therm, up by 0.25 p/th on day, while the day-ahead contract hit an intraday high of 37.50 p/th before easing into the close, at 36.725 p/th, to mark a day-on-day loss of 0.10 p/th. System operator National Grid had demand for the day in its 1400 figures at 257 million cu m, with flows falling behind at 249 million cu m. After having seen almost no flows since June, gas began coming into the UK from the Netherlands through the BBL pipeline at the start of the week, sending 3 million cu m Sunday, 13 million cu m Monday and 12 million cu m Tuesday. Nominations for Wednesday were back to zero, Eclipse Energy, an analytics unit of Platts, showed. Elsewhere, the supply picture looked steady for the UK while demand for gas fired heating trimmed back as the country enjoys warmer than average temperatures. Local distribution zone (LDZ) demand was nominated at 140 million cu m, down 11 million cu m from Tuesday’s nominations, Eclipse said. Temperatures in the UK were forecast to climb 3.1 degrees Celsius above five-year averages Wednesday and are expected to keep climbing throughout the week to 5.3 C above on Friday, Eclipse said. Gas prices on the front of the curve held steady with no changes on day to December (39.00 p/th) or Summer 16 (35.60 p/th), but there were again firm losses on the far curve. Winter 17 saw the heaviest fall, losing 0.65 p/th at 39.30 p/th, whereas contracts from Summer 17 to Winter 19 saw 0.40-0.45 p/th declines. One market source said the moves are the result of the British Forex, oil buffet TTF markets Dutch curve prices came under the influence of both a weaker euro and falling crude oil markets Wednesday, with contracts retracing early forex-driven gains in response to oil price declines. Winter 17 dealt up at Eur18.65/MWh in the early afternoon, marking a 15 euro cent rise from Tuesday’s close. However, it had fallen 20 euro cent off its intra-day high by 16:30 London time to be assessed 5 euro cent down day on day at Eur18.45/MWh. Brent December crude was almost $1/b lower day on day at $48.81/b. Winter 18 TTF posted the strongest net response to the oil declines, falling by 10 euro cent day on day to Eur18.45/MWh. On the near-curve, early forex-related gains outpaced later bearish sentiment from lower crude oil to leave contracts slightly up on the day. By the close, Q1 15 and Summer 16 were both assessed 7.5 euro cent higher at Eur18.05/MWh and Eur17.425/MWh, respectively. On the prompt, day-ahead posted similar intra-day movements to the curve, with early strength giving way to declines from midafternoon. By the close, the spot was assessed 2.5 euro cent down on the day at Eur17.475/MWh. Real-time Norwegian flow rates into Emden-Dornum on the DutchGerman border stood at 145 million cu around 16:30 London time, according to network operator Gassco. Gassco reported that the unplanned outage due to compressor failure at the Asgard field would continue until Sunday or Monday. The volume impact on Wednesday was 10.5 million cu m/d, falling to 11.3 million cu m/d Thursday. Copyright © 2015 McGraw Hill Financial 4 p/th Change D-1Eur/MWh $/MMBtu (p/th) UK NBP market Within day 37.150+0.25017.964 5.715 DA 11:00 am 37.200+0.30017.988 5.723 Day ahead 36.725-0.10017.759 5.650 Weekend35.900+0.05017.360 5.523 Working week+1 36.700-0.30017.747 5.646 Balance month 38.000+0.10018.375 5.846 December39.000+0.00018.859 6.000 January39.500-0.05019.101 6.077 February39.850+0.00019.270 6.131 March 38.900+0.00018.810 5.985 Q1 2016 39.400-0.05019.052 6.062 Q2 2016 35.900+0.00017.360 5.523 Q3 2016 35.300-0.05017.070 5.431 Q4 2016 38.900-0.25018.810 5.985 Summer 16 35.600+0.00017.215 5.477 Winter 16 39.950-0.25019.318 6.146 Summer 17 35.300-0.40017.070 5.431 Winter 17 39.300-0.65019.004 6.046 Summer 18 34.700-0.40016.780 5.338 Winter 18 38.850-0.45018.786 5.977 Summer 19 34.200-0.40016.538 5.262 Winter 19 38.800-0.40018.762 5.969 Gas year 2016 37.625-0.32518.194 5.788 Cal 2016 37.375-0.07518.073 5.750 ICE UK NBP futures, November 4, 2015 (p/th) Month Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Sum 16 Win 16 Sum 17 Win 17 ClosePrevious ChangeLow HighVolume 38.95039.000 -0.05038.75039.600 8120 39.41039.450 -0.04039.38040.060 1595 39.76039.800 -0.04039.76040.350 1025 38.86038.900 -0.04038.86039.480 880 37.24037.300 -0.06037.38037.820 120 39.33439.374 -0.04039.35040.000 1835 35.822 35.882 -0.060—— — 35.271 35.344 -0.073—— — 38.953 39.183 -0.230—— 25 40.830 41.257 -0.427—— 25 35.581 35.964 -0.383—— — 35.087 35.493 -0.406—— — 38.296 38.913 -0.617—— — 35.54535.612 -0.06735.50036.300 2625 39.88140.209 -0.32839.85040.550 1815 35.33335.727 -0.39435.25035.900 745 39.30339.956 -0.65339.25040.000 835 Source: ICE Futures Europe ICE ENDEX UK OCM, November 3, 2015 No. tradesSAP (p/th)Energy (therms)Values (GBP) NBP total 127 37.7300 6,665,000 2,514,705 OCM – On-the-day Commodity Market Source: ICE ENDEX Platts UK NBP intra-day gas prices: November 4 p/thWithin day (A)Next day (B)EFA day ahead November 4 37.300 37.200 37.225 Prices assessed at 1100 UK time. EFA day-ahead is calculated at A*6/24 plus B*18/24. This reflects the difference between the 5am-start gas day and the 11pm-start EFA power day. During Monday-Thursday only the top row contains data, other rows used ahead of weekends and bank holidays. CustomWeather forecast temperatures in Amsterdam at 4 degrees Celsius above the 11/5 C high/low norms Wednesday, with temperatures predicted as high as 8 C above norms by Saturday. Eclipse Energy, an analytics unit of Platts, forecast at around 16:30 London time domestic demand in the Netherlands at 90 million cu m, down from 98.8 million cu m. Eclipse’s short-term demand model is calculated from demand, temperature and wind speed outturns in addition to deviations between weather forecasts and these last outturns. European Gas Daily November 5, 2015 ZEE prices largely steady, tracking UK Gas prices on Belgium’s Zeebrugge trading hub were largely steady Wednesday, tracking UK movements closely. The ZEE day-ahead contract closed the session valued at 36.10 pence/therm, down by 0.05 p/th, while its discount to the UK edged 0.05 p/th narrower to 0.625 p/th. Gas flows from the UK to Belgium across the Interconnector pipeline were marginally lower on day. There was 33 million cu m nominated to be sent, down from 36 million cu m Tuesday, according to Eclipse Energy, an analytics unit of Platts. The current rates are a step up from the average 29 million cu m/d sent during October, and a lot more than November last year when there was a daily average of just 1 million cu m/d, Eclipse data shows. LNG terminal sendout in Belgium remained at a steady 2 million cu m/d. The next LNG tanker scheduled to arrive in Belgium is the Lusail which is due November 17, Eclipse shows. It would be the first for the month after four tanker arrivals in October and three in September. Gas consumption in Belgium was forecast to fall Wednesday to 49 million cu m from 52 million cu m Tuesday, Eclipse showed. Eclipse’s short-term demand model is calculated from demand, temperature and wind speed outturns in addition to deviations between weather forecasts and these last outturns. Temperatures in Belgium were forecast to be 3.8 degrees Celsius above the five-year average Wednesday and are forecast to steadily rise throughout the week until Saturday when they are expected to be 8.2 C above, Eclipse showed. The front-month December contract rose by 0.05 p/th to 37.35 p/ th with its discount shrinking marginally, by 0.05 p/th, to 1.65 p/th. Summer 16 was unchanged at 35.95 p/th with no change to its premium of 0.35 p/th over the UK. German curve supported by weaker euro German wholesale gas curve prices edged up Wednesday as a weaker euro against the pound supported near-term contracts while the spot was bearish on mild weather. December and Q1 16 on NetConnect rose 7.5 euro cent day on day to Eur18.175/MWh and Eur18.275/MWh, respectively. On the GASPOOL, the same contracts also rose 7.5 euro cent to Eur18.025/MWh and Eur18.125/MWh, respectively. As crude oil prices were bearish Wednesday, the Cal 16 at both hubs was less supported. December fell 98 cents to $48.81/b at the close, according to Platts assessments, as investors took profit from the previous session’s rally. NetConnect and GASPOOL Cal 16 were flat, closing at Eur18.075/ MWh and Eur17.925/MWh, respectively. Closer in, the NetConnect day-ahead closed at Eur17.70/MWh, down 17.5 euro cent, while the GASPOOL equivalent fell 10 euro cent to Eur17.825/MWh. CustomWeather forecast temperatures in Berlin to be 4 Celsius higher than the 9/3 C seasonal norms for Thursday. Temperatures were predicted to be well above seasonal norms in both cities for the latter part of the week. End-of-day imported nominations from Norway into Germany were 112 million cubic meters at about 1800 London time, according to Eclipse Energy, an analytics unit of Platts. Domestic demand in Germany was seen at 285.8 million cu m Wednesday, Eclipse data showed. Eclipse’s short-term demand model is calculated from demand, temperature and wind speed outturns. in addition to deviations between weather forecasts and these last outturns. Copyright © 2015 McGraw Hill Financial 5 Platts Dutch TTF assessments (Hi-cal gas) November 4, 2015 p/thEur/MWh Change D-1 $/MMBtu (Eur/MWh) Day ahead 36.148 17.475-0.0255.562 Weekend 35.89017.350+0.0005.522 Working week+1 36.304 17.550+0.0005.586 December 37.07917.925+0.0755.705 January 37.39018.075+0.0755.753 Q1 2016 