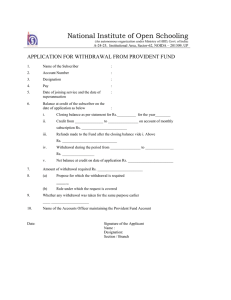

THE GENERAL PROVIDENT FUND (TAMIL NADU) RULES ©

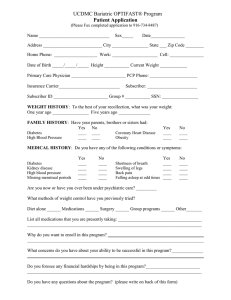

advertisement