Efficient Estimation with Panel Data When Instruments Are

advertisement

Efficient Estimation with Panel Data When Instruments Are Predetermined: An Empirical

Comparison of Moment-Condition Estimators

Author(s): James P. Ziliak

Reviewed work(s):

Source: Journal of Business & Economic Statistics, Vol. 15, No. 4 (Oct., 1997), pp. 419-431

Published by: American Statistical Association

Stable URL: http://www.jstor.org/stable/1392488 .

Accessed: 15/11/2012 19:20

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

.

American Statistical Association is collaborating with JSTOR to digitize, preserve and extend access to Journal

of Business &Economic Statistics.

http://www.jstor.org

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Efficient

Estimation

With

Panel

Data

When

Instruments Are

An

Predetermined:

Empirical

Estimators

Comparisonof Moment-Condition

James P. ZILIAK

Departmentof Economics,Universityof Oregon, Eugene, OR 97403-1285

I examinethe empiricalperformanceof instrumental

variablesestimatorswith predetermined

instrumentsin an applicationto life-cycle labor supplyunderuncertainty.The estimatorsstudied

aretwo-stageleastsquares,generalizedmethod-of-moments

(GMM),forwardfilter,independently

weightedGMM,and split-sampleinstrumentalvariables.I comparethe bias/efficiencytrade-off

for the estimatorsusing bootstrapalgorithmssuggestedby Freedmanandby BrownandNewey.

Resultsindicatethatthe downwardbias in GMMis quitesevereas the numberof momentconditions expands,outweighingthe gainsin efficiency.Theforward-filter

estimator,however,has lower

bias andis moreefficientthantwo-stageleast squares.

KEY WORDS: Bootstrap;Life-cyclelaborsupply;Overidentifying

restrictions;Split samples.

The panel-dataliteratureofferslittle guidanceon the rel- stratedvia MonteCarlosimulationthatthe bias in OMD is

ative empiricalperformanceof instrumentalvariables(IV) quite severe,the sourceof which,like feasiblegeneralleast

estimatorswhen appliedto samples of the size typically squares,is dueto a correlationbetweenthe samplemoments

encounteredin practice.For example,when the numberof and the estimatedweight matrixused in optimallyminiobservationsis large (say,greaterthan500), are the small- mizing the distance between populationand sample mosample concernsof a bias/efficiencytrade-offin general- ments. They attemptedto correctfor the bias by developized method-of-moments

(GMM)raisedby Tauchen(1986) ing a split-sampleestimator,called independentlyweighted

and Altonji and Segal (1994) binding?Moreover,if bias OMD (IW-OMD)but foundthatboth OMD and IW-OMD

is present,is it due to a correlationbetween the sample aredominatedin termsof lowerbias androotmean

squared

moments and the sample weight matrix (Altonji and Se- error(RMSE)by equallyweightedminimumdistance.Algal 1994) or to instrumentsweakly correlatedwith the en- thoughthe findingsof bias in GMMby Tauchenandby Aldogenousregressoras recentlydiscussedby Bound,Jaeger, tonjiandSegal seem conclusive,they arefor smallsamples,

and Baker (1995) and Angrist and Krueger(1995)? The andthereis no a

prioriexpectationthat comparableresults

latterissue is crucialfor efficiencyconsiderationsbecause exist in a

large panel-datasetting. If comparablenegative

the optimalnumberof momentsmay containinstruments results

againstGMM do exist, then a case could be made

datedfar into the past, possibly weakeningthe correlation for less efficientestimatorssuch as

two-stageleast squares

between the instrumentsand the endogenousregressor(s).

(2SLS) or Keane and Runkle's (1992) forward-filter(FF)

In this article,I examinethe samplepropertiesof several estimator.

panel-dataIV estimatorsfirst by applyingthem to a wellParallelto the time series researchon IV estimatorsof

known life-cycle labor-supplymodel and then comparing

and Segal (1994), Nelson and Startz (1990), and

the estimatorsin terms of the bias/efficiencytrade-offvia Altonji

Tauchen(1986) is cross-sectionalresearchon the propera bootstrapMonteCarlo.

ties of IV estimatorswhen the correlationbetweenthe inFor many panel-dataapplications,GMM is the obvious

strumentsand the endogenousregressoris weak (Bekker

estimatorof choice:It does not requirea full specification

and Stock 1994; Angristand Krueger1995;

of the stochasticprocess (Hansenand Singleton 1982), it 1994; Staiger

Boundet al. 1995).As pointedout by Boundet al., a weak

is consistent asymptoticallyunder a variety of situations

correlationbetweenthe instrumentsandthe endogenousreincludingwhen the only instrumentsavailableare predetermined ratherthan strictlyexogenous(Andersonand Hsiao gressorcan lead to (1) a large standarderror,(2) a bias in

IV even if a weak correlationexists between the instru1982; Arellano and Bond 1991), and it attains the effiments and the structuralerror,and (3) a bias in IV toward

ciency bound in the class of IV estimators(Chamberlain

least squares(OLS) as the explanatorypower of

ordinary

1987; Ahn and Schmidt 1995; Arellanoand Bover 1995).

the

instruments

approaches0. They demonstratedthat the

Tauchen(1986)demonstrated,

however,thatin samplestypresultsfrom the overidentifiedmodels

ically encounteredin time series applications(N = 50 or returns-to-schooling

and

reported

by Angrist

Krueger(1991) are biased toward

75) GMM is biased as the numberof momentconditions

OLS

due

to

correlated

instrumentsand,worse still,

weakly

expands,leadingto a bias/efficiencytrade-off,and thus he

recommendedthe use of "suboptimal"

instrumentsets.

AltonjiandSegal (1994)extendedthe small-sampleanal? 1997 American Statistical Association

ysis of Tauchento least squaresoptimalminimum-distance

Journal of Business & Economic Statistics

(OMD) estimationof covariancestructures.They demonOctober 1997, Vol. 15, No. 4

419

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

420

Journalof Business & EconomicStatistics,October1997

thatsimilarIV resultsare foundby using instrumentsfrom tions test. Because each algorithmis asymptoticallyvalid

a uniformrandom-number

for the estimator,I comparebootstrapresultsfrom the apgenerator.

the

criticisms

et

of

Bound

and

al.,

Addressing

Angrist

proachesof both FreedmanandBrownandNewey.

a

convenient

From a 10-yearbalancedpanel of men, I find the fol(1995)

Krueger

developed computationally

IV

as

an

alternative

to

estimator

2SLS.

(SSIV)

split-sample

lowing results of note. The downwardbias in GMM is

SSIV is not biased towardOLS;however,the estimatoris quite severeas the numberof momentconditionsexpands,

biasedtoward0, so they proposedto "inflate"the SSIV es- outweighingthe gains in efficiency.The bias is due to a

timateswith a bias-correctionfactor,giving unbiasedSSIV correlationbetween the sample momentsused in estima(USSIV).TheyconcludedthatUSSIV gives resultscompa- tion and the estimatedweight matrix.The IW-GMMesrableto 2SLS but at a substantialloss of efficiencydue to timatoris generally successful at eliminatingthe bias in

the smallersamplesused in estimation.Becausepaneldata GMMparameterestimatesusing Freedman'sbootstrapalwith a long time series presentthe opportunityfor many gorithm;however,the standarderrorsfrom asymptoticthe(possiblyweaklycorrelated)instruments,SSIV andUSSIV ory seem to understatethe truesamplingvariation,andthe

test tendsto overreject.Thelevoveridentifying-restrictions

may be viable alternativesto standard2SLS or GMM.

In this article,I focus on panel-dataIV estimatorsthat els distortionin the overidentifying-restrictions

test persists

are consistent asymptoticallywhen only predetermined in models with many moments,even after recenteringthe

instrumentsare available. Applications that fall within distributionusingBrownandNewey's (1995)algorithm.Fithis class of estimatorsincludedynamicmodels, rational- nally,the bias in FF parameterestimatesis less thanGMM

models. and 2SLS, and it is more efficientthan2SLS.

expectationsmodels, and simultaneous-equations

Predeterminedinstrumentscomplicate the estimation of

AND PREDETERMINED

1. ESTIMATION

thateliminate

suchmodelsbecausecertaintransformations

INSTRUMENTS

the model'stemporallypersistentlatentheterogeneity,such

as deviationsfromtime-means(the "within"estimator),are

I begin with a brief overviewof the IV estimatorsused

inconsistentwhen instrumentsare predetermined(Keane in the empiricalapplicationandbootstrapsimulations.Conand Runkle 1992). The estimatorsconsideredhere include siderthe linearregressionfor individuali (i= 1,..., N) in

2SLS, GMM,FF, SSIV,USSIV, and an IV analogto IW- time t (t = 1,...,T)

OMD thatI refer to as IW-GMM.

