HANDBOOK OF EMPLOYEES` PROVIDENT FUND

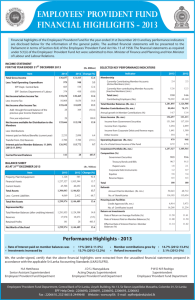

advertisement