CONTENTS - Cgglobal

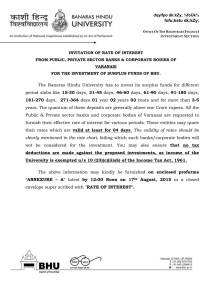

advertisement

CONTENTS

02

Highlights

2008-09

04

Chairman’s

Letter

08

Corporate

Information

12

Management

Discussion

And Analysis

34

ten yearS'

Financial

Highlights

36

Directors’

Report

50

Corporate

Governance

56

additional

shareholder

information

62

Financials

CG stand-alone

CG consolidated

144 Products

& Services

148 Establishments

>?=>B?=>JI

(&&.#&/

;l[d_dj^_iY^Wbb[d]_d][Yedec_Yf[h_eZ"

9hecfjed=h[Wl[i^Wi"j^hek]^_jiij[[bo

Z[j[hc_dWj_edZ[b_l[h[ZWYh[Z_jWXb[_dYh[Wi[

_d]hemj^hWj[i#ioij[cWj_YWbboWYYecfb_i^_d]

ckY^^_]^[hYedieb_ZWj[Zh[l[dk[i"j^ki

Yh[Wj_d]]h[Wj[hi^Wh[^ebZ[hlWbk[$

H;L;DK;

IN RS. CRORE

(,

PER CENT

EF;H7J?D=

H;L;DK;

9,031

7,181

D;MFHE:K9JI7D:IEBKJ?EDI

9=Fem[h_im[bbfbWY[Zjeb[l[hW][j^[i_]d_\_YWdjWdj_Y_fWj[Z

_dYh[Wi[_dZ[cWdZ\hecj^[fem[hWdZ_d\hWijhkYjkh[i[YjehWdZ_i

fhe]h[ii_l[bocWa_d]_jifh[i[dY[\[bj_dd[mfheZkYjWdZiebkj_ed

i[]c[dji"m_j^_ji_dYh[Wi_d]WX_b_j_[i"je_cfb[c[djWd_dj[]hWj[Z

iebkj_edifehj\eb_e$

79GK?I?J?EDIJEM?:;D87I;

7Ygk_i_j_edie\KI7XWi[ZCI;Fem[hIoij[ci=hekfWdZ<hWdY[

XWi[ZIedecWjhW^Wl[m_Z[d[Zj^[9ecfWdo¼iYWfWX_b_j_[ie\e\\[h_d]

[dZ#je#[dZicWhjfem[hiebkj_edi$7Ygk_i_j_ede\CI;Fem[hIoij[ci

m_bb_dYh[Wi[j^[9ecfWdoiijh[d]j^WiWioij[ci_dj[]hWjeh\eh;FC

Xki_d[ii_dj^[_cfehjWdjH[d[mWXb[;d[h]oWh[dW$J^[IedecWjhW

WYgk_i_j_edm_bb[d^WdY[j^[9ecfWdo¼iI[hl_Y[ZecW_d$

FEM;H=;D;H7J?ED

L_[m_d]fem[h][d[hWj_edWiWijhWj[]_Yeffehjkd_jo\eh\kjkh[

]hemj^"j^[9ecfWdo^WiZ[Y_Z[Zje[nfWdZ_jifh[i[dY[_dj^_i^_]^

]hemj^i[Yjeh"XoWYgk_h_d]WijhWj[]_YijWa[_d7lWdj^WFem[h

?d\hWijhkYjkh[B_c_j[Z"m^_Y^fh[i[dj[ZWdWjjhWYj_l[Xki_d[ii

effehjkd_jo$

(&&.

(.

PER CENT

(&&/

D;JI7B;I

I;HL?9;I

8,737

6,832

?D:KIJH?7BIOIJ;CI

;l[d_dj^[mWa[e\WZl[hi[cWha[jYedZ_j_edi"j^[?dZkijh_WbIoij[ci

Xki_d[ii^WicW_djW_d[Z_ji]hemj^WdZfhe\_jWX_b_jo"j^hek]^

cWha[j_d]"ikffboY^W_dWdZYWf_jWbcWdW][c[dj_d_j_Wj_l[i$

9EDIKC;HFHE:K9JI

J^[9edikc[hFheZkYjiXki_d[ii^WiZ[b_l[h[ZYecc[dZWXb[

f[h\ehcWdY[j^_io[Wh"ekjf[h\ehc_d]j^[cWha[j$?j_ij^[9ecfWdo¼i

ceiji_]d_\_YWdjYWi^][d[hWjeh$

(&&.

(&&/

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

;7HD?D=I

H;JKHDI

IN RS. CRORE

PER CENT

)&

PER CENT

;8?:J7

EARNINGS BEFORE INTEREST,

DEPRECIATION, TAX AND

AMORTISATION

)-

*$,

F7J

PROFIT AFTER TAX

PER CENT

PER CENT

POINTS

1,054

HE9;

RETURN ON CAPITAL

EMPLOYED

563

36.4%

31.8%

811

410

(&&.

*'

(&&/

(&&.

F8J

PROFIT BEFORE TAX

PER CENT

).

PER CENT

(&&/

(&&/

F7J

*PROFIT AFTER TAX,

MINORITY INTEREST & SHARE

OF ASSOCIATE COMPANIES

867

615

(&&.

560

407

(&&.

(&&/

(&&.

(&&/

CONSOLIDATED F INANCIAL H IG H LIG H TS

CHAIRMAN’S

LETTER

2008-09 began with

continuing global

inflation, and ended with

the sharpest decline

in trade and GDP that

the world has ever

seen since the Great

Depression of the 1930s.

In the first week of July 2008 the spot price for

crude oil was being quoted at over US$ 145

per barrel, with everyone predicting it would

cross the US$ 200 mark. Oil was not the only

commodity whose price was going through

the roof. The prices of gas, coal, steel, copper,

zinc, other metals and all key minerals were

rising with every passing day.

The bankruptcy of Lehman Brothers on 14

September 2008 caused the meltdown of the

entire financial system that continued right up

to December 2008.

This has been followed by the economic

crisis of the real sectors: sharp drop in demand,

GDP and world trade, followed by recession

and rising unemployment in all developed

economies. Today, the financial crisis is a

thing of the past because of massive and

unprecedented interventions by governments

and central banks across the world. But the

recession and economic slowdown continues.

Every country is either suffering from shrinking

GDP or sharply reduced growth.

As I write to you, the global situation

continues to be quite bleak:

● Although most experts believe that the

US economy will bottom out by the end of

the third quarter of 2009, the estimated GDP

growth for the year will be -2.9%. In April 2009,

unemployment was ruling at 8.9%, and rising.

The first four months of 2009 has seen 2.7

million net job losses, in addition to 1.7 million

in the last quarter of 2008.

● The Euro area is in a deep recession. GDP

growth for 2009 is estimated at -3.7%. The UK’s

GDP growth for 2009 is just as bad: -3.7%.

● Japan may be heading towards yet another

long term crisis. Industrial output has been

falling by more than 30%; and GDP growth for

2009 being estimated at -6.4%.

● With an estimated 11% to 12% fall in the real

value of world trade in 2009, China’s growth is

expected to reduce to 6.5%.

● India’s growth is down from the 9% plus

range of the last three years to 6.7% in 2008-09,

with the chances of it being the same in

2009-10.

In such difficult times, your Company

has performed extraordinarily well. It has

significantly grown consolidated revenues

and profits; acquired new businesses; and has

successfully positioned itself as an integrated

products, systems and solutions provider

across all its businesses — both in India and

overseas. If anything, your Company has

accelerated in its journey to be a globally

significant player in the spaces that it operates.

Let me share with you some key financial

facts about your Company for FY2009.

Net sales and services grew by 28% to

Rs.8,737 crore in FY2009, which was a 7 per

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

Your Company has

accelerated in its journey

to be a globally significant

player in the spaces that it

operates.

cent point increase in the growth rate over the

previous year.

● Earnings before interest, depreciation, taxes,

and amortisation (EBIDTA) increased by 30%

to Rs.1,054 crore — and grew faster than the

top-line.