I study the sample propertiesof the estimatorsin a

realistic setting using data from the Panel Study of InYit= +i Xit3 Eit,

(1)

come Dynamics (PSID). The empiricalmodel employed

is MaCurdy's(1985) life-cycle labor-supplymodel under uncertainty.MaCurdy'smodel is pertinentto the is- wherea2 representsfixed latentheterogeneity,xit is a (1 x

sues studiedhere becauseuncertaintysuggests a rational- K) vector of predeterminedexplanatoryvariables,/ is a

expectationssolution to the consumer'sproblem,thereby (K x 1) vectorof parametersto estimate,andEitis a random

makingthe instrumentset predetermined.In addition,the errorthatvariesover i and t andis assumeddistributediid

model producesestimatesof the intertemporalsubstitution (0, cr). Under the assumptionof fixed effects, the latent

elasticity,a key parameterused in understandingthe co- heterogeneityis correlatedwith the explanatoryvariables

movementsin earningsand hoursover the businesscycle. for all periods;thatis, E[ailxit] 4 0 for all t.

A common practice in panel data is to eliminate the

For each estimator,I sequentiallybuildup the momentmatrix by adding extra years as instruments,and I test the fixed effect by takingdeviationsfrom the individual'stime

specificationwith Sargan'stest of the overidentifyingre- series means, known as the within transformation.In IV

estimationwith predeterminedinstruments,however,the

strictions(Godfrey1988).

is inconsistent.In particular,for the

with

a

the

I complement empiricalinvestigation

bootstrap withintransformation

MonteCarloas developedby Efron(1979) andextendedto within transformationto be consistentit is necessaryfor

IV by Freedman(1984) and Freedmanand Peters (1984). the instrumentset to be strictlyexogenousto the model's

The bootstrapis used to comparethe estimatorsin terms error term for all periods, E[eis Wit] = 0 for all s, t;

of bias, efficiency,RMSE, medianabsoluteerror(MAE), however,predeterminedinstrumentsonly guaranteeweak

and asymptoticcoveragerates. The strengthof the boot- exogeneity, E[Eis]Wit] = 0 for all s > t. This inconsisstrapover standardMonte Carlo analysis lies in the fact tency carries over into the class of endogenousrandomthat,like the IV estimatorsthemselves,the researchersim- effects estimatorsstudiedby Hausmanand Taylor(1981).

ply approximatesthe empiricaldistributionof the estimator The first-difference(Andersonand Hsiao 1982;Keaneand

estimateof the underlyingerrordis- Runkle 1992; Schmidt, Ahn, and Wyhowski 1992) and

with a nonparametric

tribution.AlthoughFreedman'smethod is asymptotically orthogonal-deviations

(Arellanoand Bover 1995) transforestimatorsfromoveridentifiedmod- mationsare consistentwhen appliedwith lagged levels of

validfor bootstrapping

els (Hahnin press),BrownandNewey (1995) andHall and predetermined(or endogenous)regressorsas instruments.

Horowitz(in press) showed that the Freedmanalgorithm Orthogonaldeviationsmay offer efficiencygains over first

does not yield an improvementin termsof coveragerates differencesbecausedifferencingexacerbatesmeasurement

(Maeshiroand Vali 1988). Each transover asymptotictheory,and more importantly,it gives the errors-in-variables

will

to the estimators.

be

formation

restricfor

the

size

applied

overidentifying

wrong

asymptotically

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Ziliak:EfficientEstimationWithPanel Data

421

Estimators

1.1 Method-of-Moments

The first estimatorI consideris 2SLS, which minimizes

the distancebetweenthe samplemomentsand the population moments,givingequalweightto each observation.The

2SLS estimatorproducesconsistentparameterestimatesfor

eitherthe first-differenceor orthogonal-deviations

transformationsand is given as

=

(2)

/32SLS (X'P(W)X)- (X'P(W)y),

where W is an (N(T - 1) x L) matrix of instruments,

P(W) = W(W'W)-1W' is the projectionmatrixof instruments,E is the stacked(N(T - 1) x 1) vectorof residuals,

X is the stacked(N(T-1) x K) matrixof regressors,andy

is the stacked(N(T - 1) x 1) dependentvariable.Underthe

assumptionof conditionalhomoscedasticity,E[e21W]= 0,

inferencefor the estimated2SLS parametersis conducted

with the variance-covariance

matrix

var(32SLS)

-=

S=

2(X'P(W)X)-1

NT N-K

(3)

(y- X32SLS)2.

As notedby White (1982), 2SLS standarderrorsareinconsistent when the conditionalhomoscedasticityassumption

is violated;thus, he proposeda robustcovariancematrix

estimatedas

var(02SLS) = (X'P(W)X)-1X'P(W)

x QP(W)X(X'P(W)X)-1,

(4)

where Q is a diagonalmatrixof squaredresiduals.

Because the number of instrumentstypically exceeds

the numberof parametersestimated (L > K), one can

test the overidentifyingrestrictionswith the Sargantest

as e(32SLS)P(W)E(G32SLS))/-E

, whichis asymptoticallydistributedX2 with L - K df (Godfrey1988). In the case of

conditionalheteroscedasticity,

Hansen's(1982)robustvariantof the overidentifying-restrictions

test givenlateris necessary for consistentinference.

1.1.1 GeneralizedMethod-of-Moments.Hansen(1982)

and White (1982) showedthat improvementsin efficiency

over 2SLS are possible by optimally weighting the distance between the sample and populationmoments,with

the weight being the inverse of the covariancematrixof

sample moments.The ensuing GMM estimatortypically

relies on residualsfrom the 2SLS estimatorfor an initial

consistent estimate of the covariancematrix. The GMM

estimatoris

andHansen'sversionof the overidentifying-restrictions

test

is e(Ogmm)'P(W(S))e(igmm),

which is distributedasymptoticallyX2with (L - K) df.

1.1.2 ForwardFiltering. As an alternativeto 2SLSand

GMM, Keane and Runkle (1992) proposedan estimator

called the forward-filter(FF) estimator.The FF estimator

eliminatesall forms of serial correlationwhile still maintaining orthogonalitybetween the initial instrumentset,

whichcontainslaggedvaluesof predetermined/endogenous

variables,and the structuralerror.Thereis a similaritybetweenforward-filtering

andthe orthogonal-deviations

transformationdevelopedby Arellanoand Bover (1995) in that

both methodsdemeanthe variableswith only currentand

futurevalues;however,filteringis likely to be superiorbecauseit eliminatesall formsof serialcorrelation.Although

Schmidtet al. (1992) arguedthat filteringis irrelevantif

one exploits all samplemomentsduringestimation,filtering maybe a desirablealternativeto GMMin practice.First,

becausethe dimensionof the GMMmomentmatrixgrows

exponentiallyas the numberof time periodsandregressors

intractableandthe overexpands,it can be computationally

identifyingrestrictionsare less likely to be satisfied,possibly due to a weak correlationbetweeninstrumentsandendogenousregressors.Second,if the small-sampleevidence

from Tauchen(1986) and Altonji and Segal (1994) carries

over to the panel-datasetting, a bias/efficiency trade-off

will arise with the optimalGMMestimator.

Similarto GMMthe FF estimatoris a two-stepestimator.

In the first step, the first-differenced

equationis estimated

residby 2SLS. The ((T - 1) x 1) vectorof first-difference

uals for individuali from the 2SLS regression,Ei,2SLS, are

used in constructinga (T - 1) x (T - 1) covariancematrix,

N=1 ,2SLSI,2SLS.The inverseof the covariFD

ance matrixis then filteredby a Choleskydecomposition,

CFF - Chol(E1), thateliminatesserialcorrelationin the

differencederrors.The second step involves transforming

the originalstackedN(T - 1) first-differenceobservations

by QFF = IN 0 CFF, leadingto the FF estimator

3FF= (X'QFFP(W)QFFX)-1(X'QFFP(W)QFFY), (7)

=

with variance-covariance matrix

var(3FF)

2(X'QFF

As

noted

infer(1992),

P(W)QFFX)-1.

by Hayashi

ence with the FF estimatoris inconsistentif the conditional homoscedasticity assumption is violated; however,

heteroscedasticity-robust variants of the variance and the

overidentifying restrictions test are easy to compute.

1.1.3 Independently Weighted Generalized Method-of-

Moments. In an attemptto mitigatethe finite-samplebias

in OMD,AltonjiandSegal (1994)developeda new estimator

calledindependentlyweightedOMD.I extendtheiridea

=

(5)

(X'P(W(S))X)-1(X'P(W(S))y),

/3gmm

to the case of IV with panel data. The motivationbehind

where P(W(S)) = W(S)-1W' is the projectionmatrixof IW-GMMis to breakthe correlationbetween the sample

instrumentsand S = W'2W is the optimal weight ma- momentsusedin estimation,(1/N)[W'E],andthe estimated

trix that permits both conditionalheteroscedasticityand weight matrix,S = W'2W, that is constructedwith the

autocorrelationin the covariancematrix Q. The variance- same data. The procedureis to randomlysplit the sample

into independentgroups(g), say two (g = 1,2), with group

covariancematrixfor the GMMestimatoris

1 used in constructingthe weight matrix,S1 = W2i W1,

(6) and group 2 used in constructingthe sample momentsto

var( gmm)= (X'P(W(S))X)-1,

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

422

Journalof Business & EconomicStatistics,October1997

estimate,(1/N)[W2e2]. The samplesplit mustoccuron the

cross-sectionaldimensionof the data becauseeach crosssectionalunit retainsits own time series for instruments.

