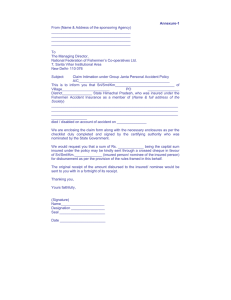

home building insurance

advertisement