Armacell Annual Report 2014

advertisement

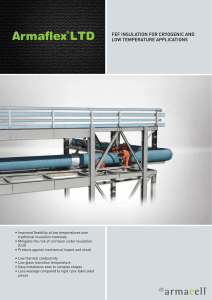

MAKING A DIFFERENCE AROUND THE WORLD. ANNUAL REPORT 2014 KEY FACTS AND FIGURES Armacell is an undisputed leader with sustainable, competitive advantages in the flexible equipment-insulation market. Its diversification across products, end markets, and regions combines growth and resilience. Based on an assetlight and value-added business model, Armacell is highly profitable and generates strong cash flows. NET SALES BY SEGMENT NET SALES in EUR million 400.1 425.3 452.2 415.7 Engineered foams 21 % Advanced insulation 79 % 2011 2012 2013 2014 ADVANCED INSULATION NET SALES BY REGION APAC India 28 % AMERICAS 23 % NET SALES BY REGION EMEA 49 % APAC India 22 % AMERICAS 35 % EMEA 43 % ADJUSTED EBITDA ADJUSTED EBITDA BY SEGMENT in EUR million in EUR million 71.2 63.5 64.9 57.0 2011 2012 2013 Engineered foams 22.0 Advanced insulation EMEA 30.5 Advanced insulation APAC India 16.4 Advanced insulation AMERICAS 17.7 2014 ADJUSTED EBITA ADJUSTED EBITA BY SEGMENT in EUR million in EUR million 50.2 51.7 56.1 43.9 2011 2012 2013 Engineered foams 17.7 Advanced insulation EMEA 23.7 Advanced insulation APAC India 14.5 Advanced insulation AMERICAS 15.8 2014 CAPEX FTE AT YEAR’S END in EUR million in EUR million 20.6 2,284 2,250 2,231 2,313 2014 2011 2012 2013 2014 18.8 16.3 10.3 2011 2012 2013 CONTENT 02 04 LETTER FROM THE CEO EXECUTIVE MANAGEMENT TEAM 01 CORPORATE STRATEGY 07 09 10 PORTFOLIO MISSION AND VISION GLOBAL PRESENCE 02 CORPORATE RESPONSIBILITY 13 14 15 16 UN GLOBAL COMPACT ENVIRONMENT SOCIAL EMPLOYEES 03 FINANCIAL RESULTS 18 19 20 23 24 25 FINANCIALS MACROECONOMIC CONDITIONS OVERVIEW OF BUSINESS PERFORMANCE BY SEGMENT GROUP FINANCIAL PERFORMANCE OUTLOOK ARMACELL OPPORTUNITIES AND CHALLENGES 26 IMPRINT LETTER FROM THE CEO 2014 was another successful year for Armacell. We were able to continue our growth as a global company and demonstrate that we can really make a difference around the world. Insulation is one of the most effective ways to improve energy efficiency in industrial, commercial and residential infrastructure. Our products, mainly based on elastomeric and thermoplastic technologies, are designed for both new and existing installations. Furthermore, they are used in diverse application segments such as heating, and plumbing, ventilation, and airconditioning, refrigeration, and food processing, automotive, light industry, transportation, wind energy, oil and gas, as well as other industries. As a consequence, Armacell is broadly positioned, well diversified, and not dependent on any trend within a particular sector. We are a world leader in flexible insulation foams for the equipment-insulation market and a leading provider of engineered foams. Today we sell the products and solutions for approximately every second insulation project in the world. Our highly diversified product range is unique and always tailor made to meet local requirements. In the period 2008 through 2013, Armacell grew approximately 5 % per year, outpacing the general market. During 2014, we were able to further strengthen our growth and achieved an increase in net sales of 8.8 % and reached EUR 452.2 million. Our adjusted EBITDA increased by 9.6 % and reached EUR 71.2 million. One of Armacell’s major drivers is the increasing demand for the substitution of existing insulation material globally. Additionally, megatrends in energy efficiency, urbanization, and noise protection are fostering and bolstering an increasing demand for our products and solutions. During the past few years, we have successfully tapped into new fields of business. These include manufacturing and marketing thermoplastic insulation materials, covering systems, fire protection, and noise-control solutions, as well as special foams for a multitude of industrial applications. Simultaneously, we have developed new insulation systems for the oil and gas industry – a key growth market for Armacell. With production plants in China, Thailand, India, Brazil, Saudi Arabia, South Korea, and recently in Turkey and Canada, Armacell has penetrated new geographic markets. Over the next three years, we are targeting additional production locations in emerging markets and regions of economic growth. Armacell enjoys significant regional market expertise. As local trends determine the product offering, our products and solutions are always oriented to local requirements in order to ensure that customer expectations and requirements are key drivers of our business. We owe our continued success as a company to our highly engaged, talented team of 2,400 employees worldwide. Each of them makes a difference in our company every day. We have entered 2015 with continued optimism. In the first quarter of this year, we have concluded two strategic acquisitions. The first is OneFlex, a leading Turkish insulation materials manufacturer that strengthens our position in Turkey, where we previously were represented by a domestic licensee. It also expands our footprint in other countries across the regions of the Middle East, Africa, and southeastern Europe. Additionally, we acquired Industrial Thermo Polymers Limited (ITP), a leading Canadian manufacturer of extruded polyethylene insulation products, making Armacell a leading manufacturer of polyethylene insulation foams on the North American continent. On behalf of the Management Board, I would like to thank all Armacell employees around the world for their contribution to our successful business performance. I would also like to extend a special thanks to our Supervisory Board members for their valuable support. We also extend our appreciation to our global customers for the confidence they have shown in Armacell, our products, and our solutions. We are fully committed to deliver on our targets. With a strong focus on implementing our strategy around the world, we will continue our business success. As a global leader in our industry, we can truly make a difference around the world. Sincerely, We provide our employees with an inspiring and rewarding work environment, and we emphasize strengthening our leadership, attracting and developing talent, fostering a culture of excellent performance, and promoting diversity in all of our teams. Patrick Mathieu CEO Armacell Group 03 Armacell is a truly global company: today, we are operating 22 production sites in 15 countries on four continents. A steadily increasing global environmental awareness and stricter energy-saving laws and regulations offer long-term potential for our global insulation business. We are pursuing organic growth, both through geographic expansion as well as through product diversification and market enlargement inside our core insulation business. These initiatives are strengthened by selective external growth activities. LETTER FROM THE CEO We continue to invest in the development of safe and innovative thermal and acoustic insulation that offer our customers