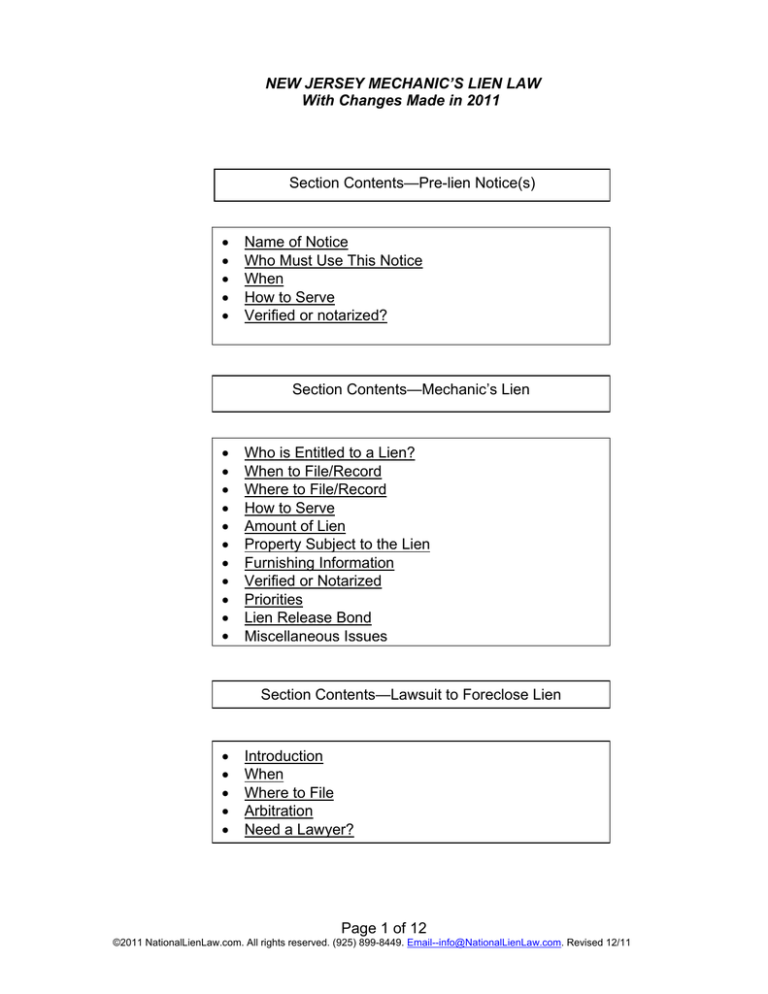

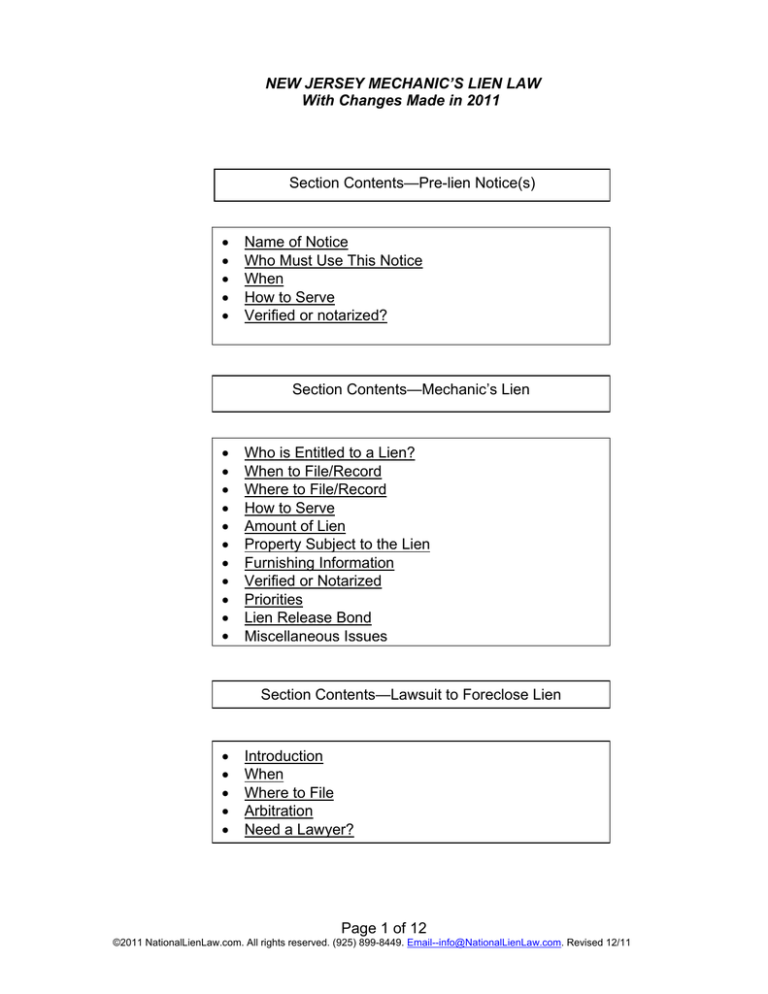

NEW JERSEY MECHANIC’S LIEN LAW

With Changes Made in 2011

Section Contents—Pre-lien Notice(s)

•

•

•

•

•

Name of Notice

Who Must Use This Notice

When

How to Serve

Verified or notarized?

Section Contents—Mechanic’s Lien

•

•

•

•

•

•

•

•

•

•

•

Who is Entitled to a Lien?

When to File/Record

Where to File/Record

How to Serve

Amount of Lien

Property Subject to the Lien

Furnishing Information

Verified or Notarized

Priorities

Lien Release Bond

Miscellaneous Issues

Section Contents—Lawsuit to Foreclose Lien

•

•

•

•

•

Introduction

When

Where to File

Arbitration

Need a Lawyer?

Page 1 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

General Notes

Be Careful:

The courts consider a mechanic=s lien to be a

privilege and not a right. You receive its benefits only if you

strictly adhere to the state law requirements. Bottom line:

miss a deadline by one day and you have lost it. Unlike

other areas of the law where you can argue equities, find

technical exceptions, and lawful excuses, there is no

forgiveness here. In this case, knowledge is not only power,

it=s a necessity.

New Legislation:

New Jersey replaced it’s centuries old mechanic’s lien

statutory system with new legislation in 1994. This was

followed by changes in 2010. Even further changes were

made when the governor signed into law revisions on

January 5, 2011. Like all mechanic’s lien statutes, the new

rules must be strictly complied with or you may lose your lien

rights. In general, the new law was meant to simplify

matters and in many cases it does so.

Written Contract

Contract

Requirement:

In most states a mechanic’s lien can be foreclosed upon

either a written or verbal contract. In those states it is

nevertheless recommended the contract be in writing. New