37.338 18.050+0.0755.745 Q2 2016 36.200 17.500+0.0755.570 Q3 2016 35.838 17.325+0.0755.514 Q4 2016 38.269 18.500+0.0255.888 Q1 2017 39.200 18.950+0.0256.032 Q2 2017 35.786 17.300-0.0255.506 Summer 16 36.045 17.425+0.0755.546 Winter 16 38.734 18.725+0.0255.960 Summer 17 35.786 17.300-0.0255.506 Winter 17 38.165 18.450-0.0505.872 Summer 18 35.166 17.000-0.0755.411 Winter 18 38.165 18.450-0.1005.872 Gas year 2016 37.286 18.025+0.0005.737 Cal 2016 36.924 17.850+0.0755.681 Cal 2017 37.079 17.925-0.0255.705 Cal 2018 36.614 17.700-0.0755.634 ICE ENDEX Dutch TTF gas futures (Eur/MWh) November 4, 2015Settle ChangeVolume WDNW First month Second month Third month First quarter Second quarter Third quarter Fourth quarter First season Second season Third season Fourth season First year Second year Third year — +0.074 +0.056 +0.100 +0.095 +0.118 +0.080 +0.027 +0.099 +0.012 -0.024 -0.045 +0.080 -0.022 -0.070 — 1870 385 20 615 — — — 1335 635 145 45 95 75 130 Total volume 5350.00 — 17.950 18.070 18.160 18.075 17.556 17.339 18.524 17.447 18.712 17.307 18.474 17.874 17.918 17.702 Source: ICE ENDEX Platts Belgian Zeebrugge Beach assessments November 4, 2015 p/th Change D-1Eur/MWh $/MMBtu (p/th) Day ahead 36.100-0.05017.457 5.556 Weekend35.250-0.20017.046 5.425 Working week+1 36.000-0.55017.408 5.541 Balance month 36.850+0.10017.819 5.672 December37.350+0.05018.061 5.749 January37.500-0.05018.134 5.772 February38.000+0.00018.375 5.849 Q1 2016 37.550-0.05018.158 5.779 Q2 2016 36.250+0.00017.529 5.579 Q3 2016 35.550-0.05017.191 5.472 Summer 16 35.950+0.00017.384 5.533 Winter 16 38.850-0.30018.786 5.979 Summer 17 35.700-0.35017.263 5.495 Winter 17 38.150-0.65018.448 5.872 Gas year 2016 37.275-0.32518.025 5.737 Platts NBP-Zeebrugge basis differentials p/th Change D-1Eur/MWh (p/th) Day ahead-0.625+0.050-0.302 December-1.650+0.050-0.798 Platts Zeebrugge Beach day-ahead flow date prices Flow date p/th Eur/MWh November 536.10017.457 European Gas Daily November 5, 2015 French spot plunges after early gains Both the PEG Nord and TRS spot prices fell Wednesday on a delayed correction from Monday’s bullish prices, while the curve was pulled up by Northwest European gas markets. The PEG Nord day-ahead lost 35 euro cent to Eur17.475/MWh, and the TRS fell further, down 60 euro cent to Eur17.75/MWh On Monday, the contracts had gained 37.5 euro cent on the PEG Nord and 82.5 euro cent on TRS, while the other equivalent markets were relatively steady. On Tuesday, spot levels moved down, but relatively not as much as they gained Monday, and the French contracts kept a part of their spread from Monday with the other markets. The curve ticked up supported by the German and Dutch equivalent contracts. PEG Nord December gained 2.5 euro cent to Eur18.125/MWh and the TRS peer gained 10 euro cent to Eur18.475/MWh. Cal 16 on the PEG Nord was the most bullish contract, up 12.5 euro cent to Eur18.05/MWh. Domestic demand in France was seen at 136 million cu m at about PLATTS DAY-AHEAD GAS PRICES, NOVEMBER 4 (Eur/MWh) Price up Price down — Price unchanged Platts European assessments, November 4, 2015 p/thEur/MWh Change D-1 (Eur/MWh) $/MMBtu French PEG Nord Day ahead December Q1 2016 Summer 16 Cal 2016 36.148 17.475-0.3505.562 37.49318.125+0.0255.769 37.855 18.300+0.0505.825 36.304 17.550+0.1005.586 37.338 18.050+0.1255.745 French TRS* Day ahead December 36.717 17.750-0.6005.650 38.21718.475+0.1005.880 German GASPOOL Day ahead December Q1 2016 Summer 16 Cal 2016 36.872 17.825-0.1005.673 37.28618.025+0.0755.737 37.493 18.125+0.0755.769 36.407 17.600+0.0755.602 37.079 17.925+0.0005.705 NetConnect Germany Day ahead December Q1 2016 Summer 16 Cal 2016 36.614 17.700-0.1755.634 37.59618.175+0.0755.785 37.803 18.275+0.0755.817 36.666 17.725+0.0755.642 37.390 18.075+0.0005.753 Austrian VTP Day ahead December 38.269 18.500+0.0255.888 38.32018.525+0.0755.896 Italian PSV Day ahead December Q1 2016 Summer 16 41.165 19.900+0.1006.334 41.37220.000+0.0756.366 41.216 19.925+0.0756.342 39.406 19.050+0.0506.063 *TRS – Trading Region South. TTF NBP 17.759 Zeebrugge Beach 17.475 GASPOOL 17.825 17.457 Platts Spanish AOC assessments, November 4, 2015 17.700 NCG PEG Nord 17.475 Austria VTP 18.500 p/thEur/MWh Change D-1 $/MMBtu (Eur/MWh) December40.648 19.650-0.1506.254 17.750 PSV TRS 19.900 Platts Spanish AOC/LNG differentials, Nov 04, 2015 Platts EAM* minus Spanish AOC gas p/thEur/MWh Change D-1 (Eur/MWh) December differential 2.571 1.243+0.327 $/MMBtu 0.396 *Cargoes lifted Free On-Board (FOB) from production/reload ports across the East Atlantic. Further information on the EAM is available in the Platts Liquefied Natural Gas Assessments and Netbacks methodology and specifications guide at www.platts.com. Source: Platts assessments EEX German