sustainable added value. Our products and solutions contribute to prolong the lifetime of the installations that they insulate. Armacell has introduced almost all significant innovations in the field of flexible technical insulation materials. “Armaflex” is currently the world’s leading brand in the field of flexible insulation. We operate one global research center and four regional product development centers. We hold more than 200 active patents worldwide, of which 176 alone were approved between 2010 and 2013. In summary, 2014 was a very successful and important year for Armacell. EXECUTIVE MANAGEMENT TEAM 04 EXECUTIVE MANAGEMENT TEAM Armacell’s Senior Executive Management Team consists of eight international managers who have extensive experience working in the industry. They focus on their responsibility towards more than 2,400 employees, our global customers, and all relevant stakeholders. Our leaders create a culture of innovation, engagement, and accountability by reflecting Armacell’s core values and Code of Conduct. Patrick Mathieu Chief Executive Officer Denis Van Roey Chief Financial Officer Roberto Mengoli Chief Technology Officer Keith A. Norwood Chief Human Resources Officer CEO Patrick Mathieu joined Armacell on May 7, 2012. He has over 25 years of experience, including 15 years in the building and insulation materials sectors. Previously, he was President of Western Europe and International Flooring Division of the Tarkett Group. He also held various positions at the Saint Gobain Group, including General Director for Gypsum (Gyproc), Insulation (Isover), and Mortars (Weber & Broutin). Denis Van Roey has been Armacell’s Chief Financial Officer since November 1, 2011. He is responsible for Group Finance, corporate controlling, accounting, and IT. He has over 25 years of experience in finance and controlling at several international industrial groups. His previous positions include being an auditor at Deloitte and Finance & Administration Director at Inter-Beton group (HeidelbergCement Group), and ImaG Group. Roberto Mengoli has been Armacell’s Chief Technology Officer since January 15, 2013. He is in charge of global technology as well as operations policies and programs. He has over 18 years of experience, primarily in operations and promoting and developing manufacturing and lean programs. He gained previous experience in manufacturing at companies such as the Saint-Gobain Group, Elica, and SACMI Group. Keith A. Norwood has been Armacell’s Chief Human Resources Officer since 2013 and is based in Mebane, North Carolina, USA. Prior to accepting his current position, he was in charge of Human Resources and Information Technology for Armacell’s Americas region. He has over 25 years of leadership experience in HRM at companies such as Armstrong World Industries and National Spinning Co. Inc. He also has extensive experience in organizational development, public relations, and mass communications. Thomas W. Himmel Vice President Americas Andrew Stearns Vice President Asia Pacific/India Dr. Karl Paetz-Lauter joined Armstrong in 1987. He has more than 30 years of professional experience – most of it in managerial functions in the insulation business of Armstrong/Armacell. Before joining Armstrong he was Vice President of the Institute for Research in Medical Education, which was founded by the German Ministry of Research and the Federal Committee for Educational Planning. Guillerme Huguen joined Armacell as Vice President EMEA on October 1, 2013. With over 20 years of experience in managing international industrial businesses, mostly in the construction and building materials industry (including marketing management at the SaintGobain Group), he is deeply familiar with the nature of the business, as well as market trends, key players, and customers. Thomas W. Himmel has been Vice President Americas at Armacell LLC since 2009 and is based in Mebane, North Carolina, USA. He has over 20 years of experience at several leading industrial enterprises including AkzoNobel Surface Chemistry and Crompton Corporation. Andrew Stearns has been Vice President Asia Pacific/ India at Armacell since June 1, 2013, and is based in Singapore. He has over 25 years of business leadership experience in the building products industry. His previous positions include Group Chief Supply Officer at Grohe AG, Divisional Marketing-/ International Business Director at Novar (Caradon), President/CEO at Grohe Americas, and Group Logistics Director at Novar plc. 05 Guillerme Huguen Vice President Europe/Middle East/Africa EXECUTIVE MANAGEMENT TEAM Dr. Karl Paetz-Lauter Vice President Research & Innovation OUR DIVERSE SET OF PRODUCTS AND MARKETS MAKES A DIFFERENCE. 01 CORPORATE STRATEGY PORTFOLIO A wide product offering across multiple end markets and industries BUSINESS SEGMENTS ADVANCED INSULATION ENGINEERED FOAMS Finished insulation products sold to distributors Semifinished and finished noninsulation products sold to converters or OEMs 21% 79 % HVAC Heating and Plumbing OVERALL INDUSTRY EXPOSURE Construction Commercial Construction Sports and Leisure Armacell is a world leader in flexible insulation foams for the equipment insulation market and also a leading provider of engineered foams. Although Armacell’s products and solutions are mostly somewhat concealed, they nevertheless form an important part of our daily lives: they are used, for example, in many modern car models in the form of insulation and seals, prevent noise emerging from water pipes, insulate the pipes in your heating basement, and dampen impacts on sports mats. Today, the company employs 2,400 individuals across the entire world and operates 22 production sites in 15 countries on four continents. Armacell’s history dates back to the year 2000. In the millennium year, Armacell was founded as the successor company to the insulation division of Armstrong World Industries as part of a leveraged management buyout. Solar Transportation Windmill Blades Others Residential Construction Energy Oil and Gas Transportation Light Industrial Oil and Gas Industrial Automotive Others In all important regions, Armacell has a leading market position. Today, we sell the products and solutions for approximately every second insulation project in the world. As a consequence, the company is almost twice as large as its nearest competitor. In 1954, the pioneering company invented Armaflex, the first flexible insulation product. In doing so, it established a new branch of industry – flexible technical insulation – that it has been shaping ever since. Armaflex is now the world’s bestknown brand for flexible technical insulation, and the brand name has become a synonym for flexible foam insulation in the building materials industry. 