Each groupis used alternatelyin constructingthe weight

matrixand the samplemomentsso that the resultingIWGMM estimatoris the averageof the independentestimations:

OIW-GMM =

S

(X1,Wg(W?9gQgW g<W9Xg)1

g=1

x

Wf9g- gW,)(X;Wg(W'9

1Wyg),

(8)

where -g refers to the excludedgroup.Because the sampling errorsof the populationmoments and weight matrix are independent,the averageis a consistent estimator.The varianceof the estimatedaverageis constructedas

var(CIW-GMM)

=

(1/G2)[var(l31) + -- + var(CG)],where

the covariancebetweenith andjth samplesplitis 0 by construction.The IW-GMMestimatoris expectedto be less efficientthanGMMbecauseof the loss in degreesof freedom.

In the applicationto follow, I fix G = 2 for the IW-GMM

estimator.

1.1.4 Split-Sample Instrumental Variables. Angrist

where W21 = W1(W2W2)-1W2X2. The asymptoticcovariancematrixtakesthe usualformas 2SLS underconditional

homoscedasticityas0, (X' W21(W1 W21)-1W1X1i)1 and

the robustcovariancematrixis the sameas in Equation(4)

with W21replacingW. For obviousreasons,thereis no test

of the overidentifyingrestrictionsin this case.

1.2 Choice of Instrument Set

To this point,little attentionhas been givento the specificationof the instrumentset otherthanthe overidentifyingrestrictionstest. When the matrix of explanatoryvariables is predetermined,

the first-differenceand orthogonaldeviationstransformationsmake instrumentsdated t - 1

and earliervalid for estimation.In the standardIV estimator, choosing one-period lagged instruments, W

=

X(t_1),

leaves the systemjust identified(L = K), whereaschoosing instruments dated t - 1 and t - 2 imposes p = 2K - K

overidentifyingrestrictionsbut sacrificesan extraperiodof

datafor each observation.

Schmidtet al. (1992)arguedthatefficiencygainsarepossible if, insteadof the usualinstrumentset, one exploitsall

of the linearmomentsavailableas impliedby the orthogonality conditionsE[WiEci,d] = 0, where Wi is the matrixof

instrumentsfor individuali and Ei,d is the vector of firstdifferenceor orthogonaldeviationsresiduals.The Schmidt

et al. approachuses levels of instrumentsfrom different

time periodsfor differentobservations.The instrumentset

for individuali when all the regressorsare predetermined

is constructedas

and Krueger(1995) confrontedthe problemof a weak correlation between the instrumentsand regressorsin their

earlierwork by developingthe split-sampleIV (SSIV) estimator.Recall that if the instrumentsand the endogenous regressor(s)are weakly correlatedand there exists a

0 ? 0

0

X, 0 0 0 ? - 0

(weak)correlationbetweenthe errorfromthe first-stagefit0

0

0

0

0

0

?

? ?

X2

Xl

ted value and the structuralerror,then IV is biased.SSIV

breaksthe correlationbetweenthe two errorsby randomly wi =

0o0 o o

splittingthe samplein half and using one-halfto estimate

.

"

"

S. . .

T-1

x1Xl

2

the first-stageequationand the other half to estimatethe

structuralparameters.Let sample2 estimatethe first-stage

(11)

equationandcombinethatwith W1to formthe fittedvalue

for X1, which is then regressedon yl, yielding the SSIV which has dimension (T - 1) x (T)(T - 1)(K)/2 and where

estimator

zt(t = 1,. .., T- 1) are the lagged levels of the explanatory

variables.For example,in period2 variablesfromperiod1

- W2X2)-1

= (X' W2

W'

)

are valid instruments,in period 3 variablesfrom both peWI(W2W2

(W2W2)-1

issIv

riods 1 and 2 are valid, and so on until period T, where

x XW2(W

2)1 Wjy, (9) variablesfrom periods 1 to T - 1 are valid instruments.

= 15 and K = 10,

which underconditionalhomoscedasticityhas an asymp- When T and K are both large, say T

there

are

restrictions,

1,040 overidentifying

highlighting the

totic covariance matrix of var(3ssiv) = &2(XW2(W

computational burden of the Schmidt et al. approach. In the

W2)-1W•X2)-1. A loss of efficiency relative to 2SLS is

to follow, I compare the efficiency of the stanexpected with SSIV because only one-half of the observa- application

set to the stacked instrument set in Equadard

instrument

tions are used in estimation. This divergence in efficiency

tion

(11).

may be exacerbated when heteroscedasticity-robust covariance matrices of Equation (4) are employed.

2. AN APPLICATIONTO LIFE-CYCLELABOR

Because SSIV is biased toward 0, Angrist and Krueger

SUPPLY UNDER UNCERTAINTY

(1995) inflated the SSIV estimator with a bias-correction

A focal point of interest in the labor-supply literature is

factor, resulting in a just-identified 2SLS estimator in samand efficient estimation of the intertemporalsubconsistent

ple 1. USSIV is consistent under group asymptotics and is

stitution elasticity (ISE). The ISE measures intertemporal

given by the formula

changes in hours of work due to an anticipated change in

the

real wage and aids in understanding comovements in

/uSSIV

= (X W 21(W

W2)W X)-1

earnings and hours over the business cycle. Consequently,

estimates of the ISE are of import to public policy

reliable

x XW;1(VINW21w)-1w21y

(10)

,

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Ziliak:EfficientEstimationWithPanel Data

in labormarkets.The life-cycle labor-supplymodel developedby MaCurdy(1985) andAltonji(1986)formsthe basis

of the empiricalexercise.

Based on a utility functionthat is additivelyseparable

betweenconsumptionandleisure,the double-loglife-cycle

labor-supplyfunctionfor individuali (i = 1,..., N) in time

t (t = 1,..., T) is

423

based on the first-differencetransformationand 46 based

on the orthogonal-deviations

transformation.The FF estimatoris not includedunderorthogonaldeviationsbecause

filteringwould be redundantin this case. I begin with the

standardinstrumentset with zit's fromt- 1 andt- 2, along

with lagged wages from t - 2. I then sequentiallybuildup

the stackedinstrumentset fromEquation(11). Becausethe

ISE

is the parameterof primaryinterest,I only presentreInhit = Aio+ 6 Inwit + zitly + Eit,

(12)

sults for the ISE in Table 1. The efficiencypatternin the

where In is the naturallog operator;hit is annualhours

variableswith changesin momentconditions

of work; A0ois the marginalutility of initial wealth that demographic

is similarto the patternin the ISE. The weightingmatrix

is a functionof all futurewages, assets, prices, and tastes for the first-difference

GMMestimatorthatcorrectedfor a

and is correlatedwith the explanatoryvariables;zit is a first-order

moving averageerrorfailed to be positive defvectorof time-varyingdemographics;and6 is the ISE painite in the stacked-momentmodels, even with modified

rameter.The assumptionsbetweenthe regressorsandstruc- Bartlett

weights; hence, the results reportedonly correct

tural randomerrorare E[cisln wit] = 0 for all s > t and for conditional

As a point of departure,

heteroscedasticity.

E[Eis zit] = 0 for all s > t. Wages are assumedto be en- I presentOLS estimatesat the bottomof Table 1. The OLS

to accountfor the pos- first-differenceISE is .111 with a

dogenousratherthanpredetermined

heteroscedasticity-robust

sible presenceof nonlinearincometaxesand/orhumancap- standarderrorof

.079, andthe orthogonal-deviations

ISE is

ital considerations,or possiblymeasurementerror.

.176 with a heteroscedasticity-robust

standarderrorof .074.

Estimationproceedsby takingfirstdifferencesor orthog2.2.1 Base-CaseResults. In the base case with demoonal deviationson Equation(12) to eliminate the unobgraphicvariablesfromt - 1 and t - 2 andwages fromt - 2

served marginalutility of wealth and then using the es- as instrumentsfor the

the firsttimatorsoutlinedin Section 1. Because of the endogene- difference2SLS and contemporaneousperiod,

GMM estimatesof the ISE are .21

ity of wages and the desire to use lagged values of wages and .52, respectively;however,neitherestimateis

signifias instruments,an extrayear of data is lost; consequently, cant even at the 10%level. As a benchmark

to judge the

there are a maximum of (T - 2) x (T - 2)[(K - 1)(T first-difference

base-caseresults,Altonji(1986)estimateda

+ 1) + T]/2 linear momentconditionsto exploit in estiof

values

from .01 to .45, most of which are imprerange

mation.The stackedinstrumentmatrixin Equation(11) for

estimated.