● Earnings before interest and taxes (EBIT) rose

by 36% to Rs.933 crore in FY2009 — and grew

faster than EBIDTA.

● Profit before taxes (PBT) grew by 41% to

Rs.867 crore — with PBT rising faster than EBIT.

● Return on capital employed (ROCE)

increased to 36.4% — up by 460 basis points

from FY2008.

● Earnings per share (EPS) were up 38% to

Rs.15.27 in FY2009.

These numbers highlight an outstanding

performance for which all credit goes to your

Company’s management. Given the peoplestrength of Crompton Greaves throughout the

world, I have every reason to believe that we

will continue to see robust profitable growth

in the future.

This brings me to the subject of

opportunities. Companies grow by identifying

opportunities earlier than others, and seizing

them before their competitors. While we

continue to grow and look for opportunities

globally, we should not neglect our home

market, the source of our strength and stability.

C H AIRMAN ' S LETTER

We believe that the

profitability of generating

power in India would not

only be substantial, but

also be more long lasting

than from being a supplier

of transmission and

distribution equipment.

We see several growth opportunities, of which

I shall share three.

The first has to do with power generation.

Given the huge shortfall in power demand

in India — the average nation-wide gap

between peak demand and supply was 13% in

2008-09 — there is massive scope for creating

long term income streams through power

generation. We believe that the profitability

of generating power in India would not only

be substantial, but also be more long lasting

than from being a supplier of transmission and

distribution equipment.

You may recall that, to gain experience in

power generation and distribution, Crompton

Greaves had acquired a 59% shareholding in

the Malanpur Captive Power Limited, which

now successfully operates a 26 MW gas based

group captive power plant at Malanpur,

Madhya Pradesh. We had also successfully bid

for power distribution across the city of Nagpur

— which, unfortunately, has not taken off due

to regulatory and other local level hurdles. We,

however, continue to try and resolve the issues

with the concerned authorities.

In keeping with the strategic need to be in

power generation, the Board of Directors of

your Company has unanimously approved a

strategic investment of up to Rs.227 crore to

purchase 41% of the shares in Avantha Power

and Infrastructure Limited (APIL) at a book

value, estimated at approximately Rs.11 per

share. APIL, an Avantha Group company, is

engaged in the generation, transmission and

distribution of electricity. Today, it operates

four captive power plants with an aggregate

capacity of 95 MW, which is being expanded

to 165 MW. In addition, it is establishing two

new independent power producer (IPP) plants,

each with a capacity to generate 600 MW in

Chhattisgarh and in Madhya Pradesh. APIL

has already purchased most of the required

land, obtained the required environmental

clearances and coal linkages, as well as ancillary

support infrastructure like water supply. It has

also finalised debt financing of the projects

through reputed banks. It is in discussion with

various power traders for tying up long term

power purchase agreements. Sudhir Trehan,

the Managing Director of your Company is the

non-executive Chairman of APIL. Moreover,

two independent Directors of your Company

are being nominated to sit on the APIL Board.

We believe this will be a significant opportunity

for Crompton Greaves to expand its footprint

into the business of power generation.

The second strategic issue relates to India.

Most commentators will agree that it is

eminently possible for the country to achieve

a long term GDP growth of 7.5% per annum

on a sustained basis. Indeed, many believe

that it could be better still. Even at 7.5% CAGR,

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

India will be the second fastest growing large

economy of the world — second only to China.

That makes the country a very attractive place

to expand businesses.

Your Company and the name ‘Crompton

Greaves’ enjoys a great reputation and

considerable franchise throughout India. It is

our strategic intent to leverage this reputation

and bring about quantum leaps in our Indian

businesses. By that I mean all our three key

businesses:

● The power sector — from smart solutions

and services to design, engineering,

equipment supply and erection in power

generation, transmission and distribution.

● The industrial sector — across all our

current plays in motors, alternators, railway

transportation and signalling equipment

— unified by drives, instrumentation, control

panels and end-to-end solutions.

● The consumer business — fans, lighting,

luminaires, pumps and appliances — with a

major focus on leveraging the ever-increasing

potential of up-country and rural markets. We

want our revolutionary, power savings 5 watt

LED lamp ‘Pharox’, which has a luminosity of 40

watts, to create waves in India; just as we want

Crompton Greaves to be the brand of choice in

every area that it operates, not just in India but

throughout the sub-continent.

The third strategic mission is to create a

global mindset for all our businesses. By that I

mean a mindset that creates one-world quality;

shares best practices across all locations and

businesses; recognises that customers want

smart solutions, not just equipment; and

through internal efforts as well as strategic

acquisitions, becomes a global player in

providing best-in-class end-to-end solutions.

This journey has begun in the Power Systems

business with the integration of our newer

service and solutions-based international

acquisitions — Microsol in the UK and Ireland,

MSE in the USA, and Sonomatra in France. It is

also coming into play with Pauwels, Ganz and

the Power Systems business in India working

in close coordination. I am seeing it happen in

Industrial Systems. And with our new products

and offerings in the Consumer business, I am

sure you will see a rapid growth in solution

centric approaches there as well.

Finally, your Company must grow through

its own Intellectual Property. We have made a

beginning here as well and I hope to be able to

come back to you with more substantial details

in the coming years.

This has been yet another excellent year for

your Company. But it is just the beginning.

We have to fuse our excellence in execution

with major strategic plays to become game

changers in all our businesses. Given the

capability of your Company’s management

and all its employees, I have no doubt that we

will get there. Sooner than we think.

Thank you for your support.

Gautam Thapar

Chairman

This has been yet another

excellent year for your

Company. But it is just the

beginning. We have to fuse

our excellence in execution

with major strategic plays

to become game changers

in all our businesses.

C H AIRMAN ' S LETTER

CORPORATE

INFORMATION

Board of Directors

Chairman Managing Direc tor Non-Executive, Independent Chief Financial Officer Company Secre tary Auditors Solicitors G Thapar

SM Trehan

S Bayman

O Goswami

S Labroo

M Pudumjee

SP Talwar

V von Massow

BR Jaju

W Henriques

Sharp & Tannan

Crawford Bayley & Co.

Bankers

Union Bank of India State Bank of India

Corporation Bank

Bank of Maharashtra

Canara Bank IDBI Bank Ltd

ICICI Bank Ltd

ABN Amro Bank NV

Standard Chartered Bank

Calyon Bank

Registered Office 6th Floor, CG House, Dr. Annie Besant

Road, Worli, Mumbai 400 030.

fold out | left to right M Schillebeeckx, VP-CG Power (Americas); DS Patil, CEO-CG Power;

AK Raina, VP-Large & Traction Machines & Stampings; W Henriques, Company Secretary, Legal Counsel

& Global Head- Human Resources; JJ Patel, VP-Global R&D; BR Jaju, CFO; SM Trehan, Managing Director;

M Verma, VP-Lighting & International; M Acharya, VP-Finance & Administration; JG Kulkarni, VP-CG

Power (Asia); F Robberechts, VP-CG Power (Europe, Middle East & Africa); M Kelly, CFO-CG Power.

The story of Crompton Greaves for FY2009

has been of accelerated profitable growth.

We have grown revenues in difficult times,

and profits at even higher rates — thus

creating greater shareholder value.

Gautam Thapar, Chairman (Right) and

Sudhir Trehan, Managing Director (Left)

MANAGEMENT

DISCUSSION

AND ANALYSIS

Overview: Global and

Crompton Greaves

For a global electrical products and solutions

company operating in intensely competitive

markets, it is always creditable to maintain

consistent growth of revenues and profits. To

accelerate growth, improve performance and

deliver even better shareholder value in a year

of extreme financial and business turmoil is

especially remarkable.

The story of Crompton Greaves for FY2009

has been of accelerated profitable growth. We

have grown revenues in difficult times, and

profits at even higher rates — thus creating

greater shareholder value.