07 Sports and Leisure Refrigeration CORPORATE STRATEGY END MARKETS 08 CORPORATE STRATEGY Armacell’s global activities are bundled within two business areas. In its Advanced Insulation area, flexible foams for the insulation of technical equipment are developed and marketed. Examples of how these products are utilized include the insulation of heating, cooling, and air-conditioning systems in commercial and residential properties; on process pipelines in industrial applications; in transportation; and in the oil and gas industry. The Engineered Foams area develops and markets technical foams for applications in various end markets such as wind energy, the automotive industry, the leisure industry, transportation, and other industrial sectors. MOSCOW AIRPORT TRAINS Stadler Rail, Altenrhein (Switzerland) Product: Armaflex Rail The first flexible, closed-cell insulation material with integrated fire protection for railway vehicles. SKANDION CLINIC Uppsala (Sweden) Product: Armaflex Ultima Maximum safety: Armaflex Ultima with extremely low smoke density for greater safety in the event of a fire. Armacell’s customers include operators of buildings and industrial plants, specialist planners, installation technicians, and craftsmen. They generally procure our products on a wholesale basis. Although Armacell’s products and solutions are not addressed directly to end customers, you will nevertheless find them installed in homes, such as in heating pipe insulation. MISSION AND VISION We owe our success to our highly engaged and talented employees, who work according to a clear mission, a well-founded vision, and practized values. These values form the foundation for the professional behavior of each individual employee and for our employees’ relationships to Armacell’s business partners. MISSION – WHY WE EXIST As inventors of flexible elastomeric foams for insulation, we focus on developing safe, innovative thermal, acoustic and mechanical solutions and systems that create value for our customers in a sustainable way. VISION – WHAT WE WANT TO BE We grow our market by providing our customers with valuable solutions that offer reliable and certified performance backed by high-calibre people for targeted applications. Certified performance means specified product properties which are confirmed by an independent testing institute. Applications include, for example, plumbing and HVAC-R solutions, solar equipment, components of industrial installations and others. Valuable stands for a price based on innovative value propositions that offer the best quality/cost ratio and durability to the market. High-calibre people are dedicated, passionate and competent individuals who operate with integrity and strive to be the best. VALUES – WHAT WE BELIEVE CUSTOMER EXPERIENCE We create a positive customer-focused culture. Customers value the Armacell experience and continuous business relationship. INTEGRITY Our employees must be aware of and comply with rules and regulations, regardless of where in the world they are working. Integrity goes deeper than that. It is about doing the right things in the right way, as individuals and as a company. Ethical and responsible behaviour is fundamental to the way we do business. Armacell is a company that can be trusted. SUSTAINABILITY We are focused on sustainable, profitable growth through the development and manufacturing of our products to ensure a positive impact on our community. We contribute to sustainable growth by creating innovations in thermal and acoustical efficiency. ARMACELLS’ CORPORATE VALUES Customer Experience Sustainability Integrity CORPORATE VALUES Accountability Commitment Empowerment 09 STRATEGY – HOW WE COMPETE EMPOWERMENT AND ACCOUNTABILITY We give our employees operational responsibility and expect them to develop and perform to the best of their talents. The basis for interaction between employees is mutual respect and trust. CORPORATE STRATEGY To be the global leader for flexible technical foams by providing value through continual product and system innovations in order to improve thermal, acoustic and mechanical efficiency in all targeted applications. COMMITMENT We are committed to developing and motivating our people, nurturing their talents and developing new skills. We will build strong teams to support our company’s performance. The safety of our employees is the company’s first commitment. GLOBAL PRESENCE OLDHAM – GB THIMISTER – BE BRAMPTON – CAN LUXEMBOURG – LU MEBANE – US SPENCER – US ŚRODA ŚLĄSKA – PL MÜNSTER (2) – DE FRIESENHOFEN – DE BEGUR – ES BURSA – TR SOUTH HOLLAND – US 10 CONOVER – US CORPORATE STRATEGY ATLANTA – US SÃO PAULO – BR Armacell is a global business and is continuously expanding into new markets. Today, Armacell manufactures products in 22 plants in 15 countries on four continents and follows a strategy of internationalization. With production plants in China, Thailand, India, Brazil, Saudi Arabia, South Korea, Turkey, and recently Canada, among other locations, Armacell has tapped new markets at an early stage and is set to grow further in emerging markets by proactively addressing the sustainable energy revolution worldwide. Our global presence and a diversified product range are key differentiating factors that set us apart from smaller competitors. In markets where Armacell does not have its own factories, sales offices and distributers complete a broad sales network that is unique in the industry. CHEONAN – KR SUZHOU – CN PANYU – CN ARMACELL MANUFACTURING FACILITIES BANGKOK – TH SALES AND ADMINISTRATION OFFICES CORPORATE HEADQUARTERS SINGAPORE – SGP MELBOURNE – AU Armacell’s headquarters is in Luxembourg with regional head offices in Münster (Germany), Mebane (USA), and Singapore. In each country where Armacell is located, we employ talented people who are keenly aware of national and international standards for their products to address different local requirements. As the portfolio is determined by local trends, Armacell products are always guided by local needs in order to ensure that the customers’ expectations and the requirements in the specific regions are met. This local knowledge feeds directly into the further development of the products and solutions. The Group operates four product development centers – in Münster (Germany), Mebane (USA), Thimister-Clermont (Belgium) and Guangzhou (China). 11 ARMACELL REGIONAL HEADQUARTERS (Americas, EMEA, Asia Pacific/India) PUNE – IN CORPORATE STRATEGY DAMMAM – SA OUR SENSITIVITY TO OUR GLOBAL RESPONSIBILITY MAKES A DIFFERENCE. 