NetConnect gas prices, Nov 4, 2015 Powernext French PEG Nord gas prices, Nov 4, 2015 EEX gas spot price Spot daily average price Settlement price Change (Eur/MWh)(Eur/MWh) NCG day ahead 10 MW 17.74 -0.17 Daily average price ChangeTotal volume (Eur/MWh)(Eur/MWh) (MWh) PEG Nord day ahead 17.69 -0.18 258690 EEX gas futures Powernext gas futures Settlement price ChangeTotal volume (Eur/MWh)(Eur/MWh) (MWh) NCG month ahead 18.22 0.10 22320 NCG month ahead+1 18.39 0.13 37200 NCG quarter ahead 18.38 0.18 174640 NCG quarter ahead+1 17.85 0.17 2184 NCG year ahead 18.22 0.16 0 NCG year ahead+1 18.25 0.01 0 Settlement price ChangeTotal volume (Eur/MWh)(Eur/MWh) (MWh) PEG Nord month ahead 18.13 0.06 37200 PEG Nord month ahead+1 18.35 0.18 0 PEG Nord quarter ahead 18.31 0.19 0 PEG Nord quarter ahead+1 17.63 0.11 0 PEG Nord season ahead 17.54 0.09 0 PEG Nord season ahead+1 19.05 0.05 0 PEG Nord season ahead+2 17.59 0.06 0 Source: EEX Source: Powernext Copyright © 2015 McGraw Hill Financial 6 European Gas Daily November 5, 2015 1800 London time, down from 136.4 million cu m Tuesday, according to Eclipse Energy, an analytics unit of Platts. Eclipse’s short-term demand model is calculated from demand, temperature and wind speed outturns in addition to deviations between weather forecasts and these last outturns. The North south link interruptible capacity was restricted by 43% compared with 17% restriction in the previous day, according to the operator GRTgaz, but this did not affected the TRS spot prices. PSV curve edges higher Italian curve prices Wednesday edged higher for a second day as TTF prices also ended firmer. December and Q1 both added 7.5 euro cent from Tuesday to close at Eur20.00/MWh and Eur19.925/MWh, respectively. Meanwhile Summer 16 gained 5 euro cent to Eur19.05/MWh. On the prompt, day-ahead rose 10 euro cent to close at Eur19.90/MWh. Minimum temperatures in Milan are seen staying in a tight range of 8 degrees C to 9 C from Wednesday through to next Tuesday, according to ilmeteo.it, while minimum temperatures in Rome will fall from 14 C Wednesday to 9 C by Sunday. As of 1300 local time, Italy had nominated 132 million standard cubic meters in gas imports for Thursday, up 1 million cu m from Wednesday, according to data from transmission system operator Snam, while total demand was indicated 1 million cu m lower from the previous day at 173 million cu m with storage withdrawals flat at 40 million cu m. On the G+1 storage platform Tuesday, 11 parties traded 91.6 GWh of gas at Eur19.898/MWh, according to Gestore Mercati Energetici. European Gas Daily – product enhancements to date October 2, 2015 March 30, 2015 Brand new Spanish AOC price assessment Brand new Spanish AOC/LNG Differentials July 1, 2015 Platts price assessment changes New Platts gas spot price map Market commentary improvements Platts monthly EU policy trackers Front-page formatting and content changes New “Market Highlights” section New “Market Commentary” section New charts area Modification to “Platts European gas midpoints” table Publication body formatting and content changes New “Key Points” for stories New “Tabs” tagging New structure to better facilitate price comparison European Gas Daily is published daily Monday-Friday except for UK public holidays, by Platts, a division of McGraw Hill Financial, registered office: 20 Canada Square, Canary Wharf, London, UK, E14 5LH. Officers of the Corporation: Harold McGraw III, Chairman; Doug Peterson, President and Chief Executive Officer; David Goldenberg, Acting General Counsel; Jack F. Callahan Jr., Executive Vice President and Chief Financial Officer; Elizabeth O’Melia, Senior Vice President, Treasury Operations. EUROPEAN GAS DAILY Volume 20 / Issue 215 / November 5, 2015 Restrictions on Use: You may use the prices, indexes, assessments and other related information (collectively, “Data”) in this publication only for your personal use or, if your company has a license from Platts and you are an “Authorized User,” for your company’s internal business. You may not publish, reproduce, distribute, retransmit, resell, create any derivative work from and/or otherwise provide access to Data or any portion thereof to any person (either within or outside your company including, but not limited to, via or as part of any internal electronic system or Internet site), firm or entity, other than as authorized by a separate license from Platts, including without limitation any subsidiary, parent or other entity that is affiliated with your company, it being understood that any approved use or distribution of the Data beyond the express uses authorized in this paragraph above is subject to the payment of additional fees to Platts. London Editorial Reginald Ajuonuma, Gary