Jersey is different. It mandatorily requires that everyone,

whether generals, subs, or suppliers, have a written contract

in order to have the right to later file a mechanic’s lien. But

the New Jersey statutes go even further. They require that

all change orders and contract addenda be in writing. Be

very careful about this aspect of the law. If an extra is not in

writing, it cannot be part of your lien. Attempt to get your

change order signed before the extra work is done. If there

is a refusal to sign, at least send a written confirmation. (It is

uncertain at this stage of the law as to whether this will be

effective.)

It need not be a formal, comprehensive contract. In fact, the

statute talks only in terms of a writing which describes the

price and the improvement.

As of 2011, material suppliers will satisfy this requirement by

a delivery or order slip signed by a general contractor,

subcontractor, or authorized agent. Typically these are

signed by anyone on the job at the time and in most cases

such persons are the authorized agent. The statute goes so

Page 2 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

far as defining a signature also as a “mark or symbol”, which

is intended to authenticate it. Apparently signing “OK”,

“Received”, or someone’s initials, would probably be

sufficient (2A: 44A-2).

In this State you will be writing down dates for at least three documents:

a) Notice of Unpaid Balance and Right to File Lien; b) Contractor’s Lien Claim;

and c) lawsuit to foreclose the mechanic=s lien. Write down all the deadlines in

your calendar. Use a highlighter or red pen. If you have a staff, use a Afail safe@

system by doubling up and putting it in their calendar also. This reminds you

twice. The first calendar entry should be two weeks before the due date as a

preliminary reminder.