02 CORPORATE RESPONSIBILITY UN GLOBAL COMPACT The Armacell Group has been consciously supporting the UN Global Compact initiative with our best efforts since joining in 2006. Whether it concerns Armacells’ high-performance systems that help to conserve energy and reduce CO2 emissions or the unique applications for oil and gas, wind energy, transportation, hospitals, schools, and many other fields, Armacell products are making a difference around the world. Our primary focus is on creating innovative solutions for complex challenges and improving performance for all targeted applications. In doing so, Armacell helps to protect and improve the environment in which the products are used. 13 CORPORATE RESPONSIBILITY In our business, the key issue is energy efficiency. We market and sell products that target energy conservation worldwide. We continually optimize our elastomeric insulation products and, through effective associations, raise awareness for energy-saving potential among industry and governments, thus making an even greater contribution to building a sustainable future. Our responsibility toward sustainable development does not confine itself only to environmental issues. Environmental awareness is linked to occupational safety, product stewardship, and corporate citizenship. We clearly understand the importance of all ten fundamental principles of the Global Compact and will strive to initiate appropriate actions to achieve a sustainable and ethical development of our business. Our annual Communication on Progress Report shows a range of activities around the Armacell globe with regard to human rights, labor standards, environmental protection, and anticorruption. ENVIRONMENT 14 CORPORATE RESPONSIBILITY A commitment to protect our environment has been an integral part of Armacell’s business strategy and a key promise behind our corporate philosophy since our foundation. Our business activities worldwide comply with the applicable environmental laws and regulations, in addition to the requirements of our environmental permits. As a global leader in energy efficiency, we are focused on sustainable, profitable growth through the development and manufacturing of our products to ensure a positive impact on our community and to protect both people and the environment by contributing to energy conservation. To demonstrate this, our company was the first manufacturer of flexible technical insulation materials to carry out an ecobalance analysis – the life-cycle assessment. INDEPENDENT ENVIRONMENTAL ASSESSMENT Armacell carried out environmental assessments at all its sites throughout the world. The environmentally relevant areas of 20 Armacell plants were audited at the beginning of 2014. Armacell was supported in this complex undertaking by ERM (Environmental Resources Management), one of the world’s leading sustainability consultancies. The audits covered all environmentally relevant topics and examined whether the individual sites comply with the legal requirements. Areas addressed included environmental management, permits, air emissions, water supply, and waste water, hazardous material storage and handling, waste management, restricted substances, environmental nuisances, housekeeping, explosion protection provisions, and soil and groundwater conditions at the sites. ERM confirmed that there are no material environmental issues at any of the Armacell plants. Further improvements recommended by the consultants have either already been implemented or will be realized in the medium term. ZERO-WASTE-GENERATION PRODUCTS FOR HIGH-QUALITY NOISE CONTROL: ARMASOUND Product developments such as ArmaSound offer the effect of a zero waste generation: trim material that cannot be reworked back into the process may be reengineered into a high-performance acoustic foam, resulting in a win-win scenario for the environment and our customers. Reusing waste materials reduces the impact of disposal while at the same time offering a solution for noise pollution. Acoustic insulation is an important attribute of comfortable living today. Effective acoustic insulation measures such as Armacell’s noise-control products minimize noise at the source, increasing both the living comfort and the value of the property. SOCIAL As a company with a global footprint, we see it as our responsibility to support local good-citizenship projects, such as child fostering in Sri Lanka, Habitat for Humanity in the US, maintenance of community gardens, and regular donations to and cooperations with nonprofit organizations. Armacell emphasizes the social dimension of sustainability among its management and employees with these projects – projects that help the local communities in which Armacell operates. • Access to clean drinking water • Construction of an elementary school • Reduction in the number of children suffering from malnutrition • Improved health care Armacell employees and their families participating in the annual Heart Walk. In 2014, charity activities of Armacell at the UK facility included raising money for Dr. Kershaw’s hospice charity in Royton, Oldham, including a six-mile moonlight charity walk by Maggie Hales and Heather Whittaker and advertisements in the annual planners and guidebooks. Colleagues also took part in a sponsored 60-mile bike ride from Manchester to Blackpool for Christie’s Hospital in Manchester and the five-kilometer Race for Life fun run for cancer research in Heaton Park, Manchester, where runners all wear pink. Through these activities Armacell employees raised a total of around GBP 2,500. Armacell employees planting trees in Thailand. 15 In Thailand, Armacell employees participate in their community activities, such as Children’s Day held by the district community, tree-planting activities, and the Run & Ride Contests in community public parks. The company is aware of its responsibility toward society and the community in which it operates and thus donated gifts for the Disabled People’s Day activities in Ratchaburi. Moreover, the company supports its community traffic police and drivers at checkpoints by sponsoring food and beverages. This helps them relax from their tiring work and driving and in turn contributes to reducing traffic accidents during long holidays (New Year). CORPORATE RESPONSIBILITY Armacell LLC in the US has a unique partnership with the HEARTS program – a nonprofit organization targeting children from all over the world undergoing bone marrow transplants at Duke University Children’s Hospital. In September 2014, Armacell employees and their families and friends participated in the annual Heart Walk. Over 20 participants walked in the event. With Armacell’s assistance, over USD 3,000 was raised and donated to the Heart Association. Armacell is supporting a World Vision program with financial support and regular correspondence with six orphans/halforphans following the tsunami in 2005. In the past, Armacell supported ten children of whom four have now reached an age where they do not need further support. Thanks to Armacell’s commitment and the excellent cooperation with local project workers and the inhabitants themselves, a great deal has been achieved over the past years. For example: EMPLOYEES 16 CORPORATE RESPONSIBILITY In all areas of the business, Armacell is committed to its corporate responsibility towards its employees, the environment, and the communities in which the company operates. Throughout 2014, the Armacell Group has been a solid foundation for the Group’s employees. Performance management, succession management processes, the systematic development of people, and global leadership