www.pwc.ie

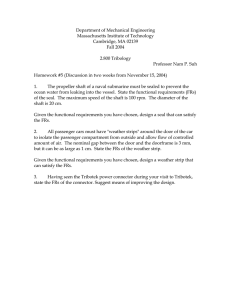

FRS 102 time to

transition?

Certain exemptions available as part of FRS 102

represent a genuine easing of the burden

associated with the FRS 102 transition,

writes PwC’s Fiona Hackett.

ACCOUNTANCY

IRELAND

JUNE 2015

VOL.47 NO.3

Practising accountants don’t often feel

that accounting standard setters are

working to make their jobs easier.

However, some of the optional

exemptions from full retrospective

application of FRS 102 do represent a

genuine easing of the burden associated

with the transition to FRS 102.

They also represent practical

expedients in the challenge of

adopting FRS 102 for the first time.

Section 35

Section 35 of FRS 102, entitled

‘Transition to this FRS’, sets out the

procedures that apply to all entities

when presenting their first annual

financial statements that comply

with FRS 102.

It also identifies the disclosures that

must be included in the first set of

FRS 102 financial statements in

order to explain how the transition

from old Irish GAAP to FRS 102

affected the entity’s previouslyreported profit and loss account

and balance sheet.

Date of transition

FRS 102 requires a first-time

adopter to apply its requirements

to the balance sheet at the date of

transition. The date of transition is

the first day of the earliest

comparative year presented in the

first financial statements prepared

under FRS 102. For a 31 December

year-end the date of transition for

most companies is 1 January 2014.

Optional exemptions

Section 35 of FRS 102 lists a

number of optional exemptions

that an entity may use in preparing

its first FRS 102 financial

statements.

that arise when an entity adopts an

accounting policy of measuring

PPE at valuation. This option can

be applied to individual items of

PPE and, if used, does not have to

be applied to all items of PPE.

Any, all, or none of these options

may be taken. Below are some of

the more attractive options

available.

An entity could therefore cherrypick particular assets to measure at

valuation on transition to FRS 102

and – hopefully – book a one-off

revaluation gain.

General principle

The general principle of FRS 102 is

that the balance sheet at the date of

transition is prepared as though

FRS 102 has always applied i.e.

retrospective application of FRS

102's requirements.

Valuation as deemed cost

Section 35 of FRS 102 contains

exemptions that allow first time

adopters to treat the:

Of course, items of PPE may not be

stated at an amount in excess of

their recoverable amount.

The impact of adopting FRS 102 is

recognised as an adjustment to

retained earnings – or, if

appropriate, another category of

equity – at 1st January 2014.

Section 35 does, however, contain

some mandatory exceptions to the

general principle and some

optional exemptions to make the

transition easier.

Mandatory exceptions

Section 35 of FRS 102 contains

four exceptions to retrospective

application of FRS 102, which must

be applied by all first-time

adopters. The exceptions are:

Accounting estimates made in

previous financial statements

are not revisited. However, any

material errors identified in

previous financial statements

are corrected;

Discontinued operations in the

prior year are not revisited;

Non-controlling interests

(minority interests) are not remeasured; and

Financial assets and financial

liabilities that have been

derecognised are not reinstated.

PwC

Fair value of certain assets as

their deemed cost; and/or

Latest revaluation of certain

assets as their deemed cost.

Fair value as deemed cost

On transition to FRS 102, entities

have the one-time option of

measuring and recognising

property, plant and equipment

(PPE) at fair value at the date of

transition. That fair value then

becomes the asset’s deemed cost,

which in subsequent financial years

is depreciated, re-measured at fair

value, or impaired.

This is essentially a one-time free

pass to use a valuation basis for

PPE, which doesn’t lock the entity

into the ongoing expense and

volatility of regular PPE valuations

Revaluation as deemed cost

Section 35 permits an entity which,

under old Irish GAAP, revalued its

PPE to use the most recent PPE

valuation as the deemed cost of those

assets on transition to FRS 102.

The revalued amount – adjusted if

necessary for depreciation between

the valuation date and the date of

transition to FRS 102 – becomes

the deemed cost of those assets at

the date of transition and is then

depreciated over the remaining

useful economic lives of the assets.

This option essentially represents

an opportunity for entities to move

away from an accounting policy of

measuring their PPE at valuation

and to adopt a simpler cost model

of accounting for PPE under

FRS 102 going forward.

"It is common for Irish entities to

use derivatives, such as forward

foreign currency contracts, to

hedge exposure to foreign currency

fluctuations as part of a financial

risk management programme."

Page 2

Hedge accounting

The most significant impact of

adopting FRS 102 for a number of

Irish entities will be the mandatory

recognition of the fair value of

derivative financial instruments on

their balance sheets.

As a small open economy with

important trading links to the UK and

USA, many Irish entities are exposed

to foreign currency risk arising from

their sales and purchases.

It is therefore common for Irish

entities to use derivatives, such as

forward foreign currency contracts,

to hedge their exposure to foreign

currency fluctuations as part of a

financial risk management

programme.

Section 12 of FRS 102, entitled

‘Other Financial Instruments

Issues’, addresses accounting for

derivatives such as forward foreign

currency contracts.

The general principle of Section 12 is

that derivatives are recognised at fair

value with changes in fair value

recognised in Profit & Loss (P&L),

leading to P&L volatility. Section 12

does allow the use of cash flow hedge

accounting, however, which reduces

P&L volatility by matching the period

in which any gain or loss on the

derivative is recognised in P&L with

the period in which the hedged gain

or loss is recognised in P&L.

