Firm Development:

10 Tips for Building Effective Learning Programs

Tip #1: Find a Learning

Administrator

To build an effective education strategy for

your professionals, you’ll need a learning

administrator to take the lead. It’s a

challenging role that requires knowledge

about how adult professionals learn as well

as an understanding of accounting firms.

How a firm decides to fill the role of

learning administrator depends largely

on the size of the firm and its available

resources. Most firms follow one of

three paths when establishing someone

to head their learning program:

Hire a full-time learning professional.

If your firm hires a dedicated training

professional, you’ll benefit from expertise

in curriculum planning and training

design. This can lead to more effective

presentations, especially for in-house

training. A learning and development

professional will bring fresh ideas from

other industries, companies or firms.

He or she will probably not be an

accountant — this person will start from

scratch designing an effective curriculum

based on proven learning principles.

Put an internal manager or partner

Introduction

Firm managers understand that lifelong professional development is

essential for maintaining a top-notch accounting staff. Continuing education

is a technical requirement of professional licensure for CPAs and CFPs and

is necessary in order to keep up with the latest changes in legislation and

technology. A robust learning program is also a very good way to attract

talented professionals to your firm. Last, but definitely not least, welltrained professionals do the best possible job for your firm. Competence

and confidence enables them to increase client service levels, generate

more billable work, and ultimately,drive more revenue for your firm.

In spite of these compelling reasons for professional development,

many firms don’t have a dedicated learning administrator or formal

curriculum in place. This guide provides best practices to help you

develop a learning program and answer questions such as:

How can our firm best leverage learning programs to develop our

professionals, attract and retain talent and grow our firm over time?

How do we develop the right curriculum?

What content do we need? Should we buy it or build it?

How can we best leverage technology to manage and track training programs?

2

in charge. Depending on available

resources, promoting from within

could involve a full-time learning and

development position or become

an additional responsibility for an

existing administrative role. If you

select a learning administrator from

existing staff, he or she may not have

much training experience. But she will

have experience in your accounting

firm and already understands its

culture and learning needs.

Work with a learning consultant.

Specialty consultancies and some

large accounting firms offer “training

as a service” for small or mid-size

firms that lack the resources for

an in-house administrator. These

consultants are experienced trainers

and can help develop curriculums.

Learning professional Linda Steele

manages Great Minds, LLC—a firm

dedicated to helping accounting firms

with curriculum planning and training.

She has found that firms with fewer

than 80 employees generally can’t

afford a full-time learning administrator.

SPOTLIGHT:

Learning Administrator —

Kathie Rotz

FIRM: Honkamp

Krueger & Co., P.C.

LOCATION:

Iowa (3 cities),

Wisconsin and

Missouri

BACKGROUND:

15+ years in corporate training

CURRICULUM ADVICE:

When creating content, use

checklists to remind you of the

six trumps that make content

engaging across all learning styles.

TRAINING TIP:

Train the trainers. Help your firm’s

subject matter experts develop

presentation styles that engage

learners and incorporate humor.

“Trainers are constantly justifying their

positions,” Steele explained. “Training,

marketing and HR professionals can

be a hard sell in accounting firms

because they are not billing hours.”

Tip #2: Determine

Objectives

To determine the objectives for your

firm’s learning program, first take stock

of business goals. Then determine

whether training is appropriate for each

goal. Next you’ll meet with employees

to see what they believe is needed

and you’ll want to evaluate those

suggestions against business goals.

Survey all of your firm’s employees —

from administrative assistants to

partners — to discover what learning

is needed at your firm and to identify

critical knowledge gaps. Find out what

people in each role need to learn in

order to deliver results for the firm.

What technical knowledge is required?

What are the professional certification

requirements? What technology is

employed? How do these professionals

learn firm workflows? What soft skills,

such as leadership or customer service,

would help? Turn the results of this

survey into specific, achievable learning

objectives for each role in your firm, at

varying levels of seniority.

Additionally, meet with firm management

to find out whether the firm faced any

tough hurdles over the past year. What are

the lessons learned from the perspective

of additional training needed? Would

it be beneficial to develop an employee

training based on some specific client

case studies related to these challenges?

