Discretionary Housing Payments guidance manual: May

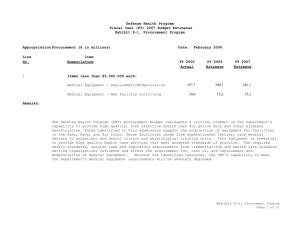

advertisement