On the macro front, FY2009 was a

tumultuous year. The first five months

saw continuing astronomical increases in

all commodity prices including steel and

copper — the key raw materials for Crompton

Greaves Limited (or ‘Crompton Greaves’

or ‘the Company’). Then came the global

financial crisis in September 2008. Conditions

deteriorated rapidly to set-off the worst

recession since the Great Depression of the

1930s. At the time of writing this Management

Discussion and Analysis, the recession and

Rs.1 crore is Rs.10 million.

All figures in US$ for 2007-08 (FY2008) are at US$ 1 = Rs.40.1238;

for FY2009 at US$ 1 = Rs.46.5363.

FY2009 stands for fiscal year 2008-09, i.e. 1 April 2008 to 31

March 2009. Analogously, FY2008.

de-growth continues. India’s growth has

decelerated from 9% in FY2008 to 6.8% in

FY2009 to about the same growth rate in

FY2010. The real volume of world trade is

estimated to shrink by a significant 12% in 2009

as compared to 2008.

In such extraordinarily difficult times,

Crompton Greaves has acquired businesses;

systematically grown consolidated revenues

and profits; and has successfully positioned

itself as an integrated products, systems and

smart solutions provider, across all its key

activities and overseas locations. Instead

of shedding growth, the Company has

accelerated in its quest to be a major global

player in the spaces that it operates. And done

so profitably.

In May 2008, the Company acquired Société

Nouvelle de Maintenance Transformateurs

(Sonomatra), based in northern France at an

approximate value of US$ 2 million. Sonomatra

is engaged in the servicing of power systems

such as providing on-site maintenance,

repairing of power transformers & on-load tap

changers, oil analysis, oil treatment and retrofilling solutions. This acquisition has widened

the Company’s solutions providing capabilities

beyond Belgium, to France.

September 2008 witnessed another

acquisition— that of MSE Power Systems

and its subsidiary in the USA for an enterprise

value of US$ 16 million. MSE Power is actively

engaged in engineering, procurement and

construction (EPC) of high voltage electrical

power transformer systems. This acquisition

will increase the Company's strength as a

systems integrator in the EPC arena, particularly

in renewable energy with a focus on the wind

segment.

Both acquisitions have widened the

Company’s base for accelerating from a

Company supplying products to offering endto-end smart power solutions.

The Board of Directors and the management

of Crompton Greaves have always felt

that power generation in India is, and will

be increasingly, a high growth sector.

Shareholders will recall that, to gain experience

in the business of power generation and

distribution, the Company in 2006, had

acquired a 59% shareholding in the Malanpur

Captive Power Limited — which now

successfully operates a 26 MW gas based

group captive power plant at Malanpur,

Madhya Pradesh.

Viewing power generation as a strategic

opportunity to ensure higher and more

sustainable rates of future growth, the Board

of Directors on 24 March 2009 approved a

strategic investment of up to Rs.227 crore to

purchase 41% of the shares in Avantha Power

and Infrastructure Limited (APIL) at a book

value, estimated at approximately Rs.11 per

share. This investment is well within the limits

12

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

In such extraordinarily

difficult times, Crompton

Greaves has acquired

businesses; systematically

grown consolidated

revenues and profits;

and has successfully

positioned itself as an

integrated products,

systems and smart

solutions provider.

First, since APIL is a group company —the

Board referred the proposal to a Committee

of Independent Directors for evaluation.

The Committee met twice to review all

operational and business details and then

examined a valuation report prepared by

an independent agency. After reviewing

the facts and subjecting the key operational

data to various stress tests, the Committee

unanimously recommended to the Board of

Directors of Crompton Greaves the purchase of

41% of APIL’s shares at a book value, estimated

at approximately Rs.11 per share. Since the

above was a Related Party transaction, the

Audit Committee also reviewed and thereafter

recommended the investment proposal for

consideration by the Company’s Board of

Directors.

● Second, given Crompton Greaves present

reserves and its future cash flows, the

acquisition price of Rs.227 crore was eminently

affordable. Moreover, it will in no way impact

the Company’s ability to acquire other assets —

both in India and elsewhere in the world — in

line with its strategy of becoming an integrated

product, systems and solutions provider.

● Third, with the advent of other outside

investors in the near future, the Company’s

shareholding in APIL will necessarily reduce

— but not below 26%, so as to give Crompton

Greaves a strategic stake in APIL.

●

Plants at Belgium, Ireland, Canada and Hungary are being overhauled

The Power Transformer factory at Mechelen, Belgium

prescribed by Section 372A of the Companies

Act, 1956.

APIL, an Avantha Group company, is

engaged in the generation, transmission

and distribution of electricity. At present,

APIL operates four captive power plants with

an aggregate capacity of 95 MW, which it is

expanding to 165 MW. In addition, it is in the

process of establishing two new independent

power producer (IPP) plants, each with a

capacity to generate 600 MW — at Korba

(near Raigarh in Chhattisgarh) and at Jhabua

(near Seoni in Madhya Pradesh). APIL has

already purchased most of the required land,

obtained requisite environmental clearances

and coal linkages, as well as ancillary support

infrastructure like water supply. It has also

finalised debt financing of the projects through

reputed banks. At the time of Crompton

Greaves considering the investment proposal,

APIL was in discussions with various power

traders for tying up long term power purchase

agreements to significantly de-risk its business.

Given the positives, the Board of Directors of

Crompton Greaves unanimously felt that an

investment in APIL, especially at book value,

would provide the Company an important

entry into the high growth power generation

sector and, simultaneously, increase long

term shareholder value. Three aspects of this

transaction need to be emphasised:

13

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

Accelerating Growth – Consolidated Financial Highlights for FY2009

Net sales and services

EBIDTA

EBIT

ROCE

Rs.8,737 crore

Rs.1,054 crore

Rs.933 crore

36.4%

28%

36%

30%

Net sales and services grew

by 28% — from Rs.6,832 crore

in FY2008 to Rs.8,737 crore

in FY2009. This translates to

a 700 basis points increase

in the growth rate over the

previous fiscal year.

Earnings before interest,

depreciation, taxes, and

amortisation (EBIDTA)

increased by 30% — from

Rs.811 crore in FY2008 to

Rs.1,054 crore in FY2009. Note

that EBIDTA grew faster than

revenue.

Earnings before interest

and taxes (EBIT) rose by

36% from Rs.685 crore in

FY2008 to Rs.933 crore in

FY2009. Consequently, the

ratio of EBIT to net sales

and operating income has

increased by 70 basis points

to 10.7%.

460bps

Return on capital employed

(ROCE) increased to 36.4%

in FY2009 — up by 460 basis

points from FY2008.

NoteS: For FY2009 US$ 1 = Rs.46.5363; for FY2008, it is US$ 1 = Rs.40.1238. Figures for FY2008 have been regrouped wherever necessary in order to make them

comparable with those of FY2009.

Detailed information on the investment in

APIL was provided to the shareholders, by the

Company’s communication dated 2 April 2009.

The Board of Directors of Crompton Greaves

also approved a proposal to buy-back equity

shares of the Company at its meeting held

on 24 March 2009, which was approved

through postal ballot by an overwhelming

majority of shareholders on 20 May 2009. This

buy-back will take place through the open

market mechanism of the stock exchanges.

The proposed maximum price of the buy-back

is Rs.170 per equity share, and the maximum

7

amount to be spent will be Rs.224.15 crore.

The Company will be commencing buy-back

shortly at an appropriate time, provided the

prevailing share price is not above Rs.170 per

equity share. Detailed information on the buyback was provided to the shareholders by the

Company’s postal ballot notice of 2 April 2009.

Even after the investment in APIL and the

buy-back, the Company will have adequate

financial resources to fund its expansion plans

and also actively pursue inorganic growth

opportunities through acquisitions.

The key performance highlights of Crompton

Greaves for FY2009 is given in the above

graphs.

Strategic Business Units

Crompton Greaves has three strategic business

units (SBUs) : (i) Power Systems called CG

Power, (ii) Industrial Systems and (iii) Consumer

Products. Chart A gives the comparative shares

of business of the three SBUs on a consolidated

global basis for FY2008 and FY2009.

