Chapter 10: Thinking Strategically

A. Introduction to game

theory:

Prisoner’s dilemma

Prisoner’s dilemma:

• Two prisoners (Horace and Jasper) have

committed a big crime

• Police have evidence to convict for a small

crime, need confession to convict for a big

crime

Police put Horace and Jasper in separate

rooms, offer Horace the following deal:

• If you confess and Jasper doesn’t, we’ll let

you go free and put him in jail for 20 years

• If Jasper confesses and you don’t, he

goes free, you get 20 years

MB MC

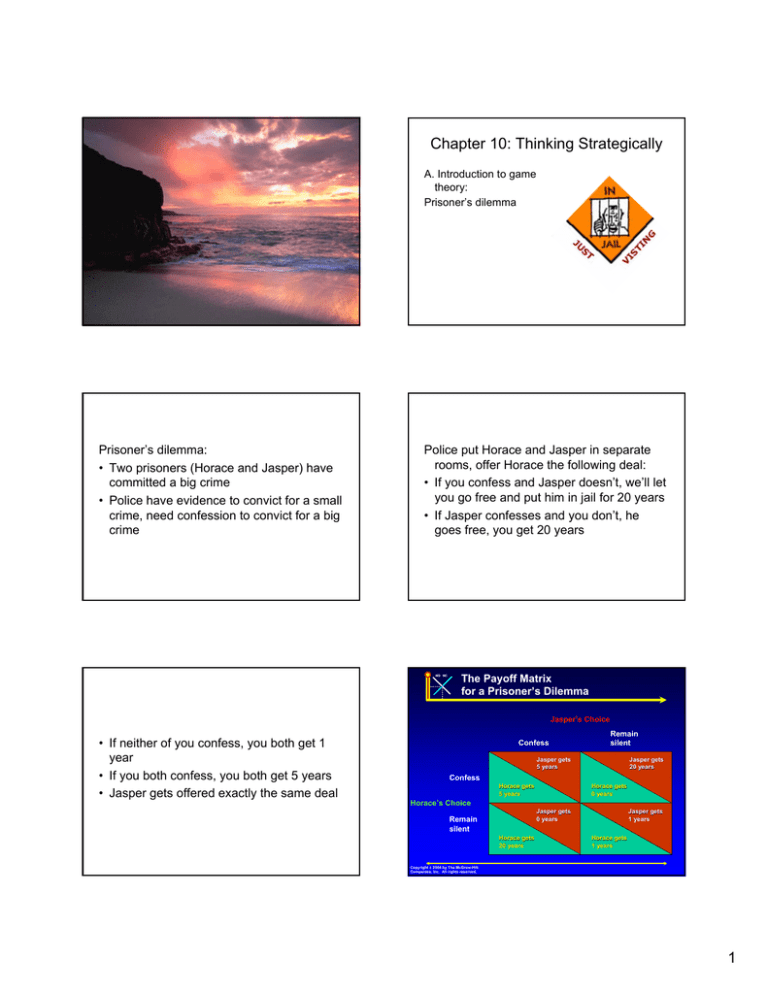

The Payoff Matrix

for a Prisoner’s Dilemma

Jasper’s Choice

• If neither of you confess, you both get 1

year

• If you both confess, you both get 5 years

• Jasper gets offered exactly the same deal

Confess

Remain

silent

Jasper gets

5 years

Jasper gets

20 years

Confess

Horace gets

5 years

Horace gets

0 years

Horace’s Choice

Jasper gets

0 years

Remain

silent

Horace gets

20 years

Jasper gets

1 years

Horace gets

1 years

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

1

MB MC

Horace reasons: if Jasper confesses,

my best option is to confess

MB MC

Horace reasons: if Jasper remains

silent, my best option is to confess

Jasper’s Choice

Confess

Jasper’s Choice

Remain

silent

Jasper gets

5 years

Remain

silent

Confess

Jasper gets

20 years

Jasper gets

5 years

Confess

Jasper gets

20 years

Confess

Horace gets

5 years

Horace gets

0 years

Horace gets

5 years

Horace’s Choice

Horace gets

0 years

Horace’s Choice

Jasper gets

0 years

Remain

silent

Horace gets

20 years

Jasper gets

1 year

Horace gets

1 year

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

Jasper gets

0 years

Remain

silent

Horace gets

20 years

Jasper gets

1 year

Horace gets

1 year

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

Horace concludes:

No matter what Jasper does, my best

option would be to confess

Definition:

