ENGINEERING ECONOMY, Sixth Edition

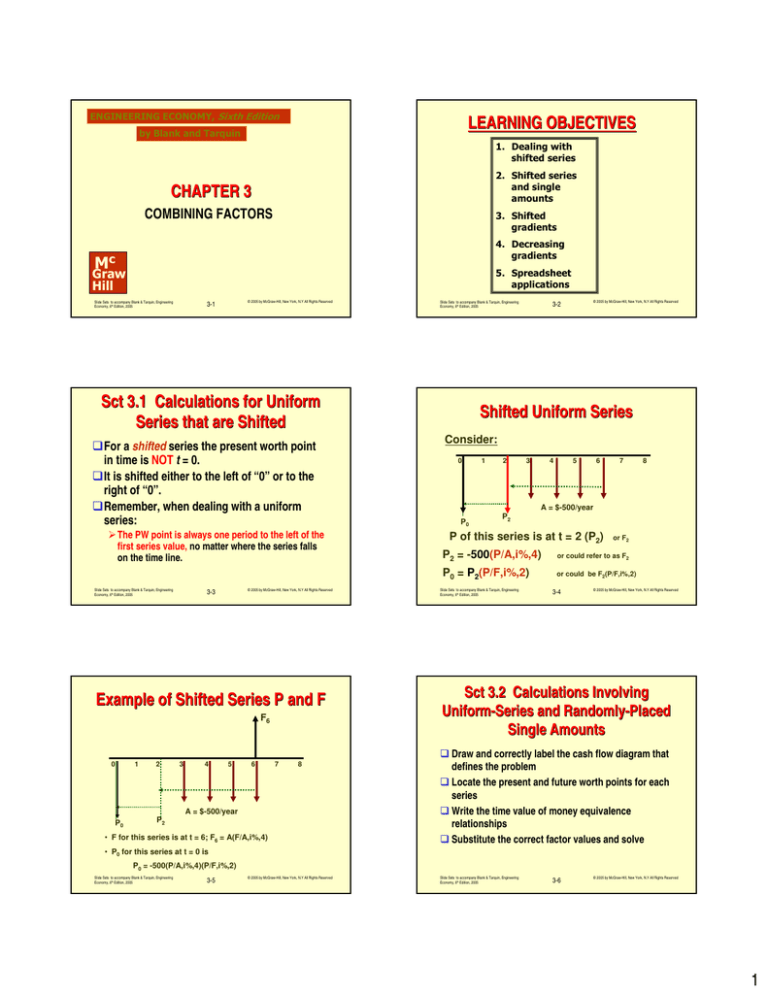

LEARNING OBJECTIVES

by Blank and Tarquin

1. Dealing with

shifted series

2. Shifted series

and single

amounts

CHAPTER 3

COMBINING FACTORS

3. Shifted

gradients

4. Decreasing

gradients

Mc

Graw

Hill

5. Spreadsheet

applications

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-1

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

Sct 3.1 Calculations for Uniform

Series that are Shifted

For a shifted series the present worth point

in time is NOT t = 0.

It is shifted either to the left of “0” or to the

right of “0”.

Remember, when dealing with a uniform

series:

The PW point is always one period to the left of the

first series value, no matter where the series falls

on the time line.

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-3

Example of Shifted Series P and F

F6

0

1

2

3

4

5

6

7

8

A = $-500/year

P0

P2

• F for this series is at t = 6; F6 = A(F/A,i%,4)

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-2

Shifted Uniform Series

Consider:

0

1

2

3

4

5

6

7

8

A = $-500/year

P0

P2

P of this series is at t = 2 (P2)

or F2

P2 = -500(P/A,i%,4)

or could refer to as F2

P0 = P2(P/F,i%,2)

or could be F2(P/F,i%,2)

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-4

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Sct 3.2 Calculations Involving