Applying cash flow hedge

accounting means that, when a

derivative satisfies the conditions

of a designated hedging relationship and the hedge is considered

effective, any fair value gain or loss

on the derivative is recognised in

other comprehensive income –

similar to the STRGL under old

Irish GAAP – and accumulated in a

cash flow hedging reserve in equity.

When the hedged transaction

occurs, such as a forecast US Dollar

sale, the gain or loss on the

derivative that has been

accumulated in the cash flow hedge

reserve is reclassified from that

reserve to P&L.

PwC

Cash flow hedge accounting for fair

value gains and losses on

derivatives can only begin from the

date when a derivative qualifies as

part of a designated hedging

relationship.

A designated hedging relationship

requires specific documentation

and:

a. Consists of a hedging item, such

as a forward foreign currency

contract to sell US dollar and

buy euro, and a hedged item,

such as a highly probable

forecast US dollar sale and cash

inflow;

b. Is consistent with the entity’s

risk management objective for

undertaking hedges;

c. Has an economic relationship

between the hedged item and

hedging instrument. For

example, a contract to sell US

dollar and forecast US dollar

sale and cash inflow;

d. Is documented with the risk

being hedged (e.g. foreign

currency risk), the hedged item

(highly probable forecast US

dollar sale and cash inflow), and

the hedging instrument (e.g.

forward foreign currency

contract) clearly identified; and

e. Causes of hedge ineffectiveness

determined and documented.

For example, a difference

between the maturity of the

forward foreign currency

contract and the expected date

of receipt of the US dollar cash.

are met no later than the date the

first FRS 102 financial statements

are authorised for issue.

Section 35's exemption in relation

to hedge accounting

documentation is a welcome relief

for first-time adopters of FRS 102

who wish to use cash flow hedge

accounting in their first FRS 102

financial statements.

Business combinations

Accounting for business

combinations is an area of

difference between old Irish GAAP

and FRS 102.

Acquisitive entities adopting

FRS 102 for the first time will be

relieved that they can elect not to

apply Section 19 entitled ‘Business

Combinations & Goodwill’ to

business combinations effected

before the date of transition to

FRS 102.

The practical benefit of this

exemption is that first-time

adopters do not have to carry out

an exercise to separately identify

and value intangible assets, such as

customer lists, acquired in business

combinations completed prior to

the date of transition.

Such intangible assets are likely to

have been subsumed in the

goodwill recognised on acquisitions

under old Irish GAAP.

Entities transitioning to FRS 102 in

2015 that would like to apply cash

flow hedge accounting to

derivatives that existed at the date

of transition, or have been entered

into since, may not have

documented a designated cash flow

hedging relationship for those

derivatives.

The FRS 102 exemption allows the

entity to retain the carrying value

of old Irish GAAP goodwill on

transition to FRS 102. Availing of

this exemption could provide a cost

saving for acquisitive entities

transitioning to FRS 102, as

external professional advice is

often needed to determine the

values of intangible assets acquired

in a business combination.

However, Section 35 offers relief

from the documentation

requirements when applying FRS

102 for the first time by allowing

entities to apply cash flow hedge

accounting if conditions A, B and C

above exist and conditions D and E

It also simplifies the subsequent

accounting under FRS 102, as no

adjustment is made to the carrying

amount of goodwill at the date of

transition and this goodwill

balance is amortised over its

remaining useful life.

Page 3

Deferred development

expenditure

FRS 102 provides an accounting

policy option to recognise an

intangible asset from the

development phase of a project –

once the recognition criteria are

satisfied – or to recognise costs

incurred on development activities

as an immediate expense in P&L.

Entities that previously adopted a

policy of capitalising development

expenditure (under SSAP 13) could

opt to change that policy on

adoption of FRS 102 and begin

recognising costs incurred on

development activities as an

immediate expense, and vice versa.

Borrowing costs

As with deferred development

expenditure, FRS 102 provides an

accounting policy option to

capitalise borrowing costs that are

directly attributable to the

acquisition, construction, or

production of a qualifying asset as

part of the cost of that asset, or to

recognise all borrowing costs as an

immediate expense in P&L.

Entities can opt to change that

policy on adoption of FRS 102. For

example, entities that previously

expensed such borrowing costs can

adopt a policy of capitalising them.

FRS 102 also allows entities the

option to commence capitalisation

of borrowing costs from the date of

transition to FRS 102.

However, where the entity is a

small company – as set out in

Company Law – an increase in

asset values might result in the

company no longer being

considered a small company and

thereby unable to avail of the reliefs

available to small companies in

Company Law.

Opt in or out?

The attractiveness for each entity,

or otherwise, of each optional

exemption needs to be carefully

considered.

In this case, the cost of availing of

the exemption while losing

Company Law reliefs available to

small companies might outweigh

the benefit of an improved balance

sheet that arises from the

exemption.

The costs and benefits may not be

immediately apparent. For

example, on the surface the

‘Valuation as Deemed Cost’

exemptions seem like a quick and

easy win for entities looking to

bolster their balance sheets by

increasing their asset base.

An increased asset base may

enhance an entity’s chances of

obtaining financing, as it

demonstrates the value of potential

security to a bank.

In summary, careful consideration

of the options available in Section

35 is a key element of the transition

to FRS 102.

Fiona Hackett ACA

is a Senior Manager

at PwC.

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

© 2016 PricewaterhouseCoopers. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a

separate legal entity. Please see www.pwc.com/structure for further details.