If a given strategy yields a higher payoff than

any other strategy, no matter what the other

players in the game choose, then it is called a

dominant strategy

Confession is a dominant strategy for Horace

Confession is also a dominant strategy for Jasper

MB MC

Both confess is the Nash equilibrium

Definition: If each

player’s strategy is

the best he or she

can choose given the

other player’s chosen

strategy, the

strategies are

characterized as the

Nash equilibrium of

the game

Jasper’s Choice

Confess

Remain

silent

Jasper gets

5 years

Jasper gets

20 years

Confess

Horace gets

5 years

Horace gets

0 years

Horace’s Choice

Jasper gets

0 years

Remain

silent

Horace gets

20 years

John Nash

Jasper gets

1 year

Horace gets

1 year

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

2

MB MC

The Prisoner’s Dilemma

Any game has 3 basic

elements:

• the players

• list of possible actions

(strategies)

• payoffs

For prisoner’s dilemma:

Prisoner’s Dilemma

z

• Horace and Jasper

• confess or remain

silent

• 0, 1, 5 or 20 years

A game in which each player has a

dominant strategy, and when each plays it,

the resulting payoffs are smaller than if

each had played a dominated strategy

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

MB MC

Chapter 10

The Payoff Matrix for

an Advertising Game

American’s Choice

A. Prisoner’s dilemma

B. Application: strategic interaction in

advertising

Raise ad

spending

Leave ad

spending

the same

American

gets $5,500

Raise ad

spending

United gets

$5,500

American

gets $2,000

United gets

$8,000

United’s Choice

Leave ad

spending

the same

American

gets $8,000

United gets

$2,000

American

gets $6,000

United gets

$6,000

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

United’s dominant strategy is to raise spending

American’s dominant strategy is to raise spending

MB MC

This advertising game is a

prisoner’s dilemma

Raising spending is the Nash equilibrium

Raise ad

spending

American

gets $5,500

Raise ad

spending

United’s

Choice

Leave ad

spending

the same

American’s Choice

Leave ad

American’s

spending

Choice

the same

United gets

$5,500

Raise ad

spending

American

gets $2,000

American

gets $5,500

Raise ad

spending

United gets

$8,000

Leave ad

spending

the same

United gets

$5,500

American

gets $2,000

United gets

$8,000

United’s Choice

American

gets $8,000

United gets

$2,000

American

gets $6,000

United gets

$6,000

Leave ad

spending

the same

American

gets $8,000

United gets

$2,000

American

gets $6,000

United gets

$6,000

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

3

MB MC

MB MC

Equilibrium When One

Player Lacks a Dominant Strategy

American’s Choice

What if the payoffs were different?

Raise ad

spending

Leave ad

spending

the same

American

gets $4,000

Raise ad

spending

United gets

$3,000

American

gets $3,000

United gets

$8,000

United’s Choice

Leave ad

spending

the same

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

American

gets $5,000

United gets

$4,000

MB MC

American’s dominant strategy is to raise spending

Nash equilibrium: American

raises spending, United does not

United therefore assumes American spends more

Raise ad

spending

American’s Choice

Leave ad

American’s

spending

Choice

the same

American

gets $4,000

United’s

Choice

Leave ad

spending

the same

United gets

$5,000

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

United has no dominant strategy

Raise ad

spending

American

gets $2,000

United gets

$3,000

Raise ad

spending

American

gets $3,000

American

gets $4,000

Raise ad

spending

United gets

$8,000

Leave ad

spending

the same

United gets

$3,000

American

gets $3,000

United gets

$8,000

United’s Choice

American

gets $5,000

United gets

$4,000

American

gets $2,000

United gets

$5,000

Leave ad

spending

the same

American

gets $5,000

United gets

$4,000

American

gets $2,000

United gets

$5,000

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

Chapter 10

A. Prisoner’s dilemma

B. Application: strategic interaction in

advertising

C. Application: stability of a two-player

cartel

We earlier looked at instability of a cartel

when one member can “cheat” by

increasing production without the other

participants knowing.

If instead the cheater knows that the others

will find out and respond, how might that

change the incentives?

4

MB MC

2.00

Price $/bottle

Example:

A duopoly of two firms (Aquapure and

Mountain Spring) have exclusive rights to

bottle water from a spring.

