Statement of recommended practice

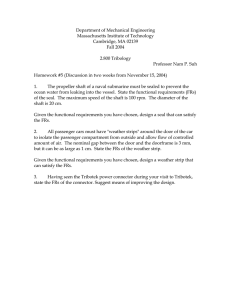

advertisement