CG Power’s net revenues grew by 32% from

Rs.4,667 crore in FY2008 to Rs.6,174 crore in

9 E D I E B ? :7J ; : D ; J H ; L ; D K ; I

E < J > ; I8 Ki

HI$9H EH ;

FEM;H

9EDIKC;H

?D:KIJH?7B

EJ>;HI

122

1,322

109

1,150

1,118

965

6,174

4,667

Unipower PROJECT for Power Transformer design is progressing well

Winding process at the Power Transformer factory at Mechelen, Belgium

(&& .

( &&/

14

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

PBT

PAT

ORDER INTAKE

UEOB

EPS

Rs.867 crore

Rs.560 crore

Rs.9,799 crore

Rs.6,568 crore

RS.15.27

38%

41%

Profit before taxes (PBT) grew

by 41% to Rs.867 crore in

FY2009. Thus PBT increased

faster than EBIT, which grew

faster than EBIDTA, which

grew more than the top line.

20%

Profit after taxes net of

minority interests and share

of associate companies (PAT)

rose by 38% to Rs.560 crore

in FY2009.

FY2009. At the average exchange rate, CG

Power’s top line was US$ 1.33 billion.

Net revenue from Industrial Systems

increased by 19% from Rs.965 crore in FY2008

to Rs.1,150 crore in FY2009.

Net revenue from Consumer Products

rose by 18% from Rs.1,118 crore in FY2008 to

Rs.1,322 crore in FY2009.

Today CG Power accounts for 71% of

Crompton Greaves’ consolidated net revenues;

followed by 15% for Consumer Products; and

13% for Industrial Systems. Chart B shows this.

CG Power: Consolidated

Performance

CG Power includes the consolidated global

transmission and distribution businesses, and is

the largest SBU of Crompton Greaves. This SBU

manufactures power transformers, distribution

transformers, extra high voltage (EHV) and

medium voltage (MV) circuit breakers, gas

insulated switchgear (GIS), EHV instrument

transformers, lightning arrestors, isolators,

vacuum interrupters and electronic energy

meters. Increasingly, it has been moving

into providing smart end-to-end turnkey

solutions for transmission and distribution

(T&D) through customised sub-station projects

and other integrated end-to-end contracts

that encompass solutions, design, products,

procurement and erection.

Given below are the facilities of CG Power in

India and overseas.

The order intake increased by

20% to Rs.9,799 crore.

20%

In India

●

K anjur Marg (Mumbai), Malanpur and

Mandideep (Madhya Pradesh) power and

distribution transformers.

●

38%

The unexecuted order book

(UEOB) as on 31 March 2009

stood at Rs.6,568 crore. This

was up by 20% over the

previous year, and represents

9 months of sales going

forward.

Nasik and Aurangabad

Earnings per share (EPS) was

up 38% to Rs.15.27 in FY2009,

versus Rs.11.10 in FY2008.

● Tapioszele (Hungary) The Ganz plant

manufactures transformers, gas insulated

switchgears (GIS), and engages in contracting

and services. It also manufactures traction

motors (see section on Industrial Systems).

(Maharashtra), Bangalore (K arnatak a)

●

EHV and MV circuit breakers, EHV and MV

instrument transformers, vacuum interrupters,

isolators, lightning arrestors, power quality

products and solutions and electronic energy

meters.

● Gurgaon (Haryana) Engineering Projects

Division (EPD).

Seymour (Connec ticut, USA) and Eagle

Overseas

● Mechelen (Belgium) The biggest plant

of Pauwels. It manufactures custom-made

medium and large power transformers, large

distribution transformers, mobile sub-stations,

and is engaged in contracting.

● Cavan (Ireland) Smaller single-phase

and three-phase distribution transformers and

micro-substations.

● Charleroi (Belgium) The services division

of Pauwels.

● Washington (Missouri, USA) Threephase and pad-mounted transformers, unitised

sub-stations and small power transformers.

● Winnipeg (Canada) Medium and large

power transformers up to 575 MVA, mobile

sub-stations and high voltage direct current

(HVDC) converter transformers.

● Bogor (Indonesia) Power transformers

from 10 MVA to 260 MVA.

Dublin (Ireland), Jarrow (UK),

(Idaho, USA) These Microsol facilities focus

on the manufacture of sub-station and

distribution automation products and systems;

and project delivery and sales management for

Europe, the Middle East and the US markets.

● Nor thern France Sonomatra facilities

for servicing of power systems like providing

on-site maintenance, repairing of power

8

I>7H;E<H;L;DK;E<J>;I8Ki

FEM;H

9EDIKC;H

?D:KIJH?7B

EJ>;HI

71%

13%

(&&.·& /

15%

1%

15

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

MSE has the capability to execute an order-to-commission of a sub-station in 16 weeks

MSE’s sub-station at the Cohocton Wind power project in USA

transformers and offering oil analysis, oil

treatment and retro-filling solutions.

● Albany (USA) Headquarters of MSE. It

operates throughout the USA and other

parts of the world as a key EPC player of high

voltage power transformer systems, especially

in renewable energy, sub-stations, aerial

9

9 E D I E B ? : 7J ; : D ; J I7 B ; I E < 9 = FEM ;H HI$9HEH;

6,174

lines and smart wind-plant information and

communications systems.

The key performance indicators of CG Power

are given in Table 1 below. This includes the

performance of CG Power’s Indian operations,

as well as that of the overseas divisions:

Pauwels, Ganz (excluding rotating motors),

Microsol, Sonomatra and MSE.

CG Power is well placed to leverage a

significant increase in power demand. In

the developed countries, especially Europe

and the USA, there is a growing demand for

creating renewable energy, especially through

solar and wind. With its leadership position in

SLIM® transformers for windmills and its ability

to implement integrated solutions to connect

wind farms to transmission grids via smart sub-

stations, CG Power is well positioned to garner

an increasing share of these businesses.

The short term outlook for distribution

transformers (DT) is not as good as it was in

FY2008, especially in the developed countries.

Acute recession in the USA and Europe has

sharply reduced new housing starts — which is

the key driver for the international DT business.

Utilities too, have been postponing purchases

of DT. Presently, it is difficult to predict the

point of time, when there will be an upsurge

in demand for DT in North America and

Western Europe. Crompton Greaves is carefully

monitoring the scenario and has taken various

mitigating measures — such cost control

and creating flexibility in its plants to produce

any type of DT according to demand. In the

near term, specifically FY2010, this cut-back

4,667

1

Consolida te d fi n a nc ial p erf orma nce o f CG Po w er

Year ended 31 March, in Rs. crore

Net Sales

EBIDTA

EBIT

Capital Employed

ROCE

Unexecuted Order Book

FY2008

4,667

507

437

1,396

31.3%

5,004

FY2009

6,174

713

625

1,533

40.8%

6,163

Growth

32%

41%

43%

10%

9.5% pts

23%

Notes: Microsol was acquired on 28 May 2007. Therefore, the consolidated figures for FY 2008 is including 10 months for

Microsol. The data for FY2009 include financial data for part of the year of MSE and Sonomatra. Figures have been regrouped

wherever necessary to make them comparable.

( &&.

( &&/

16

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

Key Performance Indicators

of CG Power : Consolidated

N et s a l es of CG Power increased from

Rs.4,667 crore in FY2008 to Rs.6,174 crore

in FY2009 — a growth of over 32% during

the year, on the back of a 21% growth in

the previous year.

E BID T A grew by 41% from Rs.507 crore in

FY2008 to Rs.713 crore in FY2009.

E BI T rose by 43% from Rs.437 crore in

FY2008 to Rs.625 crore in FY2009.

R O C E Despite a 10% growth in capital

employed, CG Power’s return on capital

employed grew from 31.3% in FY2008 to

40.8% in FY2009.

u ne x ec u te d o r d e r b ook ( U E O B )

increased by over 23%, from Rs.5,004

crore as on 31 March 2008 to Rs.6,163

crore in FY2009. This represents net sales

of twelve months going forward.

in demand may partly dampen CG Power’s

international growth.