The orthogonal-deviations

2SLS estimates

cisely

the labor-supplymodel contains,in period 3, wages from are more efficient than

their first-differencecounterparts,

period 1 along with demographicsin periods 1 and 2 as possibly due to reducedmeasurementerrorrelativeto difinstruments,wages fromperiods1 and 2 along with demo- ferencing;however,thereis no

generalpatternof efficiency

graphicsfrom periods 1 to 3 are instrumentsin period4, gainsacrossthe otherorthogonal-deviations

estimators.The

and so on until period T when there are (T - 2) lagged IW-GMMestimates

across

the

first-difference

and

vary

wages and (K - 1)(T - 1) lagged demographic variables as orthogonal-deviations

transformations

in thatthe formerininstruments.

flate the correspondingGMM estimateby about40% and

the

latterdeflateit by about40%. Of course,the objective

2.1 Data

of IW-GMMis to correctfor bias in GMM,whetherit be

The dataused to estimatethe life-cycle labor-supplypa- positive or

negativebias. On the contrary,SSIV and USrameterscome fromWavesXII-XXI (calendaryears 1978- SIV

uniformlyinflatetheir2SLS counterpartsacrossspec1987) of the PSID.The sampleis selectedon manydimen- ifications,althoughthere is a substantialloss in

efficiency

sions and is similar to other researchstudyinglife-cycle due to smaller

samplesizes. Interestingly,underconditional

modelsof laborsupply.The sampleis restrictedto continu- homoscedasticity,the FF estimator

performsbest on effiously married,continuouslyworking,prime-agemen aged ciency groundsin the base case, even surpassingGMM;

22-51 in 1978 from the Survey Research Center random however,once one accountsfor

heteroscedasticity,GMM

subsample of the PSID. In addition the individual must ei- and IW-GMMimproveon the FF estimates.

ther be paid an hourly wage rate or must be salaried, and

The resultsfrom the Sarganoveridentifying-restrictions

he cannot be a piece-rate worker or self-employed. This tests aremixedacrossthe models.The

conditionallyhomoselection process resulted in a balanced panel of 532 men scedasticp values of .02 and .01 from the first-difference

over 10 years or 5,320 observations. The real wage rate, wit, 2SLS and FF estimatorsdo not lend much

supportto the

is the hourly wage reported by the panel participant rather choice of instruments;

however,the GMMand orthogonalthan the average wage (annual earnings over annual hours) deviations versions do not reject the

overidentifying

to minimize division bias (Borjas 1981). The predetermined restrictions.The test rejectsthe IW-GMMspecificationsuntime-varying taste shifters, zit, include a quadratic in age, der first differencesbut does not reject SSIV models.Two

the number of children in the household, and a dummy vari- importantfindings that emerge in the base case and are

able for bad health.

magnifiedin the stacked-momentresultsto follow are that

(1) once the Sargantest is modifiedfor the presenceof het2.2 Results

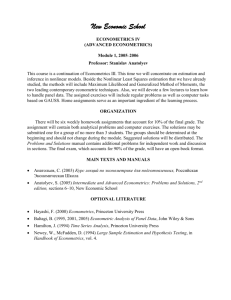

eroscedasticity,the overidentifyingrestrictionsare not reIn Table 1 I report the results from 101 regressions, 55 jected in any of the 2SLS or FF specificationsand (2) as

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

424

Journal of Business & Economic Statistics, October 1997

Table1. Intertemporal

SubstitutionElasticitiesUnderAlternativeMoment-Condition

Estimators

Firstdifference

Moments

2SLS

Base case:

T - 1, T - 2

GMM

FF

IW-GMM SSIV

USSIV

2SLS

Orthogonaldeviations

GMM IW-GMM

SSIV

USSIV

.2091

(.4155)

(.4231)

[.0234]

[.3147]

.5192

(.3638)

[.4482]

.1350

(.3163)

(.3857)

[.0138]

[.1925]

.7161

(.3498)

[.0059]

.7158

(.6183)

(.7109)

[.3447]

[.4356]

1.7491

(2.0709)

(1.8272)

.2552

(.3773)

(.4488)

[.1361]

[.5744]

.4506

(.4011)

[.6431]

.2603

(.4044)

[.0392]

.8931

(.6427)

(.8237)

[.5862]

[.8326]

.5428

(.1808)

(.2259)

[.0700]

[.3837]

.3942

(.1504)

[.4248]

.5422

(.1525)

(.2007)

[.0284]

[.2778]

.3971

(.0846)

[.0000]

.6752

(.2120)

(.4878)

[.0000]

[.0002]

6.0887

(7.3626)

(7.1342)

.7130

(.1719)

(.2119)

[.0697]

[.1185]

.6158

(.1586)

[.2040]

.5069

(.0908)

[.0000]

.4289

(.1764)

(.4880)

[.8188]

[.9315]

8.2390

(19.205)

(18.444)

3

.5620

(.1436)

(.1817)

[.0632]

[.3932]

.3916

(.1158)

[.4560]

.2868

(.0584)

[.0000]

.3768

(.1609)

(.3564)

[.0017]

[.0065]

-3.4139

(3.6721)

(4.2839)

.3724

(.0626)

[.0000]

.1933

(.1013)

[.3192]

.1832

(.0462)

[.0000]

.6702

(.8119)

(1.2464)

.2778

(.1031)

[.2363]

.2819

(.0497)

[.0000]

.1714

(.0898)

[.0480]

.2838

(.0412)

[.0000]

.3502

(.1084)

(.1772)

[.0000]

[.1927]

.2763

(.1028)

(.1758)

[.0000]

[.2051]

.1524

(.0802)

[.3509]

.1448

(.0799)

[.1303]

.4031

(.0346)

[.0000]

.1413

(.0743)

[.1849]

.3082

(.0287)

[.0000]

-.0654

(.0850)

(.2331)

[.0000]

[.0000]

.7629

(1.1336)

(1.6145)

.2653

(.1003)

(.1686)

[.0000]

[.1663]

.0659

(.0691)

[.3562]

.1051

(.0679)

[.1709]

.2781

(.0262)

[.0000]

.0931

(.0674)

[.3787]

.1227

(.0661)

[.1926]

.2544

(.0255)

[.0000]

-.0800

(.0825)

(.2270)

[.0000]

[.0000]

-.0824

(.0822)

(.2207)

[.0000]

[.0000]

.8239

(.9977)

(1.3779)

.2814

(.0987)

(.1623)

[.0000]

[.1875]

.1115

(.0247)

(.0791)

.0881

(.1168)

(.2886)

[.0000]

[.0002]

.0218

(.1044)

(.2389)

[.0000]

[.0000]

.0299

(.0940)

(.2242)

[.0000]

[.0000]

.0158

(.0849)

(.2109)

[.0000]

[.0000]

.0017

(.0834)

(.2035)

[.0000]

[.0000]

.0046

(.0827)

(.1949)

[.0000]

[.0000]

.1070

(.1342)

(.3406)

[.3946]

[.4759]

-.0489

(.1064)

(.3007)

[.0000]

[.0000]

-.0898

(.0972)

(.2779)

[.0000]

[.0000]

-.0754

(.0910)

(.2550)

[.0000]

[.0000]

-2.4665

(6.1924)

(7.2017)

.3774

(.1279)

(.1780)

[.0000]

[.2211]

.3123

(.1179)

(.1742)

[.0000]

[.0705]

.5885

(.1353)

(.1792)

[.0109]

[.0959]

.5432

(.1242)

(.1733)

[.0002]

[.0772]

.4006

(.1133)

(.2000)

[.0000]

[.0125]

.4051

(.1044)

(.1860)

[.0000]

[.0253]

.3650

(.1005)

(.1799)

[.0000]

[.0505]

.3408

(.0984)

(.1738)

[.0000]

[.0364]

.3512

(.0971)

(.1694)

[.0000]

[.0431]

.3768

(.1156)

[.2209]

T - 1 to T - 4

.5093

(.1225)

(.1779)

[.0089]

[.2096]

.4568

(.1118)

(.1711)

[.0003]

[.2715]

.3108

(.1008)

(.1829)

[.0927]

[.0824]

{9}

Stacked cases:

T - 1 to T - 2

{72}

T-

1 to T-

{107}

{137}

T - 1 to T - 5

{162}

T - 1 to T - 6

{182}

T - 1 to T - 7

{197}

T - 1 to T- 8

{207}

T-

1to T-9

{212}

OLS

.1186

(.0878)

[.1393]

.1017

(.0741)

[.3510]

.3517

(.0927)

(.1778)

[.0000]

[.1383]

.3069

(.0893)

(.1677)

[.0000]

[.2126]

.2781

(.0869)

(.1592)

[.0000]

[.1593]

.2961

(.0856)

(.1540)

[.0000]

[.1793]

.3170

(.0346)

[.0000]

.3615

(.0311)

[.0000]

.3444

(.0247)

[.0000]

.3479

(.0237)

[.0000]

.3173

(.0228)

[.0000]

-.1169

(.5247)

(.7319)

-.2473

(.6665)

(.9609)

-.2577

(.7653)

(1.0709)

-.1355

(.7492)

(.9927)

-.1808

(.7238)

(.9267)

1.1224

(.7987)

(.8270)

.3272

(.9251)

(1.4420)

.5920

(.7368)

(1.1203)

.7449

(.9966)

(1.4588)

.7825

(.9308)

(1.2813)

.1755

(.0224)

(.0743)

are in squarebrackets.The second valuesin parenthesesandsquarebrackets

restrictions

NOTE:Standarderrorsare in parenthesesandp valuesforthe nullhypothesisof correctoveridentifying

standarderrorsand p values. N = 532 and T = 8. The numbersbetween( } are the numberof instruments

forthe 2SLS, FF,SSIV,and USSIVestimatorsreferto heteroscedasticity-robust

used in estimation.

the ratio of instruments to cross-sectional sample size rises,

Hansen's test seems to overreject. This will become evident

in Subsection 2.2.2 when one compares GMM to IW-GMM

and 2SLS to SSIV.