training programs are the core of these efforts. As an employer whose focus is the well-being of its employees, Armacell supports a range of additional activities for motivating and fostering the development of the company’s main asset: its people. We take the requests of our people seriously and do our best to create a positive working atmosphere. In return, we expect them to perform to the best of their abilities, as well as, represent an attitude of mutual respect, reliability, and trust. In an effort to strengthen these values, we established a Code of Conduct in 2011, which applies to every employee worldwide. Furthermore, we present awards to recognize the work of an individual or a working team. Our philosophy is to encourage and support each of our employees, as well as a strong team approach as the basis for strong company performance. To recognize the commitment of our employees, we launched the A.R.M.A. Way Award System. Established in 2013, the aim is to further support our philosophy of managing our activities as an organization in the A.R.M.A. Way. A.R.M.A. WAY Appreciate our customers R aise our efficiency M anage our cash Act to empower our employees Getting suitable talent from the market is becoming very difficult, costly, and time consuming, and the talent available directly from universities is also not directly utilizable. The Graduate Engineer Trainees (GET) project for reducing recruiting costs and increased bench strength is a different approach: the Armacell India team has taken on eight fresh graduate engineer trainees from different engineering institutes across India. During their first year at Armacell, these individuals are trained in five phases in different functions: manufacturing, technical and application support, product development and marketing, sales, and a project as the fifth and final phase. After appropriate assessment, they may be placed in a suitable role if vacancies are available. This process will be repeated every year. While the GETs gain experience while being paid and have a good chance of finding their dream job at Armacell, Armacell India saves substantially on recruitment costs from hiring people from the outside and avoids the time lag between a vacancy and a suitable employee joining the company. OUR SUCCESS IS CHARACTERIZED BY CONTINUOUS GROWTH THAT MAKES A DIFFERENCE. 03 FINANCIAL RESULTS FINANCIALS 2011 2012 2013 2014 400.1 425.3 415.7 452. 2 57.0 63.5 64.9 71.2 Income statement items in EUR millions Net sales Adjusted EBITDA1 % of net sales 14.2 % 14.9 % 15.6 % 15.7 % Adjusted EBITA2 43.9 50.2 51.7 56.1 % of net sales 11.0 % 11.8 % 12.4 % 12.4 % 5.7 7.0 *24.0 12.5 Non-recurring items EBIT 14.9 26.3 10.6 21.7 Financial items -27.5 -22.5 -30.4 -38.9 Net result -12.3 5.0 -19.6 -11.5 18 FINANCIAL RESULTS Balance sheet items in EUR millions Current assets 164.0 163.0 124.1 159.1 Non-current assets 343.9 335.8 498.9 514.4 Current liabilities 109.9 71.4 81.4 115.9 Non-current liabilities 405.2 402.9 474.5 522.2 -7.3 24.4 67.2 35.3 Cash from adjusted operating activities 47.1 62.7 54.5 56.3 Investments and acquisitions 10.3 18.8 16.3 20.6 39 44.3 38.9 33.2 2,284 2,250 2,231 2,313 Equity Other items in EUR millions Adjusted free cash flow Number of employees in FTE Number of employees at year’s end Due to a change of shareholders of the Armacell Group as of July 2, 2013, the financial data presented for 2011, 2012, the first half of 2013, and the second half of 2013 come from the Audited Combined Financial Statements for the respective periods reflecting the combined results of operations and financial position of the operational Armacell Group and are comparable to the 2014 financial data from the Audited Consolidated Financial Statements of Armacell International S.A. Luxembourg. The 2013 financial data presented here is the result of the sum of the Audited Combined Financial Statements for the first half 2013 and the Audited Combined Financial Statements for the second half 2013. *The increase in the amount of nonrecurring items in 2013 results from transaction costs associated with the change in shareholders and the related new financing of the Armacell Group. 1 Adjusted EBITDA is the result before amortization, depreciation, interest and taxes adjusted by non-recurring items. 2 Adjusted EBITA is the result before amortization, interest and taxes adjusted by non-recurring items. MACROECONOMIC CONDITIONS The global economy continued its path of recovery in 2014, albeit somewhat more moderately than originally anticipated. Global GDP rose by 3.6 % (2013: 3.0 %), fueled by increasing growth momentum in industrialized countries during the second half of the year. Developments in individual regions, however, were strongly divergent. Economic growth in the eurozone returned to positive territory of about 1.2 % despite ongoing weakness in the southern countries and overly static slow growth in other regions, mainly because of weak investments, exports and inflation. Decent growth was again achieved in the United Kingdom. In emerging countries, growth in Asia again achieved the highest rates at an estimated 6.5 % on average, almost matching the previous years’ growth of 6.6 %. Increasing growth momentum was observed in India. China still grew at a rate of 7.4 %, which compared decently with the previous years’ rate of 7.8 %. GDP in Brazil was affected by low investments and political uncertainties. The economy in Russia suffered heavily from the slump in oil prices, the depreciation of the ruble and the political tensions linked to the conflict in Ukraine. Finally, in the Middle East & North Africa region, economic activity picked up in 2014, but remained fragile due to political tensions and transitions in many countries. The economy in the United States rebounded in 2014 with an expected annual growth of around 2.4 % following a decline in unemployment as well as inflation due to the appreciation of the U.S. dollar and the decline in oil prices. 19 FINANCIAL RESULTS OVERVIEW OF BUSINESS PERFORMANCE BY SEGMENT Armacell’s global activities are bundled within two business areas: Advanced Insulation and Engineered Foams. ADVANCED INSULATION EUROPE, MIDDLE EAST AFRICA The Advanced Insulation business offers flexible insulationfoam products for the insulation of mechanical equipment in markets where energy distribution is required, such as in commercial and residential construction, oil and gas applications and in other industrial applications. On the back of continued mixed economic trends, 2014 was a year of transition for the overall European construction sector, which is now starting to recover slowly. Total construction is expected to have increased by some 1 % in 2014, with positive growth in the U.K., Ireland, the Eastern and Nordic countries and Germany more than offsetting further weakness in France, Italy and Spain. Both the residential and nonresidential subsectors saw similar development. It is important to note that investments in construction have decreased in recent years. As a result, the contribution of construction output to European GDP is now at its lowest level (9.3 %) since 2006. 