The medium and longer term outlook for

CG Power remains robust. Between 2008 and

2030, world demand for primary energy will

rise from 11.4 billion metric tons to about

17.7 billion metric tons of oil equivalent; and

almost three-quarters of this increase would

be accounted for by India and China. In the

electrical energy space, there will be a steady

increase in global demand for transmission

and distribution equipment and solutions

— both for replacement and, in Asia, for new

projects. Nearer home, the per capita electricity

consumption in India is at 625 kWh, versus

12,200 kWh in the USA and 2,150 kWh in

China. Given that the peak shortage of power

in India stood at over 13% in FY2009, there is

considerable scope for growth in the power

sector — be it in transmission and distribution

2

Creating flexibility to produce any type of Distribution Transformer

A Distribution Transformer production hall at Mechelen, Belgium

equipment as well as in providing end-to-end

solutions. With its synergies of size, scale, scope

and global reach, CG Power is well placed

to exploit these various opportunities and

continue with its double-digit growth in the

future.

CG Power in India: financial

performance

CG Power (India) has performed excellently

in FY2009. Table 2 gives the key performance

indicators for FY2008 and FY2009.

Net sales of CG Power (India) grew by 23%

over last year to reach Rs.2,224 crore. This

translates to a 3-year CAGR of 18%. EBIDTA

increased by 34% to Rs.370 crore. EBIT rose by

35% to Rs.349 crore. Return on year-end capital

employed (ROCE) was at 81.2% — an 18.3 per

cent point jump over last year’s figure of 62.9%.

S tan d - a lone p e r f or m a nce of C G Po we r ( Ind i a )

Year ended 31 March, in Rs. crore

Net Sales

EBIDTA

EBIT

Capital Employed

ROCE

Unexecuted Order Book

FY 2008

1,806

277

258

410

62.9%

1,709

FY2009

2,224

370

349

430

81.2%

2,431

Growth

23%

34%

35%

5%

18.3% pts

42%

The unexecuted order book (UEOB) grew by

42% to Rs.2,431 crore.

CG Power (Overseas): financial

performance

The financial performance of the CG Power

(Overseas) is given in Table 3.

The overseas Power Systems business has

showed a 36% top-line growth in FY2009 to

reach Rs.4,034 crore (US$ 867 million). EBIDTA

increased by 49% to Rs.342 crore (US$ 74

million). EBIT grew by 54% to reach Rs.276 crore

(US$ 59 million). ROCE rose by 7.3 per cent

points to 25%. And the unexecuted order book

(UEOB) as on 31 March 2009 grew by 13% to

Rs.3,732 crore (US$ 802 million) — or over 11

months of sales.

Key Developments in CG Power

Crompton Greaves looks at the CG Power

business as an integrated and seamless whole.

FY2009 saw several significant developments

in CG Power, some of which are outlined

below:

● Pauwels remains global number one for

SLIM® transformers and wind farm installations.

Major long term contracts spanning three to

five years have been received in this area from

17

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

global majors such as Siemens, Enercon and

Multibrid.

● MSE has interconnected over 23% of all

wind power in the USA to the grid. This is a

technologically demanding task — that of

matching the variable frequency of wind

power with the constant frequencies of the

grid. In the process, MSE has proven itself to be

a leader in this business. Today, it can execute

an order-to-commission of a sub-station in

16 weeks. Going forward, MSE will be the key

organisation for smart grids in the USA.

● CG Power was awarded its first contract for a

build-operate sub-station — thus opening the

area of integrating solution with equipment

and service income streams. This is a 2 x 40 MVA

150/33 kV sub-station at Ghlin in Belgium, and

CG Power’s first in offering integrated solutions.

● New turnkey contracts for building

sub-stations won for the first time in Western

Europe: Belgium, Holland and France.

● Developed the first off-shore wind

transformers: 4 MVA, 33 kV-690V BioSlim®.

Trackside transformers for railways application

have been developed at the Company’s power

transformer plant at Mechelen, Belgium.

● The transmission and distribution (T&D)

business of Europe, Middle East and Africa

(EMEA) filed for a European patent to connect

off-shore wind farms to mainland transmission

grids though smart, low maintenance offshore sub-stations. T&D EMEA and Canada are

considered as world leaders in the design and

sales of mobile sub-stations up to 220 kV.

● The services business in EMEA is doing

well, with a solid reputation in key markets. It

can repair transformers of any make and any

vintage. In this, Sonomatra is a big help, by

widening the service footprint to customers in

northern France.

● The Unipower (power transformer

unification) initiative is progressing well.

Through this programme CG Power is on

target to achieve technology leadership in

the transformer business. Power transformer

plants at Kanjur Marg and Mandideep in

India, Belgium, Canada, Indonesia, and Ganz

in Hungary are increasingly operating as a

seamless whole, in matters of technology and

design.

● The plants at Belgium, Ireland and Canada

as well as the Ganz facility in Hungary are being

completely overhauled. The operations of MSE

and Sonomatra have been integrated with CG

Power. Work is progressing rapidly to make all

distribution transformer plants flexible, to deal

with any product mix — similar to the USA

facility at Missouri.

● Ganz has yielded a major success. In March

2009, CG Power was awarded an order to

supply 14 units of 500 MVA, 765 kV autotransformers for the Power Grid Corporation of

India Limited (PGCIL) for a total of Rs.324 crore

— the largest single order for CG Power. Ganz

is producing 11 of these 14 transformers, while

CG Power (India) is building the remaining

three. This order has established Ganz and CG

Power (India) as one of the leading players in

ultra high voltage (UHV) power transformers.

Ganz will become the hub for designing,

technology sharing and producing UHV

transformers — the Company’s future for big

ticket power transformers. Ganz is also capable

of making mobile transformers, and has found

new markets in UK, Congo, Iraq and Libya. Its

gas insulated switchgear (GIS) achieved KEMA

certification for short circuit performance

and switching performance. Ganz has also

produced 220 kV and 145 kV GIS for the Bhilai

Steel Plant (order value of €4.9 million), which

was supplied in June-July 2008, and the

installation was completed in January 2009. It

also supplied a second order to Torrent Power,

Surat (value of €3.5 million), whose installation

was completed in April 2009.

● Microsol’s strengths in automation solutions

and delivery for power utilities has also

delivered results; backed up by strong design

and development capabilities for automation

products. It launched IEC 61850 connectivity

on the XCell automation platform and

executed the first installation in a

sub-station in Qatar. This has secured Microsol’s

position as the supplier of choice by Scottish

Power, with Microsol’s offerings to be used as

Scottish Power’s IEC61850 integration platform

globally and in the UK. Microsol has also

begun to supply protection relays and other

third party products to offer more complete

solutions to customers. This has resulted in

a successful partnership between Microsol

3

and the T&D EMEA business for the delivery of

the automation system for a major project in

Kenya. Integration between Microsol and MSE

has resulted in enlarging the scope for both

companies — with MSE assisting Microsol in

the wind energy sector, and Microsol assisting

MSE in the utility sector. Microsol is also

working closely with EMEA to offer automation

solutions to customers and to assist EMEA

entering into the UK markets. In this, Microsol

with MSE and EMEA have begun to develop

a Smart Grid Identity along with a strategy for

the entire organisation in the smart grid space

— an area that promises explosive growth in

the near future.

● CG Power (India) will be producing three of

the 14 units of 765 kV power transformers for

PGCIL. Its plant at Kanjur Marg has successfully

conducted short circuit testing of 102 MVA,

400 kV single phase generator transformer for

NHPC’s Subansiri Project in Arunachal Pradesh

at KEMA in Holland. The Mandideep plant also

successfully conducted short circuit testing of

25 MVA, 400 kV single phase and 32 MVA, 220 kV

single phase generator transformer for NHPC’s

Uri and Chamera projects at Central Power

Research Institute , Bangalore.

● CG Power (India) also developed a 1200

kV capacitive voltage transformer (CVT) — a

first of its kind in India. It produced a 550 kV

capacitive voltage transformer (CVT) for

Malaysia, which was a first for Crompton

Greaves in India. It also produced 550 kV

current transformer (CT) for Malaysia. CG

Power (India) also developed a 72 kV SF6

circuit breaker through arc assist technology;

the capability was enhanced from 31 kA to 40

kA; the product was successfully tested, and

orders supplied. In addition, it developed 420

kV, 50 kA SF6 Circuit breaker — enhanced its

capability from 40 kA to 50 kA — and secured

an order from a multinational power major for

60 units. CG Power (India) also developed and

successfully type tested 800 kV, 50 kA SF6 gas

circuit breaker.

