EA Review and Info Session_SP16

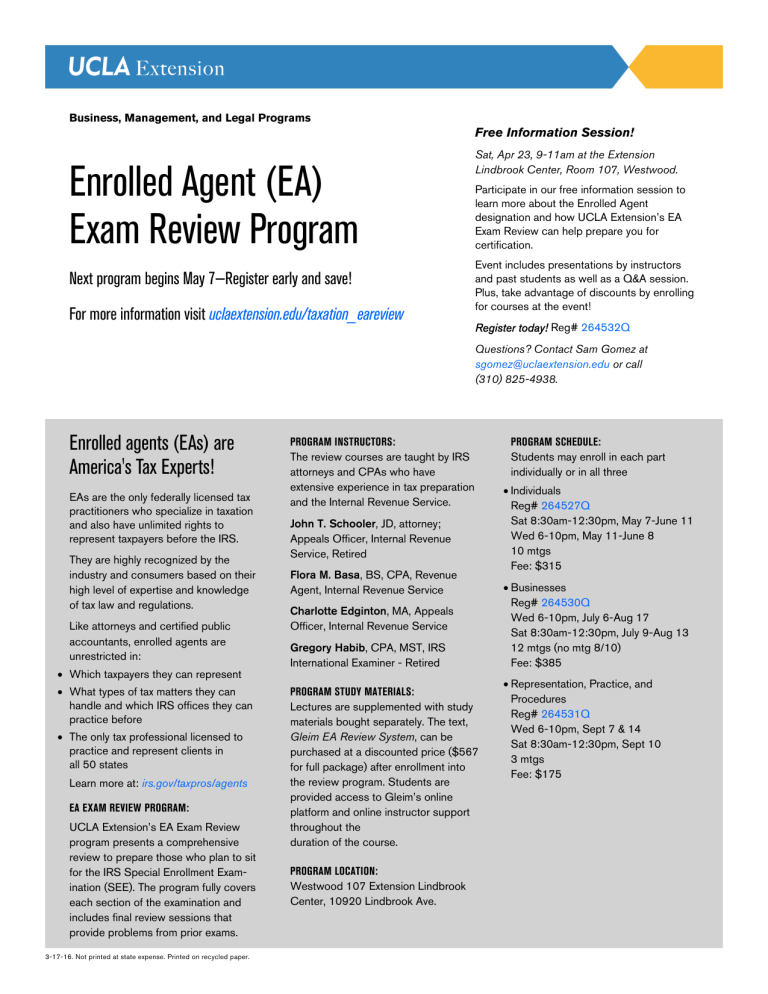

Business, Management, and Legal Programs

Enrolled Agent (EA)

Exam Review Program

Next program begins May 7—Register early and save!

For more information visit uclaextension.edu/taxation_eareview

Free Information Session!

Sat, Apr 23, 9-11am at the Extension

Lindbrook Center, Room 107, Westwood.

Participate in our free information session to learn more about the Enrolled Agent designation and how UCLA Extension’s EA

Exam Review can help prepare you for certi fi cation.

Event includes presentations by instructors and past students as well as a Q&A session.

Plus, take advantage of discounts by enrolling for courses at the event!

Register today! Reg# 264532Q

Questions? Contact Sam Gomez at sgomez@uclaextension.edu or call

(310) 825-4938.

Enrolled agents (EAs) are

America's Tax Experts!

EAs are the only federally licensed tax practitioners who specialize in taxation and also have unlimited rights to represent taxpayers before the IRS.

They are highly recognized by the industry and consumers based on their high level of expertise and knowledge of tax law and regulations.

Like attorneys and certi fi ed public accountants, enrolled agents are unrestricted in:

Which taxpayers they can represent

What types of tax matters they can handle and which IRS of fi ces they can practice before

The only tax professional licensed to practice and represent clients in all 50 states

Learn more at: irs.gov/taxpros/agents

EA EXAM REVIEW PROGRAM:

UCLA Extension’s EA Exam Review program presents a comprehensive review to prepare those who plan to sit for the IRS Special Enrollment Examination (SEE). The program fully covers each section of the examination and includes fi nal review sessions that provide problems from prior exams.

3-17-16. Not printed at state expense. Printed on recycled paper.

PROGRAM INSTRUCTORS:

The review courses are taught by IRS attorneys and CPAs who have extensive experience in tax preparation and the Internal Revenue Service.

John T. Schooler , JD, attorney;

Appeals Of fi cer, Internal Revenue

Service, Retired

Flora M. Basa , BS, CPA, Revenue

Agent, Internal Revenue Service

Charlotte Edginton , MA, Appeals

Of fi cer, Internal Revenue Service

Gregory Habib , CPA, MST, IRS

International Examiner - Retired

PROGRAM STUDY MATERIALS:

Lectures are supplemented with study materials bought separately. The text,

Gleim EA Review System , can be purchased at a discounted price ($567 for full package) after enrollment into the review program. Students are provided access to Gleim’s online platform and online instructor support throughout the duration of the course.

PROGRAM LOCATION:

Westwood 107 Extension Lindbrook

Center, 10920 Lindbrook Ave.

PROGRAM SCHEDULE:

Students may enroll in each part individually or in all three

Individuals

Reg# 264527Q

Sat 8:30am-12:30pm, May 7-June 11

Wed 6-10pm, May 11-June 8

10 mtgs

Fee: $315

Businesses

Reg# 264530Q

Wed 6-10pm, July 6-Aug 17

Sat 8:30am-12:30pm, July 9-Aug 13

12 mtgs (no mtg 8/10)

Fee: $385

Representation, Practice, and

Procedures

Reg# 264531Q

Wed 6-10pm, Sept 7 & 14

Sat 8:30am-12:30pm, Sept 10

3 mtgs

Fee: $175