On the second calendar entry, do a white lie to yourself. Put the due date

as one week before it is actually due as insurance in case you get busy or need

legal advice.

Time is money. You will waste a lot of valuable time running around and

doing it at the last moment, as opposed to doing it early.

PRELIEN NOTICE

This state requires a prelien notice be sent out on residential projects

before the mechanic=s lien is filed/recorded. For simplicity, this notice will be

referred to as a APrelien Notice@. The basic information on this Notice is as

follows:

Name of Notice:

Notice of Unpaid Balance and Right to File Lien.

As of 1994, there is no longer a requirement to serve a

prelien notice except for residential construction. Residential

construction is defined as construction or improvement to a

one- or two-family dwelling, condominium, cooperative,

townhouse, subdivision, or other planned unit development.

Remember that this prelien notice is only the first step in

protecting your mechanic’s lien. You must also take the

second step of filing the construction lien claim.

Who Must Use

this Notice:

Unlike most states where only subcontractors and suppliers

are required to file the prelien notice, all lien claimants are

required to file the notice in this state. This means generals,

Page 3 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

subs, equipment/material suppliers, laborers, design

professionals, and any other persons claiming a lien.

When:

How to Serve:

See Time Deadlines table.

The prelien notice must be filed in the County Clerk’s office in

the county in which the project is located. On commercial or

industrial property, it is not necessary to serve anyone with the

prelien notice.

On residential projects, you must serve copies of the notice

after filing with the County Clerk. If you are a general

contractor, serve the owner by certified mail, return receipt

requested, at the last business or residence address. If you are

a subcontractor or supplier having a contract with the general,

you will serve the owner and general contractor. If you are a

sub-subcontractor or supplier with a contract with a

subcontractor, you will serve the subcontractor, the general

contractor, and the owner.

It is recommended that the notice be served within 10 calendar

days after filing with the County Clerk (as is done with

construction lien claims).

If more moneys are owed to you after serving your first prelien

notice, it is a good idea to file an Amendment to Notice of

Unpaid Balance and Right to File Lien. Service is done in the

same fashion as the original notice.

Verified or

Notarized?:

Added Benefit

of Prelien

Notice on

Commercial

Property:

A verified notice simply means you sign it and are representing

the contents are true and accurate. A notarized notice is signed

in front of a Notary Public or other official. The notice must be

both verified and notarized.

Although it is not required to serve such a notice on commercial or

industrial property, it is recommended you do so. It is especially

handy if the property is later sold or permanent financing is

recorded. If you file your prelien notice before this happens, the

new buyer or lender takes subject to your lien rights.

Page 4 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

Mandatory

Arbitration:

New Jersey is the only state which mandatorily requires any

disputes arising out of a prelien notice for residential projects

(does not apply to commercial) to be quickly resolved through

binding arbitration). After your serve your prelien notice, it is

required that you take the following additional steps:

A.

Unless the parties have agreed in writing to another

arbitrator, you must serve within 10 days of the Notice of

Unpaid Balance and Right to Lien, a Demand for Arbitration

with the American Arbitration Association. It will be an

expedited proceeding with one arbitrator.

B.

If the arbitrator believes that some of your work is defective

or there are valid set-offs or defenses, he/she may require

you to post a bond in the amount of your lien.

C.

The arbitrator will hold a hearing and make a decision as to

the probable validity of the lien. It is not binding either way,

but is simply a signal that you have a likelihood of

prevailing in court and the Notice was filed in good faith

D.

If the arbitrator determines you have a valid lien, within 10

days thereafter but no later than 120 days from the last

performance of work, file your actual construction lien

claim.

This is a very beneficial procedure but it goes very quick, so pay

attention to the time deadlines.

MECHANICS= LIENS

Name of Lien:

Who is Entitled

to a Lien:

Construction Lien Claim.

A mechanic=s lien is primarily for general contractors,

subcontractors, laborers, as well as material/equipment suppliers.

But it also covers licensed architects, engineers, and land

surveyors (who are not employees of the owner or general). It

additionally covers a number of claimants who have a direct

contract with the owner, including not only the general contractor,

but construction managers as well.