2.2.2 Stacked Moment Results. Turning now to the

stacked moment-condition results reveals a striking change

in the efficiency of the ISE. With 72 moment conditions

in the stacked t - 1 and t - 2 case, significant efficiency

gains are achieved for all the estimators, with the average

reduction in standard errors around 50%. The FF estimator outperforms 2SLS in efficiency in all cases, but GMM

is more efficient than FF in all of the stacked-moment

specifications. No clear efficiency pattern emerges between

orthogonal deviations and first-difference GMM, nor with

heteroscedasticity-robust 2SLS across the transformations.

Quite remarkably,IW-GMM outperforms GMM across the

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Ziliak: Efficient Estimation With Panel Data

425

bias-correctionfactormay be undesirablewith manyoveridentifyingrestrictions.The FF estimatorfrom Keaneand

Orthogonal-deviations Runkle

(1992)does not appearto sufferfromthe samebias

F test

WaldTest

as in GMMandyet is more efficientthan2SLS.

Table2. First-StageF and WaldTests for Wage Changes

First-difference

F test

Moments

Base case:

T - 1, T -

2.2.3 Testsfor WeakInstruments. An obvious question

2

2.541

20.095

3.979

30.293

[.007]

[.017]

[.000]

2

1.182

[.141]

92.589

[.052]

1.382

[.019]

104.331

[.008]

3

1.197

[.084]

129.862

[.066]

1.303

[.021]

150.497

[.004]

4

1.098

[.208]

160.540

[.083]

1.154

[.109]

187.569

[.003]

5

1.074

[.251]

210.043

[.007]

1.092

[.205]

245.218

[.000]

6

1.138

[.104]

241.216

[.002]

1.120

[.134]

286.980

[.000]

7

1.149

[.080]

271.128

[.000]

1.097

[.175]

309.148

[.000]

8

1.146

[.079]

291.226

[.000]

1.079

[.214]

326.667

[.000]

9

1.160

[.061]

325.604

[.000]

1.080

[.210]

362.342

[.000]

{9}

Stacked cases:

T - 1 to T {72}

T- 1 to T{107}

T- 1 to T {137}

T- 1 to T {162}

T- 1 to T {182}

T- 1 to T {197}

T- 1 to T {207}

T - 1 to T {212}

WaldTest

[.000]

NOTE: The nullhypothesisis thatthe instrumentsjointlyexplainnone of the variationin the

wagechanges. P valuesare givenin brackets.Forthe F test, the numerator

degrees of freedom

are (# of moments- 1) and the denominator

degrees of freedomare NT - N - #moments,

=

=

whereN 532 and T 8. The degrees of freedomforthe Waldtest arethe numberof moment

conditions.

boardon efficiencygrounds.This resultis surprisinggiven

that IW-GMMonly uses half of the sample for each estimationand may point to some small-sampleadvantages

of IW-GMMover GMM.Likewise, SSIV standarderrors

underhomoscedasticitydominate2SLS and FF; however,

2SLS and FF are far superioronce one controls for heteroscedasticity.Proceedingdown the columns, note that,

as additionalmomentsare addedto the instrumentset, the

ISE is estimatedmorepreciselyas predicted.For example,

exploitingall moments(212)reducesthe 2SLS andFF standarderrorsby at least 45% and the GMM standarderrors

by at least 55%comparedto the suboptimalmatrixwith 72

moments.

The efficiency gains of extra instruments,nonetheless,

come at a cost. A clear patternof downwardbias in the

first-differenceand orthogonal-deviations

GMM and SSIV

estimators emerges in the stacked-moment results of Table

1. With 72 moments imposed, the first-difference 2SLS and

GMM ISE parameters differ by 27%, but the difference is

67% with 212 moments. The bias is even more severe under

orthogonal deviations. Unlike GMM, the finding that the

SSIV parameter estimates converge toward 0 as the number of overidentifying restrictions expands is an expected

property of the estimator (Angrist and Krueger 1995). What

is not expected is the erratic and puzzling behavior of the

USSIV estimator. The estimated ISE ranges from 8.239 in

the 72-moment orthogonal-deviations case to -3.414 in the

107-moment first-difference case. No obvious explanation

emerges for the disappointing USSIV results, but the findings indicate that "forcing" exact identification through the

arises:Is the bias in GMMdue to instrumentsweakly correlatedwith the wage or due to a correlationbetweenthe

samplemomentsandthe estimatedweight matrix?Several

corroboratingfacts suggest that a correlationbetweenthe

sample moments and the estimatedweight matrix is the

sourceof the bias. In Table2 I reportfirst-stageF tests and

Waldtests withtheirassociatedp valuesfor the endogenous

wage regressor.I presentthe Waldtest becausethe F test

is inconsistentwhen thereis heteroscedasticity.

As seen in

Table 2, the F test frequentlyleads to the incorrectconclusion that there are weakly correlatedinstrumentswhen

the Waldtest does not, suggestingthatwhen heteroscedasticity is presentthe Waldtest is the more appropriatetest

for the correlationbetweeninstrumentsandregressors.The

conclusionthat the instrumentsare not weak is strengthenedby notingthatthe overidentifying-restrictions

test does

not rejectthe modelunderheteroscedasticity-robust

GMM,

2SLS, or FE

Potentiallythe strongestpiece of evidence that the bias

comes from the estimatedweight matrixis the IW-GMM

parameterestimates.Beginningwith 162 moments,the IWGMM estimates are at least twice as large as GMM on

averageand are comparableto 2SLS and FF estimates,a

resultthat would not ariseif therewere no correlationbetweenthe GMMsamplemomentsandestimatedweightmatrix or if the instrumentsareweak.Unfortunately,

Hansen's

test

all

the

of

IW-GMM

overidentifying-restrictions rejects

specifications(andall SSIV modelsbeginningwith 137 moments). This "overrejection"as the ratio of moments to

cross-sectionalsamplesize increases,whichreachesa maximum of 212/266 underIW-GMMcomparedto 212/532

underGMM,may indicatea weaknessin the test.

2.2.4 Summary. The resultsof Tables 1 and 2 suggest

that GMM is biased downwardrelativeto 2SLS and FF

as the numberof moment conditionsexpandsbecause of

a correlationbetweenthe estimatedweight matrixand the

samplemoments.Moreover,IW-GMMis successfulin correctingthe bias in GMM;however,the IW-GMMparameter estimatesare more variablethan 2SLS and FF and the

overidentifying restrictions are rejected in each specification. SSIV is biased toward 0 as the number of instruments

expands and USSIV performs poorly. Finally, inference,

whether it be standard errors, overidentifying restrictions,

or first-stage F tests, can be quite misleading when the assumption of conditional homoscedasticity is incorrect.

3.

BOOTSTRAPPING OVERIDENTIFIEDMODELS

To investigate the sample properties of the estimators

such as the potential bias/efficiency trade-off in GMM,

more deeply, I now turn to the bootstrap. The bootstrap, recently surveyed by Efron and Tibshirani (1993) and Jeong

and Maddala (1993), is a powerful statistical technique for

the computation of measures of variability,confidence inter-

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

426

Journalof Business & EconomicStatistics,October1997

vals, andbias of an estimator.In the currentapplication,the

bootstrapis a naturalalternativeto standardMonte Carlo

estimateof

analysisbecauseit is basedon a nonparametric

the underlyingerrordistribution.Recall that a strengthof

each of the IV estimatorsconsideredin Section2 emanates

fromtheirlackof dependenceon an a priorispecifiedsmallsampledistribution.Moreover,the parametricMonteCarlo

is difficultto implementbecausethe labor-supplyliterature

offerslittle help in the way of thejoint small-sampledistributionof wages andhours,makingthe choiceof a distribution a dubiousexerciseat best. Consequently,the bootstrap

maintainsthe semiparametric,

empirical-basedspiritof the

article.