Hornby, Nathan Richardson, Lucie Roux Phone: +44 (0)20 7176 6119 Email: power@platts.com Fax: +44 (0)20 7176 6670 Head of Content Fabio Reale Head of Pricing Anna Crowley Global Editorial Director, Power Sarah Cottle Chief Content Officer Martin Fraenkel Platts President Imogen Dillon Hatcher Advertising Tel : +1-720-264-6631 Manager, Advertisement Sales Kacey Comstock To reach Platts: E-mail:support@platts.com; North America: Tel:800PLATTS-8; Latin America: Tel:+54-11-4121-4810; Europe & Middle East: Tel:+44-20-7176-6111; Asia Pacific: Tel:+65-6530-6430 Copyright © 2015 McGraw Hill Financial 7 Disclaimer: DATA IN THIS PUBLICATION IS BASED ON MATERIALS COLLECTED FROM ACTUAL MARKET PARTICIPANTS. PLATTS, ITS AFFILIATES AND ALL OF THEIR THIRD-PARTY LICENSORS DISCLAIM ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE AS TO THE DATA, OR THE RESULTS OBTAINED BY ITS USE OR AS TO THE PERFORMANCE THEREOF. A REFERENCE TO A PARTICULAR INVESTMENT, SECURITY, RATING OR ANY OBSERVATION CONCERNING A SECURITY OR INVESTMENT PROVIDED IN THE DATA IS NOT A RECOMMENDATION TO BUY, SELL OR HOLD SUCH INVESTMENT OR SECURITY OR MAKE ANY OTHER INVESTMENT DECISIONS. NEITHER PLATTS, NOR ITS AFFILIATES OR THEIR THIRD-PARTY LICENSORS GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE DATA OR ANY COMPONENT THEREOF OR ANY COMMUNICATIONS, INCLUDING BUT NOT LIMITED TO ORAL OR WRITTEN COMMUNICATIONS (WHETHER IN ELECTRONIC OR OTHER FORMAT), WITH RESPECT THERETO. ACCORDINGLY, ANY USER OF THE DATA SHOULD NOT RELY ON ANY RATING OR OTHER OPINION CONTAINED THEREIN IN MAKING ANY INVESTMENT OR OTHER DECISION. PLATTS, ITS AFFILIATES AND THEIR THIRD-PARTY LICENSORS SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS OR DELAYS IN THE DATA. THE DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE OF THE DATA IS AT YOUR OWN RISK. Limitation of Liability: IN NO EVENT WHATSOEVER SHALL PLATTS, ITS AFFILIATES OR THEIR THIRD-PARTY LICENSORS BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE OR CONSEQUENTIAL DAMAGES, INCLUDING BUT NOT LIMITED TO LOSS OF PROFITS, TRADING LOSSES, OR LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY OR OTHERWISE. Permission is granted for those registered with the Copyright Clearance Center (CCC) to photocopy material herein for internal reference or personal use only, provided that appropriate payment is made to the CCC, 222 Rosewood Drive, Danvers, MA 01923, phone (978) 750-8400. Reproduction in any other form, or for any other purpose, is forbidden without express permission of McGraw Hill Financial. For article reprints contact: The YGS Group, phone +1-717-505-9701 x105. Text-only archives available on Dialog File 624, Data Star, Factiva, LexisNexis, and Westlaw. Platts is a trademark of McGraw Hill Financial Copyright © 2015 by Platts, McGraw Hill Financial European Gas Daily November 5, 2015 Fuel Switching Snapshot Platts daily spot vs NWE oil-indexed gas indicator Platts cross fuel comparisons, November 4, 2015 November 4, 2015 NBP day ahead – current month NBP month ahead – month ahead NBP month ahead+1 – month ahead+1 Eur/MWh -4.781 -2.859 -1.563 p/th -10.515 -6.517 -3.808 $/MMBtu -1.644 -1.028 -0.610 TTF day ahead – current month TTF month ahead – month ahead TTF month ahead+1 – month ahead+1 Eur/MWh -5.065 -3.793 -2.589 p/th -11.092 -8.438 -5.918 $/MMBtu -1.732 -1.323 -0.934 Coal CIF ARA Month ahead 90 Days p/thEur/MWh$/MMBtu 38.495 38.389 UK gas prices at NBP Balance month December January Q1 2016 76.00036.74211.692 78.00037.70912.000 79.00038.19212.154 78.80038.09512.123 Dutch gas at TTF December January Q1 2016 74.15835.85111.409 74.78036.15211.505 74.676 36.102 11.489 18.610 18.559 5.922 5.906 Fuel oil 1% (NW Europe cargoes) December January Q1 2016 116.07656.11617.858 118.92357.49218.296 121.25258.61818.654 Electricity (UK baseload) December January Q1 2016 116.93556.53017.990 120.01358.02018.463 119.13357.59518.328 Electricity (German baseload) December January Q1 2016 62.365 64.123 63.296 30.150 31.000 30.600 9.595 9.865 9.738 Prices in this table show the cost of electricity generated from each fuel, taking into account the following plant efficiencies: CCGT gas plant 50% HHV, coal 35%, fuel oil 32%. Assumed calorific value: fuel oil 17,800 Btu/lb, Coal 6,000 kcal/ton. HHV – high heating value. Platts Coal Switching Price Indicator (CSPI) UKUKNetherlands November 4, 2015 (p/th) (Eur/MWh) (Eur/MWh) Month ahead 41.2319.9313.07 Quarter ahead 40.5219.5910.19 Year ahead 39.98 19.33 9.98 Efficiency used is 50% for gas plants, 35% for UK coal plants and 40% for Dutch coal plants. Platts CSPI is the theoretical threshold at which gas is more competitive than coal in power generation. When the gas price is higher than the CSPI, CCGTs are more