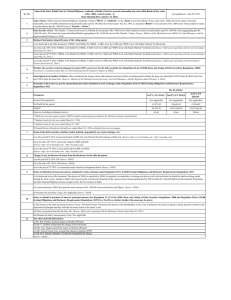

Sr. No. 1 2 3 4 5 6 1st FY ( FY 2016)* 2nd FY (FY 2017) 3rd FY (FY

advertisement

Sr. No. Name of the Issue: Public Issue by National Highways Authority of India of tax free secured redeemable non convertible Bonds of face value of Rs. 1,000/- each (Tranche - II) (Issue Opening Date: February 24, 2016) Last updated on: June 03, 2016 1 Type of Issue : Public Issue by National Highways Authority of India ("NHAI" or “Authority” or the “Issuer”) of tax free Bonds of face value of Rs. 1000 each in the nature of secured, redeemable, non convertible debentures having benefits under section 10(15)(iv)(h) of the Income Tax Act, 1961, as amended (“Bonds”) for an amount of Rs. 1000 crores with an option to retain oversubscription upto Rs. 3,300 crores (“Tranche – II Issue”). 2 Issue size (Rs. crore): The Tranche - II Issue by the Issuer is of Bonds for an amount of Rs. 500 crores with an option to retain oversubscription upto Rs. 2,800 crores aggregating upto Rs. 3,300 crores. The Issuer has issued and alloted Bonds aggregating to Rs. 3,300 crores in the Tranche - II Issue. (Source: Minutes of the Meeting between NHAI; the Lead Managers; and the Registrar dated March 08, 2016) 3 Rating of instrument alongwith name of the rating agency (i) As disclosed in the offer document: 'IND AAA' by IRRPL, 'CARE AAA' by CARE, "[ICRA] AAA” by ICRA, "CRISIL AAA/Stable" by CRISIL (ii) at the end of FY 2016: 'IND AAA' by IRRPL, 'CARE AAA' by CARE, "[ICRA] AAA” by ICRA, "CRISIL AAA/Stable" by CRISIL (Source: Half yearly reporting dated June 02, 2016 to Debenture Trustee) (iii) at the end of FY 2017: Not Applicable (iv) at the end of FY 2018: Not Applicable 4 Whether the security created is adequate to ensure 100% asset cover for the debt securities (See Regulation 26 (6) of SEBI (Issue and Listing of Debt Securities) Regulations, 2008): Yes (Source: Certificate dated May 18, 2016 obtained from the Statutory Auditor of NHAI) 5 Subscription level (number of times): After considering the bids not banked, bond corrections, cheque returns and technical rejections (before excluding partial refund), the Issue was subscribed 18.0017 the Base Issue Size and 2.7225 times the Issue Size. (Source : Minutes of the Meeting between the Issuer; the Lead Managers; and the Registrar dated March 08, 2016). 6 Financials of the Issuer (as per the annual financial results submitted to stock exchanges under Regulation 52(4) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Rs. (In Lakhs) Parameters 1st FY ( FY 2016)* 2nd FY (FY 2017) 3rd FY (FY 2018) Income from operations Not Applicable Not Applicable Not Applicable Net Profit for the period -13,304.82 Not Applicable Not Applicable 125,57,639.68 Not Applicable Not Applicable 748.68 Not Applicable Not Applicable Capital Reserves excluding revaluation reserves *Limited Review Results for the half year ended March 31, 2016 filed with the stock exchanges 7 Status of the debt securities (whether traded, delisted, suspended by any stock exchange, etc.) (i) at the end of FY 2016: Listed and Traded on BSE and NSE. (Source: http://www.bseindia.com/ http://nseindia.com) (ii) at the end of FY 2017: Not Applicable (iii) at the end of FY 2018: Not Applicable 8 Change, if any, in directors of issuer from the disclosures in the offer document (i) at the end of FY 2016: As given in the Material Information below (Source: NHAI) (ii) at the end of FY 2017: Not Applicable (iii) at the end of FY 2018: Not Applicable 9 Status of utilization of issue proceeds (as submitted to stock exchanges under Regulation 52(7) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015) (i) As disclosed in the offer document: The funds raised through Bonds will be utilized for the part financing of various on-going projects under the NHDP and also various special projects and future projects to be awarded under different modes. (ii) Actual utilization: NHAI as on date has spent entire amount raised through public issue in 2015-2016 towards various project. (Source: NHAI) (iii) Reasons for deviation, if any: Not Applicable 10 Delay or default in payment of interest/ principal amount (See Regulation 23 (5) of the SEBI (Issue and Listing of Debt Securities) Regulations, 2008 and Regulation 52(4) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015) (Yes/ No) (If yes, further details of the same may be given). No (i) Disclosures in the offer document in terms of issue: The Bond Trustee will protect the interest of the Bondholders in the event of default by the Issuer in regard to timely payment of interest and repayment of principal and they will take necessary action at the Issuer’s cost. (Source: Prospectus Tranche - II dated February 22, 2016) (ii) Delay in payment from the due date: No (Source: Half yearly reporting with the Debenture Trustee dated June 02, 2016 ) (iii) Reasons for delay/ non-payment, if any: Not Applicable 11 Any other Material Information: (i) Mr. R.K. Pandey assumed charge as Member (Project) (ii) Mr. V. Chibber relinquished the charge on his retirement (iii) Mr. A.K. Singh assumed the charge as Member (Project) (iv) Mr. Neeraj Verma, IAS, assumed the charge as Member (PPP) (v) Mr. M.P. Sharma, Member (Technical) relinquished the charge (Source: NHAI)