The typicalregression-based

bootstrapis a multistepprocedurewherebythe researcherresampleswith replacement

the estimatedresiduals,constructsa new dependentvariable

as the sum of the fittedvalue from the regressionplus the

bootstrappedresidual,reestimatesthe model, and repeats

the exercise B times (b = 1,..., B). There are then B ob-

samplingalgorithmas an alternativeto Freedman'smethod.

The idea is to resamplefrom the multinomialdistribution

in which each observationreceives a differentprobability

weight,iA, such thatthe samplemoments,9i = g(?, X, W),

are satisfiedby construction,EZ=1 ig = 0. In general,

jiA

is solved numericallyfrom a linearprogrammingproblem;

however,Brown and Newey suggesteda closed-formsolution for the probabilitygiven as Ai = (1 g'V-l-i)/

and V =

[N (1 - g-V-1g)], where

= 1/N -Igi

1/N EN_, gi. The estimated probabilities are expected to

satisfy the usual regularityconditionssuch as •i > 0 and

Si= li = 1.

For each experiment,I computethe bias as (1/B) Eb=1

6b- 6, where6bis the bthbootstrapestimateof the ISE and

6 is the pseudotruevalueof the ISE definedlater,the averstandarderrorconstructed

age heteroscedasticity-consistent

fromthe asymptoticformulasin Section1 (SE-A),the bootstrap standard error as [(Bl(b

-

B)2)

-

servationsfrom which to computemeasuresof bias, vari- 1)11/2/vB (SE-B), the RMSE definedas the squareroot

of the sum of bias squaredand the averagevarianceconability,or confidenceintervals.This approachis consistent structedfrom

formulas(RMSE-A),the RMSE

only underthe assumptionsof conditionalhomoscedastic- definedas the asymptotic

root

of the sum of bias squaredand

square

ity, no serialdependence,andnonstochasticregressors.

and the MAE. In addition,I

SE

boot

(RMSE-B),

squared

Whenthe regressorsare stochasticor thereis conditional

a

measure

of

of asymptoticinferenceby

reliability

report

heteroscedasticityas is typicalin IV estimation,Freedman

the

rates

on a 95%two-tailedconficonstructing coverage

(1984) and Freedmanand Peters (1984) suggested an al- dence

intervalas the fractionof times the pseudotruevalue

ternativeprocedure.Instead of resamplingthe residuals,

of the ISE falls within the intervalbased on asymptotic

one resamplessimultaneouslythe estimatedresidualsalong

formulasand asymptoticcriticalvalues.

standard-error

with the regressorsandinstruments.More specifically,one

Because the t distributiondoes not adjust confidence

resampleswith replacementfrom (E,X, W), whereE is the intervalsfor the presenceof skewness in the underlying

or orthogonal-deviations

vectorof estimatedfirst-difference

population,I also constructbootstrap-tcriticalvalues that

residuals,X is the matrixof first-differenceor orthogonal- have the

to accountfor skewness (Efronand Tibdeviationsregressors,and W is the matrixof instruments. shirani ability

1993, pp. 159-162). The idea is to approximate

Call the constructed"pseudodata"(g*,X*, W*). The new the

asymptoticpivotal t statistic from the bootstrapas

dependentvariableis Y* - X*3 + ^*, which is regressed t(b) = (6b - 6)/se(b), where se(b) is the bth estimated

on X* with W* as instrumentsto generatea new 3*, and

asymptoticstandarderror.The a and 1 - a critical valthe procedureis repeatedB times.This approach,in which ues are foundby orderingthe t(b)'s for the entirebootstrap

each observationhas equal probabilityweight 1/N of be- sampleand are then used in constructingbootstrap-tconing drawnfromthe discreteempiricaldistributionfunction, fidenceintervals.The bootstrap-tmay offer asymptoticreis an asymptoticallyvalid methodof bootstrappingan IV finementsover critical values from first-orderasymptotic

estimator,even when the model is overidentified,and pro- theory (Brown and Newey 1995; Hall and Horowitzin

vides asymptoticcoverageratesequalto theirnominalrates press).Finally,to gaugethe potentialgainsin the Brownand

(Hahnin press).

Newey algorithmoverFreedman'sfor correctingthe size of

Brown and Newey (1995) and Hall and Horowitz (in

press), however, showed that the Freedman method does

not yield an improvement in terms of coverage rates over

first-orderasymptotic theory, and more importantly,it gives

the wrong size, even asymptotically, for the overidentifyingrestrictions test. The problem lies in the fact that when the

model is overidentified the sample moments are typically

not 0, and thus one bootstraps from an empirical distribution that is a poor approximation to the true underlying

distribution. Hall and Horowitz attempted to mitigate this

problem by recentering the moments at their sample values,

and Brown and Newey suggested recentering the empirical

distributionby imposing the moment conditions on the data.

Because Brown and Newey showed that their approach

is efficient in the class of bootstrap methods, I use their re-

the overidentifying-restrictions test, I report the fraction of

times the bootstrap value of the overidentifying-restrictions

test exceeds the asymptotic critical X2 value at the .05 level

(Boot-J).

3.1 Results

To make relative comparisons of bias, RMSE, and MAE

across the estimators I need to "prime" the bootstrap (i.e.,

construct?) with a common vector of parameters.This approach of choosing a common set of starting values mimics the parametric Monte Carlo and has been applied to

the bootstrap by Freedman and Peters (1984). Because the

focus is on the ISE, I use the estimated ISE most often

encountered in male labor-supply studies as the pseudotrue

value of 5. Pencavel (1986) noted that the ISE has a cen-

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Ziliak: Efficient Estimation With Panel Data

427

Table3. BootstrapComparisonsof First-Difference

Moment-Condition

EstimatorsWhereObservationsAre DrawnWithProbability1/N

Estimators

Bias

SE-A

SE-B

2SLS

GMM

FF

IW-GMM

SSIV

USSIV

-.108

.174

-.097

.189

.208

.828

.485

.360

.351

.459

.854

15.621

.474

.330

.309

.565

.909

6.082

.497

.400

.365

.497

.879

15.643

2SLS

GMM

FF

IW-GMM

SSIV

USSIV

.128

-.093

.055

.013

.137

-1.107

.169

.097

.142

.070

.310

3.4E2

.199

.108

.156

.337

.273

42.527

.212

.134

.152

.071

.339

3.4E2

RMSE-A

RMSE-B

MAE

95%

asym-t

coverage

95%boot-t

critical

values

.263

.280

.183

.336

.451

1.683

.99

.95

.98

.88

1.00

.99

-1.59,

-1.35,

-1.93,

-1.48,

-1.63,

-1.04,

1.71

2.15

1.29

3.99

1.67

1.53

.29

.13

.44

.66

.29

.145

.108

.136

.149

.160

4.965

.85

.81

.87

.47

.95

1.00

-1.53,

-3.34,

-1.79,

-7.28,

-2.13,

-1.19,

3.27

.98

2.63

8.06

1.95

1.69

.99

.99

.99

1.00

.63

.147

.179

.090

.156

.211

.927

.74

.21

.87

.19

.84

.96

-3.73,

-5.62,

-3.74,

-15.1,

-3.07,

-2.26,

4.05

-.2

1.49

19.1

.31

1.79

.99

1.00

1.00

1.00

.90

.084

.172

.069

.144

.192

1.099

.79

.04

.85

.14

.83

.99

-4.50,

-6.0,

-3.69,

-27.4,

-2.86,

-1.58,

3.12

-1.74

1.84

32.5

-.31

1.41

1.00

1.00

1.00

1.00

.95

Boot-J

rejection

rate:5%

9 moments

.486

.373

.324

.596

.932

6.138

72 moments

.236

.142

.168

.337

.306

42.541

162 moments

2SLS

GMM

FF

IW-GMM

SSIV

USSIV

.022

-.169

-.046

--.020

-.216

-.932

.131

.055

.119

.029

.188

11.598

.219

.077

.128

.229

.124

5.707

.220

.186

.136

.230

.249

5.782

.132

.178

.128

.035

.286

11.636

212 moments

2SLS

GMM

FF

IW-GMM

SSIV

USSIV

-.014

-.175

-.037

.044

-.209

-.372

.124

.043

.100

.018

.175

13.467

.166

.047

.106

.219

.096

5.783

.125

.180

.107

.047

.273

13.472

.166

.181

.112

.224

.231

5.794

The pseudotruevalueof the ISEis fixedat .21 forallcalculations.Biasis computedas the differencebetweenthe averagebootstrap

NOTE:Allcalculationsare based on 100 bootstrapreplications.

estimateand the pseudotrueISE,SE-Ais the averagestandarderrorcomputedfromasymptotictheory,SE-B is the averagestandarderrorconstructedfromthe bootstrap,RMSE-Ais the root

meansquarederrorcomputedwiththe variancefromasymptotictheory,RMSE-Bis the rootmeansquarederrorcomputedwiththe variancefromthe bootstrap,MAEis the medianabsoluteerror,

95%asym-t coverageis the fractionof times the pseudotruevalue of the ISEfallswithinthe 95%confidenceintervalbased on standarderrorsand criticalvalues fromasymptotictheory,95%

restrictionstest exceeds

boot-tcriticalvalues are the .025 and .975 valuesfromthe bootstrapt statistic,and boot-Jrejectionrateis the fractionof timesthe bootstrapvalueof the overidentifying

the criticalX2 valueat the .05 level.

tral tendency of .20, which, coincidentally,is consistent

with the 2SLS 9-momentmodel of Table 1; thus,the 2SLS

9-momentparametersform the startingvalues. I present

100 bootstrapreplicationsfor the 9-, 72-, 162-, and 212momentcases for both the first-differenceand orthogonalThe small numberof bootstrap

deviationstransformations.

