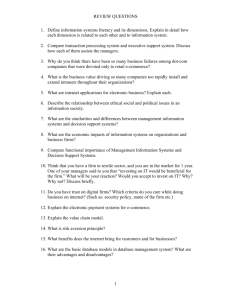

Online vs. Offline Competition - Personal Websites

advertisement