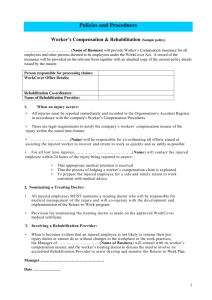

Workers` Compensation and Rehabilitation Act 2003

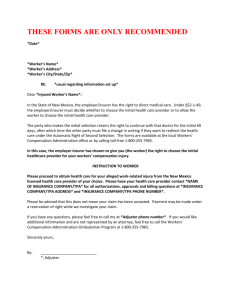

advertisement