Monte Carlo drawsis sufficientfor measuresof bias and

variabilityfor most samplesizes but is sufficientfor confidenceintervalsonly in largersamples(Hall 1986;Efronand

Tibshirani1993, p. 161). All experimentswere conducted

in Gauss with a Pentium-90,where the models with 212

momentstook at least 48 hours to compute.I presentthe

resultsfrom the Freedmanalgorithmin Tables3 and4 and

fromBrownandNewey's algorithmin Tables5 and6. I focus on the first-differenceresultsbecausethe implications

from orthogonaldeviationsare largelythe same.

3.1.1 Results From Freedman Algorithm. Beginning

with the base case of 9 moments in Table 3, 2SLS and

FF tend to be biased toward OLS (6oLs = .11), which is

consistentwith the presenceof a finite-samplebias in IV

estimators.The absolute value of bias in GMM exceeds

both 2SLS and FF, whereasGMM dominatesall three of

the split-sampleestimatorsin terms of lower bias. Com-

paringthe averageasymptoticstandarderror(SE-A)to the

bootstrapstandarderror(SE-B) suggeststhat thereis little

differencefor 2SLS, FF, andGMMstandarderrors,butthe

asymptoticand bootstrapstandarderrorsdivergefor IWGMM,SSIV,andUSSIV.FF dominatesall of the estimators

in termsof lower RMSEand MAE, but GMMdoes better

than2SLS in termsof RMSEbut not for MAE. Moreover,

GMMdominatesall of the split-sampleestimatorsfor lower

RMSEandMAE.In termsof asym-tcoveragerates,GMM

performsbest, 2SLS, FF, SSIV,and USSIV tend to underreject, and IW-GMMoverrejects.The bootstrap-tcritical

values suggest that there is a slight departurefrom symmetry for each of the estimatorsand that asymptoticcritical values are too large.The boot-J rejectionrates,however, reveal that there is a serious level distortionin the

test computedwith Freedman's

overidentifying-restrictions

algorithm.Overall,Keaneand Runkle'sFF estimatorperforms best in the base case.

The most obvious trend arising in the stacked-moment

cases is the increasingbias in GMMas the numberof moment conditionsexpands.The bias in the GMM ISE rises

(i.e., becomes more negative)from -.093 under 72 moments to -.175 with 212 moments.This finding,reenforc-

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Journal of Business & Economic Statistics, October 1997

428

Moment-Condition

EstimatorsWhereObservationsAre DrawnWithProbability1/N

Table4. BootstrapComparisonsof Orthogonal-Deviations

Estimators

Bias

SE-A

SE-B

RMSE-A

RMSE-B

MAE

95%

asym-t

coverage

95%boot-t

critical

values

Boot-J

rejection

rate:5%

9 moments

2SLS

GMM

IW-GMM

SSIV

USSIV

.099

.303

.068

.419

.312

.432

.370

.444

.753

5.992

.440

.366

.451

.647

3.793

.443

.478

.450

.862

5.999

2SLS

GMM

IW-GMM

SSIV

USSIV

.280

.011

.124

.058

.355

.165

.096

.069

.292

31.512

.219

.113

.264

.168

12.082

.325

.097

.142

.298

31.512

.452

.475

.457

.771

3.806

.259

.317

.285

.494

1.079

.96

.87

.90

.99

.97

-1.85,

-1.68,

-1.72,

-1.61,

-1.05,

2.16

2.67

2.63

1.69

2.11

.30

.16

.73

.12

.270

.080

.160

.130

3.825

.62

.88

.45

.99

1.00

-.80,

-2.36,

-8.95,

-1.78,

-1.17,

4.40

2.62

11.5

1.39

1.28

1.00

1.00

1.00

.42

.160

.140

.184

.255

1.220

.77

.27

.20

.83

.91

-2.24,

-5.21,

-17.3,

-3.11,

-2.23,

7.36

.12

17.3

.07

2.32

1.00

1.00

1.00

.85

.121

.150

.155

.243

1.274

.84

.07

.13

.71

.98

-2.49,

-6.62,

-23.7,

-2.81,

-1.49,

7.62

-1.21

40.5

-.01

2.32

1.00

1.00

1.00

.90

72 moments

.356

.114

.292

.178

12.087

-

162 moments

2SLS

GMM

IW-GMM

SSIV

USSIV

.112

-.141

.042

-.252

-1.458

.141

.053

.031

.222

83.064

.209

.074

.248

.134

10.147

.180

.150

.052

.336

83.077

2SLS

GMM

IW-GMM

SSIV

USSIV

.087

-.154

.009

-.239

-.039

.123

.041

.019

.186

17.758

.175

.056

.251

.101

6.229

.151

.159

.021

.302

17.759

.238

.159

.252

.286

10.252

-

212 moments

.196

.164

.251

.259

6.230

-

NOTE: See note to Table3.

ing the results of Table 1, extends Tauchen's(1986) and

AltonjiandSegal's(1994) findingof bias in GMMin small

samplesto the large-samplecase of panel data.The 2SLS

andFF estimatorsare not biasedtowardOLS as in the base

case, while IW-GMMhas negligible bias in each of the

stacked-moment

simulations.Consistentwith the resultsof

Table 1 is the bias toward0 in SSIV and USSIV as the

numberof momentconditionsincreases.The USSIV estimatordoes not succeedin its primaryfunctionto "inflate"

the SSIV estimates.

In terms of statisticalinference,there appearsto be little differencebetweenthe bootstrapstandarderrorandthe

averageasymptoticstandarderrorfor the FF andGMMestimators.Onthe contrary,the standarderrorsdo divergefor

the otherestimators,especiallyIW-GMMandUSSIV.This

suggests that the small IW-GMMstandarderrorsin Table

1 may understatethe true samplingvariabilityin the estimator,makingthe bootstrapuseful for correctlyestimating

IW-GMMstandarderrors.Examiningthe 95%asym-tcoverageratesindicatesthatall of the estimatorsexceptUSSIV

tend to overrejectthe event thatthe pseudotrueISE lies in

the confidenceregion,with the overrejectionbeing particularly acute for both GMM and IW-GMM.In GMM, the

asymptoticconfidenceregion is distortedbecause of the

bias in the parameterestimatestoward0, coupled with a

tight standarderror.IW-GMM,on the otherhand,has little

bias in the estimatedISE'srelativeto GMM,butbecausethe

asymptoticstandarderrorsare estimatedtightly,the confidence intervalis short, excludingthe pseudotrueISE too

frequently.Moreover,inspectingthe boot-t criticalvalues

revealsthatGMMdoes not even include0 in the criticalregion in the 162- and 212-momentcases. This suggeststhat

the bootstrap-tconfidenceintervalis useful for GMMand

IW-GMMto capturethe skewnessin the underlyingdistribution.The FF estimatorcontinuesto outperform2SLS in

coveragerates;meanwhile,given the bias in the estimated

ISE, the SSIV and USSIV estimatorsgive relativelygood

coverage.

Comparingthe omnibusmeasuresof estimatorperformance(RMSEandMAE)for the stacked-moment

bootstrap

simulationsrevealsthatFF dominates2SLS in all cases and

both FF and 2SLS alwaysdominateGMMexcept with 72

moments.Highlightingthe problemsnoted by Brownand

Newey (1995) and Hall and Horowitz(in press),however,

the overidentifying-restrictions

test is distortedseverely,resultingin 100%rejectionrateswhen the nominalrejection

rate is 5%.It mustbe stressedthat,as establishedby Hahn

(in press),overrejectionof the overidentifyingrestrictions

does not invalidatethe otherbias/efficiencyresultsin Tables 3 and 4--the estimatorsand overidentifyingrestrictions are separate.