UniformUniform-Series and RandomlyRandomly-Placed

Single Amounts

Draw and correctly label the cash flow diagram that

defines the problem

Locate the present and future worth points for each

series

Write the time value of money equivalence

relationships

Substitute the correct factor values and solve

• P0 for this series at t = 0 is

P0 = -500(P/A,i%,4)(P/F,i%,2)

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-5

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-6

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

1

Series with additional

single cash flows

3.2 Series with Other cash flows

It is common to find cash flows that are combinations of

series and single, randomly-placed cash flows

F4 = $300

♦ Consider:

A = $500

For present worth, P

Solve for the series present worth values then move to t = 0

Then solve for the P at t = 0 for the single cash flows using the

P/F factor for each cash flow

Add the equivalent P values at t = 0

0

1

2

3

4

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-7

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

2

2

3.2 The PW Points are:

1

4

5

6

7

8

i = 10%

t = 1 is the PW point for the $500 annuity;

“n” = 3

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

0

1

2

2

3

3

4

5

6

7

8

i = 10%

F5 = -$400

3-9

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3.2 Write the Equivalence

Statement

P = $500(P/A,10%,3)(P/F,10%,2)

+

$300(P/F,10%,4)

400(P/F,10%,5)

Back 5 Periods

F5 = -$400

t = 1 is the PW point for the two other

single cash flows

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-10

3-11

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3.2 Substitute the factors and

solve

P = $500( 2.4869 )( 0.8264 )

+

$300( 0.6830 )

400( 0.6209 )

=

Substituting the factor values into the

equivalence expression and solving….

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

F4 = $300

A = $500

3

3

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-8

Back 4 periods

A = $500

1

8

•Find the PW at t = 0 for this cash flow

F4 = $300

1

7

F5 = -$400

3.2 The PW Points are:

0

6

i = 10%

For future worth, F

Convert all cash flows to an equivalent F using the F/A and F/P

factors in year t = n

Add the equivalent F values at t = n

5

$1,027.58

$204.90

$248.36

$984.12

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-12

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

2

Sct 3.3 Calculation for Shifted

Gradients

The Present Worth of an arithmetic gradient

(linear gradient) is always located:

One period to the left of the first cash flow

in the series ( “0” gradient cash flow) or,

Two periods to the left of the “1G” cash

flow

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-13

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Shifted Gradient

A Shifted Gradient

has its present value

point removed from

time t = 0

A Conventional

Gradient has its

present worth point at

t=0

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-14

Example of a Shifted Gradient

Example of a Conventional Gradient

♦ Consider:

Gradient Series

Gradient Series

……..Base Series ……..

……..Base Series ……..

0

1

2

n-1

…

n

0

1

2

n-1

…

This represents a conventional gradient

n

The present worth point for the

base series and the gradient is

here!

The present worth point is t = 0

This represents a shifted gradient

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-15

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Shifted Gradient: Numerical Example

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-16

Shifted Gradient: Numerical Example

PW of the base series

P0

nseries = 8 time periods

P2

G = $+100

Base Series = $500

0

1

2

3

4 ………..

………..

Base Series = $500

9

10

0

1

2

3

4 ………..

………..

9

10

Cash flows start at t = 3

$500/year increasing by $100/year through

year 10; i = 10%; Find P at t = 0

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-17

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

P2 = 500(P/A,10%,8) = 500(5.3349) = $2667.45

P0 = 2667.45(P/F,10%,2) = 2667.45(0.8264)

= $2204.38

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-18

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3

Shifted Gradient: Numerical Example

PW for the gradient component

P0

For the base series

P0 = $2204.38

For the arithmetic gradient

P0 = $1,324.61

P2

G = +$100

1

0

Example: Total Present Worth Value

2

3

4 ………..

………..