expensive to run than coal-fired plants. COAL SWITCHING PRICE INDICATOR VS NBP – QUARTER AHEAD 49 The differential table shows the difference between the spot gas price and the indicator. Platts November 2015 NWE oil-indexed gas indicator Eur/MWh Current month Month ahead Month ahead+1 Change M-1 p/th $/MMBtu 22.540-0.73347.240 7.294 21.718-0.82245.517 7.028 20.664-1.05443.308 6.687 The Monthly NWE oil-indexed gas contract indicator is a modeled price reflecting the cost of gas sold in NW Europe under a traditional long-term sales contract indexed against fuel oil and gasoil. The model does not include any adjustment for discounts from contract renegotiations. Prices are originally calculated in Euro per MWh, then converted to p/th and $/MMBtu using current exchange rate. N2EX UK power auction, spark spread: November 4 Delivery date: November 5 N2EX – day ahead power auction Platts – EFA day ahead gas* NASDAQ OMX – UK day ahead spark spread 37.69 GBP/MWh 37.230 p/th 11.84 GBP/MWh *Reflects 11pm start electricity day Forex indicators, November 4, 2015 NOKSKrDKrSFrGBPUS $ ZlotyTRY Euro 9.35979.37087.45941.0785 0.70581.08604.23283.1027 US $ 8.62018.63026.86960.9931 0.65001.00002.8572 Source: Tullett Prebon, spot FX at 16:00 London time (p/th) NBP Q4-15 CSPI 50% Q4-15 47 NBP Q1-16 CSPI 50% Q1-16 Weather summary, November 4, 2015 45 Week normal high/low temps (C) and projected deviations from normal 43 CelsiusNormal 04 05 06 07 0809 10 Central Europe 41 39 02-Jul 17-Jul 03-Aug 18-Aug 03-Sep 18-Sep 05-Oct 20-Oct 04-Nov (Trade date) CSPI includes CPS – Carbon Price Support. Efficiency at Higher Heating Value. Source: Platts Berlin Frankfurt-Am-Main Prague Vienna Warsaw 9/3 0+4+6+7+6+5+6 10/5 0+4+6+6+5+5+3 8/2 +3+5+7+7+9+7+5 11/4 +1+3+5+6+8+8+7 8/2 +1 -1 0 +2 +6 +4 +3 Northwest Europe CLEAN SPARK SPREAD, NOVEMBER 4, 2015 50% EFFICIENT 20 15 10 5 0 -5 -10 -15 -20 (Eur/MWh) Amsterdam Brussels London Paris 11/5 +4+5+7+8+4+6+5 11/5 +4+6+8 +10+6+6+4 12/6 +3+4+6+6+3+4+3 12/6 +4+6+7+9+7+6+4 Scandinavia Copenhagen Helsinki Oslo Stockholm 9/5 +1+3+5+6+5+4+4 5/1 +5+1+2+4+5+3+2 4/-1 +7+4+6+9+7+6+8 6/2 +5+5+5+6+6+3+4 Southern Europe UK* DA German Dutch MA Belgian MA+1 QA *UK spreads exclude UK-specific CPS – Carbon Price Support. Source: Platts Copyright © 2015 McGraw Hill Financial 8 QA+1 Lisbon Madrid Milan 19/13 +3+2+4+4+4+4+3 17/6 +2+4+5+7+7+5+6 13/5 +4+4+5+6+6+7+7 Source: CustomWeather, 04Nov15/06:54 AM EST/1154 GMT European Gas Daily November 5, 2015 NEWS & ANALYSIS CONTINUED ‘Efficiency gains may boost Norway output’ ■■“Positive signs emerging”: Petoro ■■Q3 oil, gas production up 24% on year PRODUCTION Petoro, the government-owned company that manages all its stakes in Norway’s oil and gas fields, says the efficiency gains currently being implemented in the industry will pay dividends in the form of eventual increased activity on the shelf, a spokesman said Wednesday. Widespread cost-cutting by companies led by state-controlled Statoil have meant projects being delayed and even canceled. Petoro spokesman Geir Gjervan told Platts by telephone that the company detected some positive signs emerging. “There are some positive indications of change with the industry is moving in the right direction,” he said, adding that the rate of drilling in some Norwegian installations had doubled against last year’s rate. Consultancy WoodMac estimated earlier in the year that total spending on the Norwegian shelf would shrink 25% in 2015 compared with 2014, and some analysts have said it could be more. Gjervan said it was positive that Statoil, as the leading operator, was now saying clearly that costs must be reduced to the level which prevailed in the industry during the early 2000s. “That’ll boost the profitability of new projects and yield increased activity on the Norwegian continental shelf (NCS),” Gjervan said. Petoro, announcing its own third-quarter figures, said doubling in the pace of drilling on certain installations showed that it was possible to meet ambitions for efficiency improvements which halved costs. It added that given what had been seen so far, it still believed great potential for improvement exists. The spokesman would not comment on the timing of when Petoro expected to see an increase in activity or what impact it would have on Norwegian production. Petoro reported that Q3 production from its stakes in Norwegian oil and gas fields increased to 1.051 million boe/d, up 24% on the year. Gjervan said the increase was mainly due to higher gas production. “Most of the gas increase [compared with last year] took place in the second and third quarters. It was production deferred from last year,” Gjervan added. He would not say if the increased gas production was expected to continue