3.1.2 ResultsFromBrownand NeweyAlgorithm. Tables 5 and 6 contain the bootstrapresults for the firstdifferenceandorthogonal-deviations

transformations

using

Brown and Newey's (1995) algorithm.The USSIV estimatoris not presentedbecause the motivationfor Brown

and Newey's methodis to get a correct overidentifyingrestrictionstest, which by definitiondoes not exist for the

USSIV. Comparedto Table 3, the most strikingresult in

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

Ziliak: Efficient Estimation With Panel Data

429

Table5. BootstrapComparisonsof First-Difference

Moment-Condition

EstimatorsWhereObservationsAre DrawnWithProbability

pi

Estimators

Bias

SE-A

SE-B

RMSE-A

RMSE-B

MAE

95%

asym-t

coverage

95%boot-t

critical

values

Boot-J

rejection

rate:5%

9 moments

2SLS

GMM

FF

IW-GMM

SSIV

.383

.316

.316

.251

.460

-.045

-.034

-.034

-.041

-.043

.306

.268

.323

.264

.351

.309

.270

.325

.267

.353

.385

.317

.316

.254

.462

.197

.161

.210

.143

.220

.99

.96

.95

.96

.97

-1.86,

-2.07,

-2.06,

-1.99,

-2.35,

1.09

1.42

2.03

2.17

.99

.03

.00

.12

.03

.00

.121

.130

.118

.116

.088

.84

.57

.73

.24

.81

-2.96,

-3.65,

-3.83,

-22.4,

-3.37,

1.61

1.08

.84

2.95

1.12

.45

.31

.58

.96

.00

72 moments

2SLS

GMM

FF

IW-GMM

SSIV

.117

.074

.101

.034

.078

-.086

-.120

-.115

-.141

-.081

.123

.093

.105

.188

.082

.150

.151

.156

.235

.115

.145

.141

.153

.145

.112

162 moments

2SLS

GMM

FF

IW-GMM

SSIV

-.099

-.108

-.103

.061

.039

.051

.082

.049

.061

.116

.115

.115

.128

.119

.120

.099

.111

.111

.58

.25

.43

-4.99, .84

-5.55, -.4

-4.91, .50

.45

.71

.84

.056

.054

.138

.138

.120

.33

-4.79, .29

.00

.142

.136

.129

.30

.03

.23

.08

-5.39, .36

-6.6, -1.83

-5.45, -.16

-5.35, -1.33

.93

.74

.96

.03

-

-.127

212 moments

2SLS

GMM

FF

IW-GMM

SSIV

.051

.031

.045

-.134

-.131

-.125

-

-

-.144

.046

.068

.040

.049

-

.035

.143

.135

.133

.150

.137

.134

-

.152

-

-

.149

.144

NOTE: See note to Table3.

the base case of 9 momentsis the dramaticimprovement

in boot-J rejectionrates. This is exemplifiedby 2SLS in

which the boot-J rejectionrate falls from .29 to .03. The

test still overrejectswith the FF estimatorbut 70% fewer

times than under the Freedmanmethod.In addition,the

Brown and Newey algorithmimproveson the efficiency

of the bootstrapestimates,especiallyfor 2SLS, IW-GMM,

and SSIV.In termsof bias, FF andGMMare identical,but

GMMdominates2SLS andFF in termsof lowerMAE and

RMSE-B.IW-GMM,however,performsbest overallin the

EstimatorsWhereObservationsAre DrawnWithProbability

Moment-Condition

Table6. BootstrapComparisonsof Orthogonal-Deviations

Ai

Estimators

Bias

SE-A

SE-B

RMSE-A

RMSE-B

MAE

95%

asym-t

coverage

95%boot-t

critical

values

Boot-J

rejection

rate:5%

9 moments

2SLS

GMM

IW-GMM

SSIV

-.009

-.044

-.081

.011

.396

.341

.291

.438

.454

.338

.390

.424

.396

.344

.302

.438

.454

.341

.399

.425

.319

.240

.230

.254

.92

.96

.86

.98

-2.11,

-2.27,

-2.74,

-1.94,

2.21

1.68

2.45

1.25

.10

.02

.03

.00

.109

.109

.089

.142

.76

.62

.33

.56

-3.74,

-3.72,

-9.86,

-4.16,

1.46

.38

3.71

1.33

.32

.20

.77

.03

.126

.119

.41

.13

-5.82, -.11

-6.01, -.99

.32

.75

72 moments

2SLS

GMM

IW-GMM

SSIV

-.101

-.108

-.090

-.119

.096

.071

.032

.098

.112

.072

.138

.101

.140

.129

.095

.155

.151

.130

.138

.156

162 moments

2SLS

GMM

IW-GMM

SSIV

-.130

-.122

.053

.037

.068

.042

.140

.127

-

-

-

-

-.142

.046

.041

.149

.147

.129

-

.147

-

-

-

.140

.12

-6.75, -.67

.00

.136

.139

.30

.05

-5.52, -.37

-7.15, -1.56

.94

.85

-

212 moments

2SLS

GMM

IW-GMM

SSIV

-.138

-.136

-.167

.049

.030

.048

.058

.037

.029

.147

.140

-

.174

.149

.141

-

.170

-

.171

-

-

.04

-6.38, -1.86

NOTE: See note to Table3.

This content downloaded by the authorized user from 192.168.72.231 on Thu, 15 Nov 2012 19:20:25 PM

All use subject to JSTOR Terms and Conditions

-

.03

Journalof Business & EconomicStatistics,October1997

430

base case in termsof lower RMSE and MAE. Because of

the gains in efficiencyand in levels of the boot-J test, the

Brown and Newey method seems to be preferableto the

Freedmanmethodwith few moments.

On the other hand,problemsarise with the Brown and

Newey algorithm,especiallyin the many-momentmodels.

First, some of the bootstrap probabilities (Pji), although

summingto one overall, are negative. This problem increased with the numberof moment conditions,ranging

from a low of .5% of the observationswith 9 moments

in 2SLS and GMMto over 40% with IW-GMMwith 212

moments.I consideredseveralmethodsto deal with this,

andthe methodI chose was to redistributea fractionof the

negativeprobabilitiesto each observationandthen assigna

small positiveprobability(1/100th of the smallestpositive

probability)to those observationswith negativeprobabilities, making sure the probabilitiessum to 1. The results

are not sensitive to the methodused. Second, because so

much weight (i.e., a "high"probability)is given to a subset of the observationsfor the IW-GMMestimatorswith

162 and 212 moments,the estimatorsare singular.Recall

that in samplingwith replacementan observationcan be

drawnmorethanonce, which can occurwith greaterprobabilityunderthe BrownandNewey algorithm.This singularityproblempersistedwith every bootstrapsampleover

a four-dayperiodand with differentrandomsamplesplits

of the originaldata as well. Consequently,I am unableto

reporton the IW-GMMestimatorfor these cases. Brown

and Newey also reporteddifficultiesdue to a singularity

problemin theirempiricalapplication.

Withthe exceptionof SSIV,the boot-J test overrejectsin

casesjust as in Tables3 and4. The disthe stacked-moment

tortionin levels, althoughless thanthe Freedmanmethod,

becomesmore severeas additionalmomentsare appended

to the instrumentset. It is importantto note thatboth Hall

and Horowitz, with their Monte Carlo, and Brown and

Newey, with their empiricalapplication,found that level

distortionspersistin the test even afterrecenteringthe distribution.In termsof bias, the estimatorsdo not distinguish

themselvesas in the Freedmanmethod,and each tends to

centeron the OLS estimate.However,2SLS and FF continueto dominateGMMin termsof lower bias. Moreover,

asym-tcoverageis worsefor eachestimator,suggestingthat

boot-t critical values may improve on coverage over firstorder asymptotics. The central conclusion from the previous

bootstrap results remains the same though; namely, in comparing the estimators across all criteria, the FF estimator

continues to be preferred in this application.

4.

SUMMARYAND CONCLUSIONS

In this article I compared several IV estimators for paneldata models with predeterminedinstruments. The empirical

results from the life-cycle labor-supply model, in conjunction with results from two separate bootstrap Monte Carlo

experiments, are summarized as follows. First, and most

important,the GMM estimator is biased downward relative

to the 2SLS and FF estimators as the number of moment

conditions approaches the optimal number of moments be-

causeof a correlationbetweenthe estimatedweightmatrix

andthe samplemoments.This leads to poorcoveragerates

for confidenceintervalsbased on asymptoticcritical values but providesa clearrole for the bootstrap-tconfidence

intervalas a basis of inferenceunderGMM. GMM performs reasonablywell with suboptimalinstrumentsbut is

not recommendedfor panel-dataapplicationswhen all of

the momentsare exploitedfor estimation.

Second, the IW-GMMestimatoris generallysuccessful

at eliminatingthe bias in GMM parameterestimatesusing Freedman'sbootstrapalgorithm;however,the standard

errorsfrom asymptotictheoryseem to understatethe true

test

samplingvariationandthe overidentifying-restrictions

is biasedtowardrejection,possiblydue to the high ratioof

momentsto cross-sectionsamplesize. Furtherresearchon

boththe asymptoticand small-samplepropertiesof this estimatoris needed.In the meantime,the bootstrapis likelyto