Offshoring Automotive Engineering

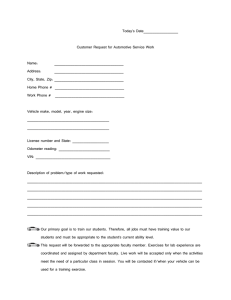

advertisement