It also includes

subcontractors and sub-subcontractors. Sub-sub-subcontractors

do not appear to be entitled to a mechanic’s lien.

The lien also applies to material and equipment suppliers who

have a direct contract with the owner, general contractor, or a

Page 5 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

subcontractor.

If you have a direct contract with a subsubcontractor, unfortunately, you are out of luck.

The old rule was a lien is not allowed for an equipment or material

supplier who has a contract directly with another supplier

(“supplier to supplier” rule). As of 2011 this was changed: a

supplier to a supplier is allowed, but only within the first three tiers

of the contracting chain. So, a supplier can deal with another

supplier who has a direct contract with the general contractor, but

no further down the chain.

For clarity, New Jersey classifies the tiers not based on your

license, but who you have your contract with:

1st Tier: (Commonly a general contractor). Any contractor,

regardless of their license, who has a direct contract with the

owner. This could be a traditional general contractor or a licensed

subcontractor (roofer, painter, plumber, electrician, etc. who has a

direct contract with the owner). But for simplicity, in these

examples, we will make the assumption that person is a general

contractor.

2nd Tier: (Commonly a subcontractor or supplier to the general

contractor). A subcontractor or supplier who has a direct contract

with the general contractor.

3rd Tier: (Commonly a sub-subcontractor or supplier to a sub). A

subcontractor or supplier who has a direct contract with another

subcontractor.

Unfortunately, there can be no liens for a “sub-sub-sub” or a

supplier to a “sub-sub”.

By statute, the following persons or entities do not have lien rights:

(a) work pertaining to mining, removal of timber, gravel, soil, or

sod, unless it is an integral part of or required by some additional

work; (b) fuel for machinery or equipment; (c) material and

equipment that has not become permanently attached to the real

estate and can be easily removed without damage; (d) evaluative

work, such as feasibility studies, which do not result in actual

construction work; and (e) equipment or materials that are subject

to a UCC Security Agreement (for example, moveable fixtures,

counters, shelving, restaurant equipment, and the like).

When to File/

Record:

See Time Deadlines table. The time periods are not extended for

warranty or service calls for work provided after completion.

Page 6 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

Where to

File/Record:

Filed with the County Clerk of the county in which the project is

located.

How to File:

The clerk’s office is quite busy and cannot always “file of record” a

document on the spot. Instead they typically mark your copies as

received and in the days and weeks later, process it for filing

(formally record it on their computers and dockets). So, New

Jersey came up with a compromise. When going in person, you

will immediately get a stamped copy back. It will be formally

stamped as “filed of record” (2A: 44A-6). This lodging date satisfies

a requirement of it being “filed “ on time. If you send your lien in by

mail, the same process occurs, except you will get a stamped copy

back in your return envelope.

How to Serve:

Within 10 business (not calendar) days after lodging (stamped as

“filed of record”) with the County Clerk, service is made on the

owner by Certified Mail, Return Receipt Requested, at the last

business or residence address. You can serve a copy, but it must

have a copy of your signature and date signed.

Many attorneys mail the original to the clerk and at the same time

mail certified a copy to the owner or general. This practice is no

longer allowed because the mailed copy does not have a court

stamp. This means that employees are going in person to the

court or using messengers--on the way back to the office they

mail it certified mail with the stamped copy.

Remember, you must serve by certified mail and ordinary mail

simultaneously (2A: 44A-7).

There is a provision that allows you to do this late if it does not

cause the other party “material prejudice”, but do not take any

chances.

If you are a general, you serve the owner only. If you are a sub or

a material supplier with a contract with the general, serve the

owner and general. If you are subcontractor or supplier with a

contract with a subcontractor, serve the subcontractor, the general

and owner.

Amount of

Lien:

Primarily for unpaid labor, material, and equipment supplied.

The statutory form of mechanic’s lien does not include blanks

Page 7 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

for interest or finance charges, so it is uncertain whether you

can receive these amounts. The amount you are owed is

reduced by any mechanics’ liens filed by others under your

contract. In other words, either the owner or the general

contractor can deduct the amounts of mechanics’ liens owed

from the amounts due you.