20 FINANCIAL RESULTS The Engineered Foams business is a bespoke service to OEMs designing and manufacturing specific light foam solutions utilizing several product characteristics like lightness, noise absorption, insulation in specific proportions for enhancing end product specifications. The products are supplied to a broad range of end markets, such as transportation/automotive, industrial and wind energy, sports and leisure and the construction business. Our brand name Armaflex is synonymous with elastomeric insulation in the equipment industry. ADVANCED INSULATION In the Advanced Insulation business, revenues were up by 8.9 % to EUR 355.8 million, accounting for 79 % of revenues in financial year 2014. The main end markets and applications for the Advanced Insulation businesses include: • Equipment for commercial construction and refurbishment is the Group’s largest sector and primarily comprises nonresidential buildings (such as hospitals, hotels and offices), where the Group’s insulation products are primarily applied to HVAC ducts and systems. • Equipment for residential construction and refurbishment includes residential buildings, where insulation products are primarily applied to heating and plumbing equipment and small HVAC ducts and systems. • Light and heavy industry includes the use of insulation products in plants and technical engineering facilities, primarily for refrigeration, HVAC ducts and systems, coolants distribution and steam transportation equipment. • Transportation includes products that are mainly used for duct systems in trains and ships. In order to meet the wide range of national standards, different products are offered in different market regions. In this context, Armacell recorded revenues of EUR 175.0 million, equaling an increase of 4.2 % compared to 2013. The positive performance was mainly driven by growth in the U.K., Ireland, Switzerland and Eastern countries as well as strong project sales in Benelux. In France, Spain and Italy, business development was held back by weak overall economic growth. In mid-2014, we acquired the remaining 49 % stake in our Saudi joint venture, Armacell Zamil Middle East Co. This increased the opportunities for Armacell in the entire Gulf region, which offers the insulation industry significant business potential due to factors such as the ongoing construction boom. Armacell products were specified and installed in a number of the region’s major construction projects, such as the Burj al Arab and the Atlantis Hotel. This company has been fully consolidated since June 2014 and is contributing to the growth trend in the EMEA region. KEY FIGURES FOR ADVANCED INSULATION EMEA EUR million 2014 2013 Revenues 175.0 168.8 Adjusted EBITDA 30.5 28.5 % of revenues 17.4 % 16.9 % 23.7 22.6 13.5 % 13.4 % Adjusted EBITA % of revenues ADVANCED INSULATION AMERICAS ADVANCED INSULATION ASIA PACIFIC/INDIA The U.S. economy showed signs of sustainable growth in 2014, with a rise in GDP of 2.4 % originating primarily from personal consumption, nonresidential and residential investments and exports. This growth was only partly offset by a reduction in public spending. The latest estimates indicate that U.S. nonresidential building increased by roughly 4.2 % during 2014. Positive trends in the private commercial and industrial sectors were offset by weakness in the institutional sector. In overall terms, economic growth in Asia in 2014 slowed somewhat due differing regional trends. Growth rates in China ultimately almost matched the previous year (expected: 7.4 %, compared to 7.8 % in 2013), with the construction sector exhibiting a shift from government-financed initiatives toward privately funded commercial/industrial projects. Residential sector growth focused on general urbanization slowed, and vacant-property levels remained high. The anticorruption initiative continued to impact volume in the project sector. EUR million 2014 2013 Revenues 82.1 79.3 Adjusted EBITDA 17.7 17.8 % of revenues 21.5 % 22.4 % 15.8 15.8 19.3 % 20.0 % Adjusted EBITA % of revenues Against this backdrop, Armacell Advanced Insulation Asia Pacific/India grew by 24 %, driven by clear market share gains in most markets on account of our distributor expansion program, an advantageous level of industrial projects and our focus on promoting sales in strategic business areas. Growth was also supported by the acquisition of the assets of Armatech Co. Ltd. in Korea, the long-time distribution partner and leading provider of engineered foams for the heating, sanitation and air conditioning industry. New product launches and a renewed focus on specification generation helped Armacell’s business in Australia, growing in an essentially flat market. In India, Armacell gained market share through a combination of increased project generation and conversion, coupled with a broader product offering that leveraged the strong distribution network. This led to a double-digit increase in revenue and visible market share growth. In Japan, Armacell’s strong growth continued at around 40 % in response to an expansion of the business in the elastomeric market, broadened contractor conversion and loyalty and trust with the brand and proposition. 21 Advanced Insulation Americas revenues increased by 3.5 %, reaching EUR 82 million. This was driven by a very strong year in the U.S. retail segment due to the unusually cold winter in 2014, appreciable growth in the U.S. contractor distributor segments and the successful implementation of demandfueling initiatives in both North and South America. Notably, Armacell products were the insulation of choice for the refrigeration and air conditioning systems at the majority of the World Cup stadiums in Brazil this summer. The elastomeric insulation material made by Armacell was installed in eight of twelve venues. KEY FIGURES ADVANCED INSULATION AMERICAS ASEAN markets faced turbulence in 2014 due to political instability and government change in Thailand as well as natural disasters in the Philippines. On the other hand, Indonesia and Singapore showed steady growth. The Japanese economy benefited from the deflated yen, but saw its fortunes vary throughout the year. India faced instability in early 2014 due to the general elections and a change in leadership. Following the changes in government, the market stabilized with a strengthened rupee and more optimism regarding future growth rates. FINANCIAL RESULTS In Brazil, construction was essentially flat during 2014 compared to 2013. Activity was stronger leading up to the FIFA World Cup and the presidential elections late in the year. However, there was a drop in activity during the fourth quarter of the year, resulting from industry’s reluctance to invest prior to the governmental elections as well as delayed investments