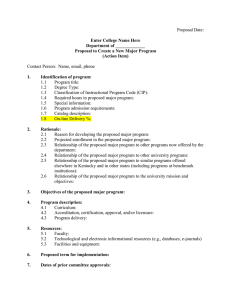

Tip #3: Create Formal

Learning Curriculums

Based on the learning objectives

you have defined, develop formal

learning curriculums. Sometimes

described as “learning ladders”,

these curriculums provide a clear

path for each employee to follow for

professional and career development.

In some firms, continuing education

is really just about obtaining CPE to

maintain a CPA license as quickly and

inexpensively as possible. But this is not

a strategic use of time, money, or human

resources. “If a firm has more than one

employee, growth is necessary for every

single person,” cautioned Kathie Rotz,

the training services manager

for Honkamp Krueger & Co., P.C.

“If you’re just trying to meet a

requirement and get it out of the way,

there’s often no true learning.”

Both firms set up curriculums based

on roles or specializations within the

firm, with variations based on

seniority level. At Briggs & Veselka,

for example, partners are encouraged

to complete most of their CPE outside

the firm at conferences where they

can also build professional networks;

less senior employees take more

training in-house and online.

Employees with clear objectives who

are cultured to learn will be more

productive and knowledgeable. They

will have the skills and ability to better

engage clients, raising satisfaction and

growing firm revenues by recommending

complementary services.

A robust training curriculum can also

be an effective tool for recruiting and

retention. “We hope all of our young

accountants will become certified. So

even if they aren’t CPAs, we’ve put in

place a firm requirement that emulates

the state of Texas annual CPE requirement

for CPAs. From first-year staff members

to shareholders, they all have the exact

same CPE requirement — at least 40

hours per year,” shared Catherine Loftis,

compliance manager at Briggs & Veselka.

CCH® Learning Center

Offers 14 Complete,

Industry-Specific

Curriculums

CCH® Learning Center is an online

professional development resource

for accounting firms provide

complete continuing education

to employees and keep up with

legislative changes and industry

developments. It provides curriculum

paths designed to direct learners to

the most relevant courses for their

specific needs. These 14 industryspecific curriculums include:

Accounting

Auditing

Compilation and Review

Corporate Income Taxation

Financial and Estate Planning

Fraud and Ethics

GAO Yellow Book

Individual Income Tax

Pass-Through Entities

Sales and Use Tax

Small Business Income Tax

State Income Taxation

Trust Taxation and

Estate and Gift Tax

U.S. and International Taxation

3

SPOTLIGHT:

Learning Administrator —

Catherine Loftis

FIRM:

Briggs & Veselka Co.

LOCATION:

Houston, Texas

SIZE:

164 professionals

BACKGROUND:

Accounting firm administration

CURRICULUM ADVICE:

Make younger, unlicensed

professionals adhere to the

same CPE requirements as

the CPAs in your firm, so they

develop good learning habits.

TRAINING TIP:

Toastmasters International is a

great resource for developing

your presentation skills.

Tip #4: Improve New

Hire Training

One curriculum that every firm should

prepare is for onboarding new employees.

New hire training should spend a couple

days acclimating to the firm’s culture

and general operational items, and then

finish the onboarding week (or longer)

learning about the firm’s specific workflows,

such as how to prepare a tax return or

an audit, and how to use the software

systems that support those workflows.

After you’ve developed an initial onboarding

curriculum, put your current staff through

the training, too. Don’t assume existing

employees already know every process

or execute workflows in the way the firm

recommends. You may be surprised at

the additional productivity gained when

everyone attends the same training.

Tip #5: Everyone

Learns Differently

Once your firm’s objectives and

curriculum are defined, it’s time to

decide where you will find your training

content. It’s important to keep in mind

that everyone learns differently — some

prefer to read; others prefer to hear.

4

Some like self-study; others need a

classroom or live group environment.

