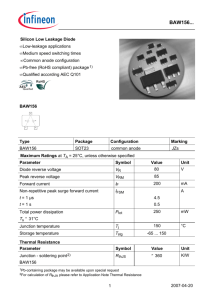

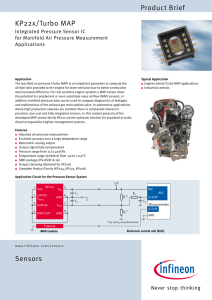

Systematic integration

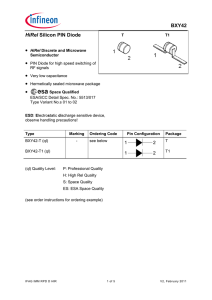

advertisement