9

10

Total present worth

P2 = $100(P/G,10%,8) = $100(16.0287) = $1,602.87

P = $2204.38 + $1,324.61 = $3528.99

P0 = $1,602.87(P/F,10%,2) = $1,602.87(0.8264)

= $1,324.61

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-19

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

To Find A for a Shifted Gradient

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-20

Shifted Geometric Gradient

Conventional Geometric Gradient

1) Find the present worth of the gradient

at actual time 0

2) Then apply the (A/P,i,n) factor to

convert the present worth to an

equivalent annuity (series)

A1

0

1

2

3

…

…

…

n

Present worth point is at t = 0 for a conventional

geometric gradient

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-21

Shifted Geometric Gradient

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-22

Shifted Geometric Gradient Example

Shifted Geometric Gradient

i = 10%/year

0

1

2

3

4

5

6

7

8

A = $700/year

A1

0

1

2

3

…

…

…

n

A1 = $400 in year t = 5

12% increase/year

Present worth point is at t = 2 for this example

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-23

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-24

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

4

Geometric Gradient Example

3.3 The Gradient Amounts

i = 10%/year

0

1

2

3

4

t

5

6

7

Base Amt

$400.00

51

62

73

84

8

$448.00

$501.76

$561.97

A = $700/year

Present Worth of the Gradient at t = 4

PW point for the A

series is t = 0

3.73674

P4 = $400{ P/A1,12%,10%,4 } = $

1,494.70

12% increase/year

P0 = $1,494.70( P/F,10%,4) = $1,494.70( 0. 6830 )

PW point for the

gradient is t = 4

P0 = $1,020,88

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-25

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3.3 The Annuity Present Worth

♦ PW of the Annuity

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-26

3.3 Total Present Worth

♦ Geometric Gradient @ t =

i = 10%/year

♦

P0 = $1,020,88

♦ Annuity

0

1

2

3

4

5

6

7

8

♦

P0 = $2,218.94

♦ Total Present Worth”

A = $700/yr

P0 = $700(P/A,10%,4)

♦

$1,020.88 + $2,218.94

♦

= $3,239.82

= $700( 3.1699 ) = $2,218.94

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-27

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-28

Sct 3.4 Shifted Decreasing Arithmetic

Gradients

PW for Shifted Decreasing Gradient

Given the following shifted, decreasing gradient

First, find PW at t = 2

F3 = $1,000; G = $-100

F3 = $1,000; G = -$100

i = 10%/year

i = 10%/year

0

1

2

3

4

5

6

7

8

Find the present worth at t = 0

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-29

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

0

1

2

3

4

5

6

7

8

PW point at t = 2

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-30

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

5

Shifted Decreasing Gradient Example

Shifted Decreasing Gradient Example

F3 = $1,000; G = -$100

Second, find the PW at t = 0

i = 10%/year

i = 10%/year

Base amount = $1,000

F3 = $1,000; G = $-100

0

1

2

3

4

5

6

7

8

0

1

2

P2

3

4

5

6

7

8

P2

The gradient amount is subtracted from the base

amount

P0 here

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-31

P0 here

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3.4 Time Periods Involved

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

3-32

3.4 Time Periods Involved

F3 = $1,000; G=-$100

F3 = $1,000; G=-$100

G = -$100/yr

$1,000

i = 10%/year

1

0

1

2

2

3

3

4

4

5

5

6

1

7

8

P2 or, F2: Take back to t = 0

P0 here

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

Dealing with n = 5.

3-33

i = 10%/year

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

0

1

2

2

3

3

4

4

5

5

6

7

8

P2 = $1,000( P/A,10%,5 ) – 100( P/G,10%.5 )

P2= $1,000( 3.7908 ) - $100( 6.8618 ) = $3,104.62

P0 = $3,104.62( P/F,10%,2 ) = $3104.62( 0 .8264 ) = $2,565.65

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-34

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Summary

Chapter summarizes cash flow

patterns that are shifted away from time

t=0

Illustrations of using multiple factors

to perform PW or FW analysis for

shifted cash flows

Illustrations of shifted arithmetic and

geometric gradients

Illustrations of the power of Excel

financial functions3-35

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

CHAPTER 3

End of Slide Set

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

3-36

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

6