Per f orma nce of CG Po w e r (Ov e rse as)

Year ended 31 March, in Rs. crore

Net Sales

EBIDTA

EBIT

Capital Employed

ROCE

Unexecuted Order Book

FY 2008

2,960

230

179

1,014

17.7%

3,295

FY2009

4,034

342

276

1,103

25.0%

3,732

Growth

36%

49%

54%

9%

7.3% pts

13%

Note: Year-on-year figures are not strictly comparable, since FY2008 did not have MSE and Sonomatra performance figures.

18

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

CG Power (India) bagged a major order

from Peru to supply 11 units of 200 MVA, single

phase, 500/220 kV (3 x 600 MVA banks with two

spare units) auto transformers valued at US$ 19

million (Rs.92 crore). This order marks CG Power

(India)'s foray in the Latin American market for

500 kV transformers.

● The medium voltage switchgear division

of CG Power (India) launched a new family

of vacuum circuit breakers called ‘Felix’ — a

highly flexible vacuum circuit breaker which

brings in standardisation and improved

electrical performance. The switchgear division

introduced intelligent electronic devices (IED)

for its products and started the manufacture of

electronic relays.

●

Since CG Power is managerially treated at

as a unified entity operating in North America,

Europe, India and South East Asia, the term

‘exports’ has little or no relevance. Even so, it

needs to be stated that CG Power (India) has

achieved an impressive growth in exports

— 68% growth in actual exports in FY2009,

amounting to Rs.1,104 crore; and 46% growth

in export order input, which stood at Rs.1,093

crore. The major markets for transformers and

switchgear supplied by CG Power (India) were

Malaysia, Syria, Qatar and Vietnam in Asia; Chile

and Peru in Latin America; and Nigeria, Kenya

and Namibia in Africa.

●

CG Power is well placed

to leverage a significant

increase in power demand.

In the developed countries,

especially Europe and the

USA, there is a growing

demand for creating

renewable energy,

especially through solar

and wind.

CG OFFERS TOTAL INTEGRATED SOLUTIONS TO CUSTOMERS WORLDWIDE

Pauwels Contracting erecting a wind sub-station at a customer location in Germany

19

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

Industrial Systems

Key Performance Indicators

of Industrial Systems Business

N E T S AL E S increased by 19% over the

previous year to reach Rs.1,150 crore.

E BI T grew by 9% to Rs.213 crore.

R O C E stood at 88.8%.

Crompton Greaves’ Industrial Systems SBU

manufactures the following types of products:

● High tension (HT) motors

● Railway transportation equipment

● Low tension (LT) motors

● Direct current (DC) motors

● AC drives

● Railway signalling equipment

● Fractional horse power (FHP) motors

● Alternators

● Stampings

Its facilities are located at:

● Madhya Pradesh Mandideep (HT motors

and rail transportation equipment) and

Pithampur (railway signalling equipment).

● Maharashtra Kanjur Marg (stampings)

and Ahmednagar (LT motors, alternators, AC

drives and stampings).

● Goa Bardez (LT motors) and Kundaim (FHP

motors).

● Hungary Tapioszele (rotating machines).

Table 4 gives the financial performance of the

Industrial Systems Group over the last two

years.

Industrial Systems’ net sales increased by

19% over the previous year to reach Rs.1,150

crore. EBIT grew by 9% to Rs.213 crore. ROCE

stood at 88.8%.

There have been some growth slowdown

in parts of the Industrial Systems business —

driven by overall reduction in industrial growth

and the deferment of capital outlays by major

clients. This has been the case particularly for

LT Motors. It explains the marginal decline

in the SBU’s unexecuted order book as on

31 March 2009, compared to a year earlier.

Despite this development the Company’s LT

Motors division still occupies the No.1 position

in AC motors; the No.2 position in alternators,

and No.1 position in the growing telecom

segment; and the No.1 position in DC motors.

The LT Motors division has increased its sales

of alternators by over 50% in value and, in the

process, gained 10 per cent points of market

share in numbers.

M7 DIVISION HAS MAINTAINED ITS PROFITABILITY IN ADVERSE CONDITIONS

The Vacuum Pressure Impregnation process plant at M7, Mandideep

20

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

A key feature of FY2009

has been the marked

improvement in the

performance of Ganz’

rotating machines. Gross

sales was up by 75% from

¤8 million in FY2008 to ¤14

million in FY2009.

CG occupies the No.1 position in AC Motors in India

The Automated Winding Machine for AC Motors at LT Motors, Ahmednagar

A key feature of FY2009 has been the marked

improvement in the performance of Ganz

rotating machines. Gross sales was up by 75%

from €8 million in FY2008 to €14 million in

FY2009. Inventory turnover ratio was up from

2.6 to 12.5, leading to substantial improvement

in cash management. Productivity was

improved; cycle times reduced; manpower

costs were brought down from 27.5% of net

sales in FY2008 to 19.3% in FY2009; and debtor

days came down from 74 to 62. The rotating

machines division of Ganz executed major

orders for marquee customers in the cement

industry and the power sector, in Hungary and

abroad.

The M7 Division, which makes HT motors,

rail transportation equipment and railways

signalling equipment, has also performed well

in FY2009. Net sales increased by 26% to Rs.280

4

crore; and the unexecuted order book as on 31

March 2009 was up by 13% to Rs.271 crore.

:

D;JI7B;IE<?D:KIJH?7B

IOIJ;CI8KI?D;II HI$9HEH;

1,150

965

Pe r fo r m ance o f the In d u str i a l S y stem s b us i ness

Year ended 31 March, in Rs. crore

Net Sales

EBIDTA

EBIT

Capital Employed

ROCE

Unexecuted Order Book

FY 2008

965

213

196

162

121.0%

425

FY 2009

1,150

230

213

240

88.8%

403

Growth

19%

8%

9%

48%

-32.2% pts

-5%

(&&.

(&&/

21

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

C0nsumer Products

Key performance indicators of

Consumer Products Business

Crompton Greaves’ Consumer Products

business supplies fans, lighting equipment

(light sources and luminaires), pumps,

integrated security systems, home automation

and a range of electrical household appliances.

The SBU has the following facilities:

● Goa Bethora and Kundaim (fans and

appliances)

● Himachal Pr adesh Baddi (fans)

● Mahar ashtr a Kanjur Marg (luminaires)

and Ahmednagar (pumps)

● Gujar at Vadodara (light sources)

The financial performance of the SBU is given

in Table 5.

Crompton Greaves’ fans and lighting were

accredited with the ‘Superbrand’ status for

FY2009 — the third time in succession for fans,

and the second consecutive time for lighting.

Thus, we can use the ‘Superbrand’ logo for

2009 and 2010.

The domestic market’s growth for fans had

slowed down to 8% in FY2009. However,

our fans grew at 23%, and we are the fastest

growing fans brand of India. The organised

segment accounts for an estimated 33 million

fans. With a 23% market share, Crompton

Greaves is a clear leader in this segment — and

the only fan manufacturer that enjoys the

‘Superbrand’ status. We sold over 5 million

fans in FY2009, a first for any company in India.

Our fans have the widest reach in terms of

retail outlets; and we dominate in the north,

west and south of India. We are progressing

on manufacturing energy saving models and

obtaining Star Ratings in the 4-Star and 5-Star

category.

Crompton Greaves’ market share for lighting,

in India stands at 12%. We are the clear leader

in the higher value sodium vapour segment

— where we have grown at 17% versus an

industry growth of 10%. The growth has

been even more pronounced in street and

high mast lighting, where we have grown at

35% compared to a market growth of 11%.

Crompton Greaves has secured an order for

5

The Consumer Products business — the

second largest SBU of Crompton Greaves

in terms of revenues and the Company’s

most significant cash generator — grew

net sales by 18% to Rs.1,322 crore in

FY2009; EBIT by 21% to Rs.146 crore;

and generated a 123.2 per cent points

increase in ROCE, bringing it up to 260.7%,

which is the highest for the Company as

a whole.

