Equine Medical Insurance…

advertisement

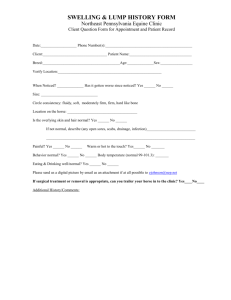

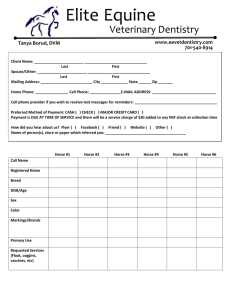

Equine Medical Insurance…The times they are a changing. By Kent Allen DVM When you remember equine medical insurance from the past, it was pretty easy to figure out. You bought a mortality policy on your horse and if you wanted to, you added a medical/surgical policy. You typically paid a $250 premium and a $250 deductible which would allow coverage by the insurance company for any surgical or medical treatments as well as diagnostics. If your horse was diagnosed with a problem that the insurance company paid for, there would be an exclusion and provided no further complications were encountered, this exclusion could be reinstated in the future. That was back when life was simple and most diagnostics and treatments were not big ticket items. Heads of insurance companies told me back in those days that the mortality policies were the money makers and that although the medical and surgical policies were the loss leaders, they were necessary to compete. That is why you could never buy a medical policy without a mortality policy. Well things have certainly changed. As I referenced in the Chronicle article “Between the Rounds- “The Snowball we dared not hoped for””, equine veterinary medicine has made some amazing strides in the last few years. Some of these treatments and diagnostics are expensive. Nowadays, MRI and stem cells, for example, cost more than a surgical colic would have a few years ago. Add on nuclear scintigraphy, shock wave therapy and various other medications and the price tag for diagnosing and fixing your horse can mount up. Is it worth it? Sure it is. Veterinary medicine is much more accurate in diagnostics and much more successful with treatments than just a few years ago. What has been happening in the equine medical insurance business and who are the players? The Insurance Company is a company that markets equine insurance policies; they are in turn reinsured by big insurance companies in the background. The first person you will probably contact is an Agent; this person sells the policy that will cover your horse. They may work for the company or be independent or even represent several companies that market equine insurance policies. The Agent is responsible for helping you purchase the correct policy for you and your horse. The person you contact when you have a problem with your horse that may involve the insurance company is the Adjuster. The Adjuster interprets the policy and tells you what is covered with regards to the problem. The company that offers the insurance product you have also readjusts it every year and puts exclusions on what it will cover. Those people are called Underwriters because they underwrite the risk that the company is willing to take with your horse. One of the major differences in equine medical insurance and human is this exclusion principle. While human policies increase each year dependent on health costs and your risk, the equine version of it has a relatively constant cost but excludes risks identified during the previous year. Like other companies in the world some insurance companies are very knowledgeable and experienced and others are merely occupying a cubicle, ask around as to which your company is. Now, unknown to most people, a whole host of changes are coming to your equine medical policy. If you own an equine medical insurance policy, you should be paying attention to the following paragraphs. Prior to buying an insurance policy, consider what coverage you want. Be aware that basic insurance includes mortality coverage only. Additional coverages may include surgical only, major medical/surgical and personal liability; however, these policies come with associated fees. In the sports medicine field, major medical insurance policies are used commonly to help cover lameness diagnostics and treatments. When shopping for an insurance policy, it’s worthwhile to call different companies and agents and compare estimates. Be sure to talk directly to an agent and get answers to specific questions such as what is the price of the premium? What does the policy cover? Is there a deductible and copayments? Different companies have different fees and coverage so it’s important to clarify these details ahead of time. One of the confusing components of modern equine insurance is that recently certain conditions, such as “navicular disease” or ”navicular syndrome”, are not covered. Not only is there no definition provided for these terms but with the advancement of veterinary diagnostic imaging the terms themselves have, in fact, become obsolete. These types of conditions are of an athletic injury nature and there is simply no way of predicting if your horse will become affected in the future. Further confounding the matter, questions pertaining to such conditions are not specified on the insurance forms and so without reading your policy in detail, you may not realize that these specific exclusions exist until a problem arises. Read the policy carefully and clarify any questions you may have with your agent. Also find out who will be the underwriter and adjuster for your policy. Finally, before buying a policy make sure you understand all of the insurance specific verbiage and be aware of vague terminology. Before providing coverage, the insurance company will need certain details about your horse. For example, mortality policies require the market value of your horse. A major medical policy may require further information regarding the medical history and current health status of your horse. This will be provided by your veterinarian when he/she submits the medical form. The insurance company will ask questions about pre-existing conditions, these need to be answered carefully. Once you have a policy, develop a relationship with your agent. Also, familiarize yourself with the coverage details of your policy prior to filing a claim. Insurance companies will not cover any veterinary services associated with the maintenance and routine treatment of healthy animals (such as Legend and Adequan injections). Many policies will only cover a certain percentage or set amount for certain diagnostics and treatments. For example, a policy may only cover shockwave treatment up to a certain dollar amount. Some policies only cover up to 50% of major diagnostics, such as nuclear scintigraphy and MRI. It is very important to know the correct channels of communication between agent, client and veterinarian, as well as the timing of communications. Most policies require immediate notification of the insurance company of any veterinary service and/or diagnostic testing. Once they have been notified, the insurance company will then send the veterinarian a report to fill out. The veterinarian will provide the company with all the required information regarding diagnoses, treatments and prognoses. As the owner, you may be required to send in the complete billing information; however, the veterinarian can send this information in for you too. Be aware that some policies will start a timer on your claim from the first known claim and that they will not cover that problem past that point. Familiarize yourself with the time frame covered by your policy as this varies between policies! Finally, it is important to realize that the insurance company may make exclusions from your policy due to a claim. You will receive these exclusions once a year at the anniversary date of your policy or after an injury that was treated; it is important to review these exclusions as they should be both specific and rational. Sometimes they are not. For example, a whole limb should not be excluded based on the diagnosis of proximal suspensory desmitis (an area that is a few centimeters in size). Overly generalized exclusions should, and can, be challenged successfully. Most veterinary practices will be very specific on a diagnosis to treat your horse correctly and help prevent these vague exclusions. In addition, if you can provide proof that a horse has recovered from a certain injury the insurance company may remove that exclusion. The other problem that can occur with exclusions is that sometimes underwriters with little or no veterinary experience are gleaning veterinary reports for words such as sidebone or navicular and then assigning exclusions to them. It may not matter to them that these words are part of a complete veterinary report and have nothing to do with the diagnosis of the case, and an exclusion is issued anyway. Many people don’t read their policy in enough detail to realize this was done erroneously until their window to challenge it has passed. Things have changed dramatically in the equine insurance industry. For example, some companies have increased the mortality rates. Other companies are increasing their rates on equine medical and surgical policies, and most are significantly limiting what they will cover. So in most cases, the horse owner is getting less coverage for their insurance dollar. Ideally, insurance companies would be upfront with regards to the coverage of these sophisticated and expensive diagnostics and treatments. To be fair some companies are stepping up and doing just that but some are vague, hiding behind insurance terms and hidden language leaving the horse owner holding the bag. In closing, find a good agent who knows you and your horse as well as the equine insurance industry. Be sure to investigate your policy, read it carefully and understand the terms. Finally, challenge vague, generalized or ridiculous exclusions when they are presented to you.