You can bring multiple types of

learning into one course by employing

a mixture of podcasts, presentations,

videos, live webinars and self-study.

Informal learning is important to your

firm. Not everything learned needs

to count toward CPE requirements.

Consider setting up firm-wide “how-

to” wikis or other types of enterprise

social media to exchange thoughts

and empower subject matter

experts to continually educate.

Build Vs. Buy Content

Firms can choose to create their

own content, purchase courses from

external learning providers, or leverage

the best of both sources. According to

the American Society for Training and

Development (ASTD), U.S. organizations

spent more than $150 billion on

employee learning in 2011. Of this, 56

percent was spent on internal training

and 30 percent on external services.1

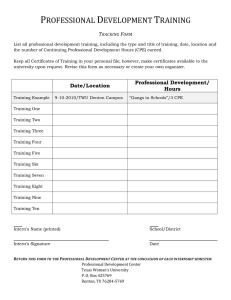

The “build-or-buy” decision is usually

driven by cost and quality of available

courses. Building your own course

requires your firm to develop course

materials, comply with state requirements,

and perform recordkeeping including

maintaining attendance sheets and

issuing certificates of completion.

AccountingWeb recently asked firms

about their preferences for developing

content in-house or purchasing it from

a provider. The survey revealed different

benefits and drawbacks for each method:2

Many firms, including Briggs & Veselka

and Honkamp Krueger, choose to leverage

a blend of internal and external training.

They present live webcasts or virtual on-

demand content to a group of professionals,

and then follow up with an in-house

discussion of how the material should be

applied in the specific context

of the firm. In other instances, firms

develop an entire course from scratch —

for example Briggs & Veselka develops

annual updates for their accounting,

audit and tax departments and

Honkamp Krueger creates approximately

80% of their technology training

and soft skills courses.

Tip #6: Use the “Six Trumps”

to Facilitate True Learning

If you are developing your own curriculum,

you need to ensure that your firm’s

professionals will enjoy the class and

remember what they learned. The trainer’s

presentation will need to effectively

engage people with different learning

styles. Knowing what learning methods

and media “trump” the standard lecture

is key to creating a more dynamic learning

environment for your professionals.

According to Sharon Bowman, these

are the Six Trumps of Learning 3

1. Movement trumps sitting —

Get learners out of their chairs and

moving around at least every 10-20

minutes. Exercise gets blood flowing

and stimulates the brain.

2. Talking trumps listening — Talking

is interactive and more conducive to true

learning than lectures. When discussing

what they’ve heard, learners triple process

the information — first by listening, then

by thinking, and finally by restating it.

3. Images trump words — The human

brain remembers images better than

words, hence the old adage “a picture

is worth 1,000 words.”

IN-HOUSE TRAINING

EXTERNAL PROVIDER

PRO: Content is tailored for your firm.

PRO: There’s an opportunity to learn

from top experts in the industry.

PRO: You can conduct the training

during your firm’s less busy times.

PRO: Provider responsible for

course compliance.

PRO: You may be able to offer CPE to

some of your business clients as a benefit,

or additional revenue stream.

PRO: Offsite training and conferences

are a good networking opportunity.

CON: You must maintain compliance

with state licensing requirements.

CON: Subject matter is generalized.

CON: A lot of time and effort goes

into creating a new course.

CON: Your firm is subject to the

places, dates, and times course is offered.

Potential new revenue stream —

SPOTLIGHT:

Learning Administrator — Linda Steele

FIRM: Great Minds, LLC — a partnership with Abacus CPAs

and Wilson Toellner that provides in-house training for small to

midsized firms. Steele writes the curriculum and conducts training.

BACKGROUND:Steele has more than 20 years of corporate training experience and

has focused on accounting firms for the past 16 years.

CURRICULUM ADVICE: Accounting firms should conduct at least one full week

of new hire training, including deep dives into the software systems that new

professionals will use every day.

TRAINING TIP:Local colleges can be a good resource for in-house training about

regulatory changes, and occasionally they will provide training for free.

4. Writing trumps reading — Writing

requires total concentration and is both

intellectual and tactile at the same time.