140,000 street lights in Mumbai and Delhi,

valued at Rs.15 crore. This is the single largest

order that any brand has executed in street

lighting. The Company has also supplied the

lighting equipment for the Delhi Metro under

Phase II. The SBU has been awarded an end-toend supply-installation order of Rs.4.4 crore for

street lighting in Pune.

The lighting divisions’ proudest achievement

is to be the first in India to indigenously

produce a highly energy efficient light emitting

diode (LED) lamp. It consumes just 5 watts

of power, has light equivalent of a 40 watt

bulb, and an average life of 50,000 burning

hours. It also has wide voltage compatibility

— from 160V to 280V. Priced at Rs.1,100 for the

consumer, here is the economics: Even if one

were to use the LED for 4.1 hours per day, the

payback period is 2.25 years. Cost savings at 4.1

hours per day equals Rs.330 per year.

The domestic market for pumps was around

Rs.3,700 crore in 2008, and grew at around 6%.

The organised sector accounts for 64% of the

market. Crompton Greaves’ market share is

12%, placing it in the No.3 position. We have

been gaining market share in pumps — our

products grew at 13% versus market growth

of 6%. We are also the clear market leaders

in the domestic (i.e. home) pumps segment,

and enjoy a very strong quality reputation.

We intend to move more aggressively in the

industrial and agricultural pumps segments in

the near future.

Pe r fo r m ance o f the Consu m er P r od u cts b u s iness

Year ended 31 March, in Rs. crore

Net Sales

EBIDTA

EBIT

Capital Employed

ROCE

FY 2008

1,118

128

121

88

137.5%

FY 2009

1,322

153

146

56

260.7%

Growth

18%

20%

21%

-36%

123.2% pts

energy efficient appliances

Wide range of CG home appliances

22

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

The lighting divisions’

proudest achievement is

to be the first in India to

indigenously produce a

highly energy efficient

light emitting diode (LED)

lamp. It consumes just 5

watts of power, has light

equivalent of a 40 watt

bulb, and an average life of

50,000 burning hours.

In the home appliances segment, we are

in small appliances (such as geysers, mixers,

grinders, toasters, electric irons and emergency

lanterns) and home UPS. Today, it is a Rs.70

crore business for the Consumer Products SBU.

We want to grow it to Rs.350 crore in the next

four years by establishing Crompton Greaves

as a reliable brand, and leveraging this through

rapid network expansion.

;

D;JI7B;IE<9EDIKC;HFHE:K9JI

8KI?D;II HI$9HEH;

1,322

1,118

CG’s Consumer Products business outperformed the market growth rate

Mumbai's iconic CST station illuminated with CG's ‘Volumina’ lamps

(&&.

(&&/

23

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

Human Resources (HR)

Crompton Greaves has always viewed HR in

an integrated manner — that of aligning all

facets of its human capital with business and

organisational transformation. Hence, HR

plays the role of a strategic influencer of the

Company’s various businesses.

An important reason for the success of HR

in Crompton Greaves, has been the formal

integration of business leadership in deciding

the HR initiatives. This has been achieved

through an HR Council consisting of business

heads and corporate HR. Having experienced

the benefits of this model, FY2009 saw a Global

HR Council being formed — consisting of the

business heads of each of foreign locations and

corporate HR from Crompton Greaves, India.

India has been chosen as the hub for its Global

HR initiatives.

During FY2009, the HR structure and

processes were re-modelled to encourage

even greater participation of the employees

in shaping both business and HR priorities. A

quarterly HR Summit programme has been

initiated, which involves participation of the

business leadership as well as HR professionals.

Through these Summits, several HR themes

have evolved, which have then become the

drivers for initiatives during the year. This

process has resulted in creating sharper

metrics and more focused action plans. In the

course of FY2009, the different HR Summits led

to formulating strategies to achieve a higher

platform for recruitment, retention, talent

management, career progression, succession

planning, leadership development, rewards

and incentives and welfare of employees. One

of the major outcomes of the HR Summits

was the creation of an integrated Talent

Management Model at all levels, with a thrust

on executive development.

FY2009 also saw the creation of a formal

HR coalition at the global level between

the Company in India and all the foreign

companies under the Crompton Greaves

fold. A Global HR Conclave was held, where

HR professionals across all group companies,

worldwide, shared their best practices. Based

on this, common frameworks have been

created. Simultaneously, themes and action

plans have been designed in performance

management systems, training and

development, talent management, diversity,

corporate social responsibility, employee

engagement and corporate branding for

the entire group. To foster better global

integration, a Global Deputation and Mobility

Policy has been put in place, which has led to

cross-border movements of many executives

within the group.

At the leadership level, the HR focus has

been to create a global mindset among

the Company’s senior management. This

pursuit has already shown results, in creating

fundamentally new initiatives of providing

end-to-end solutions for customers, in One

World Quality, in operational excellence,

and in exploring new growth areas and

diversification.

In addition to all these, a focus of HR is to

consistently raise productivity through the

implementation of the Crompton Greaves

Production System (CGPS). Having achieved

133% of work content/CGPS norms at all

its manufacturing units across India, the

Company’s emphasis has been to further

increase productivity abroad. We have

succeeded implementing CGPS at Indonesia,

Hungary (rotating machines plant) and at

Canada. To further increase labour productivity

and reduce work content, Crompton Greaves

has initiated ‘Breakthrough Engineering

Improvement Projects’ to achieve an additional

20% improvement in overall productivity

at the workstations, and a minimum 2%

improvement at unit or the Company level.

Pressing this point yet further, an initiative

has been launched called the ‘Accelerated

Improvement Projects (AIP), which can lead to

at least a 40% improvement in productivity in

specific projects. At present, the AIP initiative

covers over 100 such projects.

The Company has successfully aligned

its performance appraisal outcomes with

a market benchmarking mechanism to set

the remuneration of all executives. The goal

setting process was revisited and strengthened

to achieving more robust performance

objectives. Meritocracy and differentiation,

based on consistency of performance and

future potential, continue to be the guiding

force for deciding remuneration. The

variable pay scheme for the leadership level

management is based on Economic Value

Added (EVA), with a difference. It is linked with

competitor performance — where businesses

have to perform better than their competitors

to get access to a larger EVA-based variable

pay pool.

As with companies elsewhere, talent

retention is a challenge. Crompton Greaves’

Having achieved 133% of

work content/CGPS norms

at all its manufacturing

units across India, the

Company’s emphasis has

been to further increase

productivity abroad.

We have succeeded

implementing CGPS at

Indonesia, Hungary

(rotating machines plant)

and at Canada.

Creating cross-cultural bonding and strengthenING common values

Celebrating CG World Day at Pauwels, Indonesia

24

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

The variable pay scheme

for the leadership level

management based on

Economic Value Added

(EVA), with a difference. It

is linked with competitor

performance — where

businesses have to

perform better than their

competitors to get access

to a larger EVA-based

variable pay pool.

CG is strengthening the talent pipeline at the managerial levels

Business Leadership Programme conducted at the CGMDC, Mulshi

efforts in this area include mentoring,

coaching, providing challenging projects,

creating cross-functional teams, giving

primacy to professionalism, and fostering

a culture of openness that encourages

the freedom to innovate with minimum

hierarchical intervention. We believe that with

our continuous improvement of processes and

benchmarking with leading global practices,

our talent pipeline will not be a cause for

concern.

Towards long term leadership development,

Crompton Greaves has started its Global

Leadership Programme (GLP) for executives

at the level of unit heads. It has also relaunched its Business Leadership Program

(BLP) to strengthen the talent pipeline at

the managerial levels. Both programmes

have best-in-class content, and are delivered

by specially chosen faculty from the best

management schools abroad and in India.

Employee engagement is a key metric for

the Company’s HR initiatives. This is achieved

through a variety of mechanisms, such as

‘open houses’ with senior management and

the performance management system. During

FY2009, Crompton Greaves’ senior leadership

volunteered and participated in a 360-degree

feedback programme.