into the fourth quarter. Petoro posted Q3 net income of NOK17.3 billion ($2.0 billion), compared with NOK19.5 billion a year earlier. — Patrick McLoughlin EC eyes 2018 for EU 2030 energy plans governments and checked by the EC to see, among other things, if collectively they will achieve the EU’s 2030 energy and climate goals. These goals are to cut EU greenhouse gas emissions by at least 40% on 1990 levels, to source at least 27% of final EU energy demand from renewables and to improve EU energy efficiency by at least 27% compared with energy demand projections. The EC is to propose legislation next year to set the legal framework for these goals, which EU leaders agreed in principle in October 2014. The emissions target is to be met partly by reductions achieved through the EU’s emissions trading system, and partly by binding national targets covering non-ETS sectors such as buildings, transport and agriculture. The renewables target would only be binding at EU level, and the efficiency target is not binding at all, so the national plans are key to monitoring if the EU targets will be achieved. Governments would have to deliver final plans to the EC in 2018, taking into account any comments from the EC or the peer review. The EC would publish a first aggregate assessment of all the plans in its 2018 state of the EU energy union report. Regional approach, streamlined reporting The EC wants national governments to cooperate and coordinate with their neighbors when preparing the plans, paying “particular attention” when developing new energy resources and infrastructures. Governments would have to include in their plans assessments of how their national policies will impact their neighbors and how to strengthen regional cooperation. The EC said it would publish detailed guidance for governments on such regional cooperation next year. Governments would also have to report on their progress in carrying out the plans to the EC every two years from 2020, and the EC would include this in its annual state of the EU energy union reports. The national plans would be updated once in 2024 to adapt to changing conditions and to keep on track for the 2030 goals, the EC said. It said it would propose legislation next year to streamline national government’s planning and reporting requirements and also publish a template for the integrated national energy and climate plans. Governments already provide separate national renewables and energy efficiency plans with regular progress reports, as well as regular reporting of their emissions, as part of efforts to reach the EU’s 2020 energy and climate goals. — Siobhan Hall ‘Aphrodite gas not shut-out of Egypt by Zohr’ ■■Aphrodite plan to be finalized in coming months ■■Gas headed to Egypt for re-export, domestic use ■■Work to start 2016, first drafts due by mid-2017 ■■Plans must deliver EU 2030 energy, climate goals POLICY & REGULATION The European Commission wants the 28 EU national governments to start work on integrated energy and climate plans for 2021 to 2030 next year and finalize them in 2018, according to unofficial draft EC guidance on the plans seen by Platts Wednesday. Governments should submit first drafts to the EC by mid-2017, the EC said in its guidance paper, which is due to be published on November 18 with the EC’s first annual state of the EU energy union report. These drafts would be peer reviewed by other national Copyright © 2015 McGraw Hill Financial 9 PRODUCTION Gas from Cyprus’ Aphrodite gas field had not been shut out of the Egyptian market following the discovery of the Zohr gas field, Noble Energy’s Cyprus Country Manager L. Gene Kornegay told delegates at an Economist conference in Nicosia on Tuesday. “Many people have said [Zohr] has destroyed the market in Egypt for any imported gas, but reports of the death of the market in Egypt have been greatly exaggerated,” Kornegay said. “We believe there are still good markets for both internal consumption and exports, and we are working hard to come to [an] agreement.” Italy’s Eni reported the discovery of the Zohr field with an estimated gas resource of 30 Tcf at the end of August. Located in Egypt’s deepwater Shorouk field, Zohr lies near Noble Energy’s European Gas Daily November 5, 2015 Aphrodite field in Cyprus’ block 12 and the Noble-operated Leviathan field offshore Israel. The size of the Zohr discovery makes it sufficient to meet all of Egypt’s medium-term gas demands once it comes on stream in 2020. Kornegay, who replaced John Tomich as country manager this summer, said that Noble was collaborating with the Cypriot government on the finalization of the development plan for Aphrodite and was “moving as quickly as we can” to complete the process within the