in oil, gas and other petrochemical projects due to ongoing corruption scandals. U.S. COMPONENT FOAMS KEY FIGURES ADVANCED INSULATION APAC INDIA EUR million 2014 2013 Revenues 98.7 78.7 Adjusted EBITDA 16.4 10.3 % of revenues 16.7 % 13.1 % 14.5 8.5 14.7 % 10.8 % Adjusted EBITA % of revenues 22 FINANCIAL RESULTS ENGINEERED FOAMS In the Engineered Foams business segment, revenues increased by 8.9 % to EUR 94.6 million, thereby accounting for 21 % of revenues in 2014. Both U.S. component foams and PET foams contributed to this positive performance. The Engineered Foams business addresses the needs of a number of markets and applications where weight and robustness are of critical importance. For example: • Within the energy sector, the Group primarily sells its products for use in wind turbine equipment and applications related to the production or transformation of energy. • In the automotive industry, Armacell’s products are primarily used for water shields or gaskets for water proofing and shock absorption. • In the sports and leisure market, applications are primarily used in connection with parts or components that require impact cushioning, flotation properties or lightness (such as flotation devices, wrestling mats and helmet paddings). • In the building and construction market, the Group offers solutions that are primarily used in lightweight construction, such as prefabricated light structures for terraces or pedestrian bridges. • For transportation end markets, products primarily include light insulating materials with thermal and acoustic properties used in composite panels in trains, trucks and trailers. • In addition, the Group supplies products for other applications and end markets, such as turfs and floor underlayment. Overall, revenues in the component foams segment grew by 5 % despite a demanding economic and competitive environment, beating the growth rate seen in 2013. Military spending in the U.S. remained severely constrained. On a positive note, the automotive market exceeded projections, helping to offset certain negative factors. In 2014, Armacell successfully combined its polyolefins and elastomers activities into one sales function and started presenting itself as a one-faceto-the-customer solutions provider. PET Armacell is currently the key supplier to leading wind-turbine builders. In 2014, the wind market recovered with an increase of 22 % after a 20 % reduction in installed capacity from 2012 to 2013. In terms of regions, the U.S. market recovered completely after a major drop in 2013 due to non-renewal of the production tax credit (PTC). Onshore growth in Europe stagnated, while China clearly stayed the leading region with close to 50 % of globally installed volume. The global offshore and emerging markets will both grow continually, yet remain a fraction of the onshore markets in Europe, the U.S. and China. Strict cost control will also continue to be an important factor for the wind market on the path to achieving grid parity as compared to more traditional energy sources (coal and nuclear power). Revenues in the PET foams segment increased strongly by 21.8 % in 2014 compared to 2013, with new developments in the light truck industry as well as in some construction projects. To counter continuing price pressure, Armacell is currently introducing its green foam, produced as part of a 100 % recycled PET stream. KEY FIGURES ENGINEERED FOAMS EUR million 2014 2013 Revenues 94.6 86.9 Adjusted EBITDA 22.0 19.3 % of revenues 23.3 % 22.2 % Adjusted EBITA % of revenues 17.7 15.7 18.7 % 18.1 % GROUP FINANCIAL PERFORMANCE The year 2014 was a successful one for Armacell. The profitable growth in both business segments and across all regions underlines the significance of the consistent international growth strategy. As a world leader in flexible insulation foams for the equipment insulation market and a leading provider of engineered foams, Armacell is well positioned to capture the growth potential in each of its markets. REVENUE AND PROFIT INVESTMENTS AND CASH FLOW Armacell continued to generate strong cash flow in 2014. In the reporting period, the company’s cash flow from recurring operating activities amounted to EUR 56.3 million. The cash flow from investing activities amounted to EUR -23.1 million and was primarily related to investment in property, plant and equipment of EUR 19 million, focusing on capacity extension. Furthermore, process and cost improvement, acquisitions and development of intangibles amounted to EUR 1.6 million, while acquisition of subsidiaries required EUR 3.2 million. Armacell’s recurring cash-flow conversion ratio reached 37.2 % in 2014. Net indebtedness of Armacell Group was EUR -322 million as of December 31, 2014, an increase of EUR 26 million compared to the previous year. The increase is mainly due to U.S. dollar currency translation. 23 In 2014, adjusted EBITDA increased by 9.6 % to EUR 71.2 million, or 15.7 % of revenues. Adjusted EBITA improved by 8.7 % to EUR 56.1 million. Despite a competitive environment, Armacell maintained an EBITA ratio relative to revenues of 12.4 % due to continued efforts to improve cost performance. At the end of 2014, total assets amounted to EUR 673 million, an increase of EUR 50 million compared to 2013. This figure reflects an increase in intangible and tangible assets resulting from capital expenditure focusing on process and cost improvements. Furthermore, total assets and liabilities increased due to the acquisition of the remaining 49 % shares in Armacell Zamil Middle East Company (Saudi Arabia) in June 2014. Trade receivables increased as a result of higher business activity in the fourth quarter 2014 as compared to the fourth quarter 2013. FINANCIAL RESULTS Against the backdrop of a global economic environment that remained challenging, Armacell increased its revenue by 8.8 % year on year to EUR 452.2 million in financial year 2014. Organic growth contributed 7.3 %, and an additional 1.5 % of growth was derived from the acquisition of the remaining 49 % share in Armacell Zamil Middle East Company (Saudi Arabia) in June 2014. Considering the impact of currency translation, which marginally reduced figures by 0.4 %, our organic growth at constant currency reached 9.2 %. The Group achieved a gross margin of 29.2 %. BALANCE SHEET OUTLOOK The basis for the long-term success of Armacell Group is its strong market position and the company’s global footprint. The global brand Armaflex and its product portfolio in particular safeguard the Group’s technology leadership and underline its status as a supplier of premium insulation solutions by maintaining high levels of R&D spending. Global GDP is expected to continue growing by 3.5 % in 2015 and 3.7 % in 2016. Three main factors characterize the overall development: oil prices remaining low, modest growth in demand and huge divergences between the regions. 