CGHR4U, the Company’s HR portal, continues

to grow in strength and has truly become an

HR Life Cycle Management System. Existing

modules are being further strengthened

for content and user-friendliness, and new

modules added. The CGHR4U systems were

validated by two phased audits to further

strengthen internal controls, processes and

procedures.

Training and development continues to

receive serious attention. A corporate training

calendar ensures regular programmes at the

units, as well as at the Company’s top class

Management Development Centre at Mulshi,

near Pune. These actions are supplemented

by sponsoring high performing–high

potential executives for training at reputed

management and engineering institutes in

India and abroad.

As a regular practice, Crompton Greaves

visits various reputed engineering colleges for

campus recruitments. We continue to be one

of the most favoured engineering companies ,

and recruited over 130 engineering graduates

on-campus during the year.

We have successfully concluded seven wage

settlements during FY2009 — these being

carried out in a multi-trade union environment.

The settlements have resulted in the higher

productivity, contact time and plant utilisation.

We celebrated the Crompton Greaves World

Day on 15 October 2008. This was meant to

rejoice at our creating cross-cultural bonding

and to strengthen common values and beliefs

among our various locations. Hereafter, 15

October will be celebrated as the CG World

Day across all locations worldwide.

25

m a n a g e m e n t d i s c u s s i o n a n d a n a ly s i s

Corporate Social

Responsibility (CSR)

Crompton Greaves commitment to CSR

grows with every passing year. During FY2009,

considerable strides were made in community

development by way of infrastructure, health,

education and upgrading of facilities; in

HIV/AIDS awareness; in affirmative action; and

in industry-academia interface.

To ensure a buy-in to CSR at the highest

level, Crompton Greaves has a CSR Council

comprising all business heads. This Council

meets once a quarter with the corporate CSR

Team to create new initiatives and review the

progress of CSR across the various projects.

The areas emphasised by the Council for

FY2009 have been: (i) raising the health and

safety bar for the employees, (ii) community

development efforts, (iii) upgrading facilities

in neighbouring villages, (iv) improving the

industry-academia interface, (v) nurturing

volunteerism, and (vi) committing firm

resources for CSR activities. Corporate HR

facilitates the Company’s CSR focus by assisting

all the 22 locations in India to achieve the

objectives established by the CSR Council.

Environment

Our manufacturing processes are reviewed

for their social and environmental impact,

especially in areas such as energy savings,

waste reduction, re-cycling and minimising

pollution.

All manufacturing divisions of the Company

in India have demonstrated their commitment

to the environment by being awarded

international accreditations — both ISO

14001 and OHSAS 18001. These certifications

enhance adherence levels, achieve higher

environmental standards and craft a path

towards creating a pollution free and healthy

environment at our workplaces.

Many of the Company’s locations have

established bio-gas plants and vermiculture

facilities for efficient conversion of all bio-waste

into compost. They have also been converting

waste water for better utilisation, and have

invested in rainwater harvesting.

This year, as earlier, employees across the

Company came together to demonstrate

their environment commitment on World

Environment Day (5 June 2008). Many activities

were undertaken at each divisions such as

substantial increase in tree planting, screening

of videos that create greater environmental

As in previous years, 1 October, was

dedicated as the Blood Donation Day.

Concerted efforts are made by all employees

to donate blood across all locations. This

movement has been gaining impetus year-onyear. This time around, we witnessed many of

the Company’s CSR community beneficiaries,

visitors and employees from neighbouring

industries also donating blood.

Many of the Company’s

locations have established

bio-gas plants and

vermiculture facilities for

efficient conversion of all

bio-waste into compost.

They have also been

converting waste water

for better utilisation, and

have invested in rainwater

harvesting.

Community Projects

All the Company’s divisions continue to

intensify their CSR efforts in identified

communities, through projects decided

according to various Needs Surveys. Some of

these projects are highlighted below:

consciousness, and having several events with

environment as the key theme.

HIV / AIDS

Our pledge to creating greater HIV/AIDS

awareness continues. In FY2009, we extended

our coverage of the HIV/AIDS awareness

programmes to members of Crompton

Greaves’ supply chain — clearing and

forwarding agents, truck drivers, suppliers,

vendors and communities in the vicinity of our

plants. This initiative has received a positive

response: some 4,000 people were covered

during the year.

●

Switchgear Complex at Ambad, Nasik

(Maharashtra) Upgrading the village of

Nandurvaidya. Continuing project. This has

involved renovating the primary and middle

school, creating a well-equipped library for the

village children, upgrading the village public

health centre, and building additional toilets

and sanitation throughout the entire village.

Several women’s self help groups have been set

up to gain additional income by making papad,

pickles, candles and stuffed toys — with the

Company’s premises being offered to sell their

products.

●

M7 division at Mandideep, near Bhopal

(Madhya Pradesh) Adopted the Ratanpur

CG is committed to the cause of environment

CG employees planting trees on World Environment Day

26

c r o m p t o n g r e av e s l i m i t e d a nn u a l r e p o r t 2 0 0 8 – 2 0 0 9

village over the last few years. Ratanpur, like

most villages in the interior of India, earlier

suffered from long and frequent power cuts.

This year, based on the village’s needs, the

division set up LED solar street-lighting; and

provided the village school children with light

based on solar power for their studies.

● M4 division (Goa) The village of Kunkoliem

in the vicinity of the division suffered from the

lack of a health centre and paucity of a nearby

pharmacy — forcing the villagers to trudge

almost six kilometres to the nearest medical

service. In FY2009, the division built a public

health centre for the village and its surrounding

areas; and has made arrangements for a doctor

to visit once a week. In addition, the division

has donated computers to the local school.

●

S6 division at Aur angabad

(Mahar ashtr a) In a collaboration with the

Indian Army, the division has converted a

large stretch of barren land into a green belt

including arrangements for water harvesting

together with a bore well and pump.

●

LT Motors division at Ahmednagar

(Mahar ashtr a) The entire village of

Hingangaon has been provided toilets, which

has helped minimise a water-borne, mosquito

carrying vector disease called chikungunia. The

village also now has full-fledged drinking water

facilities.

● Nor thern Region office Has

collaborated with an NGO running a hospital in

Sunder Nagri, East Delhi, and in establishing a

multi-media institute, where computer classes

are conducted for the local youth at very

nominal fees.

There are many more such initiatives: Kanjur

village (by our Kanjur complex at Mumbai),

Gurari village (by T3 division at Mandideep),

Nimgaon village (by the M6 division at

Ahmednagar), Shevta village (by the S6 division

at Aurangabad), Kasarwara village (by the fans

division at Goa), and Chitral and Gametha

villages (by the lighting division at Baroda).

Whenever a village or a community is

adopted, we focus on educational facilities,

and have contributed to rebuilding village

schools, upgrading educational facilities and

supporting better teachers and teaching aids.

We also sponsor coaching classes, personality

development classes, libraries, self-help

groups and computer literacy — all aimed

at raising overall education standards and

creating employability. Equal emphasis is

given to establishing medical facilities, setting

up or upgrading public health centres, and

making essential medicines available to the

villages and their surrounding areas. These are

supplemented by regular health camps and

eye camps. The third thrust area is improving

Our pledge to creating

greater HIV/AIDS

awareness continues. In

FY2009, we extended our

coverage of the HIV/AIDS

awareness programmes

to members of Crompton

Greaves’ supply chain

— clearing and forwarding

agents, truck drivers,

suppliers, vendors and

communities in the

vicinity of our plants.

living conditions: drainage, sanitation,

electricity, street lighting and toilet facilities.

Affirmative Action (AA)

In November, 2006, Crompton Greaves

became a signatory to the Confederation of

Indian Industry’s Code on Affirmative Action,

thus declaring its public commitment to

promote the cause of Affirmative Action (AA).

Our AA initiatives during FY2009 have been as

follows:

●

Working with colleges and

universities in Nasik and Bhopal, in the

areas of classroom training, study missions,

developing course curriculum and relevant

industrial exposure.

●

Sponsoring coaching classes for the