As of 2011, the statute defines the lien amount as including

monies owed on the base contract, retainage, and

“amendments” (2A: 44A-2). It is uncertain whether the later

refers to change orders. But based on the rule that the contract

must be in writing, it may be the case that arbitrators and

judges will insist upon written and signed change orders--so

beware.

Property

Subject to

the Lien:

A mechanic=s lien applies only to private projects. The lien

applies to the property itself as well as offsite infrastructure

(example: utilities). No lien is allowed in public projects against

government property.

There is a continual debate in states as to whether a

mechanic’s lien goes against a subsequent purchaser. For

example, contractor does work for owner A who then sells to

B. Within the time limitations allowed, contractor files a lien

after B takes title. In many states, B would take subject to the

lien, but not in New Jersey (2A: 44A-3(g)). If the lien is

recorded after B takes title, the contractor loses. This assumes

B is a bona fide purchaser who is innocent of the facts leading

to the lien. Solution? Make sure you record your Notice of

Unpaid Balance and Right to Lien as soon as possible and

before close of escrow to B. This will allow B’s interest to be

encumbered.

Tenant

Improvements:

As of 2011 (2A: 44A-3), there is clarification on this issue as

well. A lien is allowed against the tenant’s interest as well as that of the owner,

only if:

1. The owners signs a written contract with the contractor which provides

the owner’s interest is subject to a possible lien (the amount is limited

to the money agreed under the contract, last partial payments made)—

something that almost never occurs, or

2. The owner pays the majority of the cost of construction, or

Page 8 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

3. The lease specifies the owner is liable for unpaid construction bills for

tenant work. In leases involving the construction of large improvements

such as warehouses, factories, shopping centers, etc., it is common for

the owner to finance the improvements in exchange for a long-term

triple net lease, and by virtue thereof the landlord has indirectly agreed

to pay for the bills. But there is typically separate contracts solely

between tenant and the contractor for additional work, and

NationalLawDocs has yet to see a lease where the landlord would be

responsible for those items.

Furnishing

Information:

Verified or

Notarized?:

Priorities:

Lien Release

Bond:

The general contractor may demand a verified list from

subcontractors of the names and addresses of all

subcontractors and suppliers on the job. The recipient then

has 10 days to furnish the list, verified under oath.

A verified notice simply means you sign it and are

representing the contents are true and accurate. A notarized

notice is signed in front of a Notary Public or other official. A

verified notice is all that is required in this state. The lien must

be both verified and notarized.

Many times an owner secures construction financing followed

by permanent financing. If you file your prelien notice before

the permanent financing is recorded, that lender will take

subject to your lien. Because of this added benefit, file your

prelien notices early.

The owner may post a bond and have the lien released by

securing a surety bond or making a deposit with the Superior

Court Clerk in the amount of 110% of the lien. You can then

continue as before with the lawsuit to foreclose, joining the

surety bond company, and if you are successful, you receive

the money from the bond.

Miscellaneous

Issues:

Written

Objection to

Lien:

If a general contractor or subcontractor receives a

mechanic’s lien, it must notify the owner and the holder of

the lien, in writing, within 20 days that it is contesting the lien,

Page 9 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

stating the reasons. If this is not done, the owner has the

option of paying the lienholder directly and deducting the

amount from your contract balance.

Full Discharge:

If you are paid in full after your lien is filed, make sure you go

to the County clerk’s office and file a Certificate of Discharge

of Construction Lien within 30 days or you can be assessed

court costs and reasonable attorney’s fees to discharge the

lien.

If your claim has been paid but you have not discharged the

lien and thirteen months have lapsed after the date of filing,

the owner can discharge lien by simply filing a discharge

certificate and affidavit.

Lien Waivers:

Previous law allowed a contractor, sub, or supplier to waive

his or her mechanic’s lien rights, but this can no longer be

done because it is against public policy. You can now waive

your lien rights only to the extent of the actual receipt of

moneys for the labor and materials you have conferred. This

means that the waiver is effective only upon receipt of a

payment for all or part of your services.

