FOC: necessary first–order condition SOC - Hu

advertisement

E LMAR G. W OLFSTETTER , M AY 22, 2014

A DVANCED M ICROECONOMICS (T UTORIAL )

E XERCISE S HEET 1 - A NSWERS AND H INTS

We appreciate any comments and suggestions

that may help to improve these solution sets.

Abbreviations:

FOC: necessary first–order condition

SOC: sufficient second–order condition

for local extreme values (maximum/minimum)

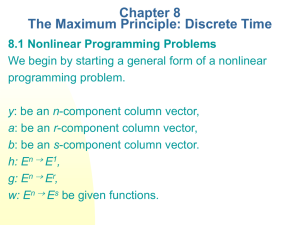

Exercise 1 (Nonlinear Programming: Kuhn-Tucker Conditions).

How to solve Kuhn-Tucker problems with non–negativity constraint (i.e. the choice variables xi

cannot be negative):

First, transform the problem into the following form:

max π = f (x1 , x2 , ..., xn )

subject to gi (x1 , x2 , ..., xn ) ≤ ri ,

x j ≥ 0,

i ∈ {1, 2, ..., m}

j ∈ {1, 2, ..., n}

Second, write out the Lagrangian function:

m

L = f (x1 , x2 , ..., xn ) + ∑ λi (ri − gi (x1 , x2 , ..., xn ))

i=1

Third, write out the Kuhn-Tucker Conditions (First–order necessary conditions for maximization

problems with inequality constraints and nonnegative choice variables):

∂L

∂L

≤ 0, x j ≥ 0, and x j

= 0,

∂xj

∂xj

∂L

∂L

≥ 0, λi ≥ 0, and λi

= 0,

∂ λi

∂ λi

j ∈ {1, 2, ..., n}

i ∈ {1, 2, ..., m}

1. min x12 + x22 , s.t. x1 + x2 ≥ 2, x12 − 2 ≤ − 21 , x1 ≥ 0, x2 ≥ 0.

x1 ,x2

Solution:

Step 1: Transform the problem into a maximization problem: max −x12 − x22 , s.t. −x1 − x2 ≤

x1 ,x2

−2, x12 ≤ 32 , x1 ≥ 0, x2 ≥ 0.

Step 2: Write out the Lagrangian function:

3

L = −x12 − x22 + λ1 (−2 + x1 + x2 ) + λ2 ( − x12 )

2

1

Step 3: Write out the Kuhn-Tucker conditions

∂L

∂ x1

∂L

∂ x2

∂L

∂ λ1

∂L

∂ λ2

= −2x1 + λ1 − 2x1 λ2 ≤ 0,

x1 ≥ 0, and x1

∂L

=0

∂ x1

[1]

∂L

= 0 [2]

∂ x2

∂L

= −2 + x1 + x2 ≥ 0, λ1 ≥ 0, and λ1

= 0, [3]

∂ λ1

3

∂L

= − x12 ≥ 0, λ2 ≥ 0, and λ2

= 0, [4]

2

∂ λ2

= −2x2 + λ1 ≤ 0,

x2 ≥ 0, and x2

Step 4: Make assumptions with respect to multipliers or choice variables, drop some of the

constraints, and find out whether there are solutions satisfying all the conditions.

(a) Case 1: Suppose x1 = 0, x2 = 0.

[3]: −2 ≥ 0 (discard Case 1)

(b) Case 2: Suppose x1 = 0, x2 > 0.

[1]: λ1 ≤ 0 ⇒ λ1 = 0 ⇒ [2] : −2x2 = 0 ⇒ x2 = 0

(contradicts x2 > 0).

(c) Case 3: Suppose x1 > 0, x2 = 0.

p

[3]: x1 ≥ 2 contradicts [4]: x1 ≤ 3/2 ≈ 1.22.

(d) Case 4: Suppose x1 > 0, x2 > 0.

[2]: x2 = λ21 ⇒ λ1 > 0 ⇒ [3] : x1 + x2 = 2

Suppose λ2 > 0.

p

p

p

Then [4]: x1 = 3/2 ⇒ [3] : x2 = 2 − 3/2 ⇒ λ1 = 4 − 2 3/2.

p

p

p

Then [1]: (−2 3/2) + (4 − 2 3/2) − 2( 3/2)λ2 ⇒ λ2 < 0 (contradicts λ2 > 0).

Therefore, λ2 = 0 ⇒ [1] : x1 = λ21 . With [2]: x1 = x2 (see above).

⇒ x1 = 1, x2 = 1.

You are recommended to draw the constraints into a diagram (as below). You can

see that by drawing the first three constraints, the fourth constraint (x2 ≥ 0) is already

satisfied. Therefore, the second line of the Kuhn-Tucker conditions can be simplified to

∂L

∂ x2 = 0.

2

2. max U(x, y) = xy s.t. x + y ≤ 100, x ≤ 40 and x, y ≥ 0

x,y

Solution: x = 40, y = 60. Explanation in: A.C. Chiang “Fundamental Methods of Mathematical Economics”, 4th ed., p.406-408

3. max(1 − x)(x − 2) s.t. 1 − x2 ≥ 0

Hint: Observe that this and the following two exercises do not have a non–negativity

constraint (x can be negative!). Therefore, the derivatives of the Langrangian with respect to

x are set equal to zero.

Set up the Lagrangian function and the Kuhn–Tucker conditions:

L = (1 − x)(x − 2) + λ (1 − x2 )

Lx = 3 − 2x − 2xλ = 0

Lλ = 1 − x2 ≥ 0,

[1]

λ ≥ 0,

Lλ λ = 0

[2]

Test λ > 0: [2] ⇒ 1 − x2 = 0 ⇐⇒ x = 1 or x = −1.