5. Shorter trumps longer — Memory is

enhanced by “chunking” information into

smaller, manageable pieces. For complex

topics, engage in very concise reviews

throughout the class.

6. Different trumps same — Human

brains pay more attention to change,

so switch things up throughout the class

by alternating speakers, activities, and

media such as video clips.

Tip #7: Discover Your

Firm’s Subject Matter

Experts and Use Them

Your firm is probably full of brilliant

professionals who have plenty of

experience and insight to share with

their colleagues. As Kathie Rotz pointed

out, the tricky part is “to educate subject

matter experts that adults learn differently

than kids. Most speakers rely on their

own experiences in school. But adults

don’t want lectures and 5,000-word

PowerPoint® slides… So we’re lightening

it up a bit and keeping people engaged.”

Catherine Loftis discovered an effective

way to help firm employees polish up

presentation skills. Her firm hosts a

Toastmasters International club, teaching

public speaking and leadership skills

that build confidence. “Even though

Toastmasters is known for being a public

speaking club, meetings also focus on

delivery, evaluation, creating effective

presentations, as well as knowing and

engaging your audience,” she explained.

1

Tip #8: Consider

NASBA Certification

If your firm is going to develop inhouse CPE courses, you might want

to consider applying for certification

from the National Association of State

Boards of Accountancy (NASBA). This

certification enables you to conduct CPE

training in any state. If the CPE compliance

requirements of your State Board of

Accountancy are more flexible or less

costly than NASBA, you may not want

to pursue certification. But if your firm

has offices or employees across several

states, becoming NASBA-certified may be

easier than registering each course with

multiple State Boards of Accountancy.

Benefits of becoming NASBAcertified include: 4

Recognized compliance and

quality — NASBA-certified learning

providers comply with uniform

standards for continuing education

in the accounting profession.

National CPE, rather than state-

by-state — Certified programs

register on a national basis.

Qualified by the IRS — The IRS

permits NASBA-certified providers to

use an abbreviated registration process

for approval to offer programs to IRS

Registered Tax Return Preparers.

Laurie Miller, “ASTD 2012 State of the Industry Report: Organizations Continue to Invest in

Workplace Learning,” American Society for Training and Development, November 8, 2012.

2“Striking a balance: In-house and external CPE,” AccountingWeb, August 23, 2010.

Registered CPE program sponsors can

provide CPE to their clients and other

accounting firms. If you’re looking for

external sources of content, consider

making NASBA-certification one of

your requirements for any new learning

provider. That way, you can be assured

that the CPE you purchase will work for

all of your professionals, in any location.

Tip #9: Don’t Forget

Soft Skills

There’s a lot more to success in business

than numbers. Most professionals receive

a lot of training in accounting-related

topics but not so much in other softer

skills, such as client service or email

etiquette. Most learning administrators

would agree that leaving soft skills out

of your firm’s curriculum would be a

big mistake.

“Naturally these people are very

technical — like doctors or engineers,

they’re very technical, highly intelligent

and really know their stuff,” said Kathie

Rotz. “The people-relationships sometimes

don’t come as naturally as the numbers.”

Some of the most popular soft skills

courses at Honkamp Krueger are dining

etiquette and a class about the differences

between generations — a hot topic

as Baby Boomer accountants retire.

Learners in the emotional intelligence and

habits classes have to dig a little deeper.

“These are topics that are so valuable

in terms of everyday relations with

clients and coworkers,” asserted Rotz.

BRIGHT IDEA:

Lunch and Learns

Briggs & Veselka provides

professionals with free lunch and

plenty of interaction during lunch

and learn sessions. The group

gathers in a room and watches a

webinar, then talks over the material.

“This provides employees the

opportunity to network in-house.

In addition, if there’s continued

discussion or something needs to

be clarified then everybody has an

opportunity to discuss it before

they walk away,” said Loftis.

