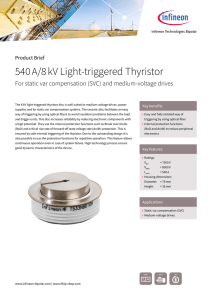

Systematic integration

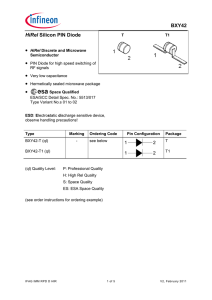

advertisement