If x = 1: [1] ⇒ λ = 12 > 0 (Both conditions [1] and [2] are fulfilled. x = 1 is a candidate

solution.)

If x = −1: [1] ⇒ λ = − 52 (contradiction to λ > 0)

Test λ = 0: [1] ⇒ x = 32 ⇒ x2 = 94 > 1 (violates the constraint)

Solution: x = 1;

4. min ex s.t. 1 − x2 ≥ 0

Hint: There is no non–negativity constraint; transform the problem to max −ex s.t. x2 ≤ 1

L = −ex + λ (1 − x2 )

Lx = −ex − 2λ x = 0

2

Lλ = 1 − x ≥ 0,

[1]

λ ≥ 0,

Test λ = 0: [1] ⇒ −ex = 0 (has no solution)

Test λ > 0: [2] ⇒ x = 1 or x = −1.

3

Lλ λ = 0

[2]

If x = 1: [1] ⇒ λ < 0 (contradiction), if x = −1: [1] ⇒ λ > 0

Solution: x = −1;

5. max(1 − x2 ) s.t. (x − 1)(x − 2) ≤ 0

Transform the constraint into the usual form and then set up the Lagrangian function.

L = 1 − x2 + λ (−x2 + 3x − 2)

Lx = −2x − 2λ x + 3λ = 0

Lλ = −x2 + 3x − 2 ≥ 0,

λ ≥ 0,

Lλ λ = 0

Solution: x=1.

Exercise 2 (Cournot point).

1. Find the Cournot point.

Obviously, quantities above 13 cannot be optimal. The price is zero and the costs are positive,

this would obviously be dominated by x = 0. We therefore restrict our search to 0 ≤ x ≤ 13.

max Π(x) = xP(x) −C(x)

x

= x(13 − x) − 3x = 10x − x2

∂ 2 Π(x)

= −2 < 0 ⇒ Profit strictly concave

∂ x2

Since P(0) −C0 (0) > 0, we have an interior solution, given by equality between marginal

revenue and marginal cost, R0 (x) = C0 (x). (Or by solving dΠ(x)/dx = 0 for x.)

⇔

xM = 5 ,

P(xM ) = pM = 8

Alternatively, one can solve the maximization problem by using Kuhn–Tucker conditions:

max Π(x) = xP(x) −C(x) = 10x − x2

x

subject to

0 ≤ x ≤ 13

Set up the Lagrangian:

L(x, λ ) = 10x − x2 + λ (13 − x)

The Kuhn-Tucker Conditions are

∂ L(x, λ )

= 10 − 2x − λ ≤ 0;

∂x

∂ L(x, λ )

= 13 − x ≥ 0;

∂λ

x ≥ 0;

λ ≥ 0;

Solving the Kuhn–Tucker conditions, one has xM = 5.

4

∂ L(x, λ )

= 0;

∂x

∂ L(x, λ )

λ

= 0;

∂λ

x

Alternative, but equivalent solution procedure: using price as the choice variable and consider

0 ≤ p ≤ 13.

max Π(p) = X(p)p −C(X(p))

p

= (13 − p)p − 3(13 − p) = (13 − p)(p − 3)

∂ 2 Π(p)

= −2 < 0 ⇒ Profit strictly concave

∂ p2

Kuhn-Tucker Conditions:

∂ Π(p)

∂ Π(p)

= −(p − 3) + (13 − p) ≤ 0;

p

= 0;

∂p

∂p

pM = 8 ,

⇔

p≥0

X(pM ) = xM = 5

The constraint p ≤ 13 is also satisfied.

2. Maximum Profit

Π(xM , pM ) = xM pM −C(xM ) = 5 · 8 − 3 · 5 = 25

3. Pareto–optimal Supply. Again we can focus on 0 ≤ x ≤ 13, as when x > 13, the social surplus

is decreasing in x.

W (x) = Consumer Surplus + Producer Surplus

Z x

=

P(s)ds − P(x)x + (P(x)x −C(x))

0

Z x

=

P(s)ds −C(x)

0

subject to

0 ≤ x ≤ 13

Set up the lagrangian:

Z x

L(x, λ ) =

P(s)ds −C(x) + λ (13 − x)

0

The Kuhn-Tucker Conditions:

∂ L(x, λ )

= P(x) −C0 (x) − λ ≤ 0;

∂x

∂ L(x, λ )

= 13 − x ≥ 0;

∂λ

x(P(x) −C0 (x) − λ ) = 0;

x≥0

∂ L(x, λ )

= 0;

∂λ

λ ≥0

λ

Solving the Kuhn–Tucker conditions, we get x∗ = 10

Hint: The derivative of an integral at the upper

boundary is the value of the integrand at this

R

boundary, i.e. the derivative of the integral 0x P(s)ds with respect to x is just P(x). Review

your undergraduate math if you are not familiar with this.

4. Subsidy

5

With the subsidy, the monopolist has a new profit function:

Π(x, s) = xP(x) −C(x) + sx

= x(13 − x) − 3x + sx

Πx (x, s) = 13 − 2x − 3 + s = 0

10 + s

⇐⇒ xM (s) =

2

An interior solution is assured for the same reasons as before. Therefore, the government sets

the per–unit subsidy s such that xM (s) = 10 = x∗ . Thus, s∗ = 10. Then the government pays

10 · 10 = 100 to the monopolist. It can get back this money by imposing a lump–sum tax of

100 on the monopolist. This does not change his behaviour. He will still supply 10 units

while his profit is zero. His new profit function would be Π(x, s) = xP(x) −C(x) + sx − 100.

Notice that without the limitation of subsidizing at most an output of 13 the monopolist

would produce an infinite output despite the arising market price of 0. This is because the

per–unit subsidy is higher than marginal cost.

6