3

Sharon L. Bowman, “Six Trumps: The Brain Science That Makes Training Stick,”

4

NASBA website

5

BRIGHT IDEA:

Train the Trainer

To help her firm’s resident experts

develop better presentation skills,

Rotz instituted a “train the trainer”

program. Train your firm’s experts

by first explaining the basic science

of learning and attention. Rotz

suggests providing pointers on how

to engage an audience and inject

humor into potentially dry topics

in accounting. Offer to conduct

“practice runs” with your presenters

and give honest feedback.

Tip #10: Insight,

Measure and Adjust

Feedback is a critical aspect of finetuning your training curriculums that

is sometimes overlooked. Feedback

is insight that you can measure

with course evaluations and use

to adjust your curriculums as you

move forward. Feedback also helps

you discover when the development

needs of the firm may be changing.

Trainers should facilitate discussion

and feedback during the class,

tweaking it to the group in the room

if possible. Linda Steele always begins

her etiquette class with a quiz so she

can find out what learners already

know and where they need help.

After a course has been completed,

elicit feedback from your professionals.

Was the trainer effective? Was the

content useful? Make gathering

this feedback part of your standard

training process for both in-house

and external training.

At least once each year, your firm’s

learning administrator should circulate

a firm-wide survey about what new

topics employees would like to see

offered. Finally, the administrator

should take time to provide feedback to

external providers, so they can improve

content and eliminate bad instructors.

Bonus Tip: Use Technology

to Help Plan Curriculums and

Track Learning Objectives

Does planning several levels of curriculum

for each type of professional in your

organization sounds daunting? It is!

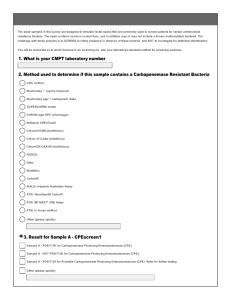

Tracking state licensing requirements

and each professional’s CPE is also

time-consuming. Fortunately,

technology can add efficiency to

both of these essential processes.

A learning management system (LMS)

can help learning administrators stay on

top of compliance and record-keeping

requirements and ensure that learning

objectives are being met. Many firms

track CPE for each professional with

spreadsheets, but an LMS offers distinct

advantages, including the ability to:

CCH Delivers

Industry-Leading Content

CCH Learning Center features more

than 300 self-study CPE courses on

timely and important topics, plus

training for CCH technology solutions.

CCH also presents hundreds of

seminars each year. CCH Seminars

are an easy and cost-effective way to

provide timely, practical training to

your firm on the latest tax, accounting

and auditing issues. Requiring no more

than an Internet connection, these

live, two-hour interactive sessions

are hosted by some of the industry’s

leading experts and are designed to

keep accounting professionals up to

date on new and emerging topics.

Set up multiple curriculum plans

Access current state licensure

requirements for all 50 states

across relevant certifications

Track individual progress against

CPE/curriculum requirements

Let professionals review their own

CPE objectives and completed courses

Receive automated alerts of

impending certification deadlines

Send out training reminders

Conclusion

Your firm’s learning needs will continue

to change and evolve as your firm

offers new services to clients, hires new

professionals, and tries to keep up with

ever-expanding legislation. Professional

education needs to be a purposeful part

of your firm’s business strategy — not

just a requirement for keeping a CPA or

CFP license. Identify a dedicated learning

administrator, create a formal curriculum

and adopt useful, efficient technology in

order to transform your firm’s learning

program into a true competitive advantage!

Track CPE and Requirements with CPE Assistant™

Connected to CCH Learning Center, CPE Assistant™ is also part of CCH Learning

Center. CPE Assistant is a learning management tool that reduces the time and cost

of maintaining a firm’s CPE compliance records. This online CPE management tool

tracks individual progress against CPE requirements and ensures that employees

maintain their certifications. It also provides complete and updated rule summaries

for all 50 CPA regulatory bodies mandating CPE, plus CLE, CFP and more.

For More Information

CCHGroup.com

800-CCH-REPS (888-224-7377)

All trademarks and copyrights are property of their respective owners.

6/13 2013-0303

Join us on

at CCHGroup.com/Social

©2013 CCH and/or its affiliates. All rights reserved.