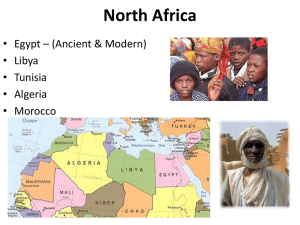

The AfDB Group in North Africa 2011

advertisement