24 FINANCIAL RESULTS Among advanced economies, the U.S. and U.K. are forecast to achieve growth of between 2 % and 3 %, while growth in the eurozone is expected to increase further in 2015 and 2016 to between 1.2 % and 1.4 %. Growth in emerging countries will vary from region to region, with sustained high growth in China, ongoing strong recovery in India and uncertainties in South America, Russia and Ukraine due to the economic crisis as well as the unstable geopolitical situation in Eastern Europe. Although the environment remains challenging in Europe, Armacell forecasts a continued increase in revenue and EBITDA in the coming years due to the increasing diversification of sales, the enlargement of addressable markets and continued cost-improvement initiatives. For 2015, we expect revenues and EBITDA to rise further. The Management Board has initiated suitable measures to achieve these targets. We anticipate raw-material prices to remain fairly stable in 2015. The further development of our global continuous-improvement approach throughout the entire Group in the form of detailed productivity action plans will further enhance manufacturing performance. Overhead costs are expected to increase moderately due to the reinforcement and professionalization of structures necessary to sustain growth, especially in emerging countries. The strengthening of most of the currencies against the euro, if continued, should further support Armacell’s positive growth. ARMACELL OPPORTUNITIES AND CHALLENGES Armacell’s core competency is its know how and technology in working with flexible foam products. In its core insulation business it continues to displace traditional glass fiblre because it is able to provide a superior product at a lower total installed cost. The product differentiation comes from the flexibility of the material which makes it more convenient to install around equipment and yet maintains its insulation, absorption and safety characteristics at the highest standard. Environmental concerns are also driving CO2 emission regulation for the transportation industry pushing OEMs to increasingly reduce the weight of the vehicles, creating need for bespoke substitution of materials within immediate components. Armacell products can offer lighter materials with similar shock and noise absorption characteristics to other materials. Armacell continues to work with OEMs to build bespoke solutions for their needs. This has been a strong growth driver for the business and is likely to further pick up. Combination of light weight and absorption characteristics is also driving growth in energy markets where Armacell is a supplier of choice for Wind blades. Besides growth opportunities driven by environmental issues, further growth potential for Armacell’s insulation business has been identified in specific industries, especially in emerging countries. The Engineered Systems business unit – which is Armacell will further strengthen measures aimed at pursuing organic growth, both through geographical expansion and product diversification as well as market enlargement inside the core insulation business. As a result, Armacell continued to pursue its international growth strategy in early 2015. With the acquisition of the Turkish insulation materials manufacturer Das Yalıtım Sanayi ve Ticaret Anonim Şirketi (OneFlex), Armacell significantly strengthened its market position in Turkey and expanded its geographic footprint into other countries across the Middle East, Africa and Southeastern Europe. The acquisition of the business of Industrial Thermo Polymers Limited (ITP) in Canada, combined with existing operations in U.S., positions Armacell as a leading manufacturer of polyethylene insulation foam on the North American continent. In the field of research and development, Armacell intends to strengthen its position as a technology leader and identify cross-regional opportunities for innovative products and technologies. Armacell’s research and development capabilities plus its long-standing industry experience ensure complex formula composition, high-quality products and a steadily growing product portfolio for specific demands in both established markets and in new business fields. The Group seeks to improve its cost position by developing new recipes, reducing price dependence and improving processes. These efforts will be accompanied by reinforcing our position as the best in class for manufacturing costs. Armacell will achieve higher efficiency by reducing complexity and leveraging the current fixed cost base. The opportunities outlined above are associated with the same uncertainties that are generally inherent to the estimates forming the basis of corporate strategic planning. However, all described actions together should have a positive influence on the earnings situation and financial position of Armacell. 25 Insulation is an effective and cost-efficient way to improve energy efficiency in industrial, commercial and residential infrastructure. Armacell’s insulation materials are designed for both new and existing installations. As a result, Armacell was able to grow faster than the market in recent years and is expecting to further benefit from this trend. With changing energy and regulatory policies, there are opportunities to increase market share across the entire insulation market. Armaflex is now the world’s best-known brand for flexible technical insulation, and the brand name has become synonymous with the building materials industry. The Group also plans to further expand the business with thermoplastic polymer applications. In addition to ongoing measures aimed at exploring and enlarging its customer base in the wind-turbine market, Armacell will focus in particular on the development of its other customer base, most notably in the automotive, transportation and construction sectors. Expansion will also continue with new applications. FINANCIAL RESULTS Growing public awareness of climate change has triggered far-reaching political decisions in favor of increasing the use of renewable energies and the avoidance of energy waste in the OECD countries and a number of emerging markets. For example, the European Union has committed itself to reducing CO2 emissions by 80 % to 95 % by 2050, as compared to 1990 levels. Our management views the increasing environmental awareness as a long-lasting trend with a strong positive impact on Armacell’s business. more specifically dedicated to the oil and gas sector, a key growth market for the Group – was extremely successful in 2014. This development, combined with our products’ ability to set new standards in the industry, will capitalize on reference projects to strongly position Armacell in the industry. IMPRINT Editor Armacell International S.A. WestSide Village 89B, rue Pafebruch 8308 Capellen, Luxembourg www.armacell.com Concept, text, design, and production heureka GmbH – einfach kommunizieren. Essen, Germany 26 IMPRINT Photography Armacell Print Woeste Druck Essen-Kettwig, Germany AC-CORP-AR-0715-GB www.armacell.com