next few months. Tomich has since relocated to Egypt, where Noble has opened an office. Kornegay, who is also a vice-president at Noble, reminded delegates that the Cypriot market was too small to warrant development of Aphrodite on its own and that a foreign market would be necessary. Noble discovered Aphrodite in December 2011 and after an appraisal well was drilled in October 2013, determined that it held 4.5 Tcf of gas. Cyprus has been holding talks with Egyptian officials since early 2014 about the sale of Aphrodite gas to Egypt, where two LNG facilities sit idle due to a lack of supply amid growing demand in the domestic market. Re-exports to Europe Aphrodite gas would arrive in Cyprus as part of the development plan, Kornegay said, but added: “The markets that are available to us now are in Egypt and the gas will be transported via a pipeline. Some of the markets in Egypt would be for export again, which could mean that some Aphrodite gas could land in Europe, but some could be consumed within the Egyptian domestic market.” Noble in 2014 signed letters of intent with the operators of the LNG plants at Damietta and Idku for delivery of gas from Israel’s Tamar and Leviathan fields, but regulatory uncertainty in Israel has brought a halt to development work at both fields. Without mentioning Noble’s involvement with Israel, Kornegay told the conference delegates that the nature of investment in the hydrocarbon industry required a degree of regulatory stability and reliability during the course of any given project. “Stability indicates several things,” he said. “One is that the basic framework remains constant, but that there is flexibility to deal with changes within the market place. It also means that the regulatory environment needs to be able to act with a certain degree of speed to capture moments both for the benefit of the country and the industry in general.” The delay in the development of the Aphrodite field has also been attributed to the current round of UN-sponsored talks designed to re-unite the Greek- and Turkish-Cypriot communities. Offshore exploration by the Greek-Cypriot Republic of Cyprus in the East Mediterranean has been a sore point with Turkey, whose troops have occupied the northern half of the island since 1974. With its crucial geographic location, Cyprus as a member of the European Union could serve as an important interface between Europe and other countries in the East Mediterranean, Kornegay said, adding that collaborative efforts between the EU, Cyprus and other states in the region could help in the success of projects that require the movement of natural resources across international borders. — Gary Lakes Copyright © 2015 McGraw Hill Financial 10 PEG Nord spot down 15% on year in October ■■Spot contract averages Eur18.491/MWh ■■Healthy supply weighs on prices ■■Cold snap needed to boost prices MONTHLY AVERAGES The average PEG Nord day-ahead price in October was down 15.14% year on year at Eur18.491/MWh, while the TRS dayahead TRS day-ahead fell 25.61% to Eur18.606/MWh, resulting in a spread between the two hubs of 11.5 euro cent, on average, in October. LNG imports up 78% year on year to 649 million cu m, and lower exports to Spain, down 50% year on year, and to Switzerland, down 57%, were responsible for downward price movements, especially on the TRS hub. An increase in net withdrawals, up 244 million cu m year on year, was another bearish driver at both hubs. At the same time, pipeline imports were down 1%, with more take from Norway not fully offsetting a drop from Belgium. Even the higher domestic gas demand failed to support wholesale gas prices. Demand was up 37% year on year to 3.5 Bcm. French supply/demand balance (million standard cu m)Oct-15Oct-14 LNG imports Total pipe imports Belgium Germany Norway Spain Storage (withdrawals) Total supply Storage (injections) Total end user demand Industrial LDZ Power Total export Spain Switzerland Belgium Total demand 649 3439 1433 483 1511 12 519 4607 707 3531 1117 2074 340 359 202 156 1 4597 % Change 366 3471 1655 475 1341 0 397 4233 829 2587 1089 1399 98 780 406 363 11 4195 78% -1% -13% 2% 13% N/A 31% 9% -15% 37% 3% 48% 245% -54% -50% -57% -88% 10% Source: Platts analysis on Eclipse Energy data PEG Nord and TRS October prices for front-month delivery were down 21.57% and 31.23%, respectively, year on year to Eur18.423/MWh and Eur18.672/MWh. Only a cold snap could support the current weak spot and prompt prices as fundamentals are bearish, with eight LNG cargoes expected to arrive to the Montoir-de-Bretagne terminal in December. — Lucie Roux FRENCH HUBS DAYAHEAD MONTHLY AVERAGE 27 (Eur/MWh) TRS PEG Nord 25 23 21 19 17 Oct-14 Source: Platts Dec-14 Feb-15 Apr-15 Jun-15 Aug-15 Oct-15