The Market Demand

for Mineral Water

1.00

Marginal cost = zero

MR

D

2,000

1,000

Bottles/day

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

MB MC

One possibilitiy: each

firm chooses P = $1 and

sells 500 bottles to earn

$500/day

2.00

Price $/bottle)

Players: two firms

Strategies: a price each charges (any

number between 0 and $2)

Payoffs: price firm charges times number of

bottles it would sell at that price

The Market Demand

for Mineral Water

This would correspond to

the firms acting together

as an optimizing

monopoly

1.00

MR

D

2,000

1,000

Bottles/day

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

MB MC

Aquapure lowers P

• P = $.90/bottle

• Q = 1,100 bottles/day

2.00

Price $/bottle)

Is this a Nash equilibrium?

Suppose that Mountain Spring charges $1

but Aquapure charges $0.90.

Then Aquapure would sell 1,100 bottles at

profit of $990 > $500.

The Temptation to

Violate a Cartel Agreement

Mountain Spring retaliates

• P = $.90/bottle

• Both firms split 1,100

bottles/day @ $.90

• Profit = $495/day

1.00

0.90

MR

D

1,000 1,100

2,000

Bottles/day

Copyright c 2004 by The McGraw-Hill

Companies, Inc. All rights reserved.

5

Chapter 10: Thinking Strategically

Nash equilibrium: price falls to marginal cost

(in this case, zero)

Have perfect competition even with only two

firms

A. Prisoner’s dilemma

B. Application: strategic interaction in

advertising

C. Application: stability of a two-player

cartel

D. Game theory in more complicated

settings

Possible extensions:

• What if I don’t know for sure the other

player’s payoffs?

• What if I’m not sure that the other player is

rational?

• What if we’re going to play the game many

times over into the future (called a

repeated game)?

Definition:

an algorithm is a formal algebraic or

computational procedure for choosing

strategies

Open competitions between algorithms in 50 repeats

of prisoner’s dilemma with same opponent/partner

And the winner is …

tit for tat

Round 1: cooperate

Round t: do what other

player did in t - 1

6

Chapter 10

Ultimatum bargaining game

A. Prisoner’s dilemma

B. Application: strategic interaction in

advertising

C. Application: stability of a two-player

cartel

D. Game theory in more complicated

settings

E. Games in which timing matters

Example: Ultimatum bargaining game

– Experimenter gives $100 to Tom

– Tom proposes how to divide $100 with

Michael

– Tom must give Michael at least $1

(X = Tom and $100 - X = Michael)

– If Michael accepts the proposal, Tom and

Michael get the money

– If Michael does not accept the proposal, the

money goes to the experimenter

Tom’s Best Strategy in

an Ultimatum Bargaining Game

Decision Tree for Tom

Possible Moves and Payoffs

$X for Tom

$(100 – X) for Michael

$99 for Tom

$1 for Michael

Michael

accepts

A

Michael

accepts

B

Tom proposes

$X for himself,

$(100 – X) for

Michael

A

Michael

refuses

$0 for Tom

$0 for Michael

B

Michael

refuses

Tom proposes

$99 for himself,

$1 for Michael

$0 for Tom

$0 for Michael

• Tom can give Michael a take-it-or-leave-it offer

• Tom will propose $1

• Michael will accept

• The outcome is a Nash Equilibrium

Game

with an Acceptance

New Rule: Michael

can commit in advance

Threshold

to the minimum offer he will accept

Credible Threat

• A threat to take an action that is in the threatener’s

interest to carry out

• Can Michael threaten Tom that he would refuse

x = 1$?

Tom proposes

$X < $(100 - Y) for himself

$(100 - X) > Y for Michael

A

Michael announces

that he will reject any

offer less than $Y

$X for Tom

$(100 – X) for Michael

B

Tom proposes

$X > $(100 - Y) for himself

$(100 - X) < Y for Michael

$0 for Tom

$0 for Michael

7

Nash equilibrium for this modification of the

game: Y = $99

That is, Tom gets $1, Michael gets $99

Tom reasons, if I specify X > (100 – Y),

then I get nothing

Results from experiments with real people

playing original ultimatum bargaining

game:

Few people actually choose the Nash

equilibrium X = $99

If someone does play X = $99, usually the

other person refuses

Most common selection: X = $50

One possible conclusion:

People don’t always behave rationally just

to get the most money.

On the other hand …

would you refuse Tom’s offer if he gets

$99 million and you get $1 million?

Perhaps notions of fairness and moral

principles help provide a commitment

mechanism that would otherwise be

lacking

If not, perhaps rational game theory is the

right way to understand multimillion dollar

business decisions after all

8