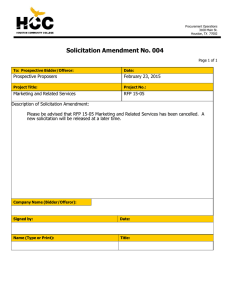

request for proposal (rfp)

advertisement