LAWSUIT TO FORECLOSE LIEN

Introduction:

Your lien is not valid forever. Because it directly affects the

owner=s title, it has a limited shelf life and must be enforced

within a short period of time. That enforcement is done by

filing a lawsuit to foreclose. Just like the time deadlines for a

Pre-Lien or Mechanic=s Lien, the courts strictly construe

these time limits which are called statutes of limitation.

Again, if you are literally one day late, the lien is ineffectual.

When:

Within one year from the completion of your work. The only

exception is if the owner serves a demand that the lawsuit

be started within 30 days, you must comply.

Arbitration:

Many construction contracts state that all disputes will be

decided by binding arbitration, as opposed to a court

proceeding by judge or jury. In fact, it has long been a

tradition to do so in the construction industry. Arbitration is

usually quicker and less costly, especially because it cuts

down on expensive discovery. The decision is final and

binding, with no right to appeal. You lose your right for a jury

trial, but few contractors want that in the first place. You

usually pick an experienced construction attorney or retired

Page 10 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

judge to hear the case in their conference room. It is just like

a court proceeding with the same general rules of evidence,

but more informal.

On the other hand, you can only foreclose your lien through

a court proceeding, not arbitration. So, how do you keep

your arbitration rights and at the same time preserve your

lien rights? Simple. You bring a lawsuit to protect the lien

and then immediately request the court to stay the court

proceedings. When arbitration is done, you go back to court

and turn the arbitration award into a judgment.

Need a Lawyer?

In this country, every individual has the statutory right

to represent themselves. This means they can prepare all

necessary papers, appear at hearings, and actually try the

case. In so doing, the court considers you to be acting either

in “pro se” or “pro per”. Before making this decision, consider

the following factors:

1.

You are a professional and thoroughly know

the ins and outs of not only the construction industry but of the

project itself. The best lawyer on his or her best day will

probably not know more than 50% of what you know.

2.

How is your public speaking abilities? If you

are uncomfortable speaking to a group, you will even more

uncomfortable in court or arbitration. You could be the

“sharpest wit in town” but may not be able to present your

arguments. Remember, appearing uncomfortable is perceived

as having deficiencies in your case. People usually think that if

you are not comfortable about your own facts, then they must

not be that strong.

3.

If the other side has a lawyer, you might want

to think twice about representing yourself. You will certainly

know the facts quite well, but you may be blindsided by legal

technicalities.

4.

You may also want to think twice if this is a

really nasty and emotional case. In other words, if the other

side is going for “blood”. Having a lawyer can shelter you from

this emotional trauma. No matter how strong you are, lawsuits

are taxing not only on your time, but on your physical and

emotional energies.

Page 11 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11

5.

If you have a good case in which you have

complied with technicalities and performed good work, you are

essentially engaging in a collection action. These actions are

typically very simple because there are few defenses or

defects alleged by the other side. It makes it easier for you to

represent yourself because it is more a question of when and

how much they will pay as opposed to whether you will win at

all.

6.

If you have a binding arbitration provision, you

may consider representing yourself. These proceedings are

much more informal and the arbitrator tends to give you more

leeway. There are also fewer rules and not they are usually

not quite as strict.

7.

You could consider representing yourself but

get advice along the way from a lawyer. It is much cheaper

that way. On the other hand, the lawyer cannot watch over

every move and you might slip up. Many times lawyers can

also help you with preparing the forms, simply putting your

name on the pleading. You can also bring in your lawyer at the

end to actually try the case.

8.

Judges and courts do not give legal advice.

They only help you with what forms to use. However, clerks

can be invaluable in steering you in the right direction as far as

where to file, time limitations, the nature of the form or

pleading, etc. But, remember when it comes right down to the

ultimate advice, they cannot help you.

9. Judges usually treat you the same as an attorney

which means they expect strict compliance with the rules.

Although some judges give you more slack, don’t count on it.

10.

The biggest dilemma is whether you should

hire an attorney for a smaller case, typically in the $5,000 to

$10,000 range. You have to watch this because you may eat

up that amount in attorney’s fees. You never make money on

lawsuits, only lawyers do. Try to settle for the best price you

can get and move on.

Page 12 of 12

©2011 NationalLienLaw.com. All rights reserved. (925) 899-